NJ Flexicap Fund: Add genuine diversification to your portfolio

NJ Flexicap Fund was launched in September 2023. Flexicap is one of the most popular equity fund categories. As per AMFI November data, Flexicap funds with Rs 3.06 lakh crores of assets under management (AUM) is the largest category (in AUM terms) among all actively managed equity fund categories. There are more than 1.3 crores folios in the flexicap funds category (source: AMFI, as on 30th November 2023). As of 30th November 2023, there are 38 schemes in the flexicap cap category. Helios Flexicap Fund is the newest scheme to be launched in this category. Prior to Helios, NJ Flexicap Fund was the last fund to be launched in this category.

How to select a fund for your portfolio?

You should select funds based on your risk appetite and investment goals. Certain equity fund categories have a higher risk profile than others e.g. small cap funds have higher risks compared to large cap funds, sectoral funds have higher risks compared to diversified funds etc. You should identify which fund category is suitable for your risk profile and investment needs.

Once you narrow down to a category, how will you select a fund for your portfolio? Many investors look at short term returns while more informed investors look at long term returns versus the benchmark. However, if you have multiple funds in your portfolio, you should also look at whether a fund adds diversification to your portfolio. If you have a lot of funds, which have many common stocks in their portfolios, you will not necessarily get diversification benefits and may even lead to sub-optimal returns. In order to avoid ineffective diversification, you should avoid selecting funds which have high overlap with other funds in your portfolio.

Portfolio overlap

A typical diversified equity fund usually invests in 50 to 70 stocks. If two funds have a large number of common stocks in their portfolios, then the overlap of the two funds will be high. Another factor contributing to high overlap will be weights of these common stocks. If some of the stocks in the overlapped portion underperform, then the performance of both the funds will suffer, in other words, you will not get the desired diversification benefits. How much overlap is high? We think overlap of more than 20 – 25% is high.

Advisorkhoj.com has a portfolio overlap tool where you can compare the portfolio of two mutual fund schemes and see how much of the portfolio is overlapping. To calculate portfolio overlap, we see the common stocks of both the funds and the weight of each common stock in the respective funds. For each common stock, we take lower of the two weights in the funds and add it for all the common stocks to get the portfolio overlap between the two funds.

High overlap in flexicap funds

One can expect high overlaps in certain categories like large caps or some sector funds because the universe of stocks in which these funds can invest is limited. But we were surprised to see high overlaps between many flexicap funds; surprising because the universe of stocks in which flexicap funds can invest is quite large; across any market capitalization segments. One notable exception is NJ Flexicap Fund.

Low overlap of NJ Flexicap Funds with peers

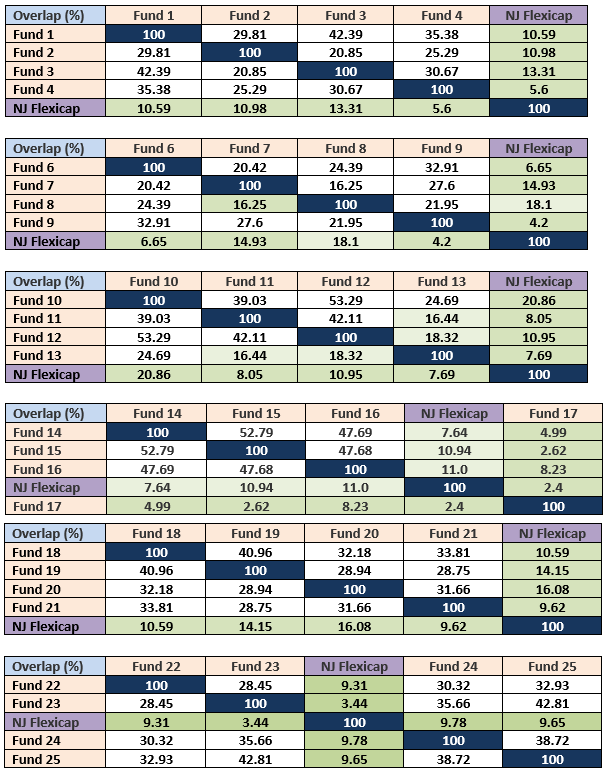

We looked at overlap of NJ Flexicap Funds with 25 Flexicap funds, and found that NJ Flexicap had the lowest overlap. You can also see that overlap of NJ with all other funds is almost always below 20%.

