Nippon India Nifty 500 Equal Weight Index Fund: Attractive low-cost diversified investment opportunity

Nippon India MF has launched a new fund offer (NFO), Nippon India Nifty 500 Equal Weight Index Fund. As the name suggests, the fund tracks Nifty 500 Equal Weight Index. Nippon India MF as an asset management company (AMC) has deep expertise in passive products. The AMC has more than 40 Exchange Traded Funds (ETFs) and Index Funds in its product portfolio. Nippon India Nifty 500 Equal Weight Index Fund is first of its kind, since it is the only index fund which tracks Nifty 500 Equal Weight Index; there are 2 other index funds which track the Nifty 500 index (market cap weighted index). The NFO will open for subscription on 21st August 2024 and will close on 4th September 2024. In this article, we will review Nippon India Nifty 500 Equal Weight Index Fund.

What is Equal Weight Index?

Passive fund (ETFs and index funds) investors would be familiar with traditional market cap weighted indices. In market cap weighted index, the weight of each index constituent will be the percentage contribution of the constituent to the total market cap of the index. For example, the contribution of HDFC Bank in the total free floating market capitalization of Nifty 50 is 11.03% (source: NSE, as on 31st July 2024), hence the weight of HDFC bank in Nifty 50 is 11.03%.

Equal Weight Indices, on the other hand, offer a unique approach to stock market indexing where each constituent in the index is assigned the same weight, regardless of the company's market capitalization. So, the weight of each constituent in Nifty 50 equal weight index in 2%, irrespective of its market capitalization. Continuing with the above example, the weight of HDFC Bank in Nifty 50 equal weight index will be 2% (after rebalancing), instead of 11.03%. These indices are rebalanced periodically, to ensure each stock maintains its equal weight.

About Nifty 500 Equal Weight Index

- All constituents forming part of Nifty 500 Index (top 500 stocks by market capitalization) will form part of the Nifty 500 Equal Weight Index at all points in time.

- Each constituent in the index will be assigned equal weights (around 0.2%) at the time of rebalancing.

- The index will be reconstituted semi-annually along with parent index (i.e. Nifty 500) i.e. new constituents / stocks may be included and existing constituents may be dropped depending on market cap.

- The weights of each constituent of Nifty 500 Equal Weight Index will be rebalanced quarterly (March, June, September, December), in other words, the weights of index constituents may deviate from 0.2% due to the share price movements of different stocks, but they will rebalanced back to 0.2% every quarter

Nifty 500 Equal Weight Index versus Nifty 500 Index

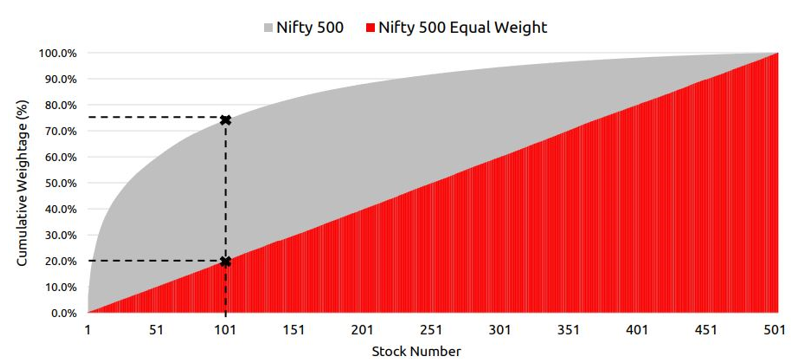

- Diversification: Nifty 500 Equal Weight Index provides greater diversification compared to Nifty 500 index. The weight of large caps in Nifty 500 index is around 75%, whereas weight of large cap in Nifty 500 Equal Weight Index is only 20% (see the chart below).

Source: Nippon India MF, NSE, as on 31st July 2024

- Higher allocations to small caps: The weight of small cap stocks in Nifty 500 index is only 9.7%, while the weight of small cap stocks in Nifty 500 Equal Weight Index in 50% (source: Nippon India MF, NSE as 31st July 2024). Small cap stocks have the potential of generating higher returns than large cap stocks over long investment horizons.

