The New SEBI Proposal: The Action & the Effect

The new SEBI proposal has multiple questions in our mind.

Through this below note and example, we are attempting to simplify the understanding. Hence, we have taken only actively managed equity funds as an example & as it also forms a bulk of the industry AUM today. (The article does not include any information on ETF, FOF & Index Funds & its proposals, if any).

Now, will this really impact the business growth for MFDs & Asset Management Companies, is the question currently chasing all of us.

On a quick foot, we believe that the proposal brings in uniformity in multiple aspects & makes the investor well aware of the exact cost impact on the NAV. Now, the impact of an all-inclusive NAV & its effect on the growth of business and distribution payouts, will be at each Asset Management Companies level to decide.

At a broader concept, the Asset Management Companies will have to do a trade-off between their blended margins & growth.

Some quick highlights:

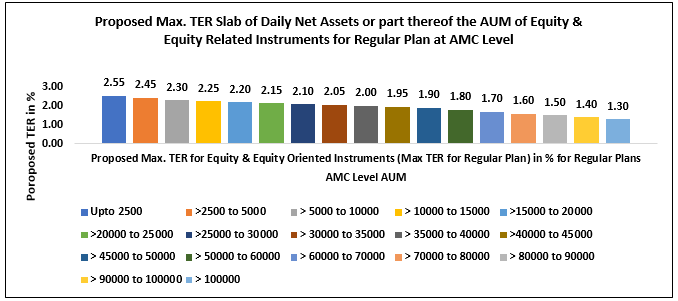

- The entire Total Expense Ratio Slab has been proposed to be revamped, for equity funds from a first slab starting at Base TER 2.25% (at scheme level) for the first INR 500 Crores of AUM (exclusive of all others charges & cost) for Equity Oriented Schemes has now been proposed at Max. TER 2.55% (at AMC Level) for the first INR 2500 Crores of AUM (inclusive of all others charges & cost) for Equity & Equity Oriented Instruments (Maximum TER for Regular Plan).

- In current scenario for equity funds (for Equity Oriented Schemes) (at scheme level), the Base TER is constant from an AUM > INR 50,000 Crores at Base TER 1.05% (exclusive of all others charges & cost) it has now been proposed to be constant from an AUM > INR 1 Lac Crore (at AMC Level) at 1.30% (inclusive of all others charges & cost) for Equity & Equity Oriented Instruments for Regular Plan.

- Now each Asset Management Company will have to calculate the Weighted Average TER at AMC (overall) asset class level, Equity & Equity Oriented Instruments and Debt (Other than Equity & Equity related instruments). Hence, One AMC, One TER for an Asset Class.

- The entire GST on Management Fee, STT paid for equity, equity trading commission/brokerage (in Cash market maximum permissible limit at 12 Basis & in Derivatives maximum permissible limit at 5 Basis), will be inclusive of the Total Expense Ratio.

- 5 Basis additional charge on Base TER Slab in lieu of exit load (schemes having provision for exit load) has been proposed to be removed.

- If a distributor is introducing a new investor through investing in a Mutual Fund for the first time across RTA level (Industry Level) with a ticket size >= INR 10,000, with the Opt-In option he gets INR 150/- as transaction charge & subsequently INR 100/- for each investment of INR >=10,000/- from the same investor. In case of SIP, with similar criteria as mentioned & provided the SIP is totaling above >=10,000/- in the year, the distributor gets INR 150/- for first SIP & subsequent more SIPs from the same investor, he gets INR 100/- (provided the SIP is totaling >=10,000/ in the year). Opt-in transaction charge has been proposed to be discontinued.

- B 30 now has been proposed to be paid through Investor Education Fund as retained by Asset Management Companies (1 Basis) as part of Financial Inclusion. B 30 now proposed to be capped at maximum of 1% of the first application from new individual investor (new PAN) at industry level or amount committed through SIP of the individual investor at an industry level, subject to a maximum of INR 2000/. Further it’s also proposed that such commission can also be allowed under Regulation 52 (4) of the MF Regulations which includes distribution commission that can be charged to the scheme. The clawback will apply and to be credited in the scheme or the Investor Education & Awareness fund, if investments are redeemed before One Year.

