Nippon India Nifty 500 Momentum 50 Index Fund: Riding momentum can generate alphas

Nippon India Mutual Fund has recently launched a new fund offer (NFO), Nippon India Nifty 500 Momentum 50 Index Fund. This is a passive smart beta fund, which will track the Nifty 500 Momentum 50 Index. Nippon India MF is one of the leading asset management companies in passive products with an impressive suite of 43 passive products (ETFs, Index Funds and Fund of Funds) and track record of 22+ years. Nippon India Nifty 500 Momentum 50 Index Fund has opened for subscription on 11th September 2024. The NFO will close on 24th September 2024.

What are smart beta funds?

Smart beta funds are funds which combines passive and active methods of investing. Smart beta funds track factor indices. Factor indices are constructed based on quantitative, rule-based investment strategies based on factors which historically drive portfolio returns and risk. Factor indices select stocks from the constituents of a certain benchmark index like Nifty 50, Nifty 100, Nifty 500 etc. based on factors like Momentum, Volatility, Beta, Alpha, Dividend Yield, Value, and Quality etc. Factor indices are generally non-market cap weighted. Nifty 500 Momentum 50 Index Fund is a factor index tracking high momentum stocks within the Nifty 500 universe.

What is momentum investing?

Momentum, in the context of equity markets, refers to the tendency of stock price trends to persist. In very simple terms it means that prices follow a trend - if stock prices are rising, it may rise further and if stock prices are falling, it may fall further. Investors are generally drawn to stocks experiencing an upward trajectory thus creating the potential of “buying high and selling higher” instead of the traditional “buy low and sell high” to generate higher returns. Momentum is measured in terms of 6 and 12 months returns adjusted for volatility.

Momentum has outperformed over long investment tenures

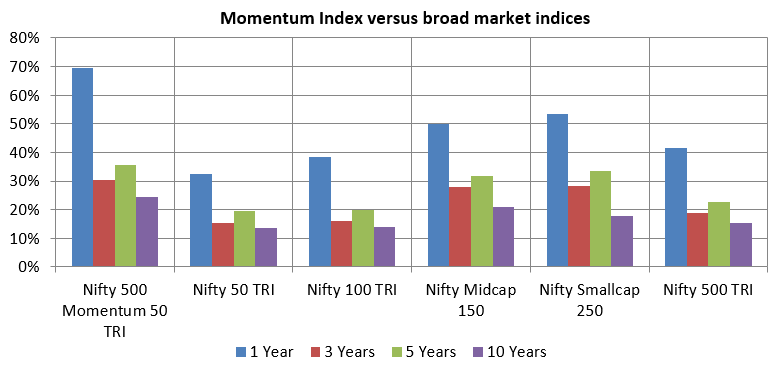

It is fairly obvious that momentum stocks outperform in bull markets but how has momentum performed over long investment tenures across multiple market cycles. You can see that the momentum index has not only outperformed in the short term (in bullish market conditions), the momentum index has also outperformed in the long term e.g. 5 years, 10 years etc (see the chart below).

Source: Advisorkhoj Research, Nippon India MF, as on 30th August 2024.

How is Nifty 500 Momentum 50 Index constructed?

Top 50 companies with highest Momentum score based on 6 & 12-month price return adjusted for volatility. Index constituents have tilt-based weights (Free Float Market Cap x Normalized Momentum score). Normalized momentum score is calculated using price returns and standard deviation at a stock level and also on an aggregate basis (i.e. Nifty 500 universe). Weights of index constituents are Capped at 5%* or 5 times the free float market capitalization weight in index (capped semi-annually). The index is rebalanced semiannually in June and December.

Index constituents need to have minimum 1 year of listing history as on cut-off date. Non-F&O stocks hitting the circuit filter >20% of the trading days in past 6 months as on cut-off date are excluded from the index. Companies having pledged promoter’s share >20% are also excluded. Bottom 10 percentile stocks based on 6-month average daily turnover or turnover ratio within the universe are ineligible for the inclusion in Nifty 500 Momentum 50 Index.

