Sundaram Midcap Fund: One of the most consistently performing midcap funds

Performance consistency in mutual funds, in our view, is one of the most important attributes of superior long term returns and wealth creation for investors. Consistent performers may not always be the best performer in a particular year, but they deliver relatively superior performance across different market conditions. Consistent performance ensures that a fund recovers more quickly from difficult market conditions and in the long term generates superior returns. Our internal research shows that, consistent performers deliver the best returns in the long term (5 years, 10 years or longer).

Rolling returns is the best measure of performance consistency of a scheme. Advisorkhoj has developed an algorithm that ranks schemes accordingly as per different rolling returns parameters – average rolling returns and rolling returns outperformance consistency. Using our proprietary methodology, we identify the most consistent performers in all mutual fund categories and show it in our tool, Top Consistent Mutual Fund Performers. We urge investors and financial advisors to user our tool, Top Consistent Mutual Fund Performers for selecting mutual fund schemes. You can see in our tool that Sundaram Midcap Fund is one of the most consistent performers in the midcap equity funds category.

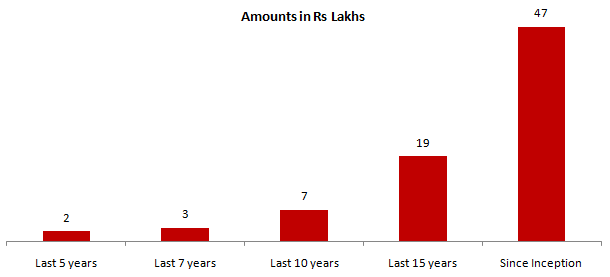

Phenomenal wealth creation over longer tenures

Sundaram Midcap Fund has delivered 18.5% CAGR returns in the last 5 years and 21.8% CAGR returns in the last 10 years. If you had invested Rs 1 Lakh in the scheme at its inception, your wealth would have grown to nearly Rs 47 Lakhs now. The table below shows how much wealth you could have created by investing Rs 1 Lakh in this fund over several investment periods.

Source: Advisorkhoj Point to Point Returns

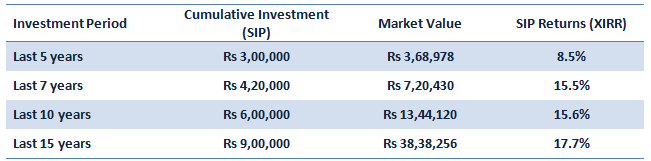

The table below shows how much money would have accumulated over different periods, if you invested Rs 5,000 every month in the scheme through Systematic Investment Plan. You can see that, you could have created substantial amounts of wealth by investing in this scheme.

Source: Advisorkhoj Top Performing Systematic Investment Plan - Equity: Mid Cap

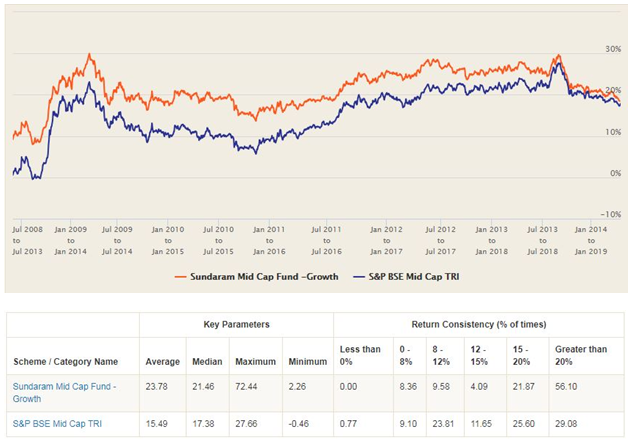

Rolling Returns

The chart below shows the 5 year rolling returns of Sundaram Midcap Fund versus its benchmark index S&P BSE Midcap TRI since its inception. We have chosen a rolling return period of 5 years, because we think investors should be prepared to remain invested for at least 5 years in midcap funds since these funds can be volatile in the short term but has the potential to generate excellent returns in the long term (5 years or longer).

