Reap the benefits of multi asset allocation by investing in Axis Triple Advantage Fund

Multi asset allocation is diversifying your invests across at least three asset classes e.g. equity, fixed income, gold, REITs, InvITs etc. Multi asset funds are hybrid mutual fund schemes which invest in at least three asset classes primarily equity, fixed income and gold.

Benefits of multi-asset allocation

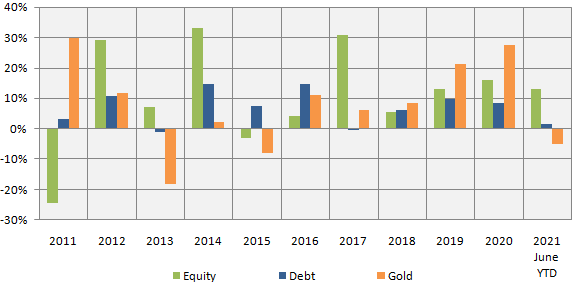

Different asset classes have different risk / return characteristics and give different returns in different market conditions. The chart below shows calendar year returns of different asset classes over the last 10 years; BSE 100 TRI is used as the proxy for equity, CRISIL Short term Bond Fund Index for debt and MCX Gold futures for Gold. You can see that in the last 11 calendar years, equity was the winner in 5 years (2012, 2013, 2014, 2017 and 2021 YTD), debt was winner in 2 years (2015 and 2016) and gold was the winner in 4 years (2011, 2018, 2019 and 2020). You can also see that, there can be considerable divergence in relative performances of different asset classes. Therefore, it is important to invest in multiple asset classes to reduce portfolio volatility and optimize returns in different market conditions.

Source: National Stock Exchange, Advisorkhoj Research, 1st Jan 2011 to 30th June 2020. Equity: Nifty 50 TRI; Debt: Nifty 10 year benchmark G-Sec Index; Gold: Gold Price in INR. Disclaimer: Past performance may or may not be sustained in the future.

Axis Triple Advantage Fund

Axis Triple Advantage Fund is a multi-asset fund. The scheme was launched in August 2010 and Rs 1,020 Crores of Assets under Management (AUM). The expense ratio of the scheme regular plan is 2.3%. Ashish Naik and R. Sivakumar are fund managers of the scheme. The asset allocation of the scheme is as follows:-

- 65 – 80% of its assets in equity and equity related securities

- 10 – 30% in fixed income

- 10 – 30% in gold

- The scheme can also invest up to 10% of its assets in REITs and InvITs.

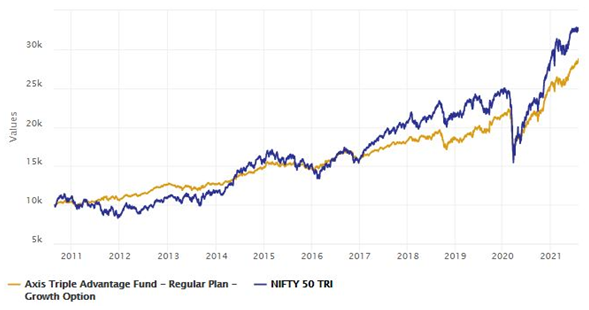

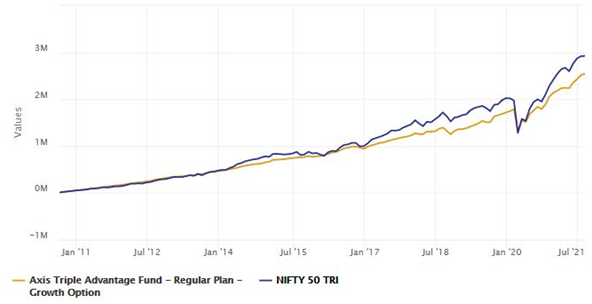

Growth of Rs 10,000 investment in Axis Triple Advantage Fund since NFO

The chart below shows the growth of Rs 10,000 investment in the scheme since launch. Over the last 11 years or so, your investment would have multiplied by nearly 2.8 times at a CAGR of 10.13% (versus Nifty 50 TRI CAGR of 11.45%).

