Nippon India Multi Asset Fund: True to label Multi Asset Allocation Fund

Market and economic context

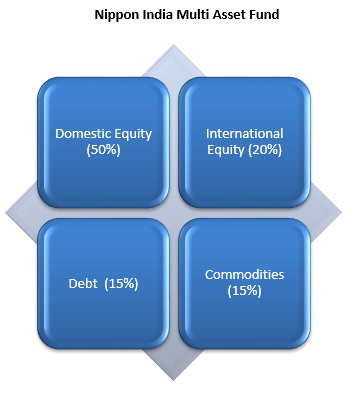

Global and Indian equities made a strong comeback in November after remaining volatile in October. The Nifty is back above the 20,000 level and the S&P 500 also posting strong gains in November. The Indian economy continues to be strong with Q2 GDP growth rate of 7.6% surprising economists on the positive side. IMF has raised India’s GDP growth forecast for FY 2023-24 to 6.3%. The US economy continues to be resilient despite high inflation and interest rates. The OECD expects the global economy to slowdown in FY 2024 due to persistent core inflation, high interest rates, geo-political conflicts (e.g. Israel – Hamas, Russia – Ukraine wars) and slower than expected recovery in China. Of particular concern, is the US GDP growth rate slowing down from 2.2% in 2023 to 1.3% in 2024. Asset allocation plays a key role in stabilizing your portfolio in times of economic uncertainties. In this article, we will review Nippon India Multi Asset Fund, which diversifies across four asset classes (as shown in the infographic below).

Why multi asset allocation?

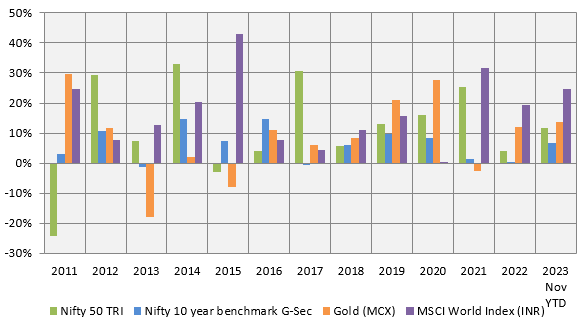

Different asset classes have low or even negative correlation of returns in different investment cycles (see the chart below). Diversifying your investment across asset class will bring stability to your portfolio and improve consistency i.e. if one asset class underperforms, the outperformance of another asset class will balance the risks.

Source: NSE, MCX, MSCI, Investing.com. MSCI World Index USD returns have been converted into INR returns by adjusting for INR versus USD appreciation or depreciation. Disclaimer: Past performance may or may not be sustained in the future

You may also like to read Is this a good time to invest in Multi Asset Funds

Nippon India Multi Asset Fund

Multi Asset Allocation Funds are mandated by SEBI to invest in at least 3 or more asset classes. Minimum allocation to each asset class will be 10%. Nippon India Multi Asset Fund invests in 4 asset classes, with fixed allocation to each asset class at all times. No other fund house at the moment is banking on fixed allocation for their multi asset allocation funds.

How is fixed asset allocation beneficial for investors?

- Fixed allocation enables fund managers to use buy and hold strategy for the equity portion of the portfolio. Buy and hold over long investment horizons can result in higher wealth creation.

- Fixed allocation to overseas equity also enables you to create wealth from global megatrend. We have seen global megatrends e.g. technology has generated superior returns for many years, even decades. Further, a fixed allocation to overseas equity also helps you to gain from long term currency depreciation. Over the last 15 years, the INR has depreciated on an average 4% every year. The currency depreciation will get added to your investment.

- Historical data shows that gold can produce inflation beating returns over long investment horizons. A fixed allocation to gold not only reduces volatility when equities underperforms (gold is usually counter-cyclical to equities), you can also get inflation beating returns on the gold allocation in the long term

- Frequent portfolio churning to change asset allocations results in higher transaction costs, which impact investment returns. Fixed allocation within certain bands entails lower transaction costs since the portfolio churning is relative lower.

- Fixed asset allocation ensures more tax efficient returns. Nippon India Multi Asset Fund enjoys indexation benefits in long term capital gains taxation.

How has Nippon India Multi Asset Fund performed?

The chart below shows the growth of Rs 10,000 investment in Nippon India Multi Asset Fund over the last 1 year compared to Nifty 50 TRI. You can see that the fund has outperformed the Nifty. You can also see that the drawdowns have been lower for the fund compared to Nifty (see portions of the chart circled in red).

Source: Advisorkhoj Research

The chart below shows the growth of Rs 10,000 monthly SIP in Nippon India Multi Asset Fund over the last 1 year compared to Nifty 50 TRI. You can see that the fund has outperformed the Nifty in SIP performance as well.

Source: Advisorkhoj Research

Why invest in Nippon India Multi Asset Fund?

- The fund provides diversification across asset classes with an aim to provide better risk adjusted returns

- The fund also offers diversification under respective asset classes e.g. across market cap segments

- Benefit from tax efficiency. Long term capital gains (investment holding period of more than 3 years) will be taxed at 20% after allowing for indexation benefits.

- The fund is a one stop solution which may help to reap benefit of Growth of Equity, Stability of Debt & Diversification from Commodities

Who should invest in Nippon India Multi Asset Fund?

- Investors looking for capital appreciation over long investment horizons

- Investors who want to reduce portfolio volatility by diversifying across multiple asset classes

- Investors with minimum 3 – 5 years investment tenure

- Investors with moderately high to high risk appetites

- You can invest either in lump sum or SIP based on your investment needs

Investors should consult their financial advisors or mutual fund distributors if Nippon India Multi Asset Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mirae Asset Investment Managers (India) Pvt. Ltd. IFSC branch launches Mirae Asset Global Allocation Fund IFSC at Gift City

Apr 21, 2025 by Mirae Asset Mutual Fund

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund