Why large cap equity mutual funds will always be a flavor for investing

Midcaps and small cap stocks had a dream run from 2014 to 2017. Top performing small / midcap equity mutual funds gave around 20% annualized returns over the last 3 years. Naturally midcap and small cap mutual funds were the flavors of the last few seasons. Some midcap mutual funds suspended new subscriptions or put restrictions on lump sum investments, but investor interest in these mutual funds did not abate, even as valuations of many midcap and small cap stocks reached sky high.

Investor interest in midcap mutual funds despite very rich valuations did not surprise us in Advisorkhoj because we had seen this many times before – it was typical investor sentiment in a bull market. In 2018, midcaps and small caps are under performing large cap stocks. On a year to date basis, the Sensex has fallen 3.33% while BSE – Midcap and BSE – Small Cap has fallen over 10%. Now we are getting comments from investors who are worried about small and midcap mutual funds. Small and midcap stocks and mutual funds tend to outperform large cap stocks and large cap equity mutual funds in bull markets, but usually underperform in corrections or bear markets.

We have mentioned a number of times in our blog that, greed and fear drives investor behavior. When the going is good, investors think that the party will continue forever. However, market cycles are inevitable and you should be prepared for volatility. Different market cap segments have different risk or volatility profiles. Big market moves, whether upside or downside, is very difficult to predict. Therefore, you should always factor in your risk capacity when making investment decisions, so that your investment portfolio is positioned well in all market conditions.

Large cap stocks and mutual funds give stability to your investment portfolio and investment advisors suggest that, large cap equity funds or large cap oriented multi-cap funds should form the core of your investment portfolio. In this blog post, we will discuss the characteristics of large cap equity mutual funds and its advantages / disadvantages vis-a-vis small / midcap mutual funds with examples. We will also discuss briefly some market allocation guidelines for your equity portfolio. But first let us discuss what large cap stocks and large cap equity mutual funds are.

What are large cap stocks and large cap equity mutual funds?

As per SEBI guidelines, the top 100 listed companies in terms of market capitalization are categorized as large cap companies. Market capitalization is defined as the share price of a company multiplied by the number of shares (of the company) outstanding. Typically, large cap companies have market capitalizations exceeding Rs 10,000 Crores. Equity mutual fund schemes which invest a large portion of their AUM in large cap companies are categorized as large cap equity mutual funds.

Characteristics of large cap stocks

Large cap companies are well known companies with usually a fairly long history. These companies command a high percentage of the market share in their respective industry sectors. Given their large size, investors believe that these companies are better placed to survive downturns in the economy compared to smaller companies; as a result these companies are perceived to be less risky and investors are ready to pay a premium for their shares.

Large cap stocks are usually better researched than midcap stocks and analysts have better visibility of future earnings growth trajectory of large cap stocks. As such, large cap stocks usually trade at a valuation (P/E ratio) premium to midcap stocks. However, under-researched small and midcap stocks may enjoy a valuation arbitrage, if their market value is less than the fair value.

For the last 2 years or so, midcap stocks have been trading at higher valuations compared to large cap stocks. The sharp price correction in midcap and small cap stocks relative to large cap stocks over the last 2 months or so clearly shows that midcap and small cap stocks were more richly valued compared to large cap stocks. There are multiple views on whether large caps should trade at a premium to midcaps. Discussion on large cap versus midcap valuation premium / discount is outside the scope of this post, but based on the historical trend, we can say that midcap premium to large cap is an unusual situation.

Midcap and small cap companies, given their smaller sizes, are more vulnerable in economic downturns compared to large cap companies. In severe economic recessions, some small companies even face survival risk. Investors who have followed or invested in the stock market over a long period of time may recall that, some small companies sank in the 2008 financial crisis and never recovered. Large cap companies, on the other hand, have more financial resources, investment capacity and easier access to credit, to better withstand economic recessions.

