Sundaram Large Cap Fund: A consistent performing fund to invest in

According to SEBI guidelines, the top 100 stocks by market capitalization in India are known as Large Cap stocks. The market capitalization of Large Cap companies lies between Rs 690 bn to Rs 18 trillion. (AMFI data as on 31st December 2023). The core sectors like petroleum products, oil and gas, coal, power, cement steel, oil and gas etc. comprise the large cap companies. Large cap funds invest at least 80% of their assets in large cap stocks.

Why invest in Large Cap Companies?

- During economic downturns and recessive markets, Large Cap funds are likely to face fewer financial upheavals. Large Cap Companies are market leaders in their respective industries and can weather volatility better than the mid or small cap companies.

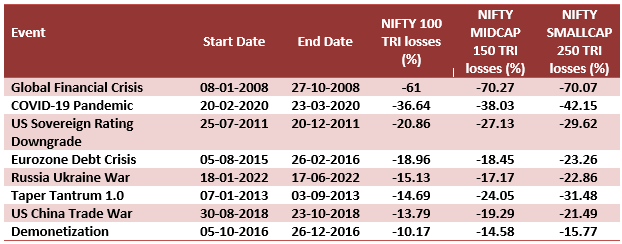

- Large cap stocks tend to be less volatile than midcap and small cap stocks, especially in deep corrections or bear markets. The chart below shows the biggest drawdowns in the market over the last 20 years. You can see large caps suffered less drawdowns compared to small / midcaps.

Source: National Stock Exchange, Advisorkhoj Research

- Large Cap funds are the highest traded stocks on the stock exchange. So, they are highly liquid. One of the biggest advantages of liquidity in large cap funds is that the fund manager can meet redemption pressures without incurring high impact costs. Impact cost is the cost that a buyer or seller of stocks incurs while executing a transaction due to the prevailing liquidity condition on the counter. A major disadvantage of stocks with low liquidity is that the fund manager may have to sell a stock at a much lower price to meet redemption needs.

- Since midcaps and small caps have relatively less free-floating shares, their trading volumes are thinner. As a result, the prices of these stocks can run up much higher – high demand and less supply. Large caps, on the other hand, do not have this problem because there is always a good supply of shares in large cap stocks due to high public ownership (institutional and retail).

In this article we will discuss the Sundaram Large Cap Fund as an investment option.

Sundaram Large Cap Fund Regular Growth

Sundaram Large Cap Fund is an open-ended large cap equity scheme with inception date of July 2002. The fund named Sundaram Select Focus merged into Sundaram Blue chip Fund on Dec 24, 2021, following which Principal Large Cap Fund merged into these and the surviving scheme was renamed effective Dec 31, 2021. As of 4th February 2024, the fund has an NAV of 18.9808 for its regular growth plan (as on 16 Feb,2024). The Benchmark for the fund is Nifty 100 TRI. The expense ratio of the scheme regular plan is 1.9% as on 2nd February 2024. The fund is managed by Sudhir Kedia and Ravi Gopalakrishnan since May 16, 2022.

