Nippon India Multi Asset Fund: A top performing multi asset allocation fund

Market and economic context

The stock market is trading at its record high despite bouts of high volatility from time to time. Foreign Institutional Investors (FIIs) have been net sellers on an YTD basis in 2024. There are multiple factors at play. FIIs are shifting their emerging market allocations from India to China because from their perspective Chinese equities are available at relatively attractive valuations. MSCI China Index (USD) gave negative returns for 3 consecutive years, CY 2021, CY 2022 and CY 2023. The deep correction in China has made their stocks relatively cheaper to Indian equities which have been rallying. There is also uncertainty about when the interest rate cycle will reverse.

IMF has revised India’s GDP growth forecast upwards FY 2024-25 to 6.8% from 6.5%. India is once again expected to be the best performing G-20 economy in 2024 – 25. While the US economy is expected to make a soft landing (avoid recession) when the new interest rate cycle begins, there are concerns about the extent of slowdown in the US, which will affect global equities. Among domestic factors, the results of the Lok Sabha elections and political stability will also be an important factor which will give direction to equities. While the long-term outlook for Indian equities remains positive, investors should be prepared for volatility in the short term.

Historical data shows that gold as an asset class outperforms in times of economic uncertainty and high inflation; gold has delivered strong returns in the last few years. Since gold returns have inverse relationships with interest rate movement, investment experts expect gold to continue to outperform when interest rate cycle reverses. In uncertain times multi asset allocation i.e. asset allocation across 3 or more asset classes can be more effective than conventional asset allocation across equity and debt only. In this article, we will review Nippon India Multi Asset Fund, a top performing fund in its category which diversifies investments across four asset classes.

Why multi asset allocation?

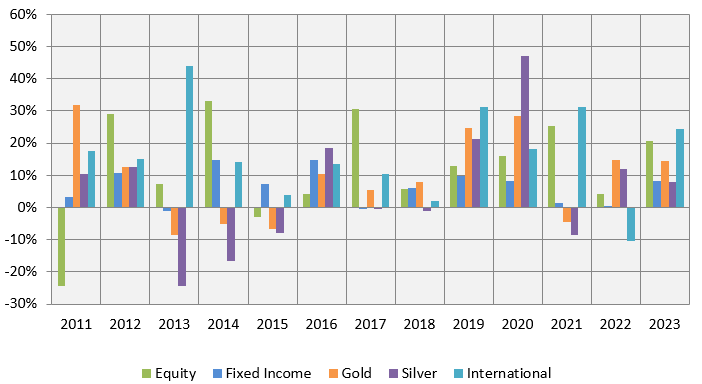

- Different asset classes have low or even negative correlation of returns in different investment cycles (see the chart below). Diversifying your investment across asset class will bring stability to your portfolio and improve consistency i.e. if one asset class underperforms, the outperformance of another asset class will balance the risks.

Source: NSE, MCX, MSCI, Investing.com. Equity is represented by Nifty 50 TRI, fixed income is represented by Nifty 10-year Benchmark G-Sec Index, gold by MCX spot prices, silver by MCX spot prices and international by MSCI World Index. MSCI World Index USD returns have been converted into INR returns by adjusting for INR versus USD appreciation or depreciation. Disclaimer: Past performance may or may not be sustained in the future

- In certain economic conditions e.g. economic slowdown and high inflation, also known as stagflation, both equity and fixed income can underperform. Historical data shows that precious metals, especially gold performs exceptionally well in times of stagflation. Multi asset allocation can provide richer diversification to your investment portfolio, especially if you add other asset classes like international equities to your portfolio.

About Nippon India Multi Asset Fund

Nippon India Multi Asset Fund was launched in August 2020. The expense ratio of the regular plan of the fund as on 30th April 2024 is only 1.56%. Despite a slow start, this fund has climbed to the top quartile (see the infographic below). The fund has given 18.3% CAGR returns since inception despite its slow start (as on 30th April 2024).

Source: Advisorkhoj Quartile Rankings

Nippon India Multi Asset Fund – Asset allocation

Multi Asset Allocation Funds are mandated by SEBI to invest in at least 3 or more asset classes. Minimum allocation to each asset class will be 10%. Nippon India Multi Asset Fund invests in 4 asset classes

- Equity Allocation - Multi Cap investment strategy, blend of growth and value stocks, large cap bias, focus on alphas creation through stock selection.

- Debt Allocation - Debt portfolio is managed with a moderate duration; duration range of 1.25 – 2.25 years, predominantly invest in high credit quality assets, focused on Accrual Income

- Commodities allocation – The fund invests in Exchange Traded Commodity Derivatives (ETCDs). Maximum commodity exposure will be 20%. Minimum 10% investment in gold through ETFs / ETCDs. 5 – 10% exposure to other commodities.

- Overseas equity allocation - Investment across geographies through investment in MSCI World Index. Overseas equities could act as an effective diversification tool as well as benefit from any currency depreciation. The fund has stopped investments in overseas securities with effect from 1st April 2024 as per SEBI’s mandate.

How has Nippon India Multi Asset Fund performed?