Earnings of smaller companies tend to be more susceptible to volatility in the wake of big Government policy changes like demonetization, GST etc. For example, we heard many smaller companies complaining about disruptions to their supply chain, increased compliance cost cause and lower profits margins caused by GST roll-out last year. Large companies are usually better positioned to use policy induced disruptions, to gain market share from their smaller competitors.

Liquidity

The biggest advantage of large cap stocks is superior liquidity. Large cap stocks are more widely held (held by the public) than midcap / small cap stocks, where the promoters and their related parties, hold a very large portion of the shares outstanding. The percentage of free floating shares (shares not held by promoters, related parties and management) of midcap and small cap companies in India is very small. The small percentage of free float shares can pose severe liquidity risks in a crunch situation; sometimes shareholders may not find enough buyers in the market especially during bear markets.

In bear markets, when panic sets in, small / midcap equity mutual fund managers can face huge redemption pressures and they may not find enough buyers to meet redemption requirements. In such a situation fund managers are forced to sell stocks which they do not want to sell and this negatively impacts investors who stay on. In some rare instances in the past, mutual funds even temporarily suspended redemptions, which is not good at all for the investors because the investor cannot get the money when he / she wants it.

While not getting your money when you want it is the worst case scenario for an investor, low liquidity also has ramifications on price volatility of small / midcap stocks. Because small and midcap stocks trade on thin volumes, investors may be forced to sell their shares at very low prices in bear markets, incurring a bigger loss. Large cap stocks do not face such liquidity crisis because institutional investors, both foreign and domestic, are the major investors in such stocks. Large cap stocks trade in much higher volumes than midcap stocks and consequently the pricing is much more efficient than midcap stocks.

Investors in open ended equity mutual funds usually want to get high returns and do not pay much attention to liquidity at the time of investment. But liquidity becomes as important factor, when you need the money / want to redeem. Liquidity should be an important consideration in investment decisions because you never know what the market condition will be when you need the money. Large cap equity mutual funds are all weather funds and therefore, should form the core of your investment portfolio.

Indiabulls Bluechip Fund – A Top Performing Large Cap Fund

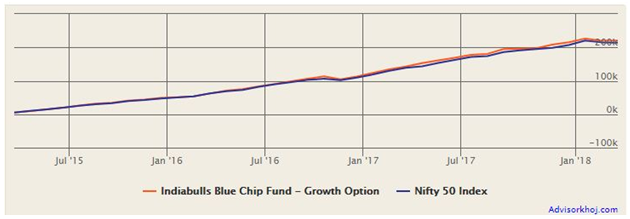

Indiabulls Blue Chip Fund has consistently outperformed both the benchmark Nifty and the large cap funds category returns over the last 3 years (please see our chart below).

Source: Advisorkhoj Research

Indiabulls Blue Chip Fund was launched in February 2012. The scheme has Rs 1,022 Crores of Assets under Management (AUM). The expense ratio of the fund is 2.94%. The fund has given 11.33% compounded annual returns since its inception. The fund is managed by Sumit Bhatnagar, an MBA in Investment Management from University of Toronto, Canada and CFA Charter (USA). Prior to joining Indiabulls Mutual Fund he has worked with SEBI. The scheme benchmark is CNX – Nifty.

Regular Advisorkhoj readers know that, Rolling Return is the best measure of a mutual fund’s performance because it is not biased point in time market conditions. The chart below shows the 3 year rolling returns of Indiabulls Bluechip Fund versus the benchmark Nifty since inception.

Source: Advisorkhoj Rolling Returns Calculator

You can see that Indiabulls Blue Chip Fund has consistently outperformed Nifty almost since inception and generated alphas for investors over a 3 years investment horizon.

Read why Indiabulls Blue Chip Fund is one of the top performing funds in the large cap category

Fund manager, Sumit Bhatnagar, follows a combination of top down and bottom up stock picking strategies. The fund manager is to be conservative in the portfolio construction process. He looks to identify key themes to play by analyzing global macro environment, Indian macros, government policies and other economic factors. Once the key themes are identified, he looks at companies that are near monopolies or oligopolies, having pricing power, strong brands, leaders/challengers in their respective sectors, strong distribution franchise, low leverage, decent growth prospects, decent RoE (Return on Equity) & RoCE (Return on Capital Employed) and high quality management teams and low leverage.

