Best investment option in the coming financial year

With FY 2013 - 2014 drawing to a close, the focus will now shift to FY 2014 - 2015. In FY 2013 - 2014 majority of retail investors stayed away from equity markets. Most of the retail investors, who did invest in the equity markets, did it through the mutual fund route. If they were able to select good funds, they would not have been disappointed with the last one year returns.

What is the outlook for 2014?

The late surge in the markets, with the Sensex and Nifty scaling historical highs, signals optimism returning to the markets. With improvement in current account deficit and the inflation situation, the macro-economic outlook is more positive than before. With Lok Sabha elections round the corner, there is the optimism about the return to agenda of economic reforms. While there are certainly good reasons for optimism, we cannot start rejoicing too early. The fiscal deficit situation is still concerning. FII flows may be impacted by the actions of the US Federal Reserve. El Nino effect on monsoons, may nudge food inflation up again. Growth continues to be weak. Finally, a fractured mandate in the upcoming elections will spoil the party mood that the market seems to be in now. Despite these concerns, the outlook for 2014 remains positive. We believe that equity will continue to be best performing asset class, as we go into FY 2014 - 15.

Why equities?

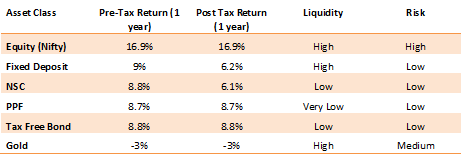

The table below shows why equity is the best investment option for investors who are willing to take on the risk. This is based on the last one year returns from the various asset classes. For equities we have taken the CNX Nifty as the benchmark. The post tax return shown in the table below, assumes an investor to be in the highest tax bracket.

A common mistake which retail investors make is to ignore the effect of inflation on their investments. With an inflation of 8%, the inflation adjusted post tax return from Bank FD is negative. Equity investment for over a year is more tax friendly and serves as a hedge against high inflation.

How to invest in equities?

One can directly invest in shares of companies listed on the stock exchanges or can buy units of mutual funds to invest in equities. To buy shares of companies listed in BSE or NSE, the investor needs to open a depositary participant account (DP account) and a trading account with stock exchange trading member (also known as a brokerage), after going through the required KYC procedures. To buy mutual fund units, the investor can buy them through a financial adviser, after fulfilling the KYC procedures. The cost of buying shares directly includes brokerage fees (usually a percentage of the total purchase of sell amount), DP fees and applicable taxes (securities transaction tax, service tax etc.). For mutual funds, the asset management company charges the asset management fees, which are adjusted from the Net Asset Value (NAV) of the unit.

Should you invest in shares directly or invest in mutual funds?

There are merits and demerits of investing in shares directly versus investing in equity funds. The cost of buying shares directly is less than mutual funds. The transaction cost in buying and selling shares, which includes brokerage fees, DP fees, STT, service tax etc is in the range of 0.3 – 0.6%. The asset management fees for mutual funds are around 1 - 2%. However, investing in shares directly requires experience and expertise, which average retail investors do not have. Mutual funds have fund managers who have the professional experience and expertise to pick stocks that will give good returns. Further, you will need a much larger capital base to build diversified portfolio of shares. In mutual funds, you can invest in well diversified portfolio, with an investment as low as Rs 5000.

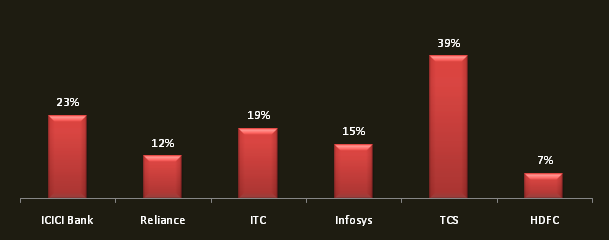

Let us illustrate this with an example. See the chart below, for trailing one year returns (24/03/2013 to 24/03/2014) from the six largest stocks in the Nifty basket. These stocks are often seen as good investments for the average retail investor.