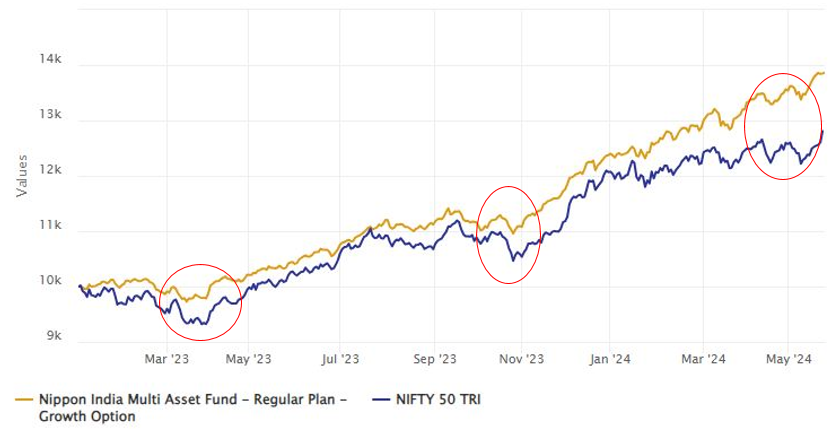

The chart below shows the growth of Rs 10,000 investment in Nippon India Multi Asset Fund since 1st January 2023 compared to Nifty 50 TRI. You can see that the fund has outperformed the Nifty 50 TRI. You can also see that the drawdowns have been lower for the fund compared to Nifty 50 TRI (see portions of the chart circled in red).

Source: Advisorkhoj Research

Performance consistency

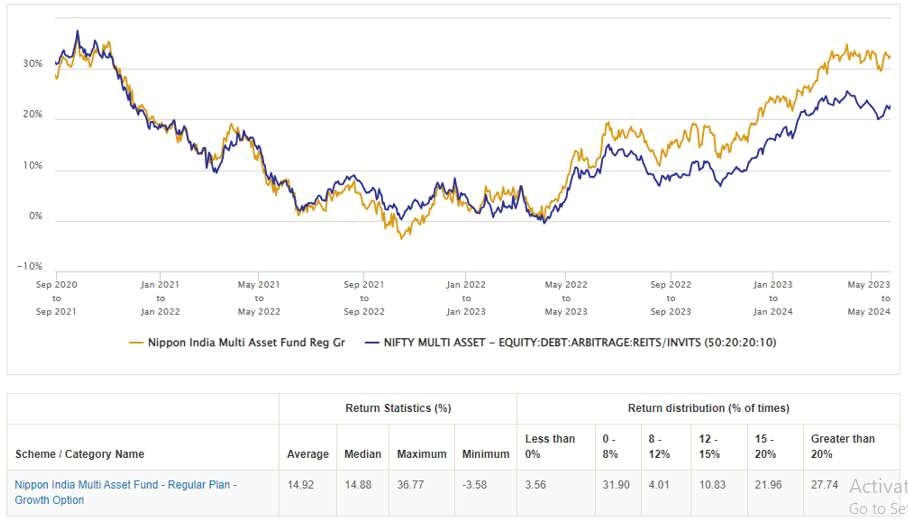

The chart below shows the 1 year rolling returns of Nippon India Multi Asset Fund versus the Nifty Multi Asset Index since the inception of the fund. You can see that the fund was able to beat the multi asset index fairly consistently over 1 year investment tenures across different market conditions. You can see that the fund was able to give 12%+ CAGR return in more than 60% of the instances.

Source: Advisorkhoj Rolling Returns

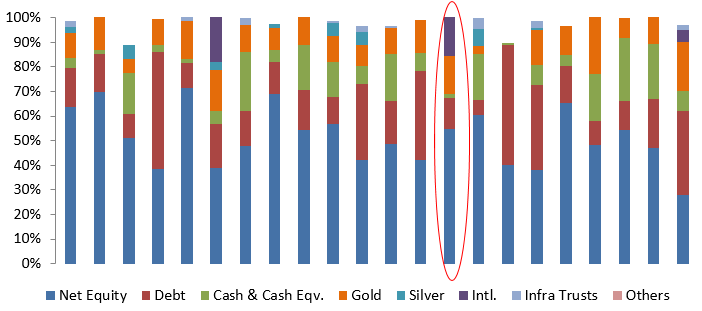

Asset Allocation - Nippon India Multi Asset Fund versus Peers

The chart below shows the asset allocation of multi asset allocation funds. You can see that Nippon India Multi Asset Fund (circled in red) is one the very few multi asset allocations funds which has allocations to international equities. There is an overall industry wide $ 1 billion limit of investments in overseas ETFs. The fund stopped investments in overseas ETFs from 1st April 2024 in compliance with SEBI’s circular. But the fund had taken sufficient exposure to MSCI World Index before SEBI’s circular was issued. This has helped the fund to reap the benefits for investors today. The asset allocation of Nippon India Multi Asset Fund shows that it is a true to label multi asset allocation fund.

Why invest in Nippon India Multi Asset Fund?

- This is an evergreen fund that provides exposure to all asset classes with an aim to provide better risk adjusted returns.

- The fund also offers diversification under respective asset classes e.g. across market cap segments to exploit opportunities of alpha generation.

- Benefit from tax efficiency. Long term capital gains (investment holding period of more than 3 years) will be taxed at 20% after allowing for indexation benefits.

- The fund is a one stop solution which may help to reap benefit of Growth of Equity, Stability of Debt & Diversification from Commodities.

Who should invest in Nippon India Multi Asset Fund?

- Investors looking for capital appreciation over long investment horizons.

- Investors who want to reduce portfolio volatility by diversifying across multiple asset classes.

- Investors with minimum 3 – 5 years investment tenure.

- Investors with moderately high to high-risk appetites

- You can invest either in lumpsum or SIP based on your investment needs

Investors should consult their financial advisors or mutual fund distributors if Nippon India Multi Asset Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team