Sundaram Services Fund: Strong performance from this thematic fund

About Services Sector in India

Services sector is the largest contributor to India’s GDP, contributing nearly 55% to Gross Value Add (source: Press note on provisional FY 2023-24 GDP estimate, Ministry of Statistics & Programme Implementation, Government of India). The services sector is also a major source of employment in our country accounting for more than 30% of India’s workforce (source: Statista, 2023). India is a major global player in services trade, being among the Top 10 services exporting countries in 2021 (source: Union Budget 2023). As per Ministry of Statistics & Programme Implementation’s provisional GDP estimates, services sector grew by 9.6% in terms of GVA on a year on year (YOY) basis in FY 2023-24. The services sector covers a variety of industries ranging from Banking and Financial Services, Information Technology, Telecom, Transportation, Hotels, etc.

Government reforms and initiatives for the Services Sector

To ensure the liberalisation of investment in various industries, the Government has permitted 100 per cent foreign participation in telecommunication services including all services and infrastructure providers, through the Automatic Route. The FDI ceiling in insurance companies was also raised from 49 to 74 per cent. Measures undertaken by the Government to boost FDI include the National Single-Window system, enhancement in the FDI ceiling through the automatic route etc. have played a significant role in facilitating investment. The Government’s push to boost the digital economy, growing internet penetration, rise in smartphone adoption and increased adoption of digital payments has the potential to accelerate economic growth. The introduction and piloting of Central Bank Digital Currency (CBDC) will also provide a significant boost to digital financial services.

About Sundaram Services Fund

Sundaram Services Fund was launched in September 2018 and has given 21.58% CAGR returns since inception. If you had invested Rs 1 lakh in Sundaram Services Fund at the time of its launch, your investment would have multiplied 3 times, as on 1st July 2024. Sundaram Services Fund is a unique offering in the industry. This is a thematic fund which invests in services sectors. The fund has Rs 3,358 crores of assets under management (AUM) as on 31st May 2024. The Total Expense Ratio (TER) of the fund is just 1.9% (Regular Plan, as on 31st May 2024). The fund performance has been stellar. There are several interesting observations about the fund’s performance which investors can take into consideration when selecting the fund for their equity portfolios.

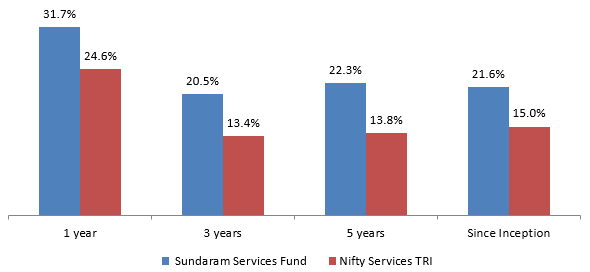

Outperformed the benchmark index

Sundaram Services Fund outperformed its benchmark index, Nifty Services TRI over different time periods creating alphas for investors (see the chart below).

Source: Advisorkhoj Research, as on 1st July 2024. Returns for periods over 1 year are in CAGR

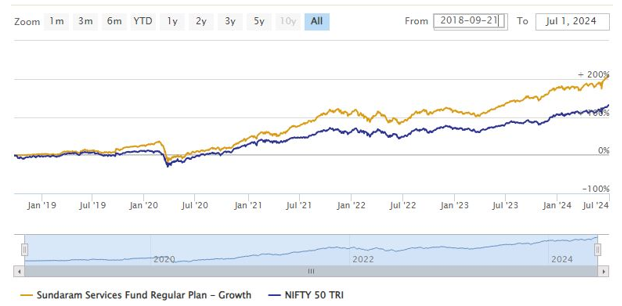

Outperformed the market

Sundaram Services Fund outperformed the leading equity market index, Nifty 50 TRI since the inception of the scheme (see the chart below).

Source: Advisorkhoj Research, as on 1st July 2024.

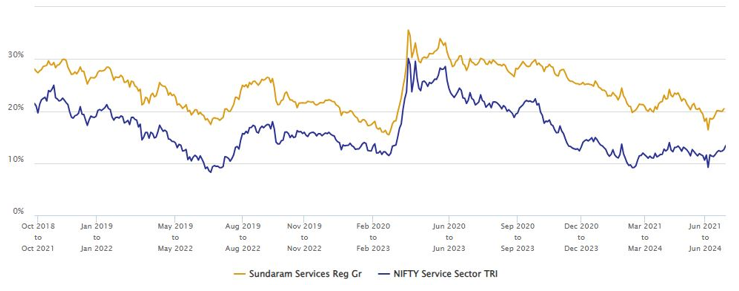

Consistency in rolling returns outperformance

We looked at the 3 year rolling returns of the fund versus its benchmark index, Nifty Services TRI since the inception of the scheme (see the chart below). You can see that the fund (coloured in yellow) consistently outperformed the benchmark index across different market conditions. The average 3 year rolling return of fund was 24.38%. The fund gave 15%+ CAGR returns over 3 year investment tenures in 100% of the instances.

