Shriram Multi Sector Rotation Fund: Trend based sector rotation

Shriram Mutual Fund has launched a new fund offer (NFO), Shriram Multi Sector Rotation Fund. This is a thematic fund which will rotate trending sectors, investing in 3 – 6 sectors at any point. The fund will use quantitative techniques to identify trending sectors and avoid sector traps. The NFO has opened for subscription on 18th November 2024 and will close on 2nd December 2024. In this article, we will review Shriram Multi Sector Rotation Fund NFO.

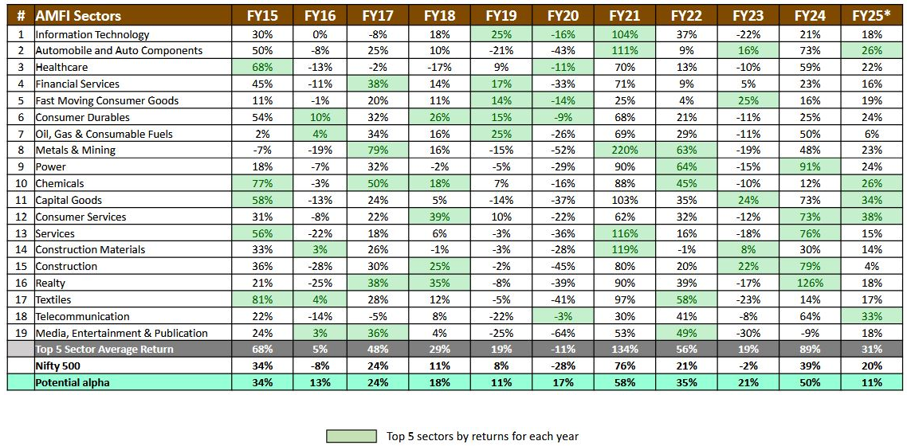

Winners rotate across industry sectors

Sectors go through their own investment cycles. Winners rotate across industry sectors. Capturing winners can lead to significant alpha creation.

Source: Shriram MF, as on 30th September 2024

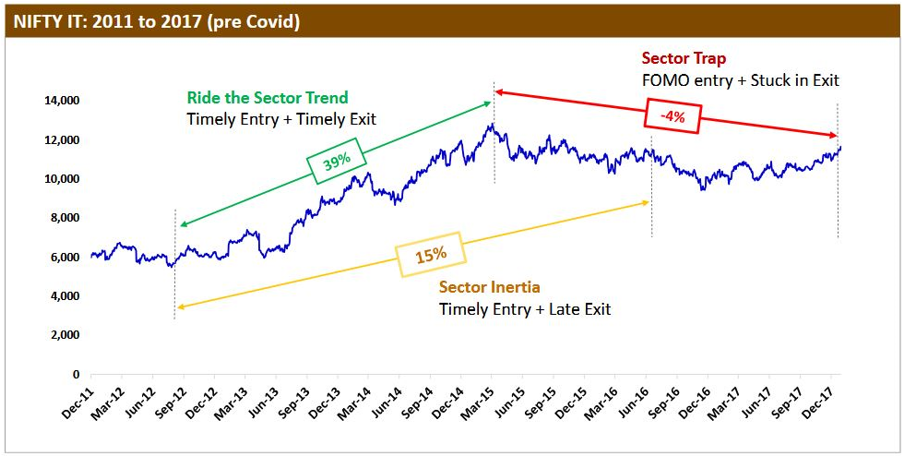

Sector Traps

Investment cycles of sectors lead to potential behavioural sector traps. Sector trap is a sector in which uptrend deceives investors into believing that uptrend will continue, while the sector goes through a prolonged downtrend (see the chart below). You can see that if you timed your sector entry too late, you can get stuck in exit and experience underperformance.

