Reliance Growth Fund: 1 Lakh to 1 Crore in 21 years

An investor who put Rs 1 lakh in Reliance Growth Fund in its NFO in October 1995 would now be sitting on more than Rs 1 Crore. The phenomenal wealth creation story of Reliance Growth Fund over the years is known to many mutual fund investors and financial advisors across India (we have covered Reliance Growth Fund a few times in Advisorkhoj.com), but 100 times growth calls for special mention. In this post, we will discuss the wealth creation story of Reliance Growth Fund.

Spectacular Success in the 2000s

The spectacular success story of Reliance Growth Fund boosted investor confidence not only in the midcap space (conventionally thought to be very risky), but also for equity mutual funds in general, in India. Reliance Growth Fund was launched in October and has an AUM of over Rs 6,300 Crores from more than 6 Lakhs investors. For a period of 15 years, Reliance Growth Fund was the second best open ended equity fund globally.

For most part of its history, Reliance Growth Fund has been helmed by two of the best fund managers in the mutual fund industry. From the early 2000s, MadhusudhanKela, known to be one of the best stock pickers in the market, managed this fund along with Sunil Singhania, the current CIO of Reliance Mutual Fund. Kela and Singhania employed bottom up approach of portfolio management, focusing on individual midcap stocks which later turned out to be multi-baggers. The bottom up approach worked wonders for Reliance Growth Fund and the NAV soared to dizzy heights. In the mid 2000s, Reliance Growth Fund was one of the fastest growing mutual fund schemes, in terms of Assets under Management (AUM).

Crash of 2008

The 2008 financial crisis was a body blow to equity markets all over the world, including India. The Dow Jones fell by more than 50% and the BSE – Sensex fell by around 60% in 2008 to early 2009. Investors panicked and exited equity markets in droves. Reliance Growth Fund was not spared. The NAV of Reliance Growth Fund crashed by more than 54%. Though the fund recovered smartly in 2009, giving nearly 100% returns to investors, the bear market of 2011 was another blow and the NAV fell by 27%. Through this period, Reliance Growth Fund underperformed versus the market.

The midcap focus of the fund led to a period of underperformance versus the benchmark index. In 2008 a significant portion of the fund portfolio was in small cap stocks. Historically, investors (especially in India) have been more tolerant of issued faced by large cap companies and less tolerant with small cap companies; investors panicked and exited small / midcap companies facing even minor problems. Consequently, a number of these stocks went out of favour and remained subdued for a long period of time.

Change in Strategy

Even before the 2008 financial crisis set in, Kela and Singhania had started allocating a significant chunk of their portfolio in large cap stocks. This trend has continued and as on April 2017, large cap stocks comprise more than 55% of the portfolio value. Kela exited Reliance Mutual Fund in 2011 to take up the role of Chief Investment Strategist of Reliance Capital, the parent company of Reliance Mutual Fund. Of course, he remains closely involved with the mutual fund in a strategic capacity. Sunil Singhania has taken over the leadership of Reliance Mutual Fund investments as CIO and is the fund manager of Reliance Growth Fund. Singhania has retained the rigorous research based and bottom up approach to fund management.

In the past 5 years, Reliance Growth Fund has given more than 20% annualized returns. In the last 3 years, the fund has given over 23% annualized and in the last one year, over 33% returns. The numbers speak for themselves.

Turnaround in performance - Rolling Returns of Reliance Growth Fund

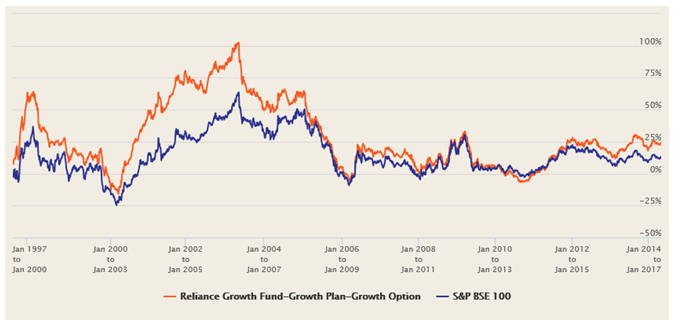

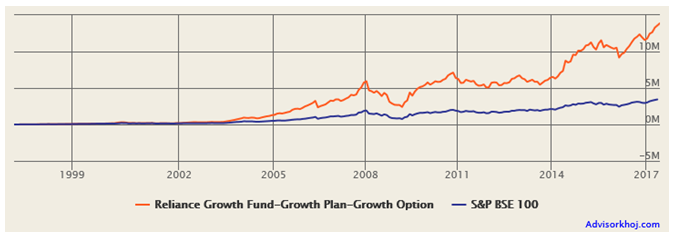

The chart below shows the 3 year rolling returns of Reliance Growth Fund since inception versus the benchmark BSE 100 index.

