Principal Balanced Fund: Best performing balanced fund in the last 3 years

In the last 3 years, Principal Balanced Fund gave 16.7% annualized returns, the highest among all equity oriented balanced funds in the industry (please refer to Advisorkhoj research tool, Top Performing Balanced Fund Equity Oriented). Even in the last 5 years, Principal was among the top 5 balanced funds, giving nearly 18% annualized returns. The fund continued its outstanding performance in 2017, giving nearly 36% annualized returns. Though Principal Balanced Fund is still not as popular as some of its industry peers (total AUM stands at Rs 870 Crores), it is one of the fastest growing (in terms of AUM) in the Balanced Fund category.

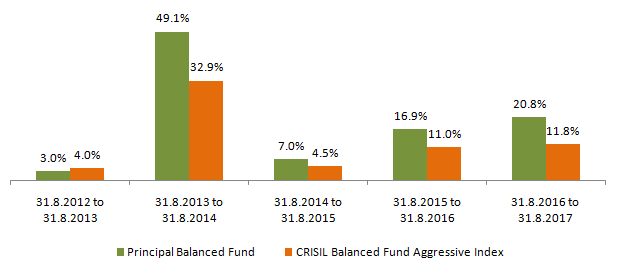

Principal Balanced Fund outperformed its more popular peers both in terms of trailing returns (1 year, 3 years and 5 years) and also in terms of performance consistency. The chart below shows the performance of Principal Balanced Fund versus its benchmark over the last 5 years.

Source: Principal Mutual Fund

You can see in the chart above, that Principal Balanced Fund generated positive alphas in most periods. In Advisorkhoj, we have developed a tool which can help investors identify the most consistent performers in any mutual fund category by looking at their annual quartile rankings over the last 5 years (please see our tool, Top Consistent Mutual Fund Performers). It is no surprise that Principal Balanced Fund is among the most consistent balanced funds as per our tool. In our blog, we have often stated the importance of performance consistency in selecting mutual funds for long term investments.

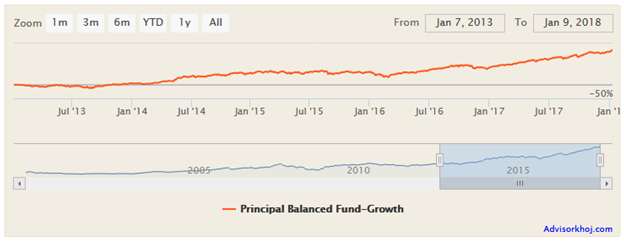

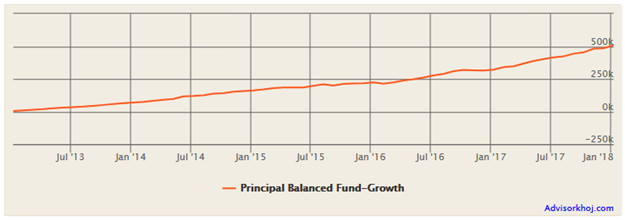

Principal Balanced Fund was launched in 2000. The equity portion of Principal Balanced Fund is managed by PVK Mohan who has total work experience of over 24 years. He has been managing this fund since May 2010. Ms. Bekxy Kuriakose manages the debt portion of this fund. She has total work experience of 16 years and has been managing this fund since Mar 2016. The expense ratio of the fund is 2.77%. The chart below shows the NAV growth of the fund over the last 5 years.

Source: Advisorkhoj Research

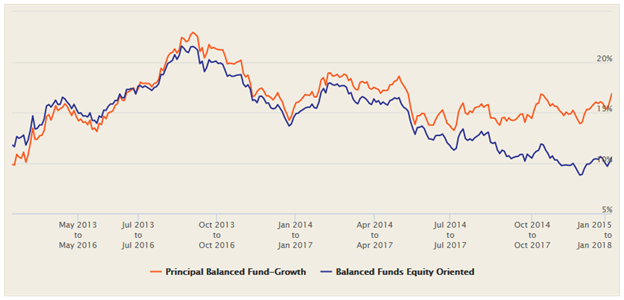

Rolling Returns

The chart below shows the three year rolling returns of Principal Balanced Fund versus the Balanced Fund category over the last 5 years. We have chosen a 3 year rolling returns period because in our view investors should have at least 3 years investment tenure for equity oriented funds, including balanced funds.

Source: Advisorkhoj Research

Rolling returns is one of the best mutual fund performance measures because it is not biased by recent market conditions and measures performance across different market conditions. You can see that, Principal Balanced Fund outperformed Balanced Funds category in term of 3 year rolling returns for most parts of the last 5 years (nearly 75% of the times). The 3 year annualized rolling returns was almost always in double digits over the last 5 years. The maximum 3 year rolling returns in the last 5 years was nearly 23%, while the minimum 3 year rolling returns in the last 5 years was around 10%. The median 3 year rolling returns of Principal Balanced Fund over the last 5 years was 15.7%.