Source: Advisorkhoj Research (as on 03.08.2021)

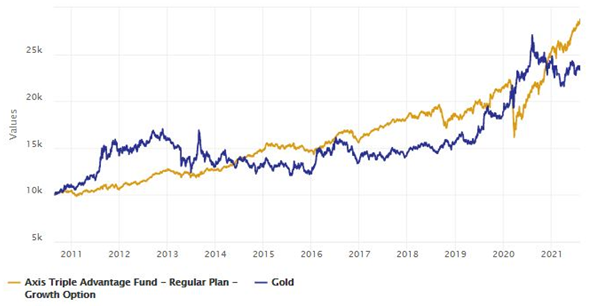

Let us now see, how Axis Triple Advantage Fund performed versus gold since inception. The chart below shows the growth of Rs 10,000 investment in the scheme versus gold since NFO. You can see that the scheme outperformed gold over long investment tenures.

The performance of Axis Triple Advantage Fund versus Nifty and gold demonstrates the benefits of multi asset allocation. The scheme outperformed Nifty in the period from 2011 to 2014, and again briefly in March 2020 during the first wave of COVID-19 pandemic. On the other hand, the scheme outperformed gold from 2014 till date, except for a brief period during the first wave of COVID-19 pandemic. Axis Triple Advantage Fund provided stability across different market conditions and investment cycles.

Source: Advisorkhoj Research (as on 03.08.2021)

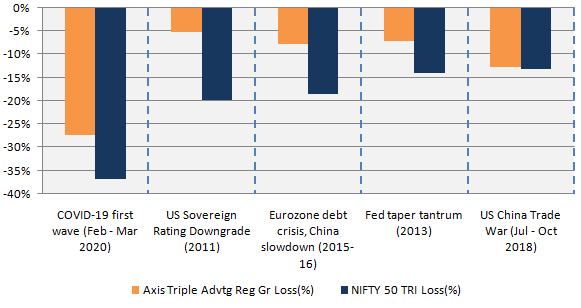

Smaller Drawdowns

The chart below shows the biggest drawdowns in the market over the last 10 years and the performance of Axis Triple Advantage Fund versus the market benchmark Nifty 50 TRI during these deep corrections. You can see that the scheme experienced much smaller drawdowns compared to Nifty 50 TRI.

Source: Advisorkhoj Research (as on 03.08.2021)

Rolling Returns

The chart below shows the 3 year rolling returns of Axis Triple Advantage Fund over the last 5 years (ending 2nd August 2021) versus the Multi Asset fund category. You can see that the scheme had consistently outperformed the category average across different market conditions.

Source: Advisorkhoj Research (as on 03.08.2021)

Suitable for long term investments

The chart below shows the SIP returns of Axis Triple Advantage Fund since inception. Over the last 11 years, you could have accumulated a corpus of Rs 25.73 lakhs (as on 3rd August 2021) at a XIRR of 11.68% through a monthly SIP of Rs 10,000 in this fund since inception.

Source: Advisorkhoj Research (as on 03.08.2021)

Why invest in Axis Triple Advantage Fund?

- Creates long-term wealth through exposure to equities.

- Protects against market volatility through debt investments.

- Facilitates investing in Gold, one of the most popular options amongst Indian investors and a good hedge against macro events.

- The fund rebalances your portfolio periodically by selling the asset which has outperformed, and buying the asset which has underperformed. This boosts the chances of increasing the average returns of investment.

Who should invest in Axis Triple Advantage Fund?

- Investors who primarily want capital appreciation over sufficiently long investment tenure.

- Investors with high risk appetites.

- Investors with at least 3 – 5 year investment horizons.

- Investors should consult with their financial advisors if Axis Triple Advantage Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team