Principal Credit Risk Fund: A good credit risk fund for medium term investment

With rise in short term yields, the spread between the 2 year and 10 year Government bond yield has narrowed to just 12 bps, this is a good time to invest in debt mutual funds which invest in corporate bonds to lock in the high yields. Credit risk funds invest in slightly lower rated papers (non-convertible debentures, commercial papers etc.) to capture higher yields.

In the last 1 year, credit risk mutual funds as a category gave 50 bps higher returns than short duration mutual funds and in the last 3 years, credit risk mutual funds gave almost 1% higher annualized returns compared to short duration mutual funds (please see our MF Category Monitor).

Principal Credit Risk fund is one of the best performing (among the Top 5) credit risk funds in the last 1 year (please see Top Performing Credit Risk Funds).

Principal Credit Risk Fund

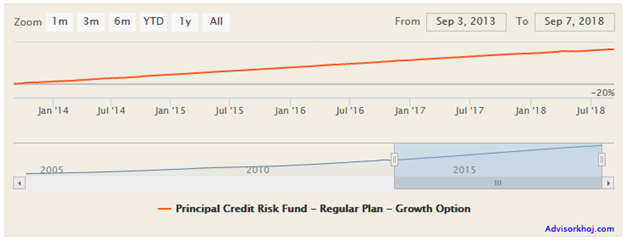

The scheme was launched in September 2004 and has Rs 90 Crores of Assets under Management (AUM). It has an expense ratio of 1.67%. Gurvinder Singh Wasanis the fund manager of this scheme. Prior to him Beckxy Kuriakose managed this scheme for around 5 years. The chart below shows the NAV growth of the scheme over the last 5 years.

Source: Advisorkhoj Research

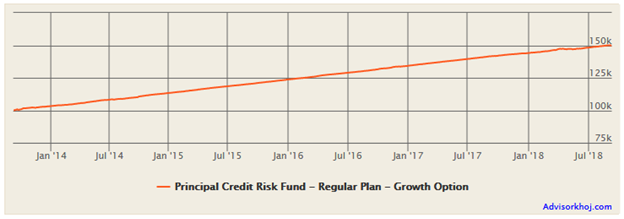

Rs 1 Lakh invested in the Principal Credit Risk Fund would have grown Rs 1.5 Lakhs in the last 5 years (please see the chart below).

Source: Advisorkhoj

Credit Quality of Portfolio

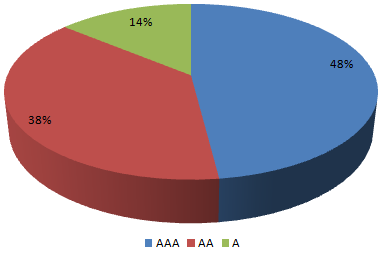

When selecting credit risk mutual funds, investors should not only look at past returns, they should also look at the credit quality of the scheme portfolio. The yields of debt papers increase with lower credit ratings e.g. AA rated bonds will give higher yields than AAA rated bond, A rated bonds will give higher yields than AA rated bonds, so on so forth. A fund manager can generate higher returns by investing in lower rated bonds, but lower rated bonds obviously carry higher credit risk compared to higher rated bonds. Investors should look at the credit quality of the scheme portfolio and should be comfortable with the credit risk profile of the scheme.

The credit quality profile of the Principal Credit Risk Fund is better than credit risk fund category averages. The average credit rating of Principal Credit Risk Fund portfolio is AA, while that of the credit risk fund category is A. Please see the credit quality composition of the scheme corporate bond portfolio in the chart below.

You can see that nearly 48% of the portfolio allocation is to AAA rated papers, the highest credit rating; credit risk funds usually have much smaller allocation in AAA rated papers and higher allocations to A or lower rated papers.