Portfolio

Currently, the fund is invested about 65.5% into equities across market capitalizations. The equity portfolio has a large cap bias (with about 63% equity allocations to large cap stocks). The composition of fund also spreads across sectors and industries which are expected to benefit from themes like consumption, infrastructure, affordable housing and rural/agriculture. Banks, consumer non-durables, chemicals, cement, automobiles etc are the major sectors. The major contributors of the fund’s performance in the last 1 year are Phillips Carbon Black, KEC International, Chambal Fertilizer and Chemicals, Dewan Housing Finance Corp and Asahi India Glass.

The fixed income portion of the fund is deployed in (i) Debt instruments like bonds and NCDs, (ii) Debt Mutual Fund Units and (iii) Cash and Other Assets. The Debt Instruments currently have average maturity of 5.03 years, modified duration of 3.59 years and yield of 7.66%; the interest rate sensitivity of the debt portfolio of Principal Balanced Fund is moderate.

Lump Sum and SIP Returns

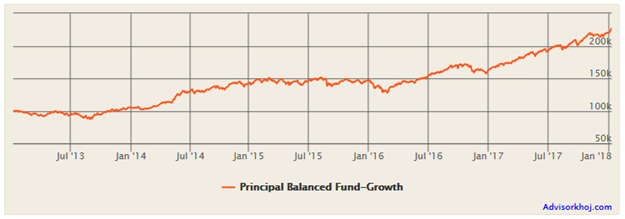

The chart below shows the growth of Rs 1 lakh invested in Principal Balanced Fund (Growth Option) over the last 5 years.

Source: Advisorkhoj Research

You can see that, the investment grew 2.25 times in the last 5 years. The 5 year annualized return was 17.7%. The chart below shows the growth of Rs 5,000 monthly SIP in Principal Balanced Fund (Growth Option) over the last 5 years.

Source: Advisorkhoj Research

With a cumulative SIP investment of just Rs 3 lakhs, the investor could have made a profit of over Rs 2 lakhs. The annualized SIP return over the last 5 years was 21%.

Why Balanced Funds?

In the last 12 months, Nifty gave 27% returns; Nifty is now (as January 15) trading at its all time high of around 10,750. The midcap index, Nifty Free Float 100, gave nearly 43% returns in the last 12 months. Naturally, many investors are concerned about valuations in the equity market and worried if a correction is imminent. Bear markets inevitably follow bull markets, but it is impossible to predict when the bear market will strike.

Our view in Advisorkhoj is that, investment decisions should be based on your goals and not market levels. As such, we believe that, equity is the best asset class for your long term financial goals. At the same time, concerns related to future returns, volatility and fears of price correction in the short to medium term are undeniable.

Balanced mutual Funds offer investors the opportunity to remain invested in the best performing long term asset class and at the same time, reduce the downside risks in the event of a correction, thereby giving your investment portfolio stability. Balanced mutual funds also offer investors automatic asset allocation rebalancing, when relative price movements approach extremes. Auto asset rebalancing yields superior risk adjusted returns in the long term. Investors can rebalance their assets by switching partially from equity to debt funds, but there is a cost associated with frequent rebalancing in the form of exit loads and short term capital gains taxation. Through Balanced mutual funds investors can achieve asset rebalancing at no cost. Investments held for more than a year in balanced mutual funds are tax free.

You may like to read in details what are balanced mutual funds

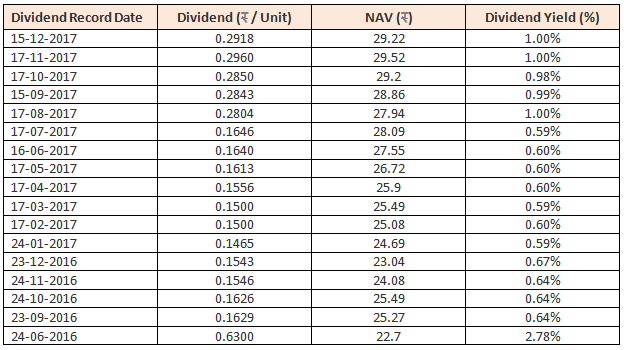

Dividend History

The table below shows the dividend history of Principal Balanced Fund – Dividend Option since 2016. You can see that, the scheme has been paying regular dividends to its investors. Dividend yield in the last 1 year has also been good. However, investors should know that, mutual fund dividends are not assured.

Conclusion

Principal Balanced Fund has completed 17 years. The performance over the past year or so has been exceptionally good. The fund has also been a consistent performer over the past 5 years. Investors with moderately aggressive risk appetites can invest in this fund with a long horizon. Investors should consult with their financial advisors if Principal Balanced Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team