Strong 5 year performance by ICICI Prudential Multicap Fund

ICICI Prudential Multicap Fund was launched nearly 23 years back. If you invested Rs 10,000 in the scheme when it was launched, then its investment value now would be around Rs 2.62 lakhs. The performance of this scheme in the last 5 years has been quite strong. ICICI Prudential Multicap Fund gave nearly 18.75% annualized returns in the last 5 years. The fund has Rs 2,812 Crores of assets under management (AUM). George Heber Joseph and Atul Patel are the fund managers of this scheme. The expense ratio of the scheme is 2.31%.

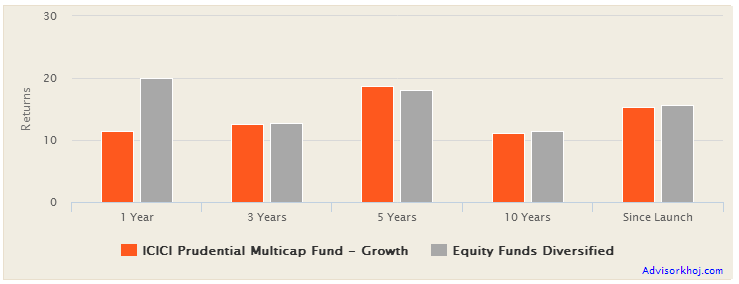

The chart below shows the trailing annualized returns of ICICI Prudential Multicap Fund versus the diversified equity funds category over the last 1 year, 3 year, 5 year and 10 year periods.

Source: Advisorkhoj Research

While the fund has underperformed versus the category in the last 12 months, its performance over the long trailing periods has been good. We have mentioned a number of times in our blog that, investors should not pay too much attention to short term performance because the short term performance is influenced by the market movement vis-a-vis the fund manager’s strategy. Long term performance is much more relevant when evaluating a mutual fund scheme.

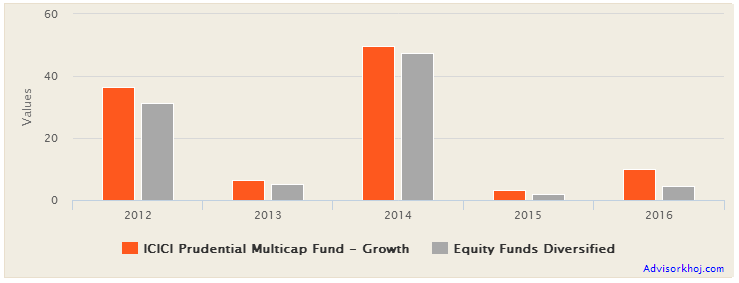

The chart below shows the annual returns of ICICI Prudential Multicap Fund versus the diversified equity funds category over the last 5 years.

Source: Advisorkhoj Research

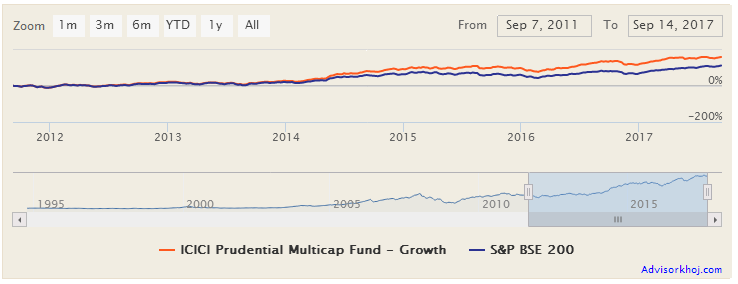

This chart shows the performance consistency of the fund versus the category in different market conditions. Net Asset Value growth of the ICICI Prudential Multicap Fund (growth option) is shown in the chart below.

Source: Advisorkhoj Research

Rolling Returns

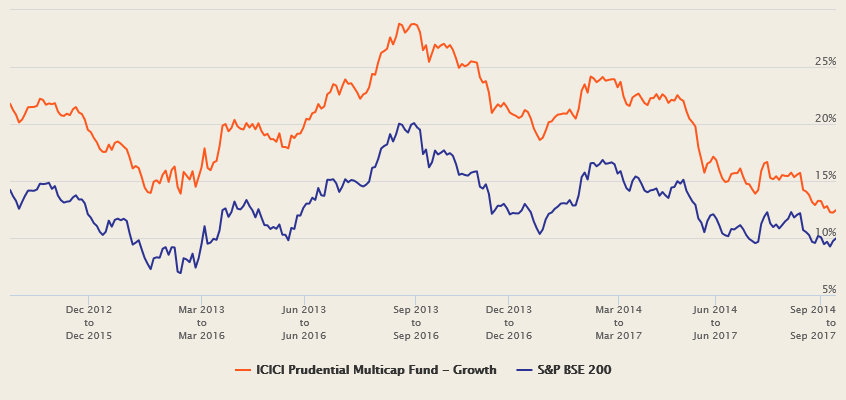

The chart below shows the 3 year rolling returns of ICICI Prudential Multicap Fund versus BSE-200 benchmark over the last 5 years. We have chosen a 3 year rolling returns period because investors should always have a long investment horizon for equity funds.

Source: Advisorkhoj Rolling Returns Calculator

You can observe that, ICICI Prudential Multicap Fund was able to beat its benchmark consistently in the last 5 years. Also notice the gap between the 3 year rolling returns of the scheme and the benchmark index is fairly stable. This shows disciplined and prudent fund management.