Yield to maturity

For the superior credit quality of the scheme portfolio the fund manager has to sacrifice some yield. The yield spread between A and AA rated papers is usually in the range of 175 bps to 200 bps, while that between A and AAA rated papers is in the 200 to 225 bps range. The yield to maturity (YTM) of Principal Credit Risk Fund is 9.08%, while average yield to maturities of credit risk fund category is 9.7%. This difference between the scheme and the category YTM shows that the yield is quite good on a relative basis despite the superior credit quality.

Interest Rate Sensitivity

Modified duration is the price sensitivity of a bond to interest rate. A bond or non-convertible debenture with modified duration of 1 year means that if interest rate rises by 1%, the bond price will fall by 1% and vice versa. The modified duration of the Principal Credit Risk Fund portfolio is 1.14 years, which implies limited interest rate sensitivity. Bond prices have an inverse relationship with interest rate changes. The average modified duration of credit risk fund category is 1.56 years. On a relative basis, Principal Credit Risk Fund has limited interest rate risk compared to average credit risk funds.

Credit rating changes

Over the past few days, there have been reports and discussions on the impact of ratings downgrade on debt mutual fund schemes in the media. While facts are facts, the media, unfortunately in our view, is biased in reporting impact of rating changes on debt mutual funds. Rating downgrades are always reported and discussed, but rating upgrades are rarely reported or discussed. While rating downgrade will cause the price of a debenture (bond) or commercial paper to fall, a ratings upgrade will cause the price to rise. Upgrades are as common as downgrades. Apart for capturing higher yields of lower rated papers, credit risk fund managers also try to identify papers, which will have upgrade potential, so that they can generate superior returns for investors.

Concentration Risk

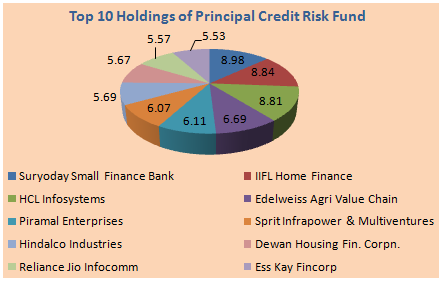

Limiting exposure to a single issuer lowers the overall risk in the event of rating downgrade. The maximum exposure of Principal Credit Risk Fund to a single bond issuer is less than 9%. The chart below shows the top holdings of Principal Credit Risk Fund and their percentage allocations in the scheme portfolio.

Dividend Payout Track Record

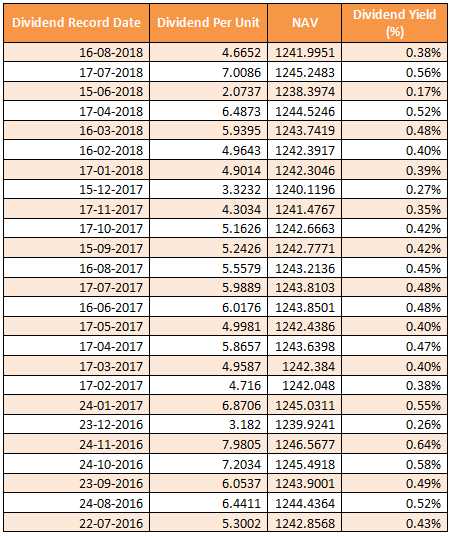

Principal Credit Risk Fund has a strong monthly dividend pay-out track record. The table below shows that the scheme has been paying regular monthly dividends for the last 2 years.

Conclusion

Principal Credit Risk Fund has nearly 14 years of track record. The fund has managed credit risk judiciously and generated good returns for investors. Credit risk fund managers employ accrual strategy, which means that they hold the bonds in their portfolio till maturity – this limits the interest rate sensitivity of the scheme. Investors should therefore, have a tenor which matches the maturity profile of the scheme to get good returns. Further, investors enjoy tax benefits in debt funds, if their investment tenors exceed 3 years because they get indexation benefits on long term capital gains tax. Investors should consult with their financial advisors if Principal Credit Risk Fund is suitable for their medium term investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team