Outstanding SIP returns by SBI Magnum Midcap Fund in the last 10 years

If you started a monthly SIP of र 5,000 in SBI Magnum Midcap Fund 10 years back, by now you would have accumulated a corpus of over र 16.4 lakhs (as of end June 2016). The annualized SIP return of this midcap equity mutual fund over the last 10 years is 19%. This top rated fund has sustained its strong performance even in the last one year. The fund delivered nearly 12% returns on a trailing twelve month basis, while the Nifty was down by around 1.5% over the same period.

In fact, SBI Magnum Midcap Fund featured in our selection of Top Midcap Funds this year (please see our post, Top 7 Best Mid and Small Cap Equity Mutual Funds to Invest in 2016: Part 1). Over the last three years, the net asset value (NAV) of fund has grown at a compounded annual growth rate (CAGR) of more than 38%, which implies that if you invested र 1 lakh in the fund just three years back, the value of your investment today (June 30, 2016) would be over र 2.6 lakhs. In their most recent mutual fund rating, CRISIL has ranked SBI Magnum Fund as Good Performer (Rank 2).

Fund Overview of SBI Magnum Midcap Fund

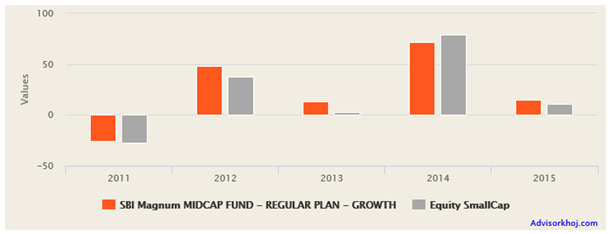

SBI Magnum Midcap Fund was launched in March 2005 and has delivered 18.1% returns since inception. The fund has र 1,965 crores of Assets under Management (AUM), with an expense ratio of 2.32%. Sohini Andani is the fund manager of this scheme. The fund has consistently outperformed the category of funds it belongs to, in most years over the last 5 years.

Source: Advisorkhoj Research

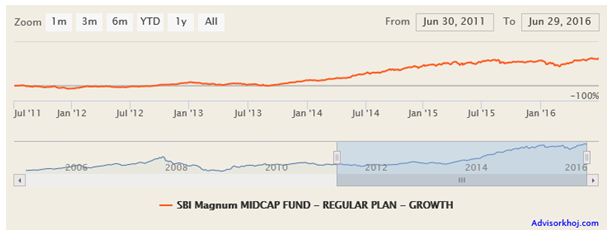

The chart below shows the NAV movement of SBI Magnum Midcap Fund over the last 5 years.

Source: Advisorkhoj Research

The chart below shows the 3 years rolling returns of the fund over the last 5 years. We have chosen a 3 year rolling returns period because investors should always have a long investment horizon (at least 3 years) for investing in equity funds. In fact, for small and midcap equity funds a longer investment horizon is often suggested by investment experts.

Source: Advisorkhoj Rolling Returns Calculator

You can see in the chart above that, the 3 year rolling returns of the fund over the last 5 years have always been above 20%. In other words, in the last 5 years, if you had a 3 year investment horizon, you would have always got more than 20% annualized returns, irrespective of when you invested. The last 5 years were not the most benign period for equity market in India and the world.

In 2011 and 2015 we had sharp downturns. There were a number of adverse global factors in the last 5 year period, like end of quantitative easing by the US Federal Reserve and interest rate hike last year, the Eurozone economic issues related to Greece and a number of other countries, economic slowdown in China and issues with earnings slowdown in our own country.

The performance of SBI Magnum Midcap Fund given these various factors is truly outstanding. In fact, over the last 5 years, SBI Magnum Midcap Fund gave more than 30% rolling returns almost 75% of the times.

Portfolio Construction of SBI Magnum Midcap Fund

The investment objective of SBI Magnum Midcap Fund is to provide investors with opportunities for long term growth in capital along with the liquidity of an open-ended scheme by investing predominantly in a well-diversified basket of equity stocks of Midcap companies. The fund manager likes to invest in growth companies. The Fund Manager has a bias for cyclical sectors like banking and finance, capital goods, cement and construction etc. Cyclical sectors usually outperform defensive sectors in the long term especially when economic growth revives and risk sentiments improve.

However, the fund also has allocations to defensive sectors like pharmaceuticals and information technology. The portfolio is very well diversified in terms of company concentration. The top 5 companies in the fund portfolio, Cholamandalam Investment and Finance, RAMCO Cements, Strides Shasun, Dr Lal Pathlabs and VA Tech Wabag account for only 20% of the portfolio value.

Source: Advisorkhoj Research

Risk and Return

In terms of risk measures, the annualized standard deviation of monthly returns of the SBI Magnum Midcap Fund is on the lower side, relative to the diversified mid and small fund category. Despite the slightly lower volatility, on a risk adjusted returns basis, as measured by Sharpe Ratio, the SBI Magnum Midcap Fund has outperformed the mid and small cap funds category. The beta of the fund is lower than that of the midcap equity mutual fund category, while the fund manager has delivered outstanding alpha.

The chart below shows the growth of र 1 lakh lump sum investment in SBI Magnum Midcap Fund (Growth Option) over the last 5 years.

Source: Advisorkhoj Research

You can see that a र 1 lakh lump sum investment in the SBI Magnum Midcap Fund would have grown to nearly र 3 lakhs in the last five years.

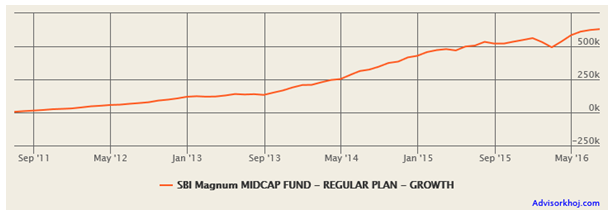

The chart below shows the returns of a र 5,000 monthly SIP in SBI Magnum Midcap Fund (Growth Option) over the last 5 years.

Source: Advisorkhoj Research

You can see in the chart above that, with a monthly SIP of र 5,000 in the fund, you could have accumulated a corpus of over र 6 lakhs in the last 5 years. This implies a profit of more than र 3 lakhs over a cumulative investment of just र 3 lakhs. The annualized SIP returns over the last 5 years work out to nearly 30%.

Conclusion

SBI Magnum Midcap Fund has delivered more than 10 years of strong performance. The wealth creation by this fund in the particularly the last 5 years has been outstanding. SBI Mutual Fund is one of the oldest fund houses in India with a strong track record of fund management over the years. SBI Magnum Midcap Fund is one of the best mutual fund scheme in the SBI stable. We should reiterate that, investors wishing to subscribe to SBI Magnum Midcap Fund, either through lump sum or SIP mode, should have a long investment horizon. Investors should consult with their financial advisors, if SBI Magnum Midcap Fund is suitable for their mutual fund portfolios.

To know more about the fund, please click here

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team