Nippon India Large Cap Fund: The best performing large cap fund

Market and economic context

FY 2021-22 was a great year for Indian equities. The Nifty 50 TRI gave 19% return in the last 12 months ending 31st March 2022. However, equities have been facing headwinds over the last several months. Even though the economy is on the recovery path from COVID-19 shock, high commodity prices and inflation is a concern for the markets. The Russian invasion of Ukraine and subsequent economic sanctions on Russia has led to surge in crude oil prices.

High inflation can be dampener to economic growth in a domestic consumption driven economy like India because high prices can lead to lower demand. The RBI has taken cognizance of the situation and has put inflation as its most important priority ahead of growth. At the same time, our economy is firmly on growth path, with record GST collections of Rs 27 lakh cores in the month of March. The Q4 corporate earnings outlook of India’s top companies is also quite positive with several analysts forecasting 20%+ PAT growth. Overall the medium to long term outlook, for Indian equities is strong despite inflationary headwinds.

The Nifty 50 TRI is down 1% on an YTD basis (as on 31st March 2022). However, the broader market has been more volatile with Nifty Midcap 150 TRI down 4% and the Nifty Small Cap 250 TRI down 5% on an YTD basis (as on 31st March 2022). Since there is considerable uncertainty about the trajectory of global commodity prices, particularly crude oil, due to ongoing War in Ukraine, we can expect mid and small caps to be more volatile than large caps in the near term.

Why invest in large cap funds

- There are considerable macro-economic uncertainties in the near term due to ongoing War in Ukraine, sanctions on Russian oil and high commodity prices. The US Federal Reserve has indicated that inflation is the highest priority for the central bank. Economists are expecting 50 – 75 bps increase in interest rates this year.

- Equity markets have taken the 25 bps rate hike its stride, but if the Fed increases interest rates too much, too fast, then it will cause volatility in equity markets. For emerging markets like India, the impact will be higher (higher volatility) as historical data suggests.

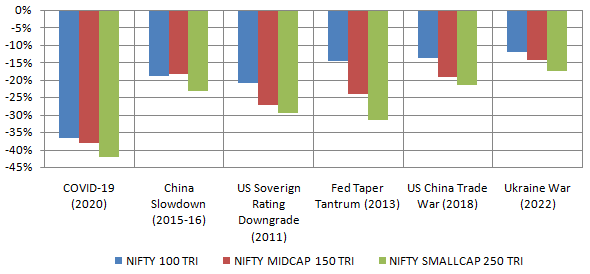

- Large caps (top 100 stocks by market capitalization) have provided relative stability to the investor’s portfolio in volatile market conditions – lower downside risks (see the chart below showing some of the biggest market drawdowns over the last years or so).

![Mutual Funds - Large caps (top 100 stocks by market capitalization) have provided relative stability to the investor’s portfolio in volatile market conditions Mutual Funds - Large caps (top 100 stocks by market capitalization) have provided relative stability to the investor’s portfolio in volatile market conditions]()

Source: NationalStock Exchange, Advisorkhoj Research, as on 31st March 2022.

- As mentioned earlier, high inflation can lead to growth pressures and margin erosion on equities especially stocks in the midcap and small cap segments. Large cap stocks, by virtue of their market share leadership in respective industry sectors will have more pricing power compared to small and midcaps.

- The Government had provided fiscal stimulus to the industry after the onset of COVID-19 pandemic to keep the Indian economy going amidst the crisis. In view of burgeoning fiscal deficit, the Government may have to roll back the stimulus at some point of time. This may have impact on several industry sectors at least in the near term.

- Similarly, interest rate hikes by the RBI to control inflation may have an impact on Capex spending required to revive economic growth in our country.

- Large cap stocks with bigger balance sheets, cash reserves and better access to financing (including cost of debt) will be better positioned to face the near term headwinds to revenues and earnings growth compared to small and midcaps.

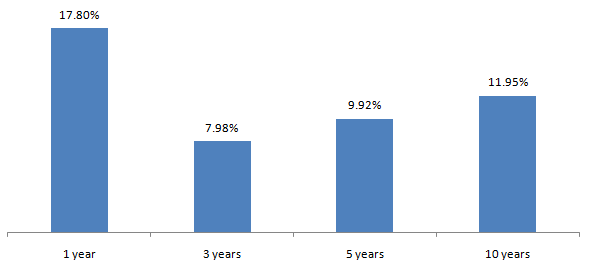

- The large cap segment of the market (top 100 stocks by market capitalization) has been a wealth creator for investors over long investment horizons. See the chart below for long term performance of large caps (represented by S&P BSE 100 TRI).