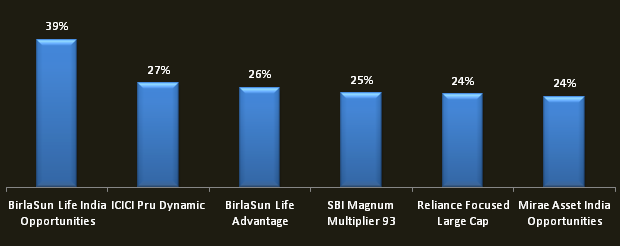

Most of the stocks have given good double digit returns. TCS, ICICI Bank and ITC have outperformed the Nifty, while the others have not. Now let us see what returns, the 6 top performing large cap funds have given in the last one year. NAVs as on Mar 24, 2014.

All the 6 funds have outperformed the Nifty and given much better returns than the stocks (except TCS) in the chart above. The reason for the outperformance is the mutual funds have a diversified portfolio of large number of stocks (including all the 6 stocks above).

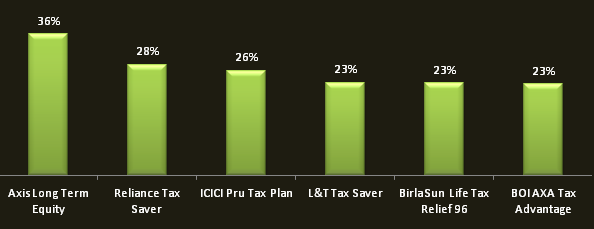

Even ELSS funds have given excellent returns in the last one year period. Let us see what returns, the 6 top performing large cap funds have given in the last one year. NAVs as on Mar 24, 2014.

All the 6 funds have outperformed the Nifty and have matched the returns given by large cap funds. Additionally by investing in ELSS, you can save up to Rs 1 lakh in taxes. However, investors in ELSS funds need to wait for three years before they can redeem their units.

As with stocks it is as difficult to pick a future top performer in equity funds. But even the average performers in the large cap and ELSS categories have given returns of 16.1% and 19.8% respectively, which match or even beat Nifty returns and are better than the returns from most stocks in the Nifty basket. So even if you had picked an average performer, you would have got good returns. Nevertheless, it is very important that you select a good fund to get the best return on your investment. A good financial advisor can help you select a good fund.

Best Investment Option in FY 2014 - 2015

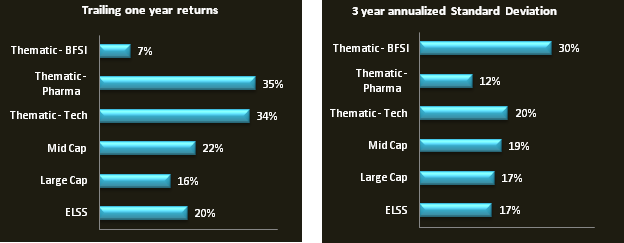

Unless you are an expert stock picker, investing in large cap equity funds or ELSS funds will be the best investment option for you. You can also invest in other categories of equity funds, but the risk is higher in other categories. See the chart below for comparison of risk and return for the categories.

Mid cap funds may do very well in FY 2014 - 2015, if the growth outlook improves and the investment cycle revives in the economy, since some of the midcap stocks are trading at relatively attractive valuations. However, midcap stocks react more adversely to negative developments compared to large cap stocks. Performance of the sector funds will depend upon sector specific risk factors, e.g. exchange rate outlook for Tech funds, interest rate outlook for BFSI funds etc.

Conclusion

Given that, there is both bullishness and some significant concerns regarding the future outlook of the economy, investors should allocate a greater percentage of their investments to large cap and ELSS funds. Regarding which fund or funds to select for their investment portfolio, investors should look at historical returns. While 1 year return is a good indicator of short to medium performance, investors should also look at 3 years and even 5 years returns to get a sense of long term performance of the fund. Investors should always consult with financial advisors, which funds will be suitable for their risk profile and time horizon.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team