Source: NSE

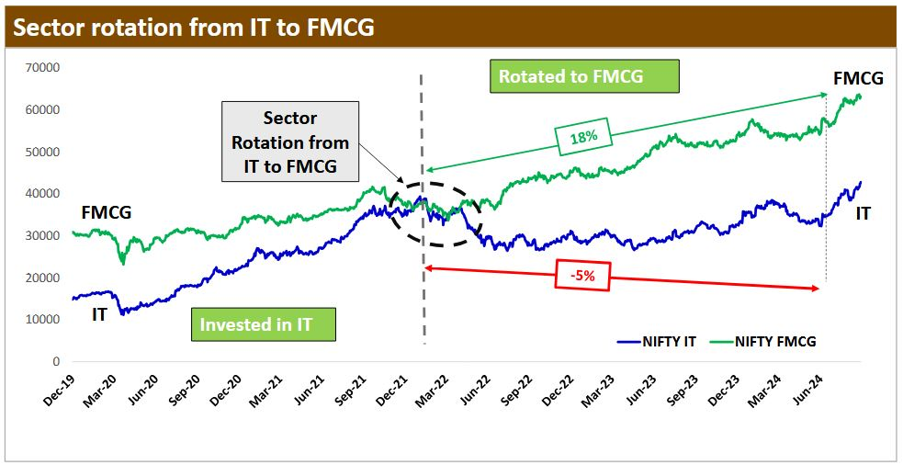

Timely sector rotation can lead to significant outperformance

Timing sector entry and exits can help investors avoid sector traps and riding sector trends (investing in winners). By actively rotating investments into sectors that are expected to outperform, investors can generate higher returns compared to a passive buy-and-hold strategy.

Source: NSE

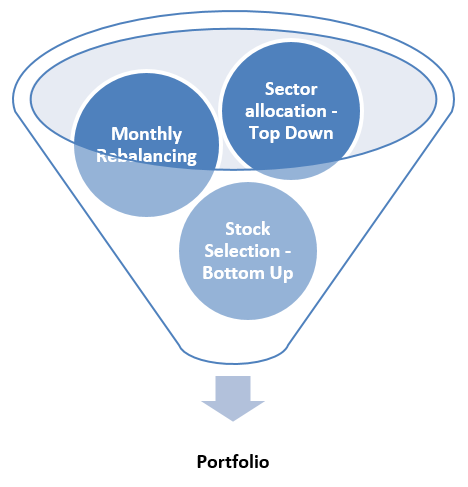

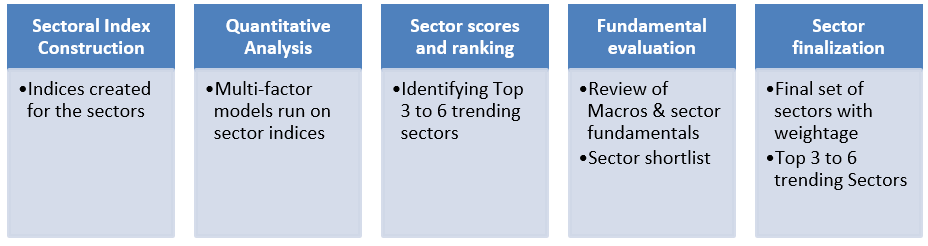

Shriram Multi Sector Rotation Fund – Investment Strategy

Sector allocation using Quanta mental (quantitative + fundamental) approach

Stock selection within sectors using Enhanced Quanta mental Investment (EQI model)

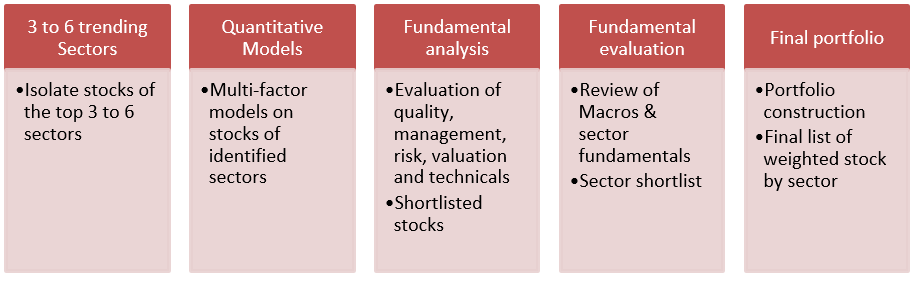

How has the Quanta mental stock and sector selection model performed?

- Outperformed the broad market indices in most financial years over the last 10 years (see the chart below).

