Sectoral Growth in India: What it means for Sectoral Funds

The projection for India to become the third largest economy in the world within 2030 does not seem like a mere dream. The resurgence of Indian economy fuelled by the upsurge in the performance of the various sectors is inevitable. CAPEX from govt, rural penetration of banking, rising adoption UPI in the payment ecosystem, and innovation across pharma and technology etc is helping India take shape and we are now the 5th largest economy in the world, with an impressive GDP growth of 8.2% in 2023-24. IMF has forecasted India to become the third largest economy by 2027-28. The Indian investment horizon presents exciting opportunities for the investors.

A large section of retail investors has traditionally favoured diversified equity funds for their investment portfolios. As per AMFI June 2024 data, more than 85% of active equity funds assets under management (AUM) are in funds which are diversified in nature (including market cap specific funds). By diversified funds, we mean mutual fund schemes which invest across multiple sectors. Diversifications reduce company and sector risks. As such, these funds are suitable for both new and seasoned investors. However, for more informed investors, sectoral funds can be attractive investment options for portfolio building.

Why invest in sectoral funds?

Financial advisors suggest that your core equity portfolio should comprise of diversified equity funds. Experienced investors or investors with higher risk appetites can have satellite allocations to sectoral funds which have the potential to boost your portfolio returns over sufficiently long investment horizons and enhance wealth creation. The investment objective of your core portfolio is to provide stability and long-term growth to meet your financial goals. Historical data shows that different sectors outperform / underperform in different market phases – sector rotation is an ongoing phenomenon in equity markets (see the chart below).

(Source: Advisorkhoj data as on 28th July 2024).

Suggested reading: Why should you consider sectoral funds for your portfolio

Some sectors can outperform the broad market in the short and long term

Different sectors outperform each other in different market phases or investment cycles. For example, cyclical sectors (like bank, automobiles, infrastructure etc.) outperform defensive sectors (like Pharmaceuticals, FMCG etc.) in growth phase and underperform in slowdowns. However, some financial advisors argue in a growth economy like India, some sectors are more likely to outperform the broad market over long investment horizons. These can be long term investment themes which do not need market timing.

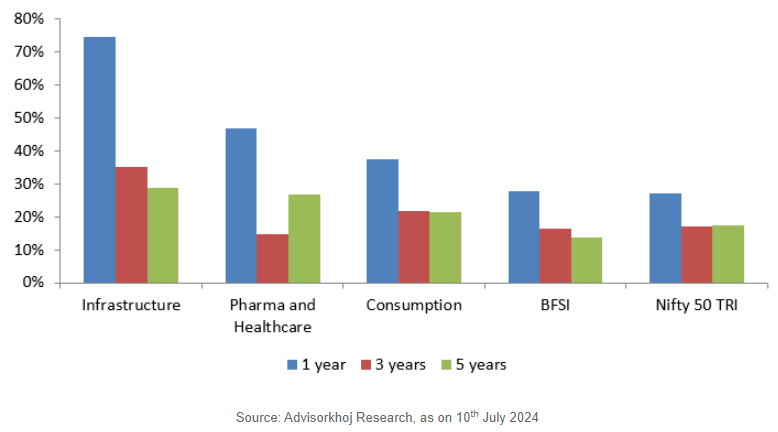

Trying to time the market is not only difficult for retail investors, but also risky. If your entry or exit is too late, then you may get lower than the expected returns or even make a loss. On the other hand, if you have a well thought out investment plan and long investment horizon, your chances of success are much higher. There are several sectors which have outperformed the broad market over long investment horizons across different market cycles (see the chart below). You can have long investment horizons in these sectors.

Allocating a portion of your investments to sectors that are likely to outperform the broad market in certain market phases can create alphas for your investment portfolio. You should bear in mind that the risk profile of thematic funds is higher than diversified funds; invest according to your risk appetite.

Which sectors can outperform in the long term?

