Principal Tax Savings Fund: A good tax saver fund to invest for FY 2021

For this assessment year (FY 2020-21 / AY 2021-22), the Government has provided investors the option of sticking to the current income tax rates (as per their income slabs) and claiming exemption like Section 80C, 80D, HRA etc. or moving to the new tax regime with lower tax rates for incomes below Rs 15 lakhs but giving up most of the exemptions. You should do your tax calculations as per the old and new tax regimes according to your personal situation and decide which regime is more advantageous. In our view, tax planning should not be an exercise in isolation. You should consider your long term financial goals in tax planning.

Equity Linked Savings Schemes or ELSS is mutual fund schemes which qualify for tax savings under Section 80C of Income Tax Act, 1961. You can claim up to Rs 1.50 lakhs deduction from your taxable income by investing in ELSS funds. ELSS investments have a lock-in period of 3 years. If you are investing in ELSS through Systematic Investment Plans, each SIP installment will be locked in for 3 years from the date of investment.

Historical data shows that ELSS has been the best performing tax saving investment over a sufficiently long investment horizon. ELSS investments not only enable you to save taxes but also create wealth for your long term financial goals. If you had invested Rs 1 Lakh in Principal Tax Savings Fund at its inception in 1996, your money would have multiplied over 30 times to more than Rs 33 Lakhs.

Scheme Overview

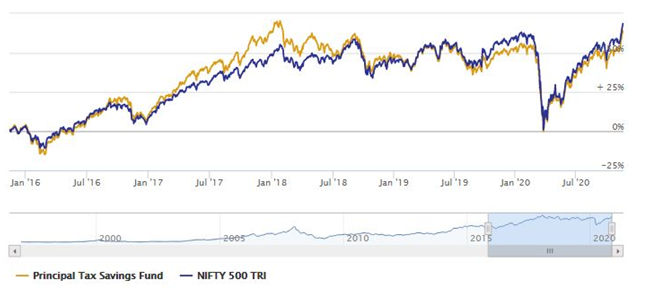

Principal Tax Savings Fund was launched in May 1996 and has Rs 408 Crores of Assets under Management (AUM as on 31st October 2020. The expense ratio of the scheme regular plan is 2.55%. Principal Tax Savings Fund is helmed by Sudhir Kedia. Mr Kedia has 13 years of fund management and research experience. The chart below shows the NAV growth of the scheme over the last 5 years. The scheme benchmark is Nifty 500 TRI. You can see that the scheme despite underperforming versus the benchmark in 2019 has now caught up with benchmark performance.

Source: Advisorkhoj Research

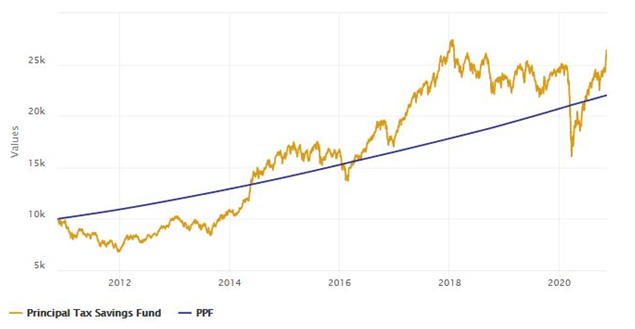

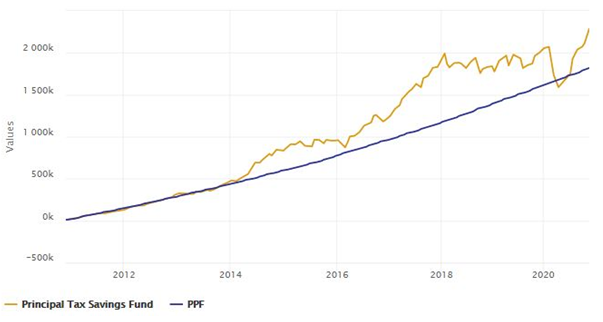

The chart below shows the growth of Rs 10,000 lump sum investment in Principal Tax Savings Fund versus PPF over the last 10 years. You can see that the scheme outperformed PPF and gave nearly 3X returns.

Source: Advisorkhoj Research

Rolling Returns

Regular Advisorkhoj readers know that we give great importance to rolling returns as anunbiased measure of fund performance. A fund may outperform or underperform versus its benchmark index depending on the market conditions and stock selection strategy of the fund manager. But rolling returns show the performance of the fund across different market conditions.