Source: Bombay Stock Exchange, Advisorkhoj Research, as on 31st March 2022. Returns are in CAGR

Large cap mutual fund schemes have traditionally been one of the most, if not the most, popular equity mutual fund category among investors – both retail and HNIs. In the current market conditions large caps may be more suitable for investors who do not have very high risk appetites, in this current economic and market environment. Nippon India Large Cap Fund has been the best performing large cap fund in the last one year.

About Nippon India Large Cap Fund

Nippon India Large Cap Fund was launched in August 2007 and has Rs 11,204 crores of assets under management (AUM) as on 31st March 2021. The expense ratio of the scheme is 1.9%. The scheme is helmed by veteran fund manager Shailesh Raj Bhan and Ashutosh Bhargava. Mr Bhan has been managing the scheme since inception. SEBI classifies the top 100 stocks by market capitalization as large cap. As per SEBI’s mandate for large cap funds, the scheme invests at least 80% of its assets in large cap stocks.

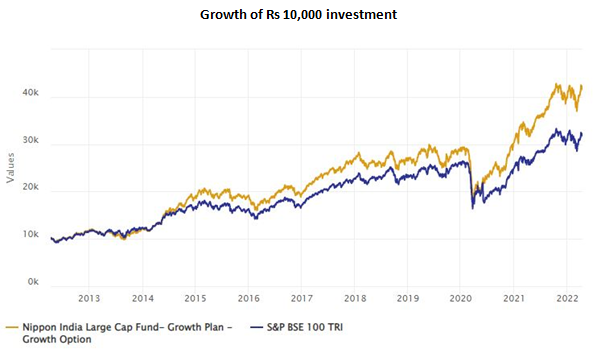

Wealth Creation by Nippon India Large Cap Fund

Rs 10,000 invested in Nippon India Large Cap Fund 10 years back would have multiplied more than 4 times (as on 14th April 2022). The scheme outperformed its benchmark index S&P BSE 100 TRI. The scheme has been able to create substantial alphas for investors as the CAGR return of the scheme over the last 10 years was 15.3%, while that of the benchmark was 12.6%.

Source: Advisorkhoj Research (as on 14th April 2022)

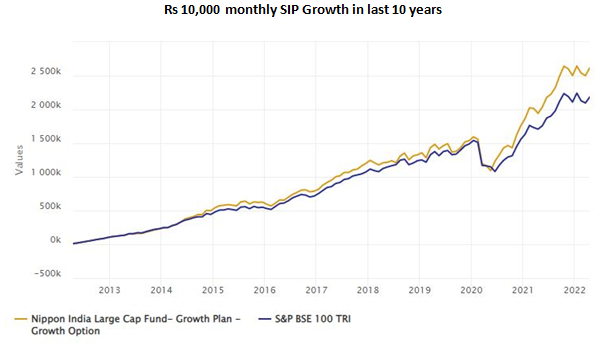

Wealth creation through SIP

The systematic investment plan (SIP) performance of the scheme over the last 10 years is equally impressive. A monthly SIP of Rs 10,000 in Nippon India Large Cap Fund would have grown to over Rs 26 lakhs in market value (as on 14th April 2022) with a cumulative investment of just Rs 12 lakhs. The annualized SIP return (XIRR) of the scheme was 14.9%.

Source: Advisorkhoj Research (as on 14th April 2022)

Rolling Returns

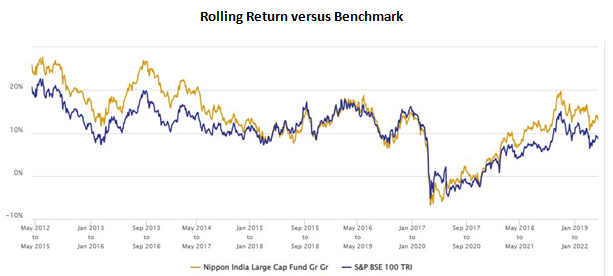

As mentioned earlier in our blog, rolling returns is the most unbiased measure of mutual fund performance. The chart below shows the 3 year rolling returns of Nippon India Large Cap Fund versus the scheme benchmark over the last 10 years. We have chosen to show 3 year rolling returns of the scheme because we think investors should have at least 3 year investment horizons when investing in equity funds. You can see that the scheme outperformed its benchmark most times.

Source: Advisorkhoj Research (as on 13th September 2021)

