Top 10 Consistent Mutual Fund Performers: Equity Funds Part 1

When picking a mutual fund for your investment consistent performance should be one of the most important selection criteria.

Why is consistency important?

- While investors should invest in mutual funds with a long time horizon to create wealth, investors also look for the flexibility of earning good returns in the short to medium term, in case they need the liquidity in that time frame

- Investors may want to invest for specific medium term (five to seven years) objectives, like buying a house, starting a small business etc, for which the returns from debt investments may not be sufficient. A consistent performer equity mutual fund is the best option for such investors

- Short term performance is not a good indicator of long term potential. Some funds may take advantage of volatility or momentum to generate high returns, but these strategies cannot be sustained in the long term

- Historical long term performance, while a good indicator of fund’s potential, does not guarantee future performance. In the mid-cap funds category Sundaram Select Midcap is one of the top three performers based on ten year annualized returns. However, in terms of past one year performance, it is not even in the top 50 in its category

- Some investors have the tendency to re-balance their portfolio based on short term performance. Frequent churn has direct and indirect costs associated with it. Picking consistent performers saves investors the cost of portfolio churning and the need of constant monitoring

Consistent performers aim to outperform the market and generate good returns across all time scales from short to long term. In bear markets, while the returns of the consistent performers may be negative, the NAV does not fall in line with the market. Similarly when bull market returns, it outperforms the market by generating better returns. It achieves this through superior fund management capabilities. CRISIL accords special importance to consistent performers. As such, they have a separate ranking based on consistent performance.

CRISIL Consistent Performers Ranking Methodology

CRISIL ranks equity funds based on several parameters like average 3 year annualized returns, volatility, portfolio concentration risk (both industry and company) and portfolio liquidity risk. On each of these parameters, each scheme is accorded a cluster rank (from 1 to 5) relative to its peer group. To derive a composite cluster rank, CRISIL has assigned different weights to each parameter, with average 3 year annualized return given the highest weights at 50%, volatility 30%, industry concentration risk 10%, company concentration risk 5% and liquidity risk 5%. The period of analysis is broken into four periods, latest 36, 27, 18 and 9 months. Each period is assigned a progressive weight starting from the longest period as follows: 32.5%, 27.5%, 22.5% and 17.5% respectively.

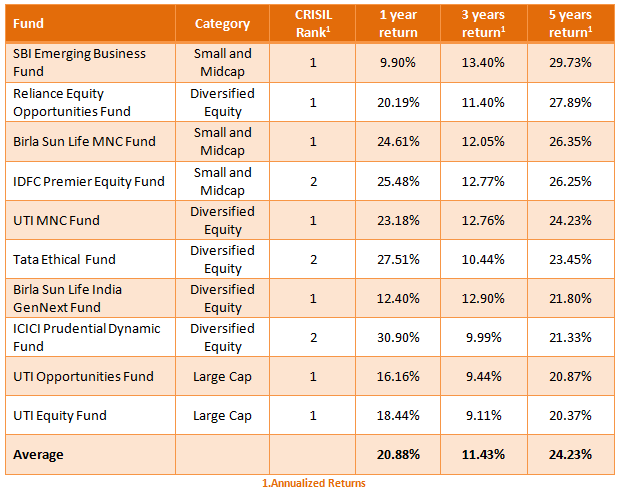

As discussed earlier, CRISIL has a separate ranking for consistent performers across all mutual fund categories. CRISIL ranks consistent performers based mean return and volatility over 5 years, in addition to the CRISIL cluster rank derived by the methodology described above. CRISIL calculates mean return and volatility for five years, with each one-year period being weighted progressively with the most recent period having the highest weight. CRISIL has recently come out with their mutual fund ranking for the quarter ending March 31, 2014. In this part of a 2 part series, we will list the top 10 consistent performers. In the second part of the series, we will discuss some of the important performance characteristics of each of these funds. The table below lists the top 10 consistent performers, based on CRISIL ranking and 5 years annualized returns. The funds are listed in descending order of 5 years annualized returns. Returns in the table are for growth options in regular plans. NAVs as on April 28, 2014.

You can see in the table above, the consistent performers are from different equity fund categories, viz. large cap funds, diversified equity funds and small and midcap funds. All these funds gave strong returns across different time scales. For example, the average return in the 3 year time period, which included the bear market of 2011, was in excess of 11%, which is higher than returns from almost all debt investments.

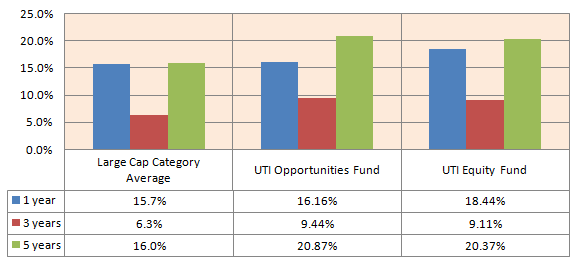

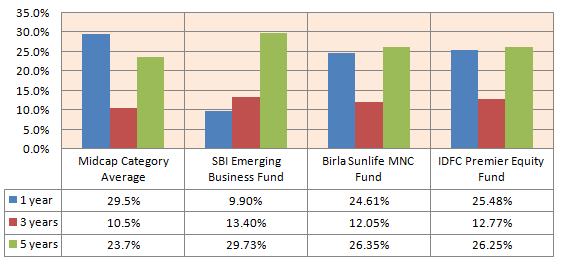

Let us see how these funds have performed relative to the equity fund categories. As discussed in our earlier articles, the risk and return differs from category to category. Large cap funds, which comprise mainly of large cap stocks, have the lowest risk among equity funds. Diversified equity funds, which comprise of both large cap and midcap stocks carry slightly more risk than large cap funds, but also give higher returns. Small and midcap funds, carry the highest risk funds, but also give higher returns.

See the chart below for the annualized returns of the top large cap consistent performers, relative to their category. NAVs as on April 28, 2014.

1CRISIL Rank: 1 – Very Good; 2 – Good; 3 – Average; 4 – Below Average; 5- Relatively Weak

See the chart below for the annualized returns of the top diversified equity consistent performers, relative to their categories. NAVs as on April 28, 2014.

See the chart below for the annualized returns of the top small and midcap consistent performers, relative to their category. NAVs as on April 28, 2014.

Our top consistent performers, may not have given the highest returns in their respective categories, but as you can see from the charts above, the top consistent performers have outperformed their respective categories across almost all time-scales.

Conclusion

Consistent performance is the most important criterion in selecting a mutual fund for investment. Good financial planners suggest that consistent performers should form a large part of your mutual fund portfolio. In this article, we have discussed about the top 10 consistent performers, as per the most recent CRISIL ranking. In our next article, we will discuss some important performance related factors of these top 10 consistent performers.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team