Top 6 Multi Cap Mutual Funds to invest in 2019

Multi Cap Mutual Funds are equity mutual fund schemes which have flexible mandates of investing across different market capitalization segments e.g. large cap, midcap and small cap. SEBI classifies the top 100 stocks by market capitalization as large cap, the next 150 stocks by market cap as midcap and the remaining stocks as small cap.

Stocks belonging to different market cap segments have different risk return characteristics. Large caps tend to be less volatile compared to the other segments while small cap are the most volatile. Small caps, on the other hand, have the potential to give higher returns in the long term. Midcaps are midway between large caps and small caps in risk return characteristics.

Suggested reading: Why is it best to invest in Multi Cap Mutual Funds

Different market cap segments also outperform or underperform each other in different market conditions. Midcaps and small caps tend to outperform large caps in bull markets, while they underperform large caps in bear markets. By investing across different market cap segments, multi-cap funds can produce superior returns in the long term, while limiting downside risks in volatile markets. The biggest advantage of multi-cap funds as a category is that there are no restrictions on allocating investments to any market cap segments; all other equity funds have restrictions with regards to market cap or other investment characteristics. This enables multi-cap funds to be better positioned to respond to emerging risks and opportunities in the market.

Though multi-cap mutual funds tend to be more volatile than large cap funds, they are less volatile than midcap or small cap funds. We have mentioned a number of times in our blog that multi-cap funds are ideal investment choices for retail investors who want to create long term wealth. However, investors should have moderately high to high risk appetites for these funds and they should always have long investment tenures (at least 5 years).

In this blog post, we will discuss the top 6 multi-cap equity mutual funds in 2019.

How we selected these funds?

In our blog post earlier this month, Top 5 best Large Cap Mutual Funds to invest in 2019, we outlined our methodology for selecting best large cap equity funds. Our methodology remains broadly the same for selecting top multi-cap funds also. We use performance consistency (as measured by rolling returns) as the underlying selection criteria and relative performance (as determined by quartile rankings) as an additional criterion. Our Top Consistent Mutual Fund Performers tool identifies the most consistent performers in each mutual fund category based on rolling returns. All the top 6multi-cap funds in our selection are among the most consistent performers based on our rolling returns based algorithm.

In addition, performance consistency, we also applied another filter to identify the outstanding performers in the large cap category. Using our Quartile Ranking tool based on last 5 year returns, we identified the top quartile multi-cap funds, which were also among the most consistent funds. Consistent performers, who generate high relative returns (alphas), do so through superior stock selection and intelligent sector allocations without taking too much risk. All the funds we selected using the above methodology have been rated 5 star or 4 star by Value Research. Here are the top 6multi-cap funds in 2019 listed in alphabetical order.

Aditya Birla Sun Life Equity Fund

In the last 3 and 5 year periods (ending June 25th 2019), Aditya Birla Sun Life Equity Fund gave 13.8% and 12.2% CAGR returns respectively. In the last one year, the scheme has given 7.4% return while YTD return is 2.9%. The chart below shows the annual returns of the scheme over the last 5 years.

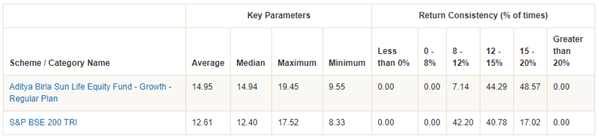

The table below shows the 3 year rolling returns performance of this scheme over the last 5 years versus its benchmark index S&P BSE 200 TRI.

Value Research has a 5 star rating for this fund. Anil Shah is the fund manager of this scheme. The scheme has an AUM of around Rs 11,300 Crores with an expense ratio of 1.98%

Read our Fund Review: One of the most consistent multi cap mutual funds

ICICI Prudential Multi-cap Fund

ICICI Prudential Multi-cap Fund is another very strong performer. In the last 3 and 5 year periods (ending June 25th 2019), the scheme gave 12.3% and 12.5% CAGR returns respectively. In the last one year, the scheme has given 8.7% return while YTD return is 5.4%. The chart below shows the annual returns of the scheme over the last 5 years.