The portfolio is built predominantly around domestic consumption and government spending themes. From a market capitalization perspective, Indiabulls Blue Chip Fund has a mandate to deploy 80% in large caps (basically top 100 companies by markets cap) and upto 20% in mid & small cap space.

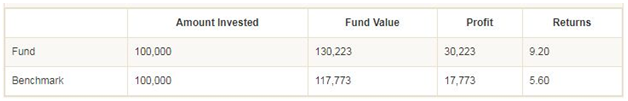

The chart below shows the growth of Rs 1 lakh invested in the Indiabulls Blue Chip Fund (Growth Option) over the last 3 years.

Source: Advisorkhoj Research

Source: Advisorkhoj Research

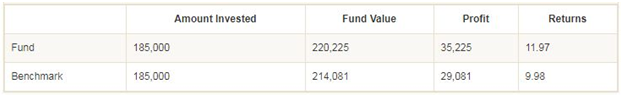

The chart below shows the returns of Rs 5,000 monthly SIP in Indiabulls Blue Chip Fund (Growth Option) over the last 3 years.

Source: Advisorkhoj Research

Source: Advisorkhoj Research

Indiabulls Bluechip Fund delivered strong performance both in relative and absolute terms over the last 3 years. Current market volatility notwithstanding, the outlook for equity in India continues to be very positive since “India is on cusp of a structural economic upturn and equities are likely to remain the best asset class from a 3 to 5 years perspective”, according to Mr. Sumit Bhatnagar, the fund manager, whom we interviewed sometime back.

Please read the full interview

Market cap portfolio allocation guidelines

You should have a good mix in your investment portfolio, which balances stability with superior capital appreciation and creates wealth for you in the long term. Investment advisors and financial planners recommend around 70% allocation of your equity portfolio to large cap equity funds and balance to midcap equity funds.

Let us understand why they recommend such an allocation mix. The Nifty (top 50 stocks by market cap) represents around 62% of the free float market capitalization of all the stocks listed on National Stock Exchange. Nifty Next 50 (51st to 100th stocks by market cap) represents around 12% of the free float market capitalization of all the stocks listed on National Stock Exchange. The Nifty and Nifty Next 50 together represent the large cap universe as per SEBI definitions. Large cap stocks therefore, represent 74% of the stock market in terms of market cap. The stock market represents the collective wisdom of all investors. Therefore, 70% to 75% allocation to large caps represents the average allocation mix in the market.

However, this is not a hard and fast optimal market cap allocation rule. If you have a higher than average risk capacity, you can allocate more to midcaps and vice versa if you have lower risk capacity. Some financial planners suggest up to even 50% allocation to midcaps for young investors (investors in their twenties and early thirties). This is because young investors have higher risk capacities and can afford to hold their investments for a long period of time.

However, if you have a more moderate risk capacity or are nearing your investment goals like children’s education, marriage, your own retirement etc. then a greater allocation to large cap equity mutual funds is more suitable for your risk profile.

Large cap equity mutual funds are also more suitable for new investors because they have less experience in how to deal with market volatility. Since these funds are less volatile, the investors are less likely to panic and therefore, remain invested for a long period of time which can help the investors create wealth through the power of compounding.

Conclusion

In this blog post, we discussed why large cap equity mutual funds will always be a flavor for investors, irrespective of prevailing market conditions. There will be times when large cap stocks or large cap equity mutual funds will underperform midcaps, but across market cycles, large caps will provide stability to your portfolio and will usually give inflation beating returns, over a sufficiently long investment horizon. Investors should discuss with their mutual fund advisors regarding the market cap mix of their mutual fund portfolios.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team

-

Abakkus Mutual Fund launches Abakkus Liquid Fund

Dec 8, 2025 by Advisorkhoj Team