Nippon India Value Fund: One of the best performing value funds in the last 3 years

Value funds are equity mutual fund schemes which follow value style of investing. The essential feature of value style is investing in stocks which are trading at a considerable discount to the fair value (intrinsic value). Fund managers buy and hold these stocks for a long period of time to capture the valuation upside i.e. when the valuation of the stock catches with up or exceeds the fair value. Value stocks usually have low Price to Earnings (P/E) or Price to Book (P/B) ratios and high dividend yields.

Though there have been a number of diversified equity mutual fund schemes across different asset management companies (AMCs) following the value investing style for many years now, SEBI in its mutual fund reclassification initiative in 2018, created a separate category for this type of funds.

Why Value Funds now?

Our research team thinks that this might be a good time to add value funds to your portfolio. The broader market has seen sharp corrections over the past 2 years and now seems to be bottoming out. Fund managers will be able to identify quality value stocks at these price levels. Fund managers who we have interviewed over the past few months have concurred with our belief. When economic recovery takes place and earnings outlook improves, value stocks can give strong returns over 3 to 5 years plus investment horizon. Investors should understand that value stocks are usually not momentum stocks and may not immediately give high returns in market rallies. In order to get best results, you need to wait for a sufficiently long time till the valuations catch up. These funds can also be excellent long term investments through the Systematic Investment Plan (SIP) mode.

Nippon India Value Fund - Overview

Nippon India Value Fund is one of the best performing value funds in the last 3 years (please see our Top Performing Mutual Funds (Trailing returns) - Equity: Value). The scheme has figured in Top 3 value funds in 2019 as well. The scheme has figured in the Top 5 value funds over long periods (5 years as well).

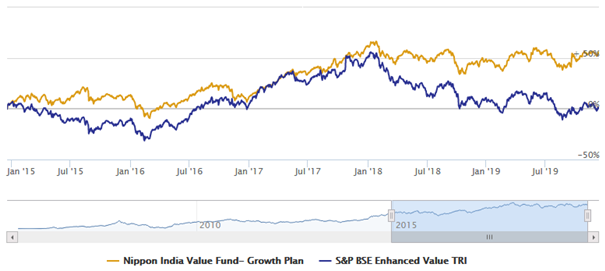

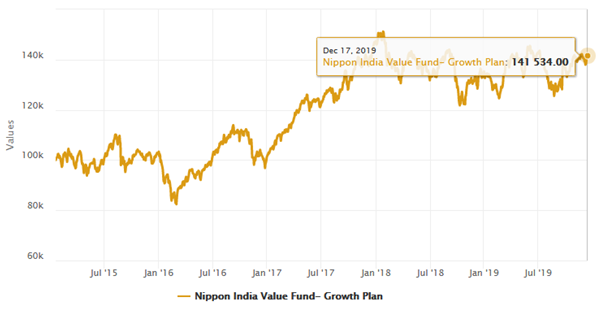

The scheme was launched in 2005 and has Rs 3,129 Crores of assets under management (AUM). The expense ratio of the scheme is 2.13%. Meenakshi Dawar is the fund manager of this scheme. The chart below shows the NAV growth of the scheme (growth option) over the last 5 years (ending 17th December 2019).

Source: Advisorkhoj Research

Strong relative performance over different periods

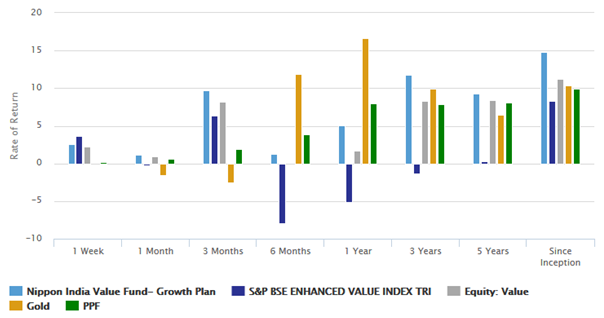

Nippon India Value Fund has outperformed its benchmark index (S&P BSE Enhanced Value TRI) and the value funds category average across different time-scales. The chart below shows the returns (returns over investment periods longer than 12 months have been annualized) of the scheme versus the benchmark, category and other asset classes over different trailing investment periods (ending 17th December 2019).

Source: Advisorkhoj Research

You can see that over longer investment horizons it has outperformed all asset classes. The chart above shows that the fund manager has been able to create alphas across different market conditions.

Rolling Returns

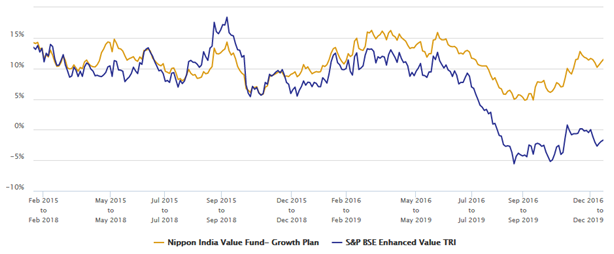

Regular Advisorkhoj readers know that we prefer to use rolling returns to evaluate fund manager performance. Rolling returns, unlike point to point returns, are not biased by prevailing market conditions. Rolling returns give a good sense of the fund manager’s performance across different market conditions. The chart below shows the 3 year rolling returns of Nippon India Value Fund versus its benchmark index S&P BSE Enhanced Value TRI over the last 5 years. We are showing 3 year rolling returns because investors should have minimum 3 year investment tenures for these funds.