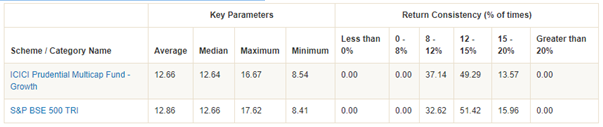

The table below shows the 3 year rolling returns performance of this scheme over the last 5 years versus its benchmark index S&P BSE 500 TRI.

Value Research has a 4 star rating for this fund. The scheme is helmed by veteran fund managers George Heber Joseph and Atul Patel are the fund managers of this scheme. The scheme has over Rs 3,847crores of AUM with an expense ratio of 2.29%.

Read our Fund Review – Strong 5 year performance ICICI Prudential Multi Cap Fund

Kotak Standard Multicap Fund (erstwhile Kotak Select Focus)

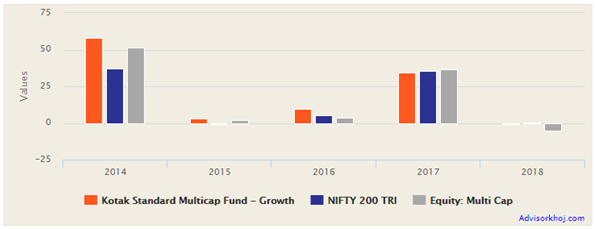

Kotak Standard Multicap Fund has been a popular diversified equity fund for many years and its AUM has sky rocketed in recent years on the back of exceptional performance. Kotak Standard Multicap is now one of the largest sized actively managed equity fund. The fund gave 15% annualized returns in the last 3 and 5 year periods (ending June 25th 2019). In the last one year, the scheme gave nearly double digit returns in difficult market conditions. The YTD performance (8.7%) is also very good. The chart below shows the annual returns of the scheme over the last 5 years.

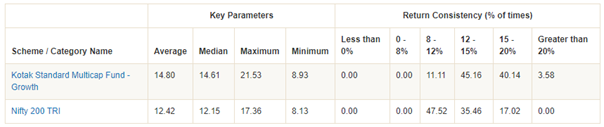

The table below shows the 3 year rolling returns performance of this scheme over the last 5 years versus its benchmark index Nifty 200 TRI.

Value Research has a 5 star rating for this fund. Industry veteran Harsh Upadhyay is the fund manager of this scheme. The scheme has over Rs 26,000 crores of AUM with an expense ratio of 1.63%.

Motilal Oswal Multicap 35

Motilal Oswal Multicap 35 has gained immense popularity among investors in the last 3 years or so. In the last 3 and 5 year periods (ending June 25th 2019), the scheme gave 13.9% and 18% CAGR returns respectively. In the last one year, the scheme underperformed giving negative returns but is now back in the black with YTD return of 4.7%. The chart below shows the annual returns of the scheme over the last 5 years.

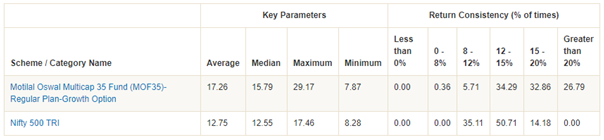

The table below shows the 3 year rolling returns performance of this scheme over the last 5 years versus its benchmark index, Nifty 500 TRI.

Value Research has a 5 star rating for this fund. Gautam Sinha Roy and Siddharth Bothraare fund managers of this scheme. The scheme was launched around 5 years back and already has over Rs 13,600 Crores of AUM. Expense ratio of the scheme is 1.56%.