Source: Shriram MF, as on 30th September 2024

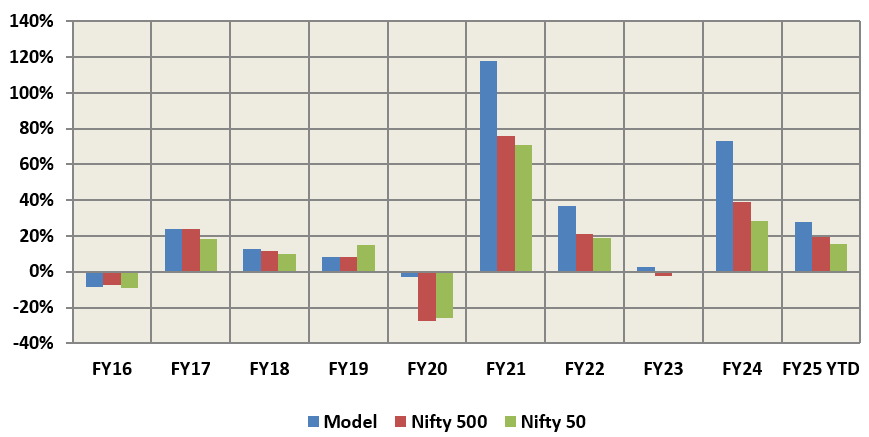

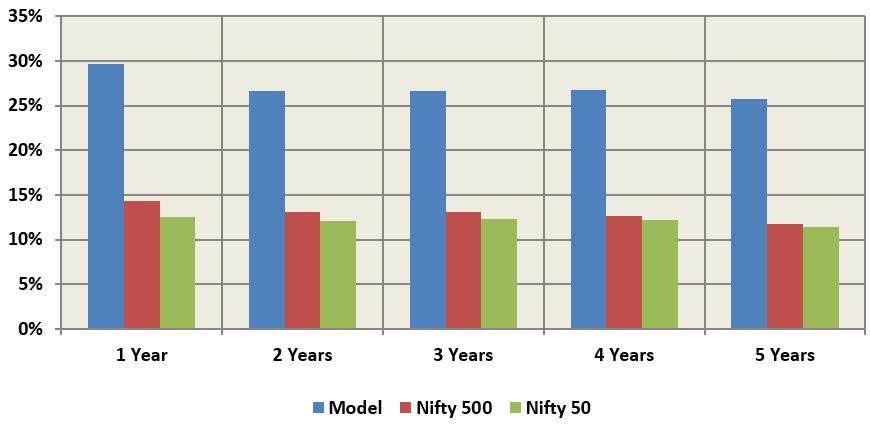

- Outperformed the broad market indices over different point to point periods.

Source: Shriram MF, as on 30th September 2024. *Returns over period exceeding 1 year are annualized (CAGR)

- Rolling returns of the model for different investment tenures across different market conditions outperformed rolling returns of broad market indices.

Source: Shriram MF, as on 30th September 2024. Returns are in CAGR.

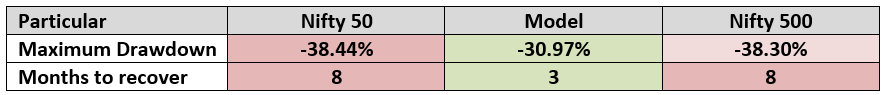

- The model experienced lesser drawdown during the COVID-19 crisis.

Source: Shriram MF

Why invest in Shriram Multi Sector Rotation Fund?

- Diversified risk: Focused exposure to 3 to 6 trending sectors, all within one fund

- Avoid sector traps, no FOMO: Seamlessly rotate across multiple sectors that are trending due to better earnings expectation, minimizing risks

- Tax efficient: No capital gains tax when the fund manager rebalances the portfolio, making it a smart and efficient investment choice

Who should invest in Shriram Multi Sector Rotation Fund?

- Investors looking for capital appreciation over long investment tenures from India’s manufacturing growth theme

- Investors looking for satellite allocations to their core portfolios

- Investors with high to very high risk appetites

- Investors with minimum 5 year investment tenures

- You can invest either in lump sum and SIP depending on your investment needs

Investors should consult their financial advisors or mutual fund distributors if Shriram Multi Sector Rotation Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team