PGIM India Flexicap Fund: One of the most consistent performers in the last 5 years

PGIM India Flexi Cap Fund has been available for investors since March 04, 2015. As equities are a long-term investment product, one must consider at least 3-yrs returns during this period. The PGIM India Flexi Cap Fund’s trailing 3-year returns stand at 27.1% (Regular Growth plan as of 21-Jun-23). The benchmark (Nifty 500 TRI) has given 25.5% during this period. This makes the fund rank in the Top 6 of its category. Meanwhile, if we look at the longer time horizon, like 5-yrs on the same date, then with 15.75% returns, the fund is ranked among the top 3 among its peers.

Wealth Creation

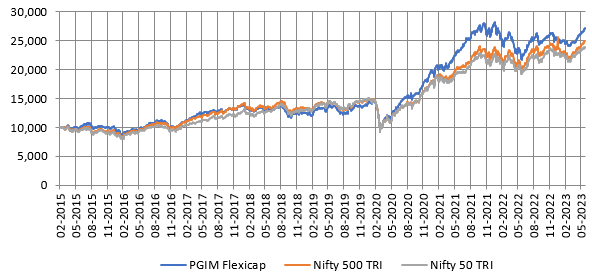

The chart below shows the growth of Rs 10,000 lump sum investment in PGIM India Flexicap Fund versus its benchmark index Nifty 500 TRI and Nifty 50 TRI since the scheme’s inception. You can see that scheme beat its benchmark index, Nifty 500 TRI and the market index, Nifty 50 TRI.

Source: Advisorkhoj.com; data as on 23-Jun-2023. Above chart rebased to 10000.

About Flexicap Funds

Flexicap funds are diversified equity mutual fund schemes that can invest across market cap segments. There are no upper or lower limits with respect to allocations to any market cap segment. According to their market outlook, the fund managers of these schemes can invest any percentage of their assets in any market cap segment, viz. large-cap, mid-cap and small-cap.

About PGIM India

PGIM India Mutual Fund is a wholly owned business of PGIM, the global investment management business of the US-based Prudential Financial, Inc. (PFI). With operations in the United States, Asia, Europe and Latin America, PFI provides customers with various products and services, including life insurance, annuities, retirement-related services, mutual funds and investment management.

PGIM is the global investment management business of PFI, and manages over USD 1.27 trillion in assets under management. PGIM offers a wide range of actively managed asset classes and investment styles, including Equities, Fixed Income and Real Estate. It has a presence across 18 countries having 46 offices with over 1,400+ investment professionals.

PGIM India Asset Management is a full-service investment manager offering a broad range of equity and fixed-income solutions to retail and institutional investors throughout the country. The AMC manages 23 open-ended funds operated by 17 investment professionals. The fund house leverages the strength and stability of PGIM’s 145-year legacy to build on its decade-long history in India.

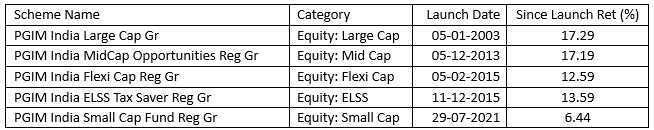

In the Equity segment, the AMC manages funds within five categories. Their long-term track record, i.e. since inception and more than five years of history, gives better conviction.

Source: Advisorkhoj.com; data as on 23-Jun-2023

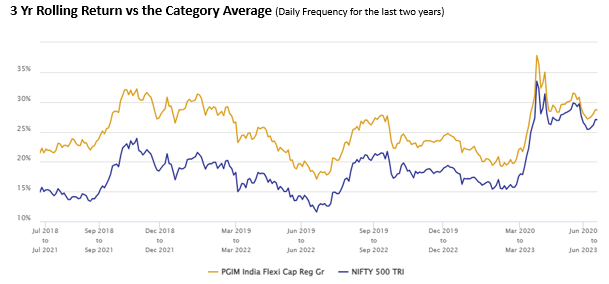

Rolling Returns – PGIM India Flexicap Fund

On analysing the past two years of rolling returns on a three-year basis. A series is created for each day for the last two years; on each day, 3-yr returns are calculated. This allows a more holistic approach to understanding the performance.

Source: AdvisorKhoj; Data as of 23-June-2023 in last two years.