Source: Advisorkhoj Rolling Returns, as on 1st July 2024

Superior risk / return trade-off

Up Market Capture Ratio and Down Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of Sundaram Services Fund over the last 3 years. For the benefit of new investors and mutual fund distributors who may not be familiar with the concept of market capture ratios, Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund.

The Up Market Capture Ratio of Sundaram Services Fund over last 3 years was 112% which implies that if the benchmark index went up by 1% in a month, then the fund’s Net Asset Value (NAV) went up by 1.12%; in other words, the fund was able to beat the market benchmark index when the market was trending up. The Down Market Capture Ratio of the fund was only 75% which implies that if the benchmark index went down by 1% in a month, then the fund’s NAV went down by only 0.75%; in other words, the fund was able to limit the downside risk of investors in falling markets. This is a clear indication of the potential of the fund to give superior risk adjusted returns of the fund.

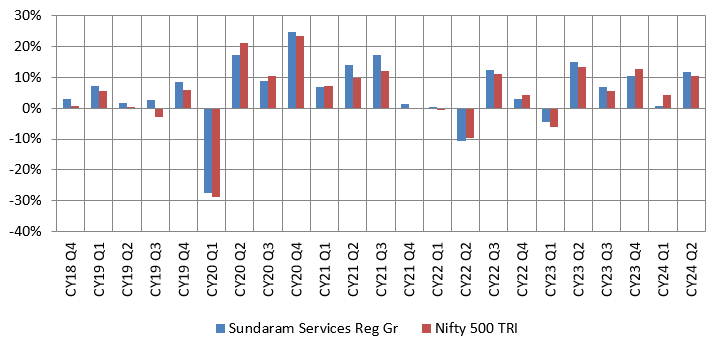

Consistency in outperformance over broad market

We looked at the quarterly returns of Sundaram Services Fund versus the broad market index Nifty 500 TRI since the inception of the scheme (see the chart below). You can see that Sundaram Services Fund outperformed Nifty 500 in around 70% of the quarters since inception (only full quarters have been considered). You can also observe that the fund outperformed in different market conditions e.g. up markets, down markets, flat markets.

Source: Advisorkhoj Quarterly Returns, as on 30th June 2024.

Investment Universe of Sundaram Services Fund

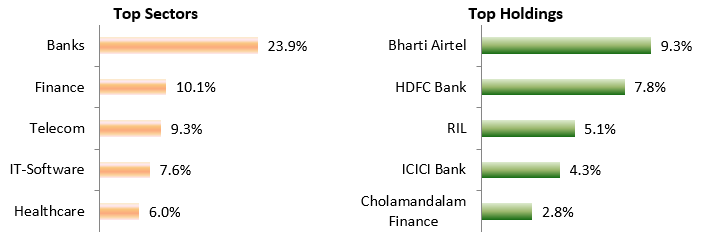

Current portfolio positioning

Source: Sundaram Fund Factsheets, as on 31st May 2024

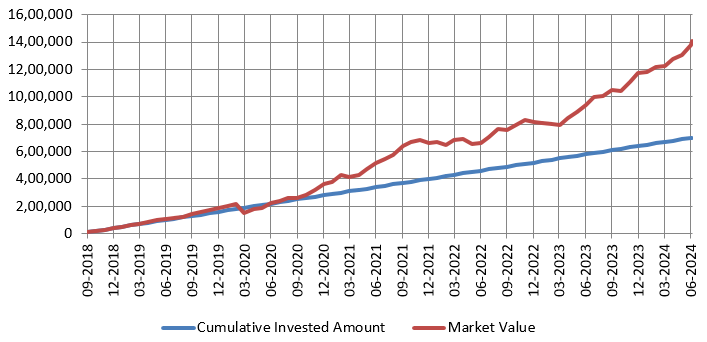

Wealth creation through SIP

The chart below shows the growth of Rs 10,000 monthly SIP in Sundaram Services Fund since the inception of the scheme. The SIP XIRR since inception was 25.4% (as on 1st July 2024)

Source: Advisorkhoj Research, as on 1st July 2024

Our take

India’s services PMI rose 61.2 in March 2024 from 60.6 in February (source: S&P Global, 31st March 2024). This is the highest services sector growth in the last 14 years. With favourable demographic dividends, rising per capita income, shift from unorganized to organized sectors and long term impact of Government’s structural reforms, the long term outlook for services sector is bright. Sundaram Services Fund is diversified across the spectrum of industry sectors within services. The fund has a strong track record of alpha creation. This fund may be suitable for long term investment option for investors who want to boost their portfolio returns with tactical allocations in thematic funds.

Who should invest in Sundaram Services Fund?

- Investors willing to have satellite allocation to overall equity portfolio.

- Investors looking for capital appreciation over long investment tenures from infrastructure theme.

- Investors with very high-risk appetites.

- Investors with minimum 3-year investment tenures.

- You can invest either in lump sum or SIP depending on your investment needs.

Investors should consult their financial advisors or mutual fund distributors if Sundaram Services Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mirae Asset Investment Managers (India) Pvt. Ltd. IFSC branch launches Mirae Asset Global Allocation Fund IFSC at Gift City

Apr 21, 2025 by Mirae Asset Mutual Fund

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund