Review of Pharma Sector Mutual Funds

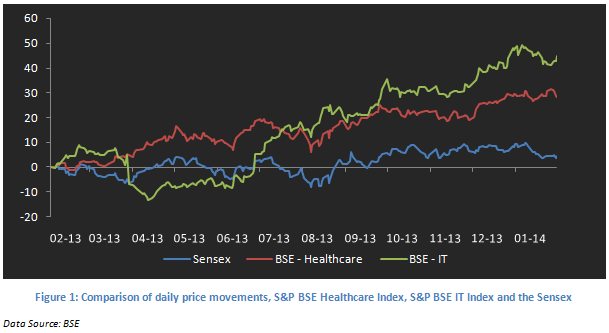

In the last article we had discussed that certain industry sectors like IT had outperformed the market over the last one to two periods. Healthcare or Pharmaceuticals is another sector that has outperformed the broader market over the last one year period. Like technology focused sector funds, there are sector funds with a healthcare focus, and in this article we will review the top healthcare sector funds. The chart below shows the daily price movements of the S&P BSE Healthcare Index (the Index for pharma stocks), S&P BSE IT Index and the Sensex, indexing prices of all the three indices on Feb 15 2013 to zero.

The chart shows that, though the trajectory of share price increase in the healthcare or pharma sector is not as steep as the IT sector, but the healthcare sector has consistently outperformed the Sensex in the last one year period. In terms of returns, the BSE healthcare Index has delivered a very healthy 28.1% returns in the last one year, while the Sensex has delivered only about 4.6%. While the depreciation of the Rupee versus the US dollar has helped exports in this sector, the domestic pharma market growing at double digits, has resulted in strong revenue growth for companies in this sector. The pharma sector is often seen as an excellent defensive bet in weak market conditions. However, there are certain risks associated with this sector, primarily due to government regulations both overseas and in India. Headwinds are seen from the demanding US FDA guidelines, which may potentially impact exports, unless the companies are able to ensure compliance with the guidelines in their domestic manufacturing plants. The Indian government’s drug pricing policies have also impacted margins. Despite the headwinds, the future outlook of the sector remains positive due to:-

- High current account deficit and lower capital inflows imply that the rupee will continue to be under pressure, which will ensure the continued competitiveness of the sector

- A number of drugs will go off patent in the next few years. This augurs well for the generics segment and the Indian pharma sector

- The government also plans to increase health expenditure to 2.5% of the GDP by the end of the 12th Five-Year Plan (2012-17), which will give the sector another big boost

Should mutual fund investors consider Healthcare Sector Funds

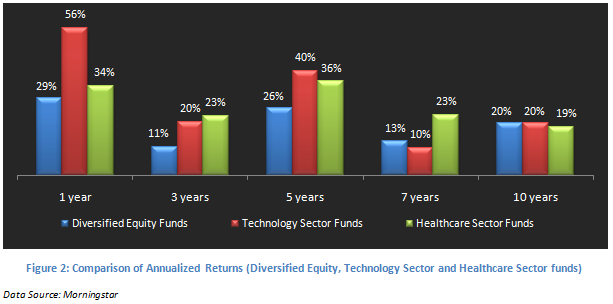

As discussed earlier in this series, for our long term financial objectives, diversification is the best strategy, and therefore for long term goals like retirement planning and children’s education, one should always choose diversified equity funds through a systematic investment plan. Changes in government policies, industry specific issues and technological developments may impact the healthcare sector, either in a positive or a negative way. However, for well informed active investors, healthcare sector funds can be good investment opportunities in the short to medium term, especially if the broader market returns are weak in the same time horizon. The chart below shows the comparison of annualized returns over one, three, five, seven and ten years time horizons, of the top performing healthcare sector funds with diversified equity and technology sector funds

While the top performing healthcare sector funds have clearly outperformed diversified equity funds in the one to seven years time horizon, over a ten year time frame the performance levels out. The above chart also tells us that the performance of the healthcare or pharma sector over various time periods is more consistent, compared to both diversified equity funds and technology funds. It is not surprising since the healthcare sector is an excellent defensive bet.

Top Performing Healthcare Sector Funds

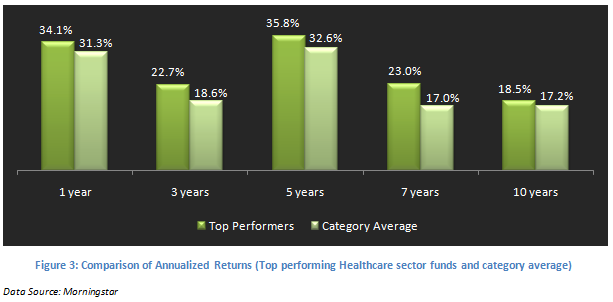

As with selection of any mutual fund scheme, fund manager track record is very important. Though there are not a lot of scheme to choose from in the healthcare sector mutual funds, the performance has been consistent across funds in this sector. The chart below shows the differences in the investment returns generated by the top performers in the Healthcare Sector Funds category and the category in general over one, three, five, seven and ten years time periods.

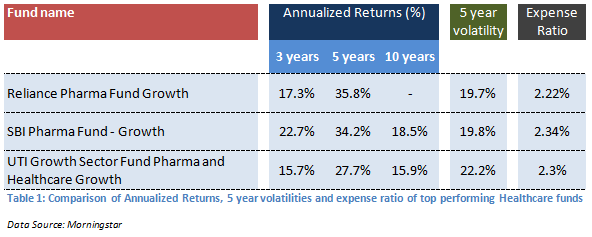

The table below lists the top 3 performing healthcare / pharma sector funds, based on five year annualized returns.

Reliance Pharma Fund:

This is the best performing scheme in the Healthcare sector with 5 year annualized return of nearly 36% returns. This scheme was launched in 2004. The fund manager has a mid cap bias with a high growth focus. It is reasonably well diversified across the sector, with its top 5 holding, Divi’s Laboratories, Sanofi, Cipla, Abbott India and Dr Reddy’s accounting for only 48% of the portfolio value. The fund has garnered Rs 7.9B assets under management and an expense ratio of 2.22%.

SBI Pharma Fund:

This is one of the oldest funds in this sector. It was launched in 1999. The fund has Rs 1.9B assets under management, with an expense ratio of 2.34%. The scheme has performed consistently well across all time periods and has predominantly a large cap focus. Sun Pharma, Dr Reddy’s, Lupin, Cipla and Glenmark comprise about 68% of the portfolio value.

UTI Growth Sector Fund Pharma and Healthcare (1999):

This fund has a large cap bias, with Sun Pharma, Dr Reddy’s, Cipla, Lupin and Glaxo Smithkline accounting for 63% of the portfolio value. The scheme, launched in 1999, has Rs 1.4B assets under management, with an expense ratio of 2.3%.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team