Sundaram Equity Hybrid Fund: Best performing aggressive hybrid fund in last one year

Aggressive hybrid funds are equity oriented hybrid mutual fund schemes which were earlier known as balanced funds. The schemes are mandated by SEBI to allocate 65% (minimum) to 80% of their portfolio to equity and equity related securities. Debt allocation of these schemes rangesfrom20% to 35% (maximum). Aggressive hybrid funds are less volatile than equity funds but they can give excellent returns over long investment tenors. As such, they are excellent investment choices for new investors who do not have experience of how to deal with market volatility, but want to invest long term for their financial goals. A major advantage enjoyed by aggressive hybrid funds is that, despite their somewhat moderate risk profiles, they enjoy equity taxation.

You may like to read All you need to know about hybrid mutual funds

Sundaram Equity Hybrid Fund – A top performing aggressive hybrid fund

Sundaram Equity Hybrid Fund is the best performing aggressive hybrid fund in the last one year. It is also among the top 5 aggressive hybrid equity funds in the last 3 years. The scheme is also one of the most consistent performers among aggressive hybrid equity funds having ranked in the top 2 performance quartiles in 3 out of the last 5 years (please see our tool, Most Consistent Mutual Funds).

Sundaram Equity Hybrid Fund was launched in June 2000. If you had invested Rs 1 Lakh in the NFO of this scheme, your investment value today would be nearly Rs 8.5 Lakhs.

If you had started a monthly SIP of Rs 5,000 in this scheme at its inception and continued till date, you could have accumulated a corpus of Rs. 38 Lakhs, with a cumulative investment of little over Rs 11 Lakhs.

Sundaram Equity Hybrid Fund has around Rs 1,393 Crores of Assets under Management and expense ratio of 2.48%. Rahul Baijal is the fund manager of this scheme.

Sundaram Equity Hybrid Fund Performance

The chart below shows the trailing returns of this scheme (period ending January 25, 2018) versus Aggressive Hybrid Funds category over different time-scales. You can see that the scheme outperformed the category most of the times.

Source: Advisorkhoj Research

The chart below shows the annual returns of Sundaram Equity Hybrid Fund versus the Aggressive Hybrid Fund category over the last 5 years. You can see that the scheme underperformed slightly during market rallies, but outperformed during corrections and periods of volatility. This shows that the scheme follows a prudent approach to asset allocation and risk management.

Source: Advisorkhoj Research

The chart below shows the NAV growth of the scheme over the last 5 years.

Source: Advisorkhoj Research

Rolling Returns

The chart below shows the 3 year rolling returns of Sundaram Equity Hybrid Fund versus the Aggressive Hybrid Funds category over the last 5 years. We chose a 3 year rolling returns period because in our view investors need to have a minimum 3 year horizon for investments in Aggressive Hybrid Funds.

Source: Advisorkhoj Research

You can see that 2015 onwards Sundaram Hybrid Equity Fund has consistently outperformed the Aggressive Hybrid Funds category. Average 3 year rolling return of the scheme over the past 5 years was 10.31%, while the median 3 year rolling return over the past 5 years was 10.12%. The maximum 3 year rolling return over the last 5 years was 14.5%, while the minimum 3 year rolling return was 6.9%. The scheme gave more than 8% rolling return 92% of the times and more than 12% rolling returns 18% of the times. Consistency is one of the hallmarks of funds which give excellent returns to investors over long tenures.

Portfolio

The current equity allocation of Sundaram Equity Hybrid Fund is 73% - the balance allocation is to fixed income and cash equivalents. Top sectors include both cyclical sectors like banks, finance, construction, auto etc and defensive sectors like IT, pharma and FMCG. The scheme is well diversified from a company concentration perspective with bias towards large cap (large cap stocks comprise 45 to 60% of the portfolio value). The debt portion of the portfolio comprises of corporate bonds with attractive yields and high credit quality. The debt portion has limited interest rate sensitivity.

Source: Advisorkhoj Research

Lump Sum and SIP Returns

The chart below shows the growth of Rs 1 Lakh lump sum investment in the Sundaram Equity Hybrid Fund over the last 5 years.

Source: Advisorkhoj Research

The chart below shows the returns of Rs 5,000 monthly SIP in the scheme over the last 5 years.

Source: Advisorkhoj Research

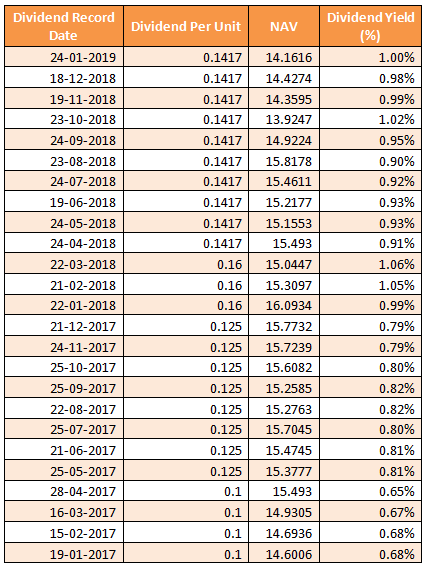

Dividend History

The scheme’s monthly dividend option has been paying regular monthly dividends for the last 2 years. The average monthly dividend yield has been in 0.8 to 1% range, which is quite high. Mutual fund investors should however, understand that dividends are paid from the accumulated profits of a scheme at the discretion of the fund manager. There is guarantee that the current dividend payout rate will be sustained in the future.

Source: Advisorkhoj Research – Dividends in a scheme

Conclusion

Sundaram Equity Hybrid Fund has completed 18 years since launch. The long term track record as well as the more recent performance of the scheme has been quite good. Given uncertainty about election outcome and global risk factors, we expect the volatile conditions of the equity markets to continue in the coming weeks and months. Aggressive hybrid funds can thus be good investment options in such situations. You can invest in Sundaram Equity Hybrid Fund in either lump sum or through SIPs depending upon your financial situation. You should consult with your financial advisor, if Sundaram Equity Hybrid Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mirae Asset Investment Managers (India) Pvt. Ltd. IFSC branch launches Mirae Asset Global Allocation Fund IFSC at Gift City

Apr 21, 2025 by Mirae Asset Mutual Fund

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund