Principal Tax Savings Fund: Strong consistent performance over the last 7 years

Equity Linked Savings Scheme (ELSS) is one of the most popular tax saving investments under section 80C of the Income Tax Act 1961. By investing in ELSS, the investors can avail three benefits - Tax savings, capital appreciation and tax free returns (Long term capital gains as well as tax free dividends). You can save up to Rs 46,350 in taxes per year by investing up to Rs 150,000 in Equity Linked Savings Schemes.

Long term returns of top performing Equity Linked Savings Schemes suggest that, investors can also build substantial wealth over a long investment horizon by investing in ELSS. The returns of Principal Tax Savings Fund since inception showcase the wealth creation potential of ELSS. If you invested Rs 1 lakh in Principal Tax Savings at its inception on March 1996, your invested would have grown nearly 30 times to around Rs 30 lakhs by October 2017.

Fund Overview

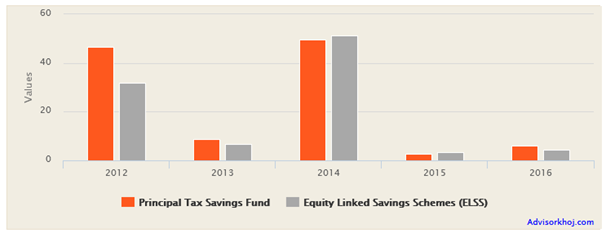

Principal Tax Savings Fund was launched on March 31, 1996 and has Rs 347 Crores of AUM (as on September 30, 2017). The expense ratio of the fund is 2.58%. The fund manager of this ELSS is PVK Mohan. The chart below shows the trailing returns of Principal Tax Savings Fund over different time-periods.

Source: Advisorkhoj Research

You can see that, the Principal Tax Savings Fund outperformed the ELSS category over the last 1, 3 and 5 years period. The return of the fund in the last one year has been quite spectacular. The chart below shows the annual returns of the fund over the last 5 years.

Source: Advisorkhoj Research

You can see that the fund outperformed the ELSS categories in most years. This shows good performance consistency.

Rolling Returns Performance versus Benchmark

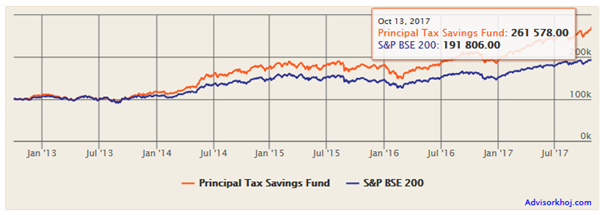

The chart below shows the 5 year rolling returns of Principal Tax Savings Fund versus its benchmark BSE-200 over the last 10 years.

Source: Advisorkhoj Rolling Returns Calculator

You can see that Principal Tax Savings fund has consistently outperformed the benchmark BSE-200 from 2009 onwards, across different market conditions. Consistent performance is the hallmark of a good fund manager. Let us now see how Principal Tax Savings Fund performed versus the category in terms of rolling returns.

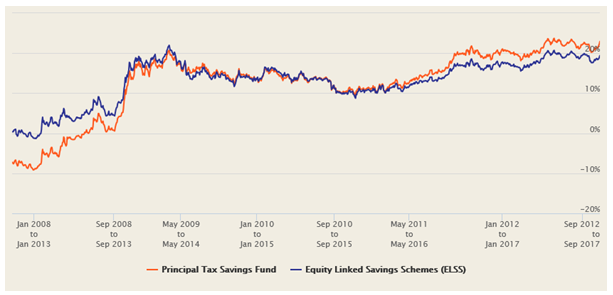

Rolling Returns Performance versus ELSS category

The chart below shows the 5 year rolling returns of Principal Tax Savings Fund versus ELSS funds category over the last 10 years.

