Reliance Equity Opportunities Fund: Consistently Best Performing Fund in last 10 years

Reliance Equity Opportunities Fund has been one of the consistent mutual fund performers in the last 10 years. Consistent performers deliver outperformance across different time-scales and market conditions. These funds not only help the investors create wealth in the long term, but also provide a degree of stability to the portfolio in volatile market conditions. Consequently these funds are suitable for a wide variety of financial planning objectives, and as such should form a core part of investor’s mutual fund portfolio. In terms of mutual funds performance ranking, CRISIL has a separate classification for consistent performers.

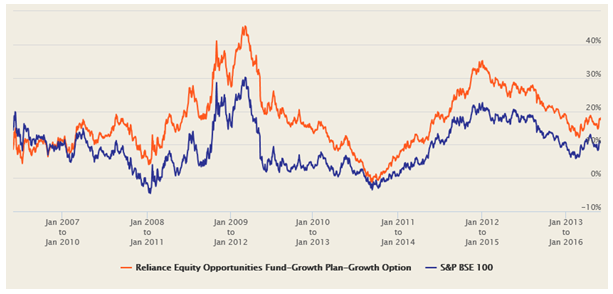

Reliance Equity Opportunities Fund is one of the top consistent performers across all equity fund categories. This diversified equity fund, ranked 2 by CRISIL has a flexible investment approach, with both large cap and mid cap companies in its portfolio. The fund also has a bias for emerging growth sector and value based themes. This has helped Reliance Equity opportunities fund generate good returns even in difficult market conditions. The chart below shows the 3 year rolling returns of Reliance Equity Opportunities fund over the last 10 years.

Source: Advisorkhoj Rolling Returns Calculator

Readers should note that, there is a dissonance between CRISIL’s categorization of Reliance Equity Opportunities Fund and our research team’s categorization. CRISIL categorizes Reliance Equity Opportunities Fund as a diversified equity fund, whereas our research team categorizes it as a small and midcap fund due to the large midcap holding percentage of this scheme. One can argue whether this scheme is a diversified equity or a small and midcap fund, but in our opinion it displays characteristics of both and the accurate classification probably lies somewhere in between.

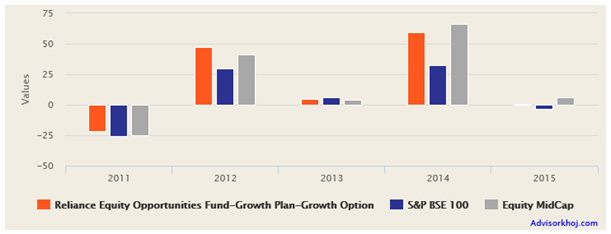

If you compare the trailing returns of Reliance Equity Opportunities Fund with both the diversified equity funds category and the small/midcap funds category, you will see that it has outperformed the average category returns in different time scales. You can also see in the rolling returns chart above that, it has consistently beaten its benchmark index the S&P BSE – 100 more than 90% of the times over the last 10 year. The chart below shows, the annual returns of Reliance Equity Opportunities Fund, Midcap funds category and the benchmark BSE – 100 over the last 5 years.

Source: Advisorkhoj Research

You can see that, Reliance Equity Opportunities Fund has outperformed the benchmark and the category in most years.

Fund Overview of Reliance Equity Opportunities Fund

This fund is suitable for investors looking for high capital appreciation over a long term, with limited downside potential in bear market conditions. As such the fund is suitable for investors planning for retirement, children’s education or other long term financial objectives.

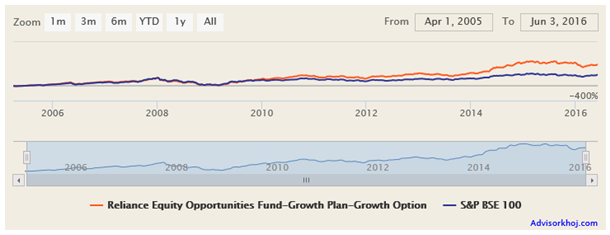

The fund was launched in March 2005 and has been very popular with investors. It has a huge AUM base of over Rs 10,000 crores, and has therefore managed to keep its expense ratio low at only 1.98%. The fund managers of this scheme are Shailesh Raj Bhan and Jahnvee Shah. Shailesh has been managing the fund since March 2005. Shailesh has been with Reliance AMC since 2003 and has established himself as an experienced portfolio manager running both diversified equity and sector funds. He focuses on inherently strong, cash rich companies with high growth potential. He also identifies high growth emerging themes, backed by robust research. The fund manager’s research oriented investment approach has led to excellent risk adjusted returns in different market conditions over the years. Morningstar has a 4 star rating for this fund. The chart below shows the NAV movement of Reliance Equity Opportunities Fund since inception.