Source: Advisorkhoj Rolling Returns Calculator

You can see that, Reliance Growth Fund was able to beat the BSE 100 index, for most parts of its history. For reasons discussed earlier, the 2008 to 2012 was a challenging period in the journey of the fund. But the fund has been outperforming the index from 2012 onwards (as you can see in the chart above).

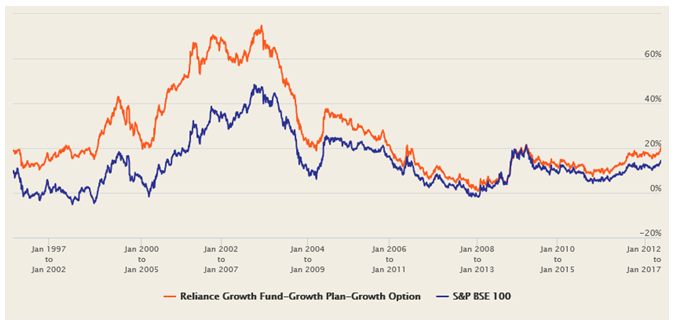

Let us now see the 5 year rolling returns of Reliance Growth Fund since inception versus BSE 100.

Source: Advisorkhoj Rolling Returns Calculator

We are showing 5 year rolling returns of this fund because a longer investment horizon is more suitable for midcap oriented funds. You can see that, the 5 year rolling returns of this fund are less volatile compared to 3 year rolling returns. You can also see that, with a 5 year rolling returns period, the outperformance of the fund versus the benchmark index was also more consistent.

Reliance Growth Fund versus other asset classes

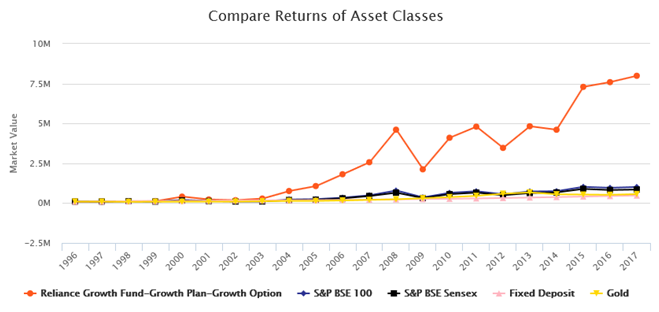

The chart below shows the growth of Rs 1 lakh invested in Reliance Growth Fund in 1996 versus various asset classes till 2017.

Source: Mutual Fund Comparison with Asset Classes

If you carefully observe the chart, you will see that, Sensex and BSE 100 outperformed Gold and Fixed Deposit over the past 20 years or so, showing the superiority of equity as an asset class; but the wealth appreciation with Reliance Growth Fund has been at a completely different level, showing the alpha created by the fund managers over the years.

SIP Returns of Reliance Growth Fund

Before we conclude, we want to share with our readers the returns of a theoretical SIP of just Rs 3,000 per month in Reliance Growth Fund over the past 20 years. Readers should note that, SIP mode of investment was not available for Reliance Growth Fund 20 years back, because SIP was introduced in India only in the late 90s, but the returns shown the chart below are accurate because we calculated the SIP returns with actual daily NAVs of Reliance Growth Fund over the past 20 years.

Source: Advisorkhoj Research

You can see in the chart above that, with an investment of just Rs 3,000 on a monthly basis over the past 20 years, you could have accumulated a corpus of nearly Rs 1.4 Crores, another example of the fantastic wealth creation by this fund. The annualized SIP returns (XIRR) over the past 20 years is nearly 25%.

Conclusion

The wealth creation story of Reliance Growth Fund over the past 20 years has indeed been spectacular. The stewardship of Sunil Singhania gives investor’s confidence with respect to future performance sustenance of this fund. Advisorkhoj congratulates Reliance Mutual Fund for this fabulous success story and wishes the best for Reliance Growth Fund in the years to come. Investors can consider investment in this funds for meeting their long term goals in consultation with their financial advisors.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty Next 50 Index Fund

Apr 22, 2025 by Advisorkhoj Team

-

Mirae Asset Investment Managers (India) Pvt. Ltd. IFSC branch launches Mirae Asset Global Allocation Fund IFSC at Gift City

Apr 21, 2025 by Mirae Asset Mutual Fund

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team