Source: Advisorkhoj Rolling Returns Calculator

You can see that the scheme has consistently beaten its benchmark index over 5 year investment periods across different market conditions since inception. The scheme has outperformed the benchmark on all rolling return parameters. In the table below the chart, you can see that the average 5 year annualized rolling return of the fund was around 20% and that the scheme gave 5 year returns in excess of 15%, nearly 75% of the times since inception. You can observe that the outperformance gap versus the benchmark has narrowed in the recent years. This has been observed across the board for most equity mutual fund schemes and is attributable to the maturing (more efficient) and deepening stock market in India, with more institutional investor (both FII and DII) in the midcap segment of the market.

Let us now see how Sundaram midcap fund rolling returns compared with midcap category. The chart below shows the 5 year rolling returns of the scheme versus the midcap category since the scheme’s inception. You can see that Sundaram Midcap Fund outperformed the category on fairly consistent basis since its inception. In terms of different parameters like average rolling return, median rolling return, maximum rolling return and minimum rolling return the scheme outperformed the category.

Source: Advisorkhoj Rolling Returns Calculator

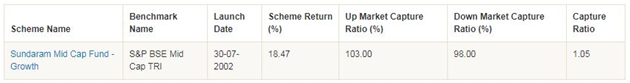

Up and Down Market Performance

Market rallies and corrections are both realities of equity investing. A mutual fund scheme which outperforms both in up markets and down markets is likely to give superior risk adjusted returns and outperform other funds in the long term.

In our tool, Market Capture Ratio, we see the performance of a fund both in up-market (months in which the benchmark index was up) and down market (months in which benchmark index was down). The ratio of the average monthly returns of a scheme versus average monthly returns of the benchmark when the market was up is known as Up-market Capture Ratio.

The ratio of the average monthly returns of a scheme versus average monthly returns of the benchmark when the market was down is known as Down-market Capture Ratio. The table below shows the market capture ratios of Sundaram Midcap Fund over the last 5 years. You can see that the scheme outperformed in both up and down markets. This reinforces why the scheme performance has been quite consistent (on a relative basis) across different market conditions.

Source: Advisorkhoj Research

Portfolio Strategy

The scheme is managed by industry veteran S Krishna Kumar. The fund manager invests in high growth midcap stocks which are reasonably valued. The scheme is currently overweight on sectors aligned towards impending domestic economic recovery and consumption. Stock selection is bottom-up using in-house research. The top industry sectors in the portfolio are banking and finance, industrial products, FMCG, retailing, auto-ancillaries, capital goods etc. The scheme is fairly well diversified in terms of company concentration.

About the scheme

Sundaram Midcap Fund was launched in July 2002 and has Rs 5,687 Crores of assets under management (AUM). The expense ratio of the scheme is 2.06%. The portfolio turnover ratio of the scheme is 46%. The minimum investment amount in the scheme is Rs 5,000 and the minimum top up amount is Rs 500. The scheme is available in both growth and dividend option. The dividend option of the scheme has been paying regular monthly dividends since 2017.

Conclusion

In this blog post, we reviewed Sundaram Midcap Fund. It is one of the most consistent midcap performers and has a great track record of wealth creation. Midcaps have corrected sharply in the last one year. The midcap index which was trading at a considerable premium to Nifty 50, 12 – 15 months back is now trading at a discount on a forward PE basis. Many fund managers we have spoken with told us that there are many attractive bottoms up stock picking opportunities in the midcap segment. While SIP is the ideal mode of investing in midcap funds, you can also tactically invest in lump sum at these valuations. If you have lump sum funds but are worried about near term volatility, you can invest in Sundaram Liquid Fund and use Systematic Transfer Plan (STP) to invest in Sundaram Midcap Fund, over the next 3 – 6 months. Investors should consult with their financial advisors, if Sundaram Midcap Fund is suitable for their long term investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team