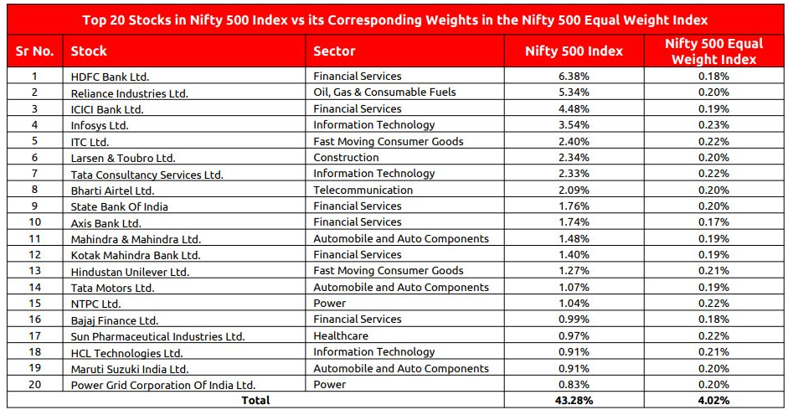

- Lower concentration risk: The weight of Top 20 stocks by market cap in Nifty 500 Index is 43%, whereas the weight of Top 20 stocks in Nifty 500 Equal Weight Index is only 4% (since each constituent / stock has equal weight in the index.

Source: Nippon India MF, NSE, as on 31st July 2024

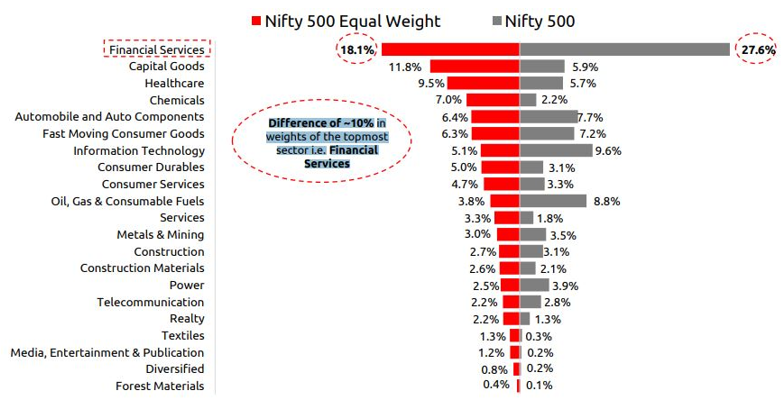

- Lower sector concentration: There is a difference of almost 10% in weights of the topmost sector i.e. Financial Services between Nifty 500 and Nifty 500 Equal Weight Index (see the chart below). Similarly, sectors like IT, Oil and Gas, FMCG etc. The sectors which have higher representation in Nifty 500 Equal Weight Index have the potential of playing an important role in different themes of India Growth Story e.g. Atma nirbhar Bharat, import substitution, renewable energy, rising per capita income and shifting consumer trends, shift from unorganized to formal industries, etc.

Source: Nippon India MF, NSE, as on 31st July 2024

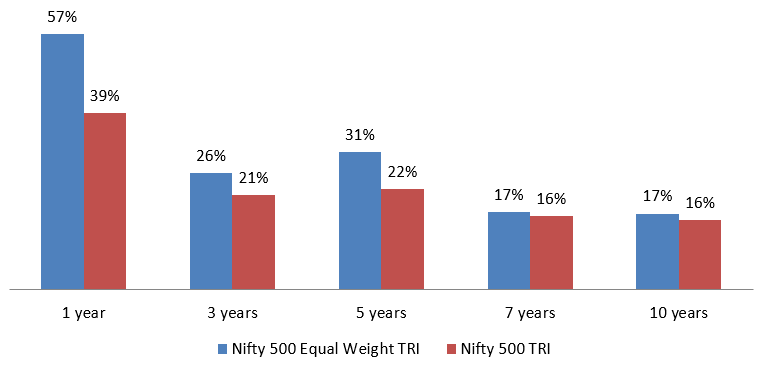

- Outperformed Nifty 500: Nifty 500 Equal Weight TRI has outperformed Nifty 500 TRI over different time periods (see the chart below).