All portfolio overlap calculations have been done on the basis of scheme factsheets as on 31st October 2023. Funds analyzed include flexicap funds only.

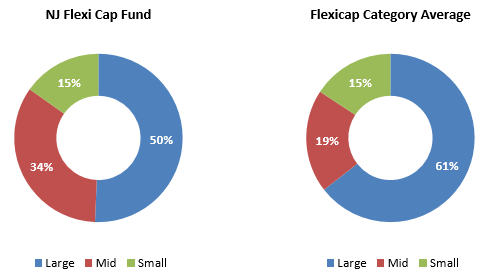

Market cap allocations of NJ Flexicap versus category average

There is considerable divergence in NJ Flexicap Fund’s large and midcap allocations from the flexicap funds category average market allocations, while the small cap allocation is in line with the category average. NJ Flexi Cap is able to have significantly higher midcap allocations compared to the category average allocations.

Source: Advisorkhoj Research, as on 31st October 2023

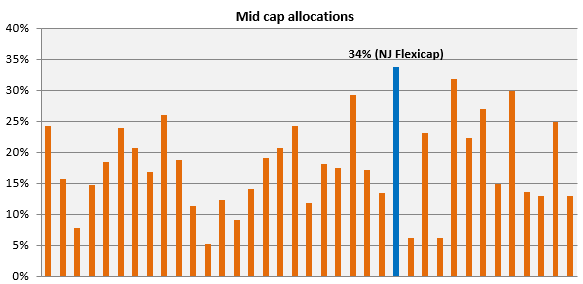

The chart below shows the midcap allocations of all flexicap funds. You can see that most of funds (around 70% of the funds) have less than 20% allocation to midcaps. NJ Flexicap in blue has the highest midcap allocation among all flexicap funds.

Source: Advisorkhoj Research, as on 31st October 2023. This excludes Helios Flexicap Fund which was launched in November

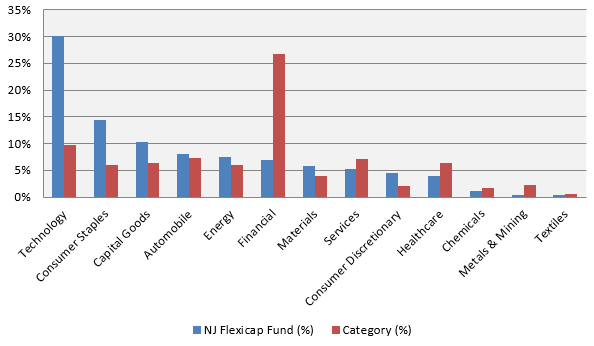

Sector allocations of NJ Flexicap Fund versus category average

The chart below shows that there is considerable divergence in sector allocations of NJ Flexicap Fund from the category average. For example, the fund has much higher allocations to technology, consumer staples etc and lower allocations to financials, compared to the average sector allocation of peers.

Source: Advisorkhoj Research, Scheme Factsheets as on 31st October 2023

Stock selection strategy

Why invest in NJ Flexicap Fund?

- Rule-Based

- Predefined rules eliminate human bias

- Pretested and always “true to label”

- Quality Focused

- Eliminates low quality stocks from all portfolios

- Improves portfolio outcomes

- Technology Driven

- Powered by NJ’s in-house SMART BETA Platform

- Genuine Diversification

- Clearly differentiated stock selection approach

- Results in clearly differentiated portfolios

- Offers style level diversification which was earlier unavailable

Investors should consult their financial advisors or mutual fund distributors if NJ Flexi Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team