Source: Advisorkhoj Rolling Returns Calculator

You can see that, Principal Tax Savings Fund has been consistently outperforming the ELSS funds category also since 2011. Consistent outperformance versus benchmark and category across different market conditions for a long period of time shows that, the fund manager has been able to deliver strong risk adjusted returns. The volatility of the Principal Tax Savings Fund, as per Advisorkhoj methodology is 15.95% (volatility as per our methodology is the annualized standard deviation of monthly returns over a 3 year trailing period). The beta of the fund as per Advisorkhoj methodology is 1.22 and the Alpha is 3.5 (alpha and beta are calculated taking 3 year monthly returns versus the benchmark, using a risk free rate of 4%, which is the savings bank interest rate). Fund managers who are able to deliver strong risk adjusted returns can be expected to create wealth for investors over a long investment horizon.

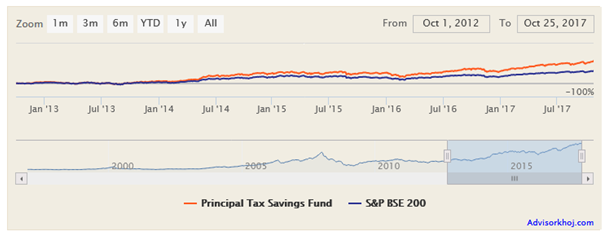

NAV Movement

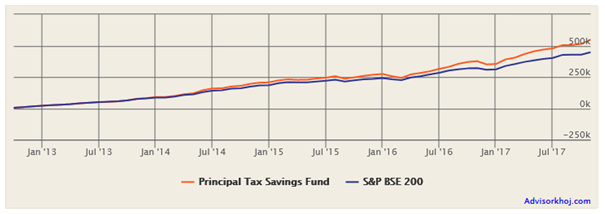

The chart below shows the NAV growth of Principal Tax Savings Fund over the last 5 years.

Source: Advisorkhoj Research

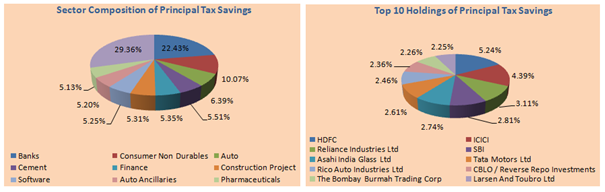

Portfolio Construction

The fund portfolio is balanced between large cap and midcap stocks. There is a bias towards cyclical sectors like banking and finance, automobiles and automobile ancillaries, cement and construction etc. Cyclical stocks perform well during the growth cycles of the economy. The Indian economy is on a secular long term growth path and cyclical stocks are likely to give good returns over a long investment horizon.

The portfolio is well diversified from a company concentration standpoint, with the top 5 stocks, HDFC Bank, ICICI Bank, Reliance Industries, State Bank of India and Asahi Glass accounting for only around 18% of the overall portfolio value. The portfolio turnover of Principal Tax Savings Fund is 0.48 which is not high relative to other peer funds; this shows that the fund manager has strong conviction on his portfolio picks.

Source: Advisorkhoj Research

Lump Sum Returns

The chart below shows the growth of Rs 1 lakh lump sum investment in Principal Tax Savings Fund (Growth Option) over the last 5 years.

Source: Advisorkhoj Research

You can see that Rs 1 lakh lump sum investment in Principal Tax Savings Fund (Growth Option) made 5 years back could have grown to Rs 2.76 lakhs by now. The annualized return over the last 5 years was nearly 23%.

Systematic Investment Plan Returns

The chart below shows the returns of Rs 5,000 monthly SIP in Principal Tax Savings Fund (Growth Option) over the last 5 years.

Source: Advisorkhoj Research

You can see that, with a monthly investment of Rs 5,000 in Principal Tax Savings Fund (Growth Option) over the last 5 years, you could have accumulated a corpus of Rs 5.43 lakhs. You could have made a profit of more than Rs 2.4 lakhs on a cumulative investment of Rs 3 lakhs in 5 years. The annualized 5 year SIP return is nearly 24%.

Conclusion

Principal Tax Savings Fund has completed more than 20 years of strong performance. The fund is a proven wealth creator and the performance over the last 5 years has been outstanding. We also saw that this fund showed very strong performance consistency over the last 6 to 7 years. In Advisorkhoj we believe consistency over a sufficiently long period of time should be one of the most important performance criteria for fund selection. You should consult with your financial advisor if Principal Tax Savings Fund is suitable for your tax planning needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team