Sundaram Balanced Advantage Fund – Good investment in volatile markets

Dynamic Asset Allocation

Dynamic Asset Allocation changes equity and debt allocations of the portfolio based on market conditions. Dynamic Asset Allocation models usually increase asset allocation to equity and reduce allocation to debt, if equity valuations fall. If equity valuations are increase, then dynamic asset allocation models reduce allocation to equity and increase allocation to debt. The aim of dynamic asset allocation is to reduce downside risk and generate risk adjusted returns. Balanced Advantage Funds are hybrid funds whichdynamically rebalance their asset allocation between equity and debt based on dynamic asset allocation model.

How Balanced Advantage Funds work

- Net or Active Equity: This is the un-hedged equity exposure of the fund. Net equity allocation is determined by a quantitative dynamic asset allocation model based on market conditions.

- Fixed Income: Fixed income allocation is determined by the asset allocation model but is usually capped at 35% to ensure equity taxation.

- Arbitrage: This is the fully hedged equity component which is not exposed to market risks but generates arbitrage (risk-free) profits based on price differences in cash and futures market or corporate actions. The arbitrage component reduces the net equity exposure and at the same time, helps to keep the gross equity exposure above 65%, which enables equity taxation.

Sundaram Balanced Advantage Fund

Sundaram Balanced Advantage Fund, formerly known as Principal Balanced Advantage Fund, works on the dynamic asset allocation strategy based on market valuations. The dynamic asset allocation model of the fund defines valuation bands and corresponding asset allocation ranges for each band. Valuation bands are based Trailing Twelve Months (TTM) Nifty Price Earnings (PE) multiples. PE bands work better than absolute PE levels because it gives the fund managers some flexibility of managing asset allocation changes within the band. Having valuation bands also reduces impact cost of sudden asset allocation changes and volatility of returns.

After the merger of Sundaram and Principal AMCs, the two dynamic asset allocation funds of the merging partners, Principal Balanced Advantage Fund and Sundaram Balanced Advantage, were merged into a single scheme. The scheme now has Rs 1,602 crores of assets under management (AUM), as on 28th February 2022. The scheme benchmark is NIFTY 50 Hybrid Composite debt 50:50 Index. The chart below shows, the trailing annualized returns of Sundaram Balanced Advantage over different time-scales.

Source: Advisorkhoj Research. As on 28th February 2022

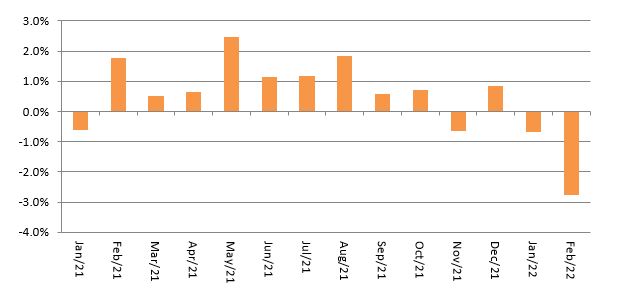

Monthly Returns of Sundaram Balanced Advantage Fund in 2021 and YTD 2022

The chart below shows the monthly returns of Sundaram Balanced Advantage Fund in 2021 and year to date, 2022. You can see that the scheme was able to provide relatively stable returns to investors. February 2022 was an exceptional month because of Russian invasion of Ukraine leading to a fall in global equities.

Source: Advisorkhoj Research. As on 28th February 2022

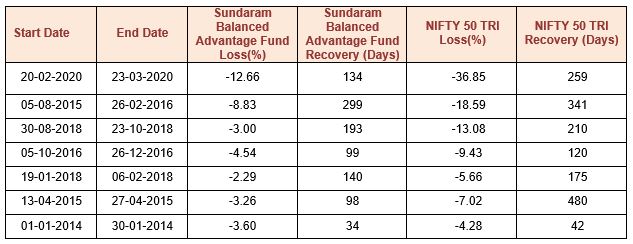

Limited Downside Risk

The table below shows the biggest market drawdowns (corrections from peak to bottom) since the inception of Sundaram Balanced Advantage Fund. You can see that the scheme was able to limit downside risk for investors in highly volatile markets. You can also see that the scheme was able to recover its losses, relatively faster. As such, Sundaram Balanced Advantage Fund can be a good investment choice for investors who do not have high risk appetites, including new investors.