Characteristics of Nifty 500 Momentum 50 Index

- Index comprises of Top 50 stocks (from Nifty 500 universe) in terms of Normalized momentum score.

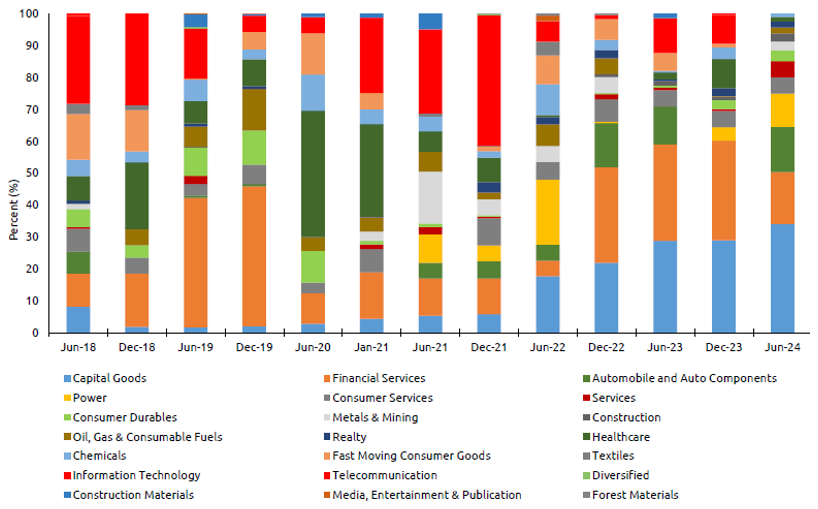

- The index is diversified across 13 sectors.

- Sector rotation takes place when the index is rebalanced (see below).

Source: Nippon India Mutual Fund, as on 30th June 2024

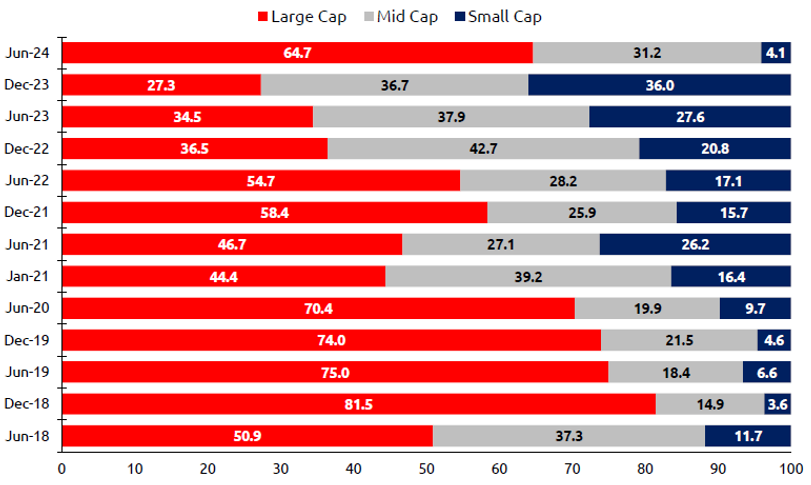

- Market cap allocations also get rebalanced when the index is rebalanced (see below).

Source: Nippon India Mutual Fund, as on 30th June 2024

Performance of Nifty 500 Momentum 50 Index versus other smart beta or factor indices