Performance of Sundaram Large Cap Fund Regular Growth –

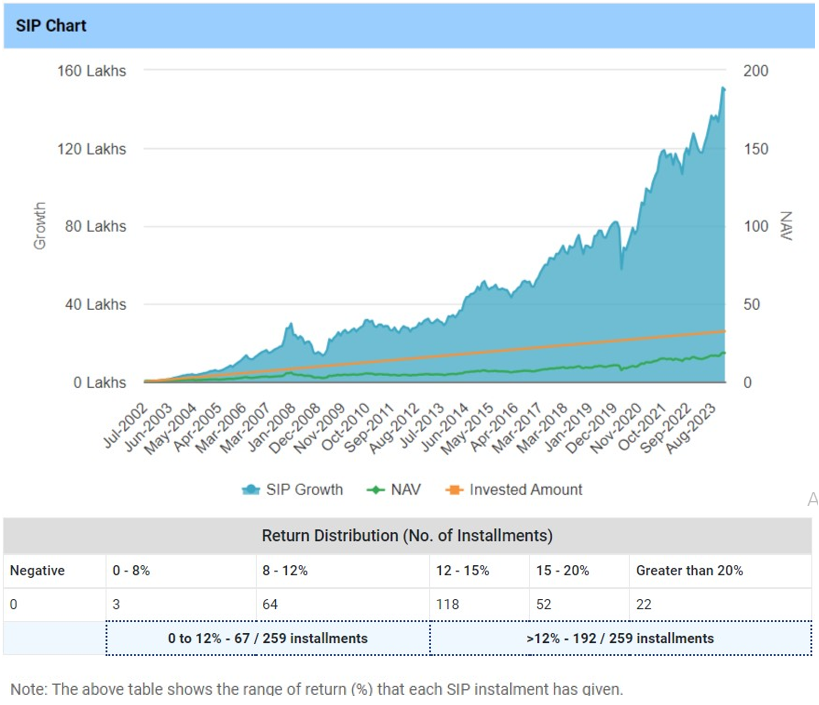

SIP Returns - A monthly SIP of Rs 10,000/ started at the inception of the fund would have grown to Rs 1,53,71, 433/- as on 16th February 2024 against a total investment of Rs 25.90 Lakhs – The fund has given an XIRR return of 14.38%.

Source: Advisorkhoj Research. Disclaimer: Past performance is not indicative of future performance.

From the above chart you can also see that out of 259 SIP instalments, the fund had delivered more that 12% return on 192 instalments. This speaks very high about the return consistency of the fund.

Lumpsum returns - A lumpsum of Rs 1,00,000/- invested in the fund at inception would have grown to a corpus of Rs 34.19 Lakhs delivering a CAGR return of 17.8% which is a bit higher than the NIFTY 50 TRI return of 17.20% in the same period (Return as on Jan 31, 2024 - Source: Advisorkhoj Research).

Investment Strategy of the Sundaram Large Cap Fund

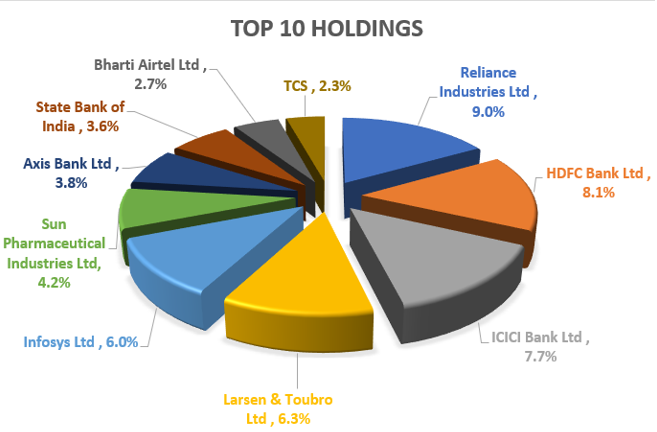

The scheme’s objective is to generate long-term capital appreciation by investing predominantly in large cap stocks. The AUM of the fund stood at Rs 3,314.86 Crores as of January 2024. The fund managers are overweight in the sectors like Pharma & Biotechnology, Construction, and Beverages and underweight on Diversified FMCG, Power, and Automobiles while allocating assets between sectors. As of January 2024, the scheme has 99.3 % equity allocation. Below is the chart for the top 10 company holdings of the fund.

Source: Sundaram Large Cap Fund Factsheet – January 2024

Why invest in Sundaram Large Cap Fund now?

- India's relative light positioning in the emerging market (EM) portfolios, and their rising size is gradually making Indian markets more relevant for global mandated funds. Therefore, structural positives such as the rising investment cycle, expected political stability along with multi-year growth visibility, and peaking of the dollar has a potential to draw higher foreign flows into large caps in 2024.

- Large caps are trading at more reasonable valuations compared to midcaps and small caps.

- Retail assets under management (AUM) moved from large cap funds to mid / small cap fund in the CY 2023. We may see trend reversal and portfolio rebalancing in CY 2024. This will boost large cap fund returns.

- The fund has delivered consistent return since its inception and has been able to beat Benchmark and Category average returns.

Who should invest in Sundaram Large Cap Fund?

The Sundaram Large Cap Fund is suitable for:

- Investors who have a moderately high to high-risk appetite with a goal of creating a corpus through long term capital appreciation.

- It is suited for investors looking to invest for their long-term financial goals like retirement planning, children’s higher education, children’s marriage, wealth creation etc.

- New and young investors who would like to start their investment journey with a low volatile equity fund as large cap funds are less volatile compared to midcap or small cap funds.

- Investors who have at least 5 years investment horizon.

Investors may contact their mutual fund distributor or financial planner to understand how the fund can align with their investment goals.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team