- As proposed, for Hybrid & solution oriented schemes, now will have to charge a different expense ratio proportionate to their equity (Equity & Equity Oriented Instruments) & debt AUM (Other than Equity & Equity related instruments) (excluding the AUM of Overnight scheme), as combined with respective asset class at an AMC Level.

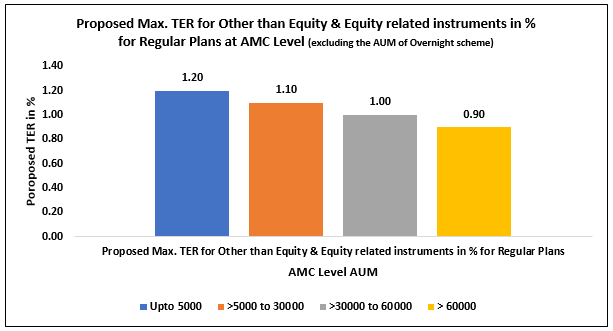

- For Other than Equity & Equity related instruments, the Max. TER (at AMC level) particularly has seen a major revamp. Now the first slab has been proposed to begin as: Upto INR 5,000 Crores (AUM at AMC Level) (excluding the AUM of Overnight scheme) Max. TER at 1.20% from earlier Base TER 2% for the first INR 500 Crore AUM at a Scheme Level.

- It is proposed that Asset Management Companies to obtain a limited purpose membership with recognized stock exchanges and undertake their own transactions in equity segment of stock exchange on behalf of their own mutual fund schemes. This can bring down the cost further.

- Emphasis on onboarding first time women investors at an Industry level & distributors to be supported with higher payout through the Investor Education as part of financial inclusion.

- For New Fund Offers it has been, any switch from a lower commission payout scheme to a higher commission pay out scheme, in such a scenario the lower commission payout continues to apply for the new scheme during NFO.

- During any TER change, a 3 business days advance notice is mandatory. Now in addition, investors should be provided with an exit load free window during such period to exit the scheme in case there is an increase in the TER. In case of products with lock or quasi lock-in such in the case of ELSS & Target Maturity Funds etc, only the new investors coming in will pay the higher TER. The existing investor will continue at the earlier TER (as grandfathered)

- Performance Based TER model to be tested under the regulatory sandbox, as an option

- Exit Load for open-ended scheme to brought from 5% to 2%

Now, for simplicity of understanding & proposed TER impact, we have taken actively managed equity fund (house) as an example with an AUM of INR 1,01,500.00 Crore. Further we have compared it with the proposed & current at present scenario:

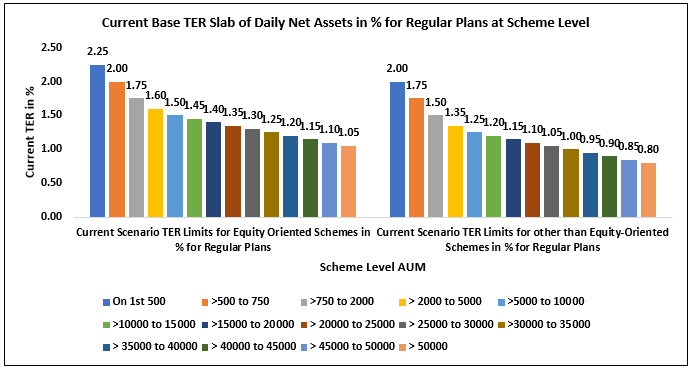

In order to understand the example, first let’s look at the current TER limits for Equity Oriented Schemes in percent for Regular Plans. In the below chart, the additional 5 basis permissible to be charged in lieu of exit load is not included.