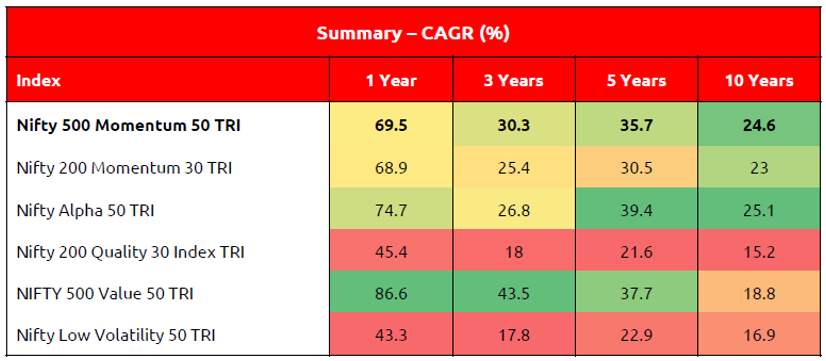

- Nifty 500 Momentum 50 TRI has outperformed other strategy indices across all periods on an average rolling returns basis

Source: Nippon India Mutual Fund, as on 30th August 2024

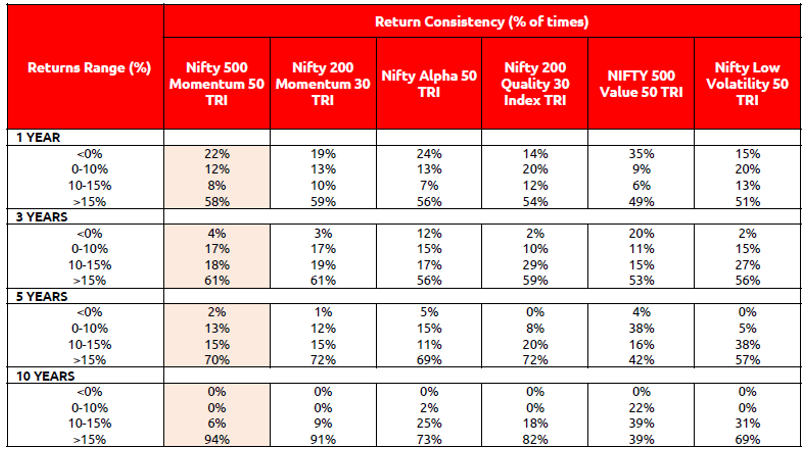

- Nifty 500 Momentum 50 TRI has given returns in excess of 15% for maximum instances relative to majority of strategy indices across all rolling periods

Source: Nippon India Mutual Fund, as on 30th August 2024

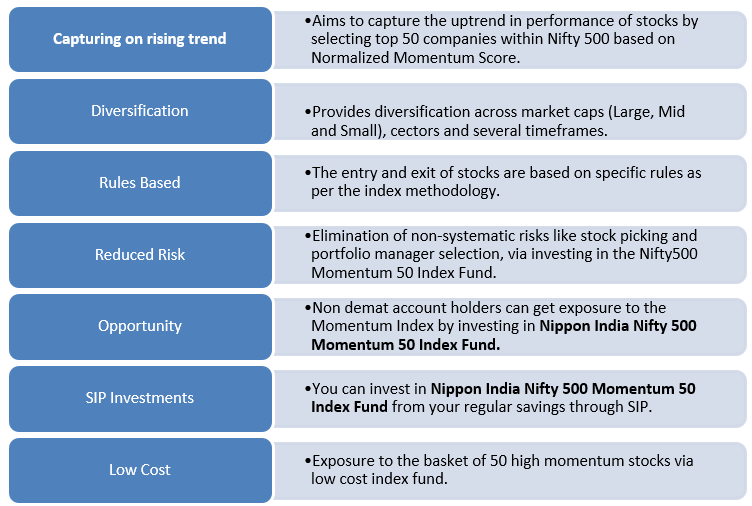

Why invest in Nippon India Nifty 500 Momentum 50 Index Fund

Who should invest in Nippon India Nifty 500 Momentum 50 Index Fund?

- Investors looking for capital appreciation over long investment tenures through passive investing.

- Investors who want to invest in a factor index based on momentum strategy.

- Investors with very high risk appetites.

- You should have minimum investment tenure of 3 to 5 years.

- Investors should consult with their financial advisors or mutual fund distributors if Nippon India Nifty 500 Momentum 50 Index Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team