Top performing Mutual Fund FMPs gave better returns than Bank FDs

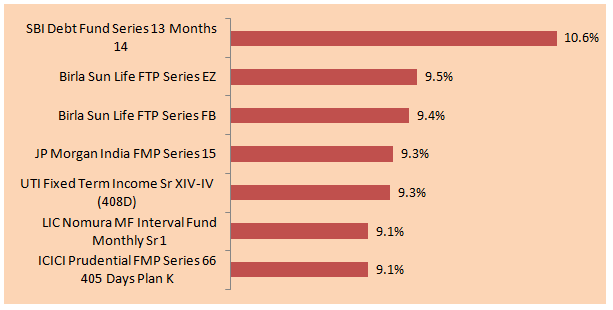

For capital safety and short term returns, bank fixed deposit is a natural choice for most Indian investors. However, fixed maturity plans (FMPs) offered by mutual funds are gaining popularity among more informed investors. Fixed maturity plans are close ended schemes that aim to generate income for the investors in a fixed term. FMP investors particularly favour FMPs maturing 12 – 15 months, because they get indexation benefit on taxes. Let us examine, why FMP is a smarter choice with actual one year data. In the last one year top performing FMPs have given better returns than bank fixed deposits, even on a pre tax basis. See the chart below for the top performing FMPs, based on last one year annualized returns (on a pre-tax basis). NAVs as Mar 14.

The chart above shows that on a pre-tax basis the top performing FMPs have given a return of 9.1 to 10.6%. Let us now compare the FMP returns with Fixed Deposit rates offered by leading banks, both in Public Sector and Private Sectors.

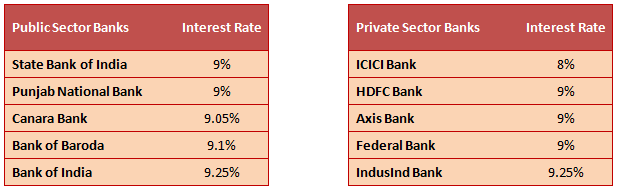

Clearly in terms of returns, FMPs have outperformed bank fixed deposits. Investors should, however, note that while FDs give assured returns, the returns of FMPs are not guaranteed. Unlike fixed deposits, FMPs may not be entirely risk free. The underlying portfolio of the FMPs may be exposed to credit risk. Most FMPs invest only in the highest rate debt paper (refer to the scheme documents) and so the risk is quite small, if at all. On historical basis, FMP returns have matched or beaten FD returns. Another point to note about FMPs is that, unlike FDs, there is virtually no liquidity before redemption of the scheme. What makes FMPs attractive is the tax efficiency of the investment. While FDRs are taxed at the applicable income tax slab rate of the tax payer, FMPs are subject to capital gains tax at 10.3% without indexation benefit and 20.6% with indexation benefit.

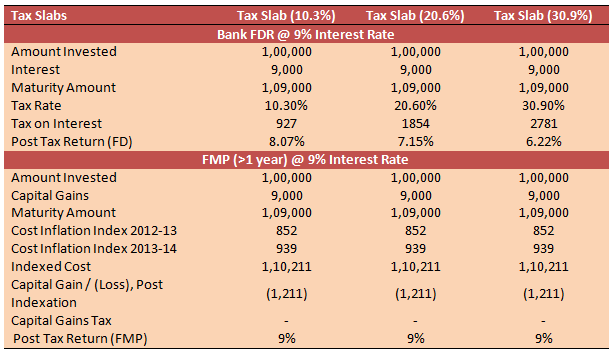

The table below illustrates the difference in post tax returns across different income tax slab rates, for an investment of Rs 1,00,000/- in a Bank FDR and an FMP, both offering a pre tax interest rate of 9%. The tenures of both the FDR and the FMP have been assumed to be little over 1 year.

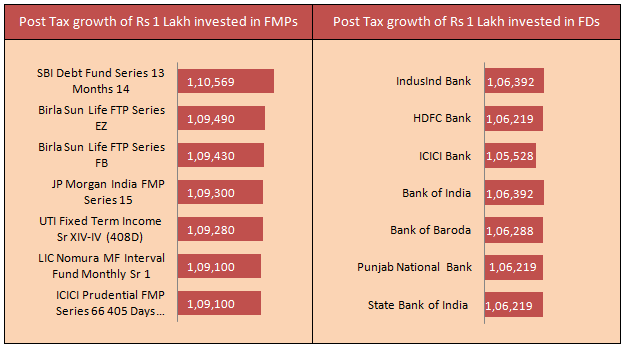

Let us now compare how much Rs 1,00,000 invested in the top performing FMPs would have grown to, in comparison to the same amount invested in FDs, on a post tax basis. The investor in the highest tax bracket would have gained anywhere between Rs 3,000 to Rs 5,000 on a post tax basis, by investing in FMPs.

Conclusion

The above clearly shows that FMPs are smart Investor’s choice over fixed deposits for short to medium term. Risk averse investors or first time Investors should strongly consider investing in these. However, the Investors should also ensure that the objectives of the FMPs and time period are aligned with their individual risk profiles and time horizons. Therefore, they should consult with their financial advisors if the same is suitable for their investment portfolio.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Kotak Mahindra Mutual Fund launches Kotak Energy Opportunities Fund

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF FOF

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF

Apr 3, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team