Source: Advisorkhoj Research. As on 28th February 2022

Why are Balanced Advantage Funds a good investment now?

There are several risk factors (mainly global risk factors), which are impacting the equity markets now:-

- Geopolitical: Russian invasion of Ukraine in the last week of February has led to an unprecedented geopolitical crisis. The West led by the United Stateshas announced stringent economic sanctions on Russia, including ban of Russian oil imports by the United Stated. This led to a surge in crude prices, with price crossing $130 per barrel. High crude price is unfavorable for Indian economy and the Indian Rupee. The equity markets are likely to be volatile, till we have a peaceful resolution of Russia – Ukraine crisis. Historically market disruptions caused by such skirmishes have tilted risk-reward favorably for long-term investors.

- 2. Interest Rates: The US Federal Reserve has taken cognizance of the inflation situation in the US and is likely to hike interest rates a number of times in this calendar. US interest rates will have an impact on emerging market equities, including India. Though the RBI has maintained an accommodative monetary policy so far, it may be forced to change its stance due to the current account deficit and inflation situation.

- 3. Valuations: Though Nifty has corrected over the past few weeks, valuation of individual stocks still seem frothy in the current scenario according to some experts and sharper correction in the near term cannot be ruled out, especially if the geopolitical crisis worsens.

- 4. Long term growth prospects: From an Indian equity perspective, despite being globally connected, the direct impact on the economy is limited. The visible risk remains largely from an extended period of high energy prices. Historically such market disruptions caused by such skirmishes have tilted risk-reward favorably for long-term investors. Amidst an upbeat earnings cycle, a healthy equity market consolidation should provide reasonable valuations and risk-reward for improving allocations to Indian equities. A portfolio balanced across cyclical and growth ideas in emerging markets such as India should continue to benefit from the post-pandemic tailwinds of economic recovery.

- 5. Favorable risk reward scenario: Amidst an upbeat earnings cycle, a healthy equity market consolidation should provide reasonable valuations and risk-reward for improving allocations to Indian equities. A portfolio balanced across cyclical and growth ideas in emerging markets such as India should continue to benefit from the post-pandemic tailwinds of economic recovery. Sundaram Balanced Advantage Fund investors can benefit.

Current portfolio strategy of Sundaram Balanced Advantage Fund

Considering normalized TTM earnings, the average monthly Nifty TTM PE stands just under ~23x for the month under review and the scheme is using the market corrections to increase the equity allocation, which was maintained all along between 40-45 percent in the past few quarters. The portfolio is well diversified across sectors given the synchronous recovery across global economies. Disproportionate focus is selection of stocks with resilient earnings, strong balance sheet, sound management pedigree and visible medium-term growth catalysts. Incremental stock selection efforts are guided by earnings-driven upsides against the stock valuations. The portfolio continued to remain diversified across sectors with moderate overweight in banking, chemicals, industrial manufacturing, auto and underweight in consumer staples. Return expectations in arbitrage segment going forward have to be aligned to two factors, the current level of interest rates, which have started to firm up and the extent to which leverage bets sustain in the derivative segment. On Fixed Income & REITs/InVITs, allocations stood at 14% and 4% respectively. The Fixed Income exposure is primarily into high quality short duration papers of under four years.

Tax Advantage

One of the biggest benefits of Balanced Advantage Funds is that they enjoy equity taxation - short term capital gains (investment held for less than 12 months) are taxed at 15%, while long term capital gains (investment held for more than 12 months) up to Rs 1 lakh are tax free - long term capital gains in excess of Rs 1 lakh are taxed at 10%. There is no Dividend Distribution Tax on mutual fund dividends, but dividends paid mutual fund schemes are taxed as per the income tax rate of the investor.

Who should invest in Sundaram Balanced Advantage Fund?

- Investors looking for capital appreciation and income over long investment horizons

- Investors who want limited downside volatility

- Investors with moderately high risk appetites

- Investors with minimum 3 year investment tenures

- First time investors with sufficiently long investment horizon can invest in this scheme

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team

-

Abakkus Mutual Fund launches Abakkus Liquid Fund

Dec 8, 2025 by Advisorkhoj Team