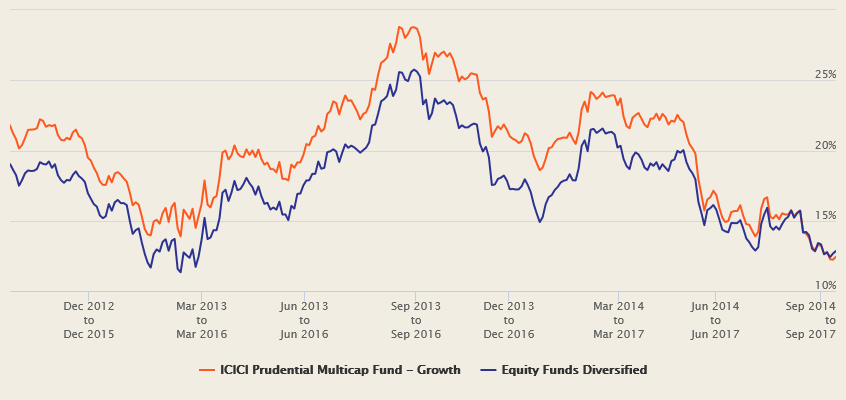

Let us now discuss the 3 year rolling returns of ICICI Prudential Multicap Fund, versus the category average rolling returns.

Source: Advisorkhoj Rolling Returns Calculator

You can see that 3 year rolling returns of ICICI Prudential Multicap Fund were consistently superior to the category average rolling returns (barring very recently). The maximum 3 year rolling return of the fund in the last 5 years was 28.8%, while the minimum3 year rolling return of the fund in the last 5 years was 12.2%. The average 3 year rolling return of ICICI Prudential Multicap Fund in the last 5 years was 20.2%, while the median 3 year rolling return in the last 5 years was 20.6%.

Portfolio Construction

This scheme has a slight large cap bias. The investment style of the fund managers is growth oriented. In the growth style, fund managers look to buy stocks which can give high earnings (EPS) growth in the coming years. In the current market context sectors focused on domestic consumption and infrastructure are likely to deliver superior earnings growth in the next few years. Accordingly, sectors like banking, power, automobiles and construction etc.has high sector allocations in this scheme.

From a stock perspective, ICICI Bank, State Bank of India, Bharti Airtel, HDFC Bank, ONGC, Tata Steel, Power Grid and L&T are some of the top stocks in the scheme portfolio. In terms of company concentration, the portfolio is well diversified with the top 10 stocks comprising less than 40% of the total portfolio value.

Source: Advisorkhoj Research

Risk and Returns

The risk adjusted performance of this fund is quite good. The volatility of the fund over the last 3 years is 12.7%, which is lower than the category average volatility. The beta of the fund is lower than 1, which means that the sensitivity of this fund to market movement is slightly limited. Funds with lower betas (less than 1) tend to outperform (on a relative basis) in volatile market.

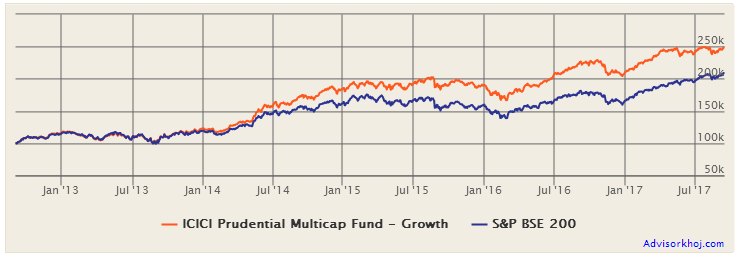

The chart below shows the growth of Rs 1 lakh investment in ICICI Prudential Multicap Fund (Growth Option) in the last 5 years. You can see that, a 1 lakh investment in the scheme would have grown to around Rs 2.5 lakhs in 5 years.

Source: Advisorkhoj Research

The chart below shows the growth of Rs 5,000 monthly SIP in ICICI Prudential Multicap Fund (Growth Option) in the last 5 years. You can see that, the current value of the SIP is more than Rs 4 lakhs, while the cumulative investment was Rs 3 lakhs only.

Source: Advisorkhoj Research

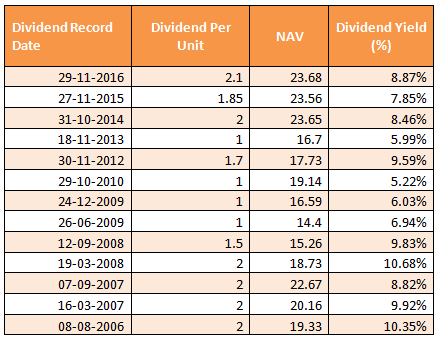

Dividend Payout track record

ICICI Prudential Multicap Fund has a strong dividend payout track record. The table below shows the dividend payout track record of the scheme over the last 10 years or so; you can see that, the scheme paid out dividends almost every year.

Source: Advisorkhoj Historical Dividends

Conclusion

In a few days, ICICI Prudential Multicap Fund will complete 23 years of existence. The performance of the fund over the last 5 years has been quite good. Investors can invest in this fund both in lump sum or SIP, but they should always have a long investment horizon to get the best results. Investors should consult with their financial advisors, if ICICI Prudential Multicap fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team