Source: Advisorkhoj Research

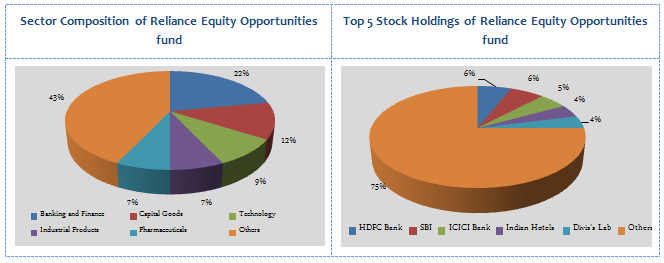

Portfolio Construction

The portfolio mix of Reliance Equity Opportunities Fund is almost 50:50 between large cap and mid cap companies. The investment style of the fund managers is growth oriented, with bias towards cyclical sectors like Banking and Finance, Industrial Capital Goods, Industrial Products, Automobiles, Construction, Hotels etc. Technology and Pharmaceuticals also have substantial allocations in the portfolio. The fund managers also like emerging themes and allocates a portion of the portfolio to these themes. The portfolio is very well diversified, in terms of company concentration, with its top 5 holdings, HDFC Bank, State Bank of India, ICICI Bank, Indian Hotels and Divi’s Lab accounting for only 25% of the total portfolio value. Even the top 10 stock holdings account for only 44% of the portfolio value.

Source: Advisorkhoj Research

Risk and Return

In terms of risk measures, the standard deviation of monthly returns of Reliance Equity Opportunities Fund is in line with the average standard deviations of small and midcap funds category and higher than average standard deviations of diversified equity funds category. But Reliance Equity Opportunities Fund has given strong returns in the last 10 years.

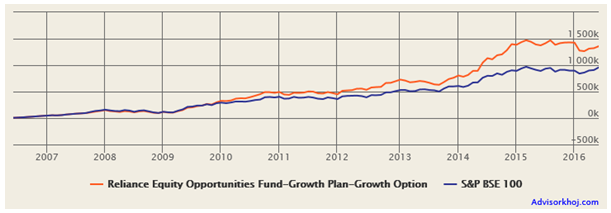

The chart below shows the growth of र 100,000 lump sum investment in Reliance Equity Opportunities Fund (Growth Option) over the last 10 years.

Source: Advisorkhoj Research – Lumpsum return calculator

You can see that a र 100,000 lump sum investment in Reliance Equity Opportunities Fund (Growth Option) 10 years back, would have grown to nearly र 420,000 by June 3, 2016, a profit of nearly र 320,000 (compounded annual return of over 15%).

The chart below shows the returns of र 5,000 SIP per month in Reliance Equity Opportunities Fund (Growth Option) over the last 10 years.

Source: Advisorkhoj Research – SIP Returns Calculator

You can see that, the current investment value of र 5,000 monthly SIP in Reliance Equity Opportunities Fund (Growth Option) over the last 10 years, is nearly र 13.6 lacs while the cumulative investment was र 6 lacs only. The annualized SIP return is nearly 16%.

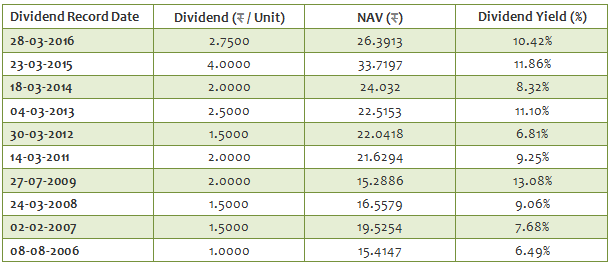

Dividend Payout Track Record

Reliance Equity Opportunities Fund Dividend Option has an excellent dividend payout track record. The fund has paid out dividends every year since its inception except 2010. The tax free dividend yields have been quite strong in most years.

Source: Advisorkhoj Historical Dividends

Conclusion

The Reliance Equity Opportunities Fund has a strong record of delivering excellent performance across different market cycles. The fund navigated through the volatile market conditions to give stable returns. As discussed earlier, consistency of performance is an important criterion in selecting a mutual fund. The Reliance Equity Opportunities fund has been a top pick for many investment portfolios. Investors can consider investing in the fund through the systematic investment plan (SIP) route or lump sum route for their long term financial planning objectives. The fund also has a good dividend payout track record and as such is suitable for investors who prefer dividend distribution plan. Investors should consult with their financial advisors if this fund is suitable for their investment portfolio, in line with their risk profiles.

You may like to know more about this fund – Strong SIP Performance over last 10 years from Reliance Equity Opportunities Fund makes it a top pick

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team