Principal Focused Multicap: One of the best performing focused equity funds

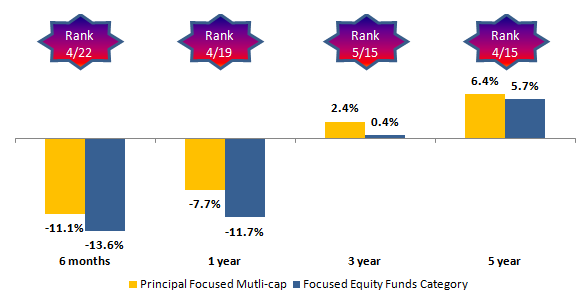

Principal Focused Multi-cap Fund is one of the best performing focused equity funds in the last 6 months to 1 year. The scheme was ranked 4th among 22 focused equity schemes in terms of last 6 months performance and 4th among 19 schemes in terms of last 1 year performance.

The chart below shows the trailing returns of Principal Focused Multi-cap fund for different periods ending 12th June 2020. You can see that the scheme has outperformed the category average in the last 1 year.

Source: Advisorkhoj Research, Returns over 1 year are annualized

Performance versus benchmark

The chart below shows the performance of Rs 10,000 lump sum investment in the scheme versus its benchmark index S&P BSE Large Midcap 250 TRI over the last 1 year. You can see that the scheme has outperformed the benchmark in the last 1 year.

Source: Advisorkhoj Research

Performance versus peer set

The table below shows the trailing returns of Principal Focused Multi-cap Fund versus its peer schemes for different periods ending 12th June 2020. You can see the Principal Focused Multi-cap was among the most consistent performers across different market conditions.

Source: Advisorkhoj Research

SIP returns

The chart below shows the growth of Rs 10,000 monthly SIP in the scheme since its inception. You can see that you could have accumulated a corpus of over Rs 38 lakhs with a cumulative investment of less than Rs 18 lakhs. The annualized SIP return (XIRR) of the scheme since its inception was 10%.

Source: Advisorkhoj Research

Performance versus different asset classes

The chart below shows the growth of Rs 10,000 lump sum investment in different asset classes since the inception of the Principal Focused Multi-cap Fund. You can see that the scheme is among the top performers across different asset classes. As such, this scheme can be an excellent investment option for investors with long investment tenure.

Source: Advisorkhoj Research

Why invest in Principal Multi-cap Fund now?

- The stock market has corrected sharply this year. The Nifty 50 is down nearly 20% on a year to date basis. Midcaps have been in correction mode for the last 2 years with Nifty Midcap 100 index down by nearly 25% in the last 2 years. Historical returns show that the market has bounced back strongly from 20 – 25% corrections in 2 – 3 years following the correction. We think that current market levels offer attractive investment opportunities for long term investors.

- The economic fallout of COVID-19 pandemic has created a lot of uncertainties in the outlook of different companies across different industry sectors. Some companies with strong business fundamentals and management teams have the potential of recovering much faster from this crisis compared to their peers. As such, a focused investment approach in high conviction stocks can generate substantial alphas in this market situation.

- Principal Focused Multi-cap Fund invests in a maximum of 30 high conviction stocks. As discussed above, the scheme has a strong track record of outperformance across different market conditions.

- Given the uncertainty around macro-economic situation and corporate earnings outlook, we expect the market to remain volatile in the near term. Principal Focused Multi-cap Fund is large cap biased (72% of the scheme assets is invested in large cap stocks) in terms of market cap segments. The large cap bias of the scheme will reduce the downside risks in volatile conditions. It will also provide a strong platform for eventual recovery.

Read detailed fund review of Principal Focused Multi-Cap Fund

Who should invest in this scheme?

- Investors looking for capital appreciation through a focused investment strategy

- Investors with high risk appetites

- Investors with sufficiently long investment horizon, minimum 5 years.

Summary

Principal Focused Multi-cap Fund is a good investment option for investors with high risk appetites and long investment horizon. You can invest in this scheme either in lump sum or through SIP or both. If you have lump sum funds available but are worried about volatility in the short term, you can invest your lump sum funds in Principal Cash Management Fund and systematically transfer from the liquid fund to Principal Focused Multi-cap Fund through 3 – 6 months STP. Investors should consult with their financial advisors if Principal Focused Multi-cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team