SBI Contra Fund: A good contra fund in high market for long term investors

What is contrarian investment style?

Contrarian investing is an investment style where the investor goes against the market trend. The market is simply the collection of all investors and the market trend reflects the collective wisdom of the majority of investors. Contrarian investment involves doing the opposite of what the majority of investors are doing. Contrarian investors believe that herd instinct often drives asset prices and causes some stocks to be over-valued or under-valued due to irrational optimism or pessimism.

Contrarian investors buy stocks that are under-performing at a particular point in time and are neglected by most investors. A stock may under-perform for a variety of reasons, but contrarian investors buy stocks which they think the market is mispricing for whatever reason. They expect the current under-performance of these stocks to be temporary and expect recovery in their share prices in the future. Since contrarian investors usually buy stocks at deep discounts relative to their intrinsic value, they can get good returns in the long term.

What is a Contra Fund?

Contra Funds are equity mutual fund schemes which follow the contrarian investment style. Contra fund managers invest in stocks that are currently underperforming due to short term issues but which have good growth potential in the medium to long term.

Difference between Contra and Value Fund

Contra and Value Funds may seem similar in terms of investment styles but investors should understand the difference between the two. Value fund managers invest in stocks which are trading at discount to what the fund manager thinks are the intrinsic values of such stocks. In his letter to Berkshire Hathaway investors in 1992, Warren Buffet wrote that “growth and value investing are joined at hip” because “growth is always a component in calculating value”. Contra fund managers invest in stocks which are currently out of favour because the market does not expect them to do well, but the fund manager does. Essentially, contra fund managers invest in high conviction stocks which they think the market is mispricing due to some reason.

About SBI Contra Fund

SBI Contra Fund was launched in July 1999 and has Rs 2,974 crores of assets under management (as on 30th September 2021). The expense ratio of regular plan of the scheme is 2.11% (as on 30th September 2021). If you invested Rs 10,000 in the scheme at the time of its inception (14th July 1999), your investment would multiplied more than 12 times to Rs 1.21 lakhs (as on 20th October 2021). The CAGR returns of this scheme since inception is 16.38% (as on 20th October 2021). Dinesh Balachandran is the fund managers of this scheme since May 2018 and has over 17 years of experience.

Performance of SBI Contra Fund

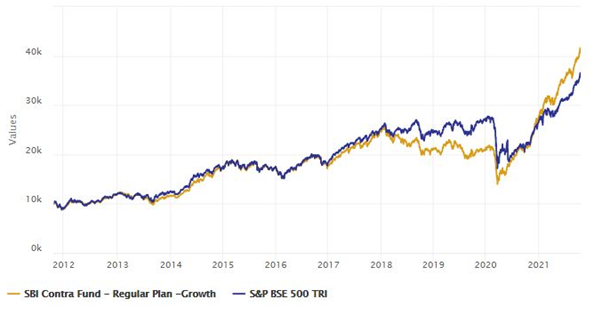

The chart below shows the growth of Rs 10,000 lump sum investment in the fund over the last 10 years ending 20th October 2021. The fund has given over 15% annualized returns and the current investment value is over Rs 40,500. You can see that the scheme outperformed the broader market index over long investment horizon. Investors may notice in the chart below that a contra fund may underperform the market for considerable periods of time in a momentum driven market like India. However, if you have long investment horizons, you can get superior returns from a contra fund.

Source: Advisorkhoj Research

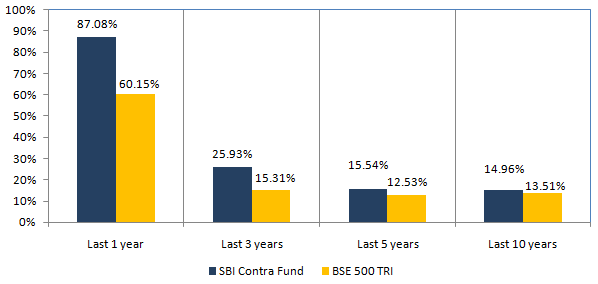

The chart below shows the annualized (CAGR) returns of SBI Contra Fund regular plan over different time-scales. You can see that scheme has outperformed the benchmark index market by a big margin in the last 1 year, even though the broader market saw a spectacular rally in the last 1 year or so. This shows that the high conviction contra bets of the fund managers gave rich rewards to investors.

Source: Advisorkhoj Research – Data as on 21st Oct21

SBI Contra Fund – Investment Strategy

The scheme focuses on companies and sectors that are currently not in favour of the markets and attempts to find companies that have the potential to revert back and grow in the long-term

- Sector level

- Identifying sectors which have long term potential but are currently out of favour

- Stock level:

- Identifying companies wherein the stock is trading at lower than its intrinsic value. The focus is on identifying neglected stocks that are undervalued today (trading at lower P/E multiple or P/BV), but have a potential of growing in the long-term

- Companies which have strong fundamentals but are available at discounted values owing to short term performance issues

Why invest in Contra Funds in high markets?

The Nifty is currently trading near its all time high. The rally in the stock market in the last few months has been driven largely by liquidity in global markets and bullish sentiments of investors. Valuations of many stocks seem to be on expensive side on the back of this rally. As seen in the past, stocks which have run up significantly are likely to see more pull-back when the correction takes place. Contra funds which focused on underperforming stocks are likely to see lesser volatility. Also, all segments of the market are cyclical in nature and businesses tend to be in and out of favour. If you can invest in quality stocks (through a contra fund) which are currently out of favour for whatever reason, you can get good returns, when these stocks are back in favour and are rewarded by the market.

Wealth creation by SBI Contra Fund

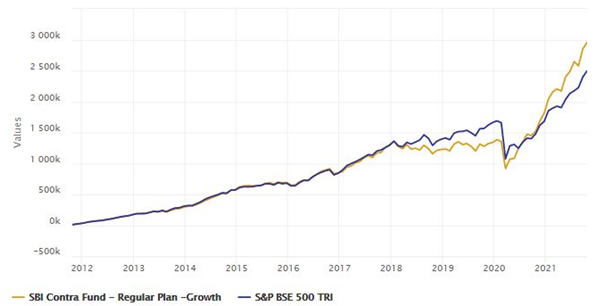

The chart below shows the growth of Rs 10,000 monthly SIP in SBI Contra Fund Regular plan Growth over the last 10 years(ending 20th October 2021). You can see that with a cumulative investment of Rs 12 lakhs you could have accumulated a corpus of nearly Rs 30 lakhs over the past 10 years. The annualized SIP return of the scheme was over 17%.

Source: Advisorkhoj Research

Who should invest in SBI Contra Fund?

- Investors looking for long capital appreciation using contrarian investment strategy

- Investors with high to very high risk appetites

- Investors with long investment horizons e.g. minimum 5 years

- Investors who want to invest in equities through SIP for long term horizon

Investors should consult with their financial advisors, if SBI Contra Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team