AUM Figure in INR Crore

Proposed Max. TER for Equity & Equity Oriented Instruments in percent for Regular Plans

AUM Figure in INR Crore

Proposed Max. TER for Other than Equity & Equity related Instruments in percent for Regular Plans

AUM Figure in INR Crore

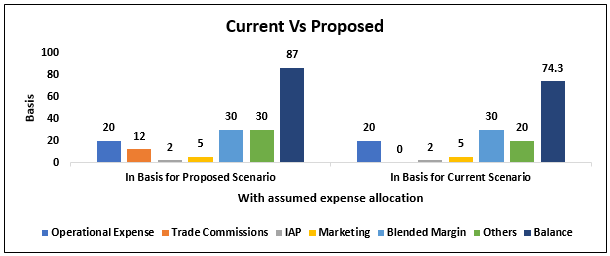

Post getting a good understanding on the TER limits in the current & the proposed scenario, lets look at the impact through the example.

As in the example we have assumed AUM of INR 1,01,500 Crore as an actively managed Equity AUM, the outcome for current Vs proposed is:

1 Basis is 0.01%

In the above chart, for current scenario of TER limit we have considered:

- 6 Actively Managed Equity Funds with total AUM INR 1,01,500.00

- 5 Basis additional expense has been factored in lieu of exit load in each TER limit

- Have assumed certain basis for operational expense, marketing, others include certain basis for staff/other cost & IAP is constant at 2 basis. Lastly, balance basis is assumed for distribution.

In the proposed TER limit, the following have been added in:

- Assumed certain basis as commission paid for equity trading

- Others also include GST on assumed blended margin & STT

- Others scenarios are kept the same

Now, it clearly shows that the new proposal will provide much more clarity to investors on their total TER for a scheme as it is inclusive of all the other expenses, while the Asset Management companies can & will negotiate a better pricing for there commissions on equity trades, will also get a greater clarity on others expenses inclusive of STT (as governed), GST & staff cost. Some AMCs can & will approach to become member broker of stock exchanges in order to bring their trading cost lower.

Some inputs:

- Since B30 Trail has been proposed to be paid through Investor education as a financial inclusion and has been capped at maximum of 1% of the first application from new individual investor (new PAN) at industry level or amount committed through SIP of the individual investor at an industry level, subject to a maximum of INR 2000/. It’s also proposed that such commission can also be allowed under Regulation 52 (4) of the MF Regulations which includes distribution commission that can be charged to the scheme. The clawback will apply and to be credited in the scheme or the Investor Education & Awareness fund, if investments are redeemed before One Year. In case it’s been paid through Investor Education & Awareness Fund, then some smaller players will have an impact as their investor education funds are not that large at the moment.

- Basis the smaller AUM’s & the proposed TER Limits, the smaller AMCs will have an advantage to build AUMs, hence a positive for them.

- Hybrid & solution oriented schemes, TER will be charged as a proportion of their Equity Assets separately included in the overall equity asset class (Equity & Equity Oriented Instruments) & Debt (Other than Equity & Equity related instruments) separately as an asset class at AMC level.

- The Debt (Other than Equity & Equity related instruments) Schemes TER has been re-adjusted, hence will impact AMCs with a higher proportion of Debt to Equity AUM Ratio. This will have a larger impact on funds in active duration management, hence 1 Year & above.

- Overall, the working of an Asset Management Company will now be more transparent, a wonderful scenario to have.

- Each AMC will now have to visualize their growth gaps & accordingly negotiate harder on their over-head expenses, desired blended margin & distribution expense.

- Mutual Funds has & will always remain a masses product, hence volumes than value will matter more going ahead. But both objectives will play hand in hand for growth.

Mutual Funds is still a Sunrise industry with only 3.77 Crore Unique PAN/PEKRN. The total PAN Cards issued are at around 61 Crore, hence the growth trajectory ahead is huge. Today, Mutual Funds play a vital role in daily turnover in stock exchanges & the SIPs are on the rise month after month.

Hence, the scope of growth for Mutual Fund Distributors, Asset Management Companies & Investors now finding Mutual Funds as their main portfolio allocation will continue to grow at a fast pace.

Please Note: TER is charged on daily net assets (AUM)

SEBI seeks the comments from Asset Management Companies on the proposal by June 1,2023

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team