Source: Advisorkhoj Research

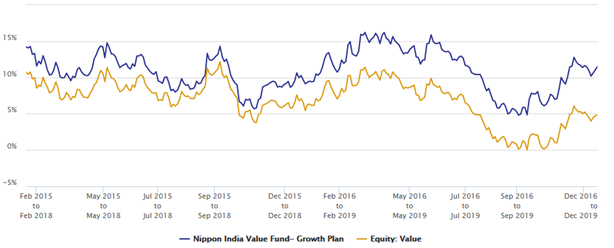

You can see that the scheme has outperformed the Benchmark most of the time in the last 5 years (across different market conditions). This is a testimony of the performance consistency of the scheme and the fund manager’s ability to create alpha across different market conditions over sufficiently long investment tenures. We will now see how this scheme performed against its peers in terms of rolling returns. The chart below shows the 3 year rolling returns of the scheme versus the value funds category average rolling returns over the last 5 years.

Source: Advisorkhoj Research

Again you can see that Nippon India Value Fund was consistently able to outperform the value fund category average over the last 5 years.

Average 3 year rolling returns of Nippon India Value Fund over the last 5 years was 11%. The maximum 3 year rolling returns of the scheme over the last 5 years was 16%, while the minimum was 5%. The fund gave more than 8% rolling returns, 85% of the times over the last 5 years and more than 12% rolling returns, nearly 40% of the times. The rolling returns statistics of the schemes shows its wealth creation potential and also downside risk limitation.

Portfolio construction

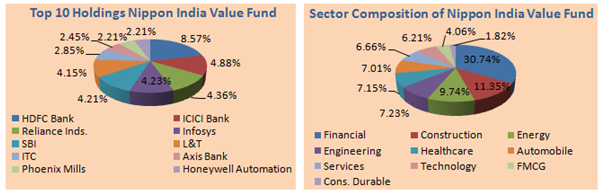

As mentioned earlier, the scheme follows the value investing style. The scheme has a large cap bias with large caps accounting for nearly 60% of the scheme portfolio. After large cap, midcap is the next biggest market cap segment, accounting for nearly 30% of the scheme portfolio. The scheme has a bias for cyclical sectors like Financials, construction, energy, engineering, automobiles etc. These sectors are expected to do well when the economy recovers. The scheme is fairly well diversified from a company concentration standpoint, with the Top 5 stocks accounting for 26% and the Top 10 stocks accounting for 40% of the portfolio.

Source: Advisorkhoj Research

Lump Sum and SIP Returns

The chart below shows the growth of Rs 1 lakh lump sum investment in the scheme over the last 5 years. You can see that your investment would have grown by Rs 41,000 over the last 5 years.

Source: Advisorkhoj Research

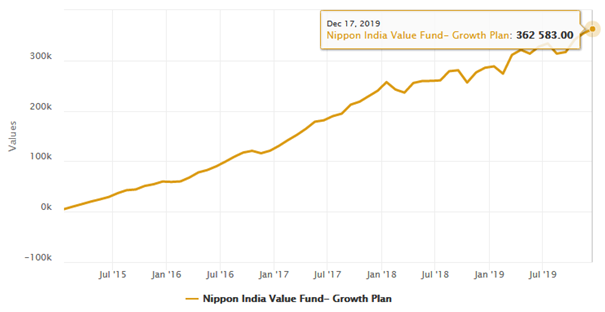

The chart below shows the growth of Rs 5,000 monthly SIP in the scheme over the last 5 years. You can see that you could have accumulated a corpus of Rs 3.60 lakhs with a cumulative investment of Rs 3 lakhs over the last 5 years.

Source: Advisorkhoj Research

Suggested Reading:

Mutual Fund SIPs and power of compounding

How you can do superior investment planning with Nippon Mutual Fund SIP plans

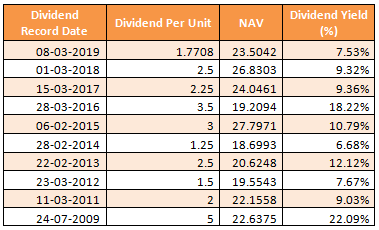

Dividend Payout Track Record

The scheme has been paying dividends regularly since 2011 (please see the table below). Dividend yield ranged from around 7% to 18%. We have stated repeatedly in our blog that mutual fund dividends are not assured and are paid at the discretion of the AMC. Investors must take that into consideration when investing in dividend options.

Source: Advisorkhoj Research

Summary

The correction we saw in the broader markets over the past 2 years or so was warranted as valuations became overstretched by the end of 2017. The sharp correction in prices of many stocks has created value investing opportunities. As such, with market bottoming out, this is a good time to add value funds to your portfolio with a long investment horizon.

Suggested reading – why it is a right time to invest in equity mutual funds

In this post, we reviewed Nippon India Value Fund. The fund has delivered strong performance over the last 5 years, across different (and sometimes difficult) market conditions. In our view, investors should have minimum 5 year investment tenures to get the best results from investment in this fund. You can also invest in this scheme through SIP for your long term financial goals. You should consult with you financial advisor if Nippon India Value Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team