Principal Focused Multicap Fund: A good focused equity fund for long term investments

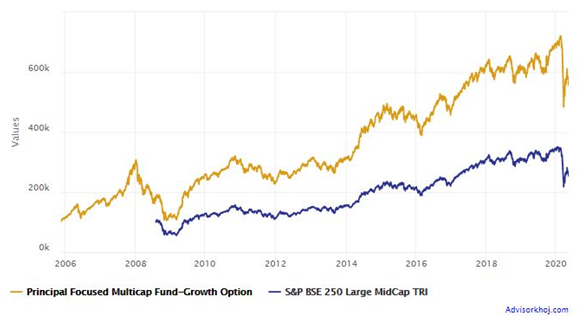

Principal Focused Multi-cap Fund invests in about 30 stocks of different sizes (large cap, midcap and small cap) with high growth potential across different industry sectors. As per SEBI’s mandate for focused funds, the maximum number of stocks in the scheme’s portfolio will be limited to 30 only. This scheme was launched in 2005 and has given 12.55% CAGR returns since inception. The chart below shows the growth of Rs 100,000 lump sum investment in the scheme since its NFO.

Source: Advisorkhoj Research

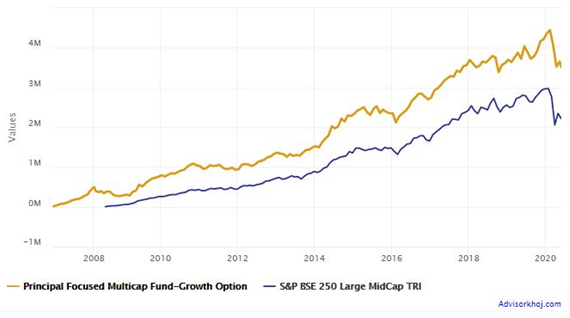

You can see that Rs 1 lakh investment in the scheme would have multiplied 5.6 times to Rs 5.57 lakhs in the last 15 years (as on 18th May 2020). The chart below shows the growth Rs 10,000 monthly SIP in the scheme since inception.

Source: Advisorkhoj Research

You can see that with a cumulative investment of Rs 17.5 lakhs, you could have accumulated a corpus of Rs 35.1 lakhs over the last 15 years (as on 18th May 2020). The annualized SIP return (XIRR) of the scheme was 9.1%. The long term lump sum and SIP returns of the scheme is a strong testimony to its track record as a proven wealth creator.

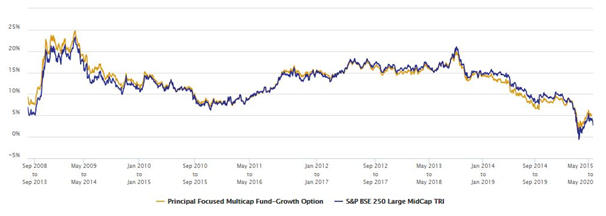

Rolling Returns versus benchmark

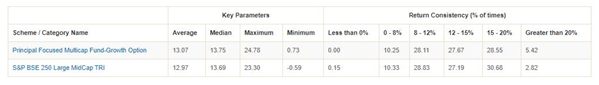

We had discussed a number of times in our blog that rolling returns are the best measures of a scheme performance because it is not biased by prevailing market conditions. The chart below shows the 5 year rolling returns of the scheme versus its benchmark index BSE Large and Midcap 250 TRI since 2008, period covering multiple bull and bear market cycles. You can see that the scheme was able to outperform the benchmark in the most periods. Over the last few years till the end of 2019, the scheme underperformed the benchmark but it has started outperforming again over the last few months. The rolling returns of the scheme versus benchmark shows that the scheme was able to generate alphas across most market conditions.

Source: Advisorkhoj Rolling Returns Calculator

The key rolling returns statistics of the scheme versus the benchmark clearly shows the outperformance of the scheme relative to the benchmark.

Source: Advisorkhoj Rolling Returns Calculator

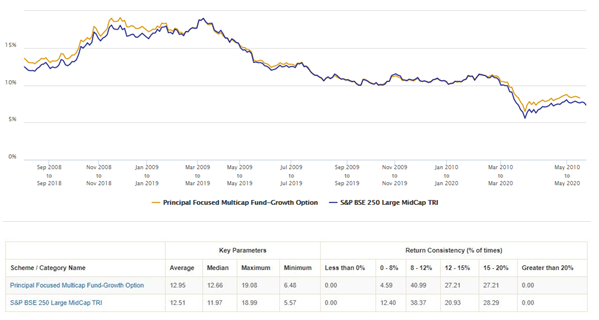

Let us now compare the rolling returns of the scheme versus the benchmark over longer investment tenures. The chart below shows the 10 year rolling return of the scheme versus the benchmark since 2008. You can see that the scheme gave in excess of 12% CAGR returns nearly 55% of the times over 10 years tenure, whereas scheme returns was below 8% CAGR only 4.5% of the times. Therefore, over log tenures the risk return trade-off of investing in this scheme is very favourable.