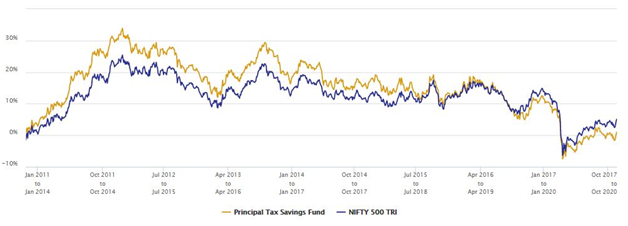

The chart below shows the 3 year rolling returns of Principal Tax Savings Fund versus its benchmark (Nifty 500 TRI) over the last 10 years. We have chosen a 3 year rolling returns period because ELSS funds have a lock-in period of 3 years.

Source: Advisorkhoj Rolling Returns Calculator

You can see that Principal Tax Savings Fund was able to beat its benchmark most of the time over the last 10 years but has underperformed since 2019. Principal MF changed the fund manager of this scheme last year and in our view, the new fund manager must be given sufficient time to implement his ideas. We had discussed earlier based on NAV performance of the fund versus benchmark that the fund manager has caught up with the benchmark performance despite earlier underperformance. This is a very promising sign for the fund.

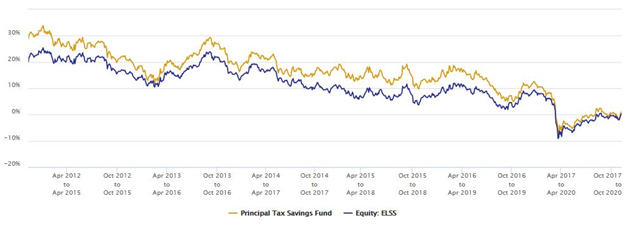

Let us now see how Principal Tax Savings Fund performed against the ELSS category, in terms of 3 years rolling returns over the last 10 years. Investors can see that Principal Tax Savings Fund was able to outperform the category consistently across different market conditions over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

Market Capture Ratios

Market moves up and down at different points of time – this is the reality of equity investing. A fund’s long term alpha creation is predicated on whether the fund managers capitalizes on upward movements in the market or is able to limit downside during corrections or both. We have built a tool in our MF Research Section where we see the performance of a fund both in up-market (months in which the benchmark index was up) and down market (months in which benchmark index was down) conditions.

The ratio of the average monthly returns of a scheme versus average monthly returns of the benchmark when the market was up is known as Up-market Capture Ratio. The ratio of the average monthly returns of a scheme versus average monthly returns of the benchmark when the market was down is known as Down-market Capture Ratio. A fund who’s Up-market Capture Ratio is more than Down-market Capture Ratio has the potential to create alpha in the long term.

Thetable below shows the Up Market and Down Market Capture Ratios of Principal Tax Savings Fund, over the last 10 years. Capture Ratio is the ratio of the Up-market Capture Ratio to the Down-market Capture Ratio. Capture Ratio of more than 1, implies that overall, across different market conditions Principal Tax Savings Fund was able to outperform the benchmark index (Nifty 500). Empirical research shows that funds whose capture ratios are more than 1 over a long period of time, across different market conditions have the potential to generate superior returns in the future.

The track record of Principal Tax Savings Fund in terms of historical capture ratios is promising for investors.

Source: Advisorkhoj Research Market Capture Ratios

SIP Returns

The chart below shows the growth of Rs 10,000 monthly SIP investment in Principal Tax Savings Fund (Growth Option) versus PPF over the last 10 years. With a cumulative investment of Rs 12 lakhs you could have accumulated a corpus of Rs 22.69 lakhs (versus Rs 18.51 lakhs in PPF). The annualized SIP returns (XIRR) over the last 10 years was 12.41%

Source: Advisorkhoj Research

Why invest in Principal Tax Savings Fund?

- Save up to Rs 46,800 in taxes (including cess) by investing Rs 150,000 in the fund

- ELSS is the most liquid investment option under Section 80C of Income Tax Act 1961

- Capital gains of up to Rs 100,000 is tax exempt and taxed at 10% thereafter in a financial year

- Strong track record of long term wealth creation across investment cycles

- Fund performance has recovered after brief period of underperformance. Bodes well for the future

- Large cap orientation (more than 75% of the portfolio) provides stability and limits downside risks

- Impressive long term performance record – Both in lump sum as well SIPinvestments

- Lock-in period allows fund manager to invest for long term without worrying about redemption pressures

- Wealth creation through superior stock selection, including tactical allocations to mid and small caps.

The scheme has a lock in period of 3 years, but to get the best returns you should be prepared to remain invested for longer periods of time. Investors should consult with their financial advisors if Principal Tax Savings Fund is suitable for their tax planning needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team