Source: NSE, as on 31st July 2024

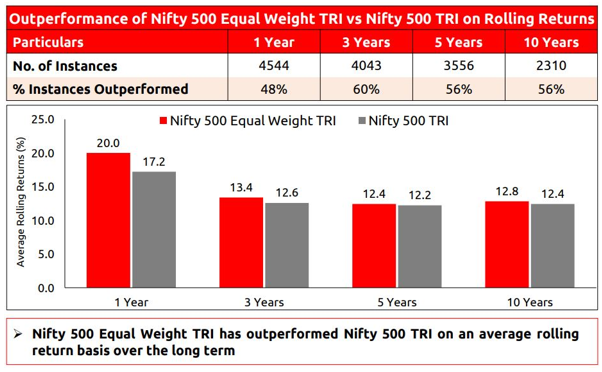

- Created alphas across different market conditions: The chart below shows the rolling returns of Nifty 500 Equal Weight TRI versus Nifty 500 TRI over different investment tenures since 2005 (covering multiple market cycles). You can see that Nifty 500 Equal Weight TRI has outperformed Nifty 500 TRI on an average rolling return basis over the long term. Over 3 years plus investment tenures Nifty 500 Equal Weight TRI has 55 – 60% probability (based on historical data) of outperforming Nifty 500 TRI.

Source: Nippon India MGF, NSE, Period: 1st April 2005 to 31st July 2024

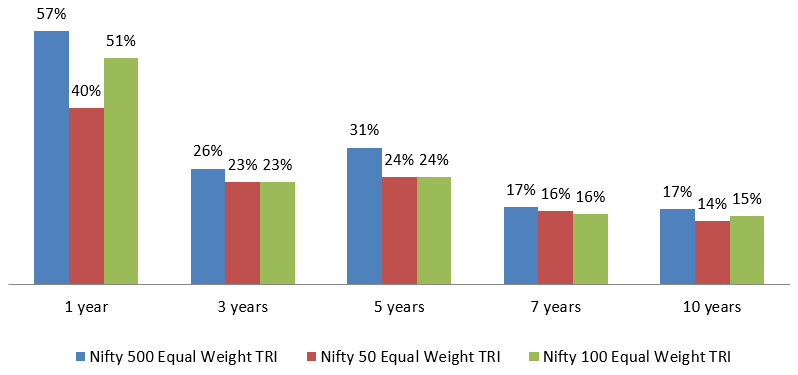

Performance of Nifty 500 Equal Weight Index versus other equal weighted indices

Nifty 500 Equal Weight TRI has outperformed other equal weighted indices across time periods (see the chart below). Nifty 50 Equal Weight Index is a popular tracking index for several ETFs and index funds. You can see that the Nifty 500 Equal Weight TRI was able to outperform Nifty 50 Equal Weight TRI by 1 – 3% over long investment tenures. Investors should understand that even a couple of percentage point difference in CAGR returns can result in significantly higher wealth creation over long investment tenures due to the power of compounding.

Source: NSE, as on 31st July 2024

Why invest in Nippon India Nifty 500 Equal Weight Index Fund?

- Contains top 500 companies selected based on full market capitalization.

- Investing in Nifty 500 universe also means you get an exposure to around 21 industry sectors (source: NSE, as on 31st July 202).

- Enhances the overall performance of a portfolio by giving equal importance to each constituent, promoting diversification, and reducing concentration risk.

- Quarterly rebalancing of the constituents in an equal weighted index ensures profits of outperforming stocks gets booked periodically & are redistributed across the constituents in the portfolio.

- Elimination of non-systematic risks like stock picking and portfolio manager selection, via investing in the Nifty 500 Equal Weight Index stocks.

- Exposure to the basket of 500 companies via low cost (Total Expense Ratio) index fund.

- It is a highly convenient investment option, allowing non demat account holders to seek exposure to stocks from Nifty 500 via investing in Nippon India Nifty 500 Equal Weight Index Fund.

- You can redeem your investments with the AMC at applicable NAVs, instead of selling your units in the stock exchange at prevailing market price if you had invested in an ETF.

- Investors can avail the benefit of Systematic Investment Plan (SIP).

Who should invest in Nippon India Nifty 500 Equal Weight Index Fund?

- Investors looking for capital appreciation over long investment tenures through passive investing.

- Investors with very high-risk appetites.

- You should have minimum investment tenure of 3 to 5 years.

- You can invest in Nippon India Nifty 500 Equal Weight Index Fund even if you do not have Demat accounts.

- You can invest in Nippon India Nifty 500 Equal Weight Index Fund from your regular savings through SIP.

Investors should consult with their financial advisors or mutual fund distributors if Nippon India Nifty 500 Equal Weight Index Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Union Mutual Fund launches Union Income Plus Arbitrage Active FOF

May 22, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India BSE Sensex Next 30 ETF

May 21, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India BSE Sensex Next 30 Index Fund

May 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty200 Quality 30 Index Fund

May 21, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Services Fund

May 20, 2025 by Advisorkhoj Team