When you are investing in sectoral funds, you should try to invest in sectors that have the potential of outperforming the broad market in the long term. From the perspective of India Growth Story and how different sectors participate in the India growth story, you should look at sectors that are linked to the following themes, which can be major growth drivers in the long-term India Growth Story-

- Consumption growth

- Rising per capita income

- Atmanirbhar Bharat

- Digital India

- Shift from unorganized to organized sectors

We present four Nippon India sectoral funds, which have the potential to benefit from the key drivers of the India Growth Story. All the funds discussed here have 20 years of vintage and have long track records of alpha creation.

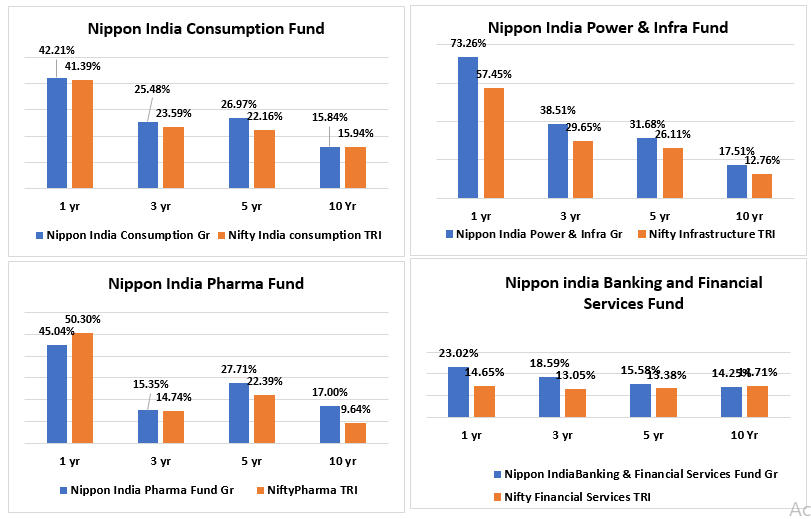

- Nippon India Power and Infra fund: Launched in May 2004, the fund invests in power and infra sectors. The fund provides opportunity within these sectors, with focused approach and flexibility to invest in Transportation, Energy, Resources, Communication and other power and infrastructure allied companies. The fund has given 31.68% CAGR returns in the last 5 years (as on 28th July 2024).

- Nippon India Consumption fund: Launched in September 2004, the fund invests in leaders or potential leaders that are likely to benefit directly or indirectly from domestic consumption led demand. The fund has a flexi cap structure and well diversified across key segments like Consumer Non-Durables, Media & Entertainment, Automobile, Healthcare Services, Pharmaceuticals, etc., driven by relative attractiveness of opportunities and valuations. The fund has given 26.97% CAGR returns in the last 5 years (as on 28,sup>th July 2024).

- Nippon India Banking and Financial Services Fund: Launched in May 2004 the fund is focused on banking and financial services sector. The fund is well diversified across sub segments like Private & Public Banks, NBFCs, Housing Finance Companies, Broking houses, Wealth Management, Rating Agencies, Asset Management Companies, Insurance Companies, Stock/ Commodities Exchange, etc. The alpha generation is attempted through tactical allocation across various sub segments and differentiated investment ideas. The fund has given 15.58% CAGR returns in the last 5 years (as on 28th July 2024).

- Nippon India Pharma fund: Launched in June 2004, the fund is focused on important segments of the pharma sector viz Domestic Business, International & Contract Research and Manufacturing Services (CRAMS). The fund invests in both deep value as well as high growth pharma businesses. The fund has given 27.71% CAGR returns in the last 5 years (as on 28th July 2024).

Given below are the charts showing the funds’ performance over different time periods compared to their relevant benchmarks. As you can see the Nippon India Funds have beaten their benchmarks consistently across most time periods.

(Source: Advisorkhoj data as on 28th July 2024).

Who should invest in Sectoral Funds?

- Investors willing to have satellite allocation to overall equity portfolio.

- Investors looking for capital appreciation or wealth creation over long investment tenures.

- Investors with very high-risk appetites.

- Investors with minimum 5 years investment tenures.

You can invest either in lumpsum or SIP depending on your investment needs. Consult your financial advisor or mutual fund distributor to see if Nippon India sectoral funds are suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team