DSP BlackRock Opportunities Fund: Consistently top quartile SIP returns in the last 3 to 5 years

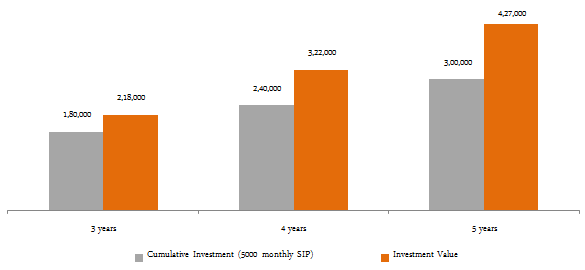

If you had invested र 1 lac in DSP BlackRock Opportunities Fund at the time of its inception (NFO) in the year 2000 the value of your investment today would be र 14 lacs. The performance of this diversified equity fund in the recent years has also been quite consistent. The fund has consistently been in the top quartile, in terms of SIP returns over the last 3 to 5 years. The chart below shows the cumulative investment and current investment value of a र 5,000 monthly SIP in DSP BlackRock Opportunities Fund over the last 3, 4 and 5 years respectively.

Source: Advisorkhoj Research

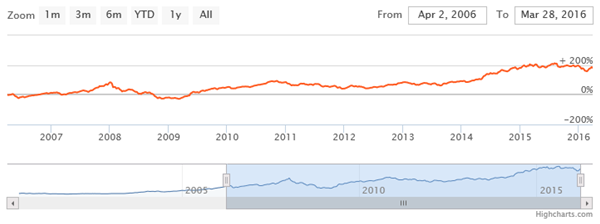

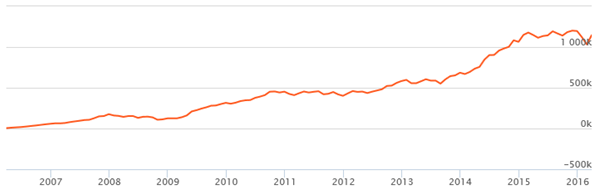

The rolling returns of the DSP BlackRock Opportunities fund showcase the consistent performance of the fund. Rolling returns are the total returns of the scheme taken for a specified period on every day and taken till the last day of the duration. In this chart we are showing the 3 year returns of DSP BlackRock Opportunities fund on every day during the last 5 years.

Source: Advisorkhoj Research

In this chart you can see that the 3 year rolling returns of the fund was above 50% (14.4% annualized) for nearly 75% of the times over the last 5 years. The last 5 years included 2 bear market periods and two bull market years. The strong 3 year rolling returns given by the fund over the last 5 years is the hallmark of a well managed diversified equity fund.

Fund Overview

DSP BlackRock Opportunities Fund was launched in May 2000. It has र 711 crores of assets under management. The expense ratio of the fund is 2.82% (as on 29-02-2016). The fund manager of this scheme is Rohit Singhania. The chart below shows the NAV movement of DSP BlackRock Opportunities Fund over the last 10 years.

Source: Advisorkhoj Research

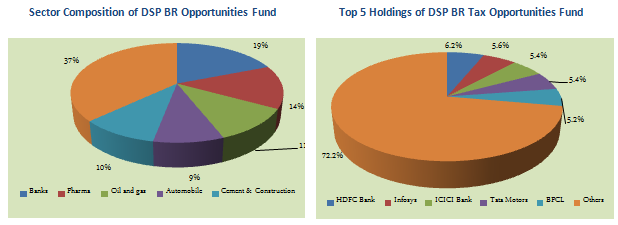

Portfolio Construction

The fund has a large cap, growth oriented focus. The fund manager has a bottoms-up portfolio construction approach. The portfolio is overweight on cyclical sectors like BFSI, Oil & Gas, Automobile & Auto Ancillaries, Cement & Construction etc. To balance its exposure to cyclical, the portfolio also has allocations to defensive sectors, with IT and Pharmaceuticals comprising more than 20% of the portfolio holdings. With cyclical sectors poised to do well with the revival in economic growth and capex cycle, the DSP BlackRock Opportunities Fund has the potential to deliver good returns in the medium and long term. The portfolio is very well diversified in terms of company concentration. The top 5 companies in the fund portfolio, HDFC Bank, Infosys, ICICI Bank, Tata Motors and BPCL account for only 28% of the portfolio value.

Source: Advisorkhoj Research

Risk and Return

In terms of volatility measures, the standard deviation of monthly returns of DSP Black Rock Opportunities fund is lower than the average standard deviation of monthly returns of diversified equity funds. The Sharpe ratio of the fund is superior to the average Sharpe ratios of the category.

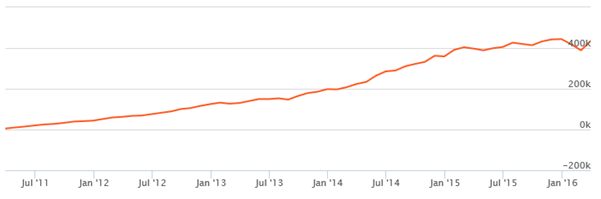

The chart below shows the growth in र 1 lac lump sum investment in DSP BlackRock Opportunities Fund over the last 5 years.

Source: Advisorkhoj Research

The Systematic Investment Plan returns of the fund over the last 5 years are more impressive. The chart below shows the returns of र 5,000 monthly SIP in DSP BlackRock Opportunities Fund over the last 5 years.

Source: Advisorkhoj Research

With a cumulative investment र 300,000 you could have accumulated a corpus of र 427,000; a profit of र 127,000 in the last 5 years. If you started your SIP 10 years back, you could have accumulated a corpus of र 11.5 lacs with a cumulative investment of र 6 lacs. This shows the power of SIPs in creating wealth over a long investment horizon.

Source: Advisorkhoj Research

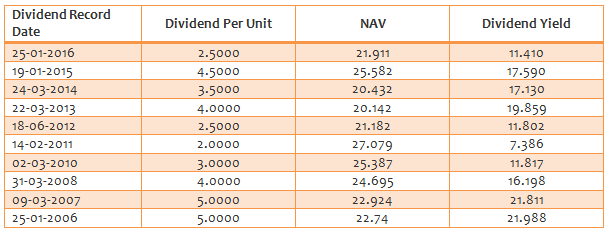

Dividend Pay-Out Track Record

DSP BlackRock Opportunities Fund has a strong dividend pay-out track record. In the last 10 years, the fund paid dividends every year except 2009. You can see in the table below the dividend yields are also quite good.

Source: Advisorkhoj Historical Dividends

Conclusion

DSP BlackRock Opportunities Fund has completed nearly 16 years since its launch. The fund has sustained its strong performance track record over the years, despite changes in the fund management. The SIP performance of the fund is especially impressive over the years. The fund also has a good dividend pay-out track record. Investors can consult with their financial advisors if DSP BlackRock Opportunities Fund is suitable for their investment portfolio.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team