PGIM India Flexi Cap fund has outperformed the category average consistently during the last two years on a three-year rolling period.

Source: AdvisorKhoj; Data as of 23-June-2023 in last two years.

For any equity fund, one must remain invested for 3 yrs at least because the results are often more volatile for a period less than that. Looking at the table above, it is evident that the probability of investors in the fund having a better experience compared to the index is higher. Approximately 90% of the time, the fund has given more than 20% returns in the last two years on a three-year rolling basis. During the same period, the Nifty 500 TRI would have given 29% of time returns of more than 20%. Thus the scheme has outperformed the benchmark index handsomely, and is an endorsement of the investment process at PGIM India.

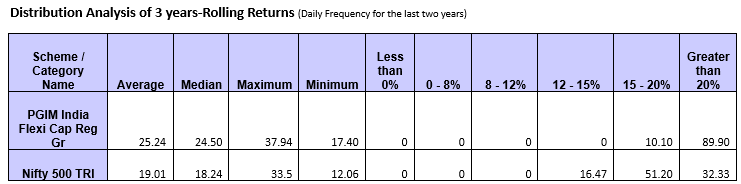

SIP Returns Analysis

Source: Mutualfundtools.com; as on June 21, 2023.

The graph above highlights how investors would have fared if they had invested for the last five years. For the initial two years, the invested amount showed nominal growth. Then in 2020, when the markets collapsed due to the pandemic, the investment’s market value went below the invested amount. Despite the tough experience in the first two years, if an investor had continued, they would have seen their investment generate 19.1% returns over five years.

Investment Style

The fund’s description of stock picking showcases growth at a reasonable valuation (GARP) approach. The AMC, PGIM India, follows a mix of quantitative and qualitative approaches to create the universe for its equity fund managers.

For example – the company’s quality is measured through quantitative metrics of relatively higher RoE than peers, and the qualitative approach is that it should be sustainable RoE. Similarly, the growth aspect is that earnings should be higher than peers along with sustainable earnings growth, again a qualitative approach. In the same way, the management is also assessed using both quantitative and qualitative measurements. The quantitative requirement is that operating cash flows be positive for 7 out of 10 years. In contrast, there are two qualitative requirements – good quality management and a good capital allocation track record. From the qualified universe, the fund manager looks at the market cap, valuations, liquidity, fund mandate, macro-outlook, etc., to create the fund portfolio.

This fund can increase or decrease exposure to Large-, Mid- or Small-Cap as per Market Cycles and the Fund Manager’s view of Markets.

Although there is a provision for investing through derivatives, the portfolio has yet to see any such instrument.

Fund Manager

There are two fund managers for equity investing -- Vinay Paharia and Anandha Padmanabhan Anjeneyan. Vinay Paharia is also the CIO at PGIM India. He has more than two decades of experience in equity investing. He was earlier the CIO of Union AMC (2018-23). Anandha has been with PGIM India since 2019. Before joining PGIM India Asset Management Pvt Ltd, he worked with Renaissance Investment Managers Private Limited and Canara Robeco AMC Limited.

Why invest in PGIM India Flexicap Fund?

Flexicap funds have the potential to create wealth over a long investment horizon while balancing risks by managing their market cap allocations dynamically according to the market outlook of the fund manager. As such, financial advisors recommend flexicap funds as part of the core equity portfolio.

Traditionally, large-cap is considered a good investment option within equities when the economic conditions are tough. Conversely, when the economy is flourishing, mid and small-cap are considered better investment options.

The commentaries on the economic condition of the USA show a divided opinion on the possibility of a recession. Therefore, under such a situation, a fund like PGIM India Flexicap Fund may be considered by investors. The Fund Manager here can adjust their allocation swiftly between large-, mid- and small-cap basis opportunities.

The fund follows a process-based investment approach. This is evidenced in the performance consistency of the fund (please see our tool -> Most consistent flexicap funds) PGIM, as an AMC, has a strong long-term (5 years plus) track record of performance across multiple equity fund categories

Who should invest in PGIM India Flexicap Fund?

- Investors looking for capital appreciation over long investment tenures

- Investors with high-risk appetites

- Investors with minimum 5-year investment tenures

- Depending on your investment needs, you can invest either in lumpsum or SIP.

Investors should consult their financial advisors if PGIM India Flexicap Fund suits their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team