Source: Advisorkhoj Rolling Returns Calculator

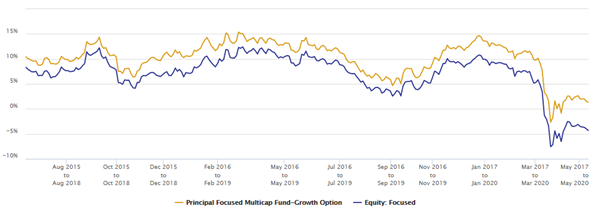

Rolling Returns versus Category

Let us now compare the 5 year rolling returns of Principal Focused Multi-cap Fund versus the focused funds category over the last 10 years. You can clearly see that the scheme consistently outperformed the category across all market conditions.

Source: Advisorkhoj Rolling Returns Calculator

Portfolio Construction

As mentioned earlier, the scheme has only 30 stocks. The scheme has a bias towards large companies with large cap stocks comprising nearly 65% of the scheme. Midcaps have the next highest allocation (25%) in the scheme portfolio. Though the scheme has higher concentration risks compared to more diversified funds, the scheme portfolio is well diversified across industry sectors like banking, finance, consumer non durables, software, petroleum products, pharmaceuticals, chemicals, industrial products, consumer durables and chemicals. The valuations of stocks in many of these sectors (except pharmaceuticals) are beaten down now, but these sectors are likely to lead the recovery the economic downturn caused by COVID-19 lockdown.

Source: Advisorkhoj Research

Why should you invest in this scheme?

- Focused fund of 30 high conviction stocks. Potential for alpha generation over a sufficiently long investment horizon.

- Valuations are at historical lows. Nifty TTM P/E multiple is at around 20 times versus 27 – 28 times in January. Similarly, Nifty Midcap 150 TTM P/E multiple is at around 20 times versus 45 – 46 in May 2018. Stocks have usually bounced back strongly when PE multiples are at or below 20 times.

- The scheme has maintained a large cap bias over the last 2 years or so. The large cap bias will limit downside risks in the times of extremely volatility.

- Strong long term performance track record.

How to invest in this scheme?

To prevent COVID-19 spreading among very large sections of vulnerable population and to provide our healthcare system sufficient time to ramp up their capabilities, the Prime Minister announced a nationwide lockdown on 25th March. The lockdown brought industrial and economic activities to a standstill. We have now entered the 4th stage of the lockdown the Government is gradually easing lockdown measures in less affected areas. However, most of the large cities in the country continue to be COVID-19 red zones and industrial activity in these cities and surrounding areas are likely to be impacted.

Therefore, we expect volatility in equity market to continue to weeks and months till normalcy is restored. If you have lump sum funds available but are worried about volatility then Systematic Transfer Plan (STP) will enable you take advantage of the volatility through rupee cost averaging of the purchase.

We will show through a real example, how STP benefits investors in volatile market –

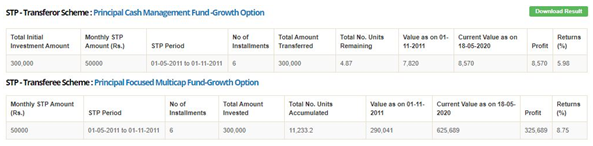

The period between May to November 2011 was very volatile due to US Sovereign Debt Downgrade crisis. Let us assume you invested Rs 3 lakhs in Principal Cash Management Fund on 1st May 2011 and transferred Rs 50,000 every month through STP to Principal Focused Multi-cap Fund till 1st November 2011.

The table below shows the results of the STP. If you invested Rs 3 lakhs in the equity scheme in lump sum on 1st May 2011, you would have bought 10,545 units. On the other hand, using STP you bought 11,233 units. The value of the additional 688 units of the Principal Focused Multi-cap Fund at current NAV (as 18th May 2020) @ 55.7 is Rs 38,331.

Source: Advisorkhoj STP Calculator

Summary

In this post, we reviewed Principal Focused Multi-cap Fund. This fund is suitable for investors with high risk appetite and long investment horizon (at least 5 years). Since the market has corrected sharply since the beginning of the year, good potential returns can be expected over sufficiently long investment tenures. You can invest in this fund through SIP for your long term financial goals, but if you have lump sum funds you can invest in this fund through a 6 month STP with good return potential over the next 5 years or so. Investors should consult with their financial advisor if Principal Focused Multi-cap Funds is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team