Principal Emerging Bluechip Fund: Strong performance recovery

We have covered Principal Emerging Bluechip Fund a number of times in our fund reviews. The scheme has been a strong performer over a long investment horizon (5 years plus), but the fund underperformed in 2018 and also in the first half of 2019.

We had discussed the reasons for the 2018-19 underperformance of this scheme in our blog post, How Principal Emerging Bluechip Fund still a good fund despite short term underperformance.

In the last 6 months, however, we saw a strong bounce-back in performance of this scheme making it one of the top performing large and midcap funds over this period.

Performance recovery

In the last 6 months, Principal Emerging Bluechip Fund has given 15.5% return versus benchmark (Nifty Large and Midcap TRI) return of 5.4%. The high return of the scheme can be attributed partly to the recovery in the broader market in the last quarter of calendar year 2019. However, the scheme has carried its outperformance into 2020, when market sentiment has been weak due a variety of factors like effect of Coronavirus, economic slowdown in India etc. This is the hallmark of a well-managed diversified equity fund – a good fund should be able to outperform the market across different market conditions.

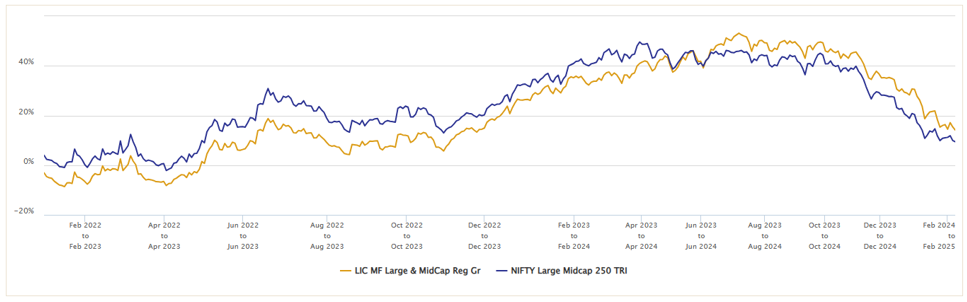

The chart below shows the trailing returns of the scheme versus the benchmark index over different periods (ending 3rd March 2020).

Let us now see how Principal Emerging Bluechip Fund performed versus the large and midcap funds category. For the benefit of readers who may not be aware of the investment characteristics of different mutual fund categories, large and midcap funds invest at least 35% of their assets in large cap stocks and at least 35% of their assets in midcap stocks. As per SEBI, the 100 largest stocks by market capitalization are classified as large cap stocks and the next 150 stocks by market cap are classified as midcap stocks. The chart below shows the trailing returns of Principal Emerging Bluechip Fund versus large and midcap category average returns over different periods (ending 3rd March 2020). You can see that the scheme outperformed the category average across all time-scales.

Rolling Returns

We have stated a number of times of blog that, rolling returns is the best measure of a scheme’s performance consistency across different market conditions. The chart below shows the 3 year rolling returns of Principal Emerging Bluechip Fund versus the Nifty Large Midcap TRI over the last five years. You can see that the scheme has historically outperformed the benchmark index but underperformed in more recent times, but if you look at the right side extremity of the chart you will see that the fund performance is again catching up.

The chart below shows the 3 year rolling returns of the scheme versus the large and midcap funds category over the last 5 years. You can see that the scheme consistently outperformed the large and midcap funds category average.

Lump sum and SIP Returns

The chart below shows the growth of Rs 1 lakh lump sum investment in Principal Emerging Bluechip Fund over the last 5 years. You can see that your invest would have grown to Rs 1.55 lakhs – profit of Rs 55,000 on an investment of Rs 1 lakh over 5 years.

The chart below shows the returns of Rs 5,000 monthly SIP in the scheme over the last 5 years. With a cumulative investment of Rs 3 lakhs, you could have accumulated a corpus of Rs 3.65 lakhs over the last 5 years.

Why invest in large and midcap funds?

We think there is confusion among many investors about this fund category and we see online content on different websites which only serve to confuse investors even more. The main confusion about large and midcap funds is that, how is this fund category different from other diversified equity funds especially multi-cap funds? The main difference between this category (large and midcap) and multi-cap funds which you need to keep in mind when making investment decision is that, large and midcap funds need to maintain at least 35% allocation to large caps, while multi-cap funds have no such restrictions.

The relative performance of multi-cap funds versus the market is driven more by the fund manager’s outlook, whereas the minimum 35% allocation to large cap brings some stability in large and midcap funds. Despite the mandated minimum allocations to large cap and midcap stocks, large and midcap fund managers feel that they have enough flexibility to deliver alphas.

Suggested reading: Different types of diversified equity mutual fund schemes from Principal Mutual Fund

Is this the right time to invest in large and midcap funds?

Midcap stocks have seen substantial correction over the past 2 years. Though midcaps have recovered from the September 2019 lows, they are still substantially lower than January 2018 highs (Nifty Midcap 100 index is down 12%). The deep correction in midcaps has created attractive long term investment opportunities in the segment. Fund managers whom we have interviewed feel that midcaps have the potential to give good long term (3 to 5 year) returns from the existing price / valuation levels.

At the same time, the global economic uncertainty due to the spread of Coronavirus has caused volatility in the stock market. It is very difficult to forecast the effect of the virus on global economy and the timeline of the effect. As such, investors should be prepared for volatility continuing in the market for a longer period of time till we have more clarity. Large cap stocks bring stability to your portfolio in times of uncertainty. News coming from the US indicate that the US Government and Federal Reserve is planning a stimulus package (including interest rate cut) to overcome the economic effects of the contagion. A stimulus will be good news for both large and midcap stocks. In the current economic situation (both global and domestic), large and midcap funds are well positioned to do well over a long investment horizon.

Conclusion

In this post, we have discussed how Principal Emerging Bluechip Fund has staged a smart recovery after underperforming in 2018-19. The scheme has a strong wealth creation track record (please see our post, Principal Emerging Bluechip Fund: Money multiplied 10 times in 10 years). We also feel this category of equity funds is positioned to continue doing well in the current environment.

Investors should have a long investment horizon for Principal Emerging Bluechip Fund. You can invest in this scheme either in lump sum or SIP depending on your investment needs. If you have lump sum funds, but are worried about near term volatility then you can invest your lump sum money in Principal Cash Management Fund and transfer your funds systematically to Principal Emerging Bluechip Fund through 3 or 6 month STP. Investors should discuss with their financial advisors if Principal Emerging Bluechip Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team