Parag Parikh Long Term Equity Fund

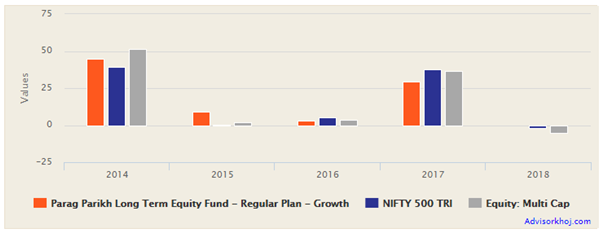

Parag Parikh Long Term Equity fund performed consistently since its launch and created wealth for its long term investors. The fund has delivered strong performance in the last 3 and 5 years, delivering 13.7% and 12.6% CAGR returns respectively. In the last one year, the scheme underperformed a bit giving 3.6% return while YTD return is 8.2%. Some investors had concerns about the AMC after the unfortunate and untimely demise of the highly acclaimed investor and AMC founder, Parag Parikh in the US around 4 years back. But the performance of this scheme over the last 3 years shows that Mr Parikh set up a strong team which can deliver outstanding performance for investors. The chart below shows the annual returns of the scheme over the last 5 years.

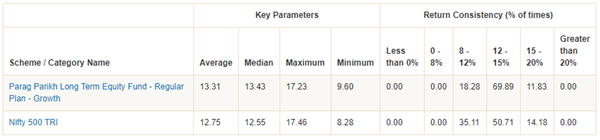

The table below shows the 3 year rolling returns performance of this scheme over the last 5 years versus its benchmark index Nifty 500 TRI.

Value Research has a 4 star rating for this fund. Rajeev Thakkar, Raunak Onkar and Raj Mehta are fund managers of this scheme. The scheme has around Rs 1,900 Crores of AUM with an expense ratio of 2.11%.

SBI Magnum Multicap Fund

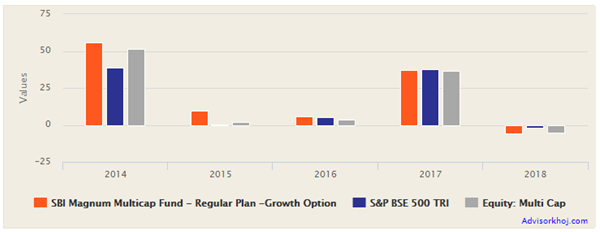

SBI Magnum Multicap Fund is another very popular fund and one of the best performers in the multi-cap category. The fund has delivered strong performance in the last 3 and 5 years, delivering 13% and 14.8% CAGR returns respectively. In the last one year, the scheme delivered 6.8% return while YTD return is 8.2%. The chart below shows the annual returns of the scheme over the last 5 years.

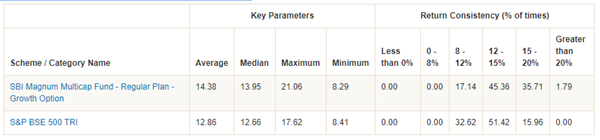

The table below shows the 3 year rolling returns performance of this scheme over the last 5 years versus its benchmark index Nifty 500 TRI.

Value Research has a 4 star rating for this fund. Industry veteran Anup Upadhyay is the fund manager of this scheme. The scheme has around Rs 7,582 Crores of AUM with an expense ratio of 1.93%.

Read our fund review – SBI Magnum Multicap Funds: Once of the best performing multi-cap funds

Conclusion

In this blog post, we discussed about the Top 6 multi-cap funds. Selecting top 5 mutual funds is not easy. There are several other funds which have performed well both in terms of performance consistency and returns, but for the benefit of new / less experienced investors who may get confused if we had a larger selection, we decided to restrict our selection to Top 6 only by following a rigorous analytical approach (described earlier in the article) to select these Multi Cap mutual funds. We think that these funds should continue to deliver strong returns in the future.

These funds are suitable for investors who have moderately high to high risk appetites. You can invest in these funds either in lump sum or SIP, depending on your financial needs but you should always have a sufficiently long investment horizon (at least 3 to 5 years). If you have lump sum funds but are worried about volatility, you can invest through STP from liquid funds over the next 3 – 6 months. If you think you need help with your investment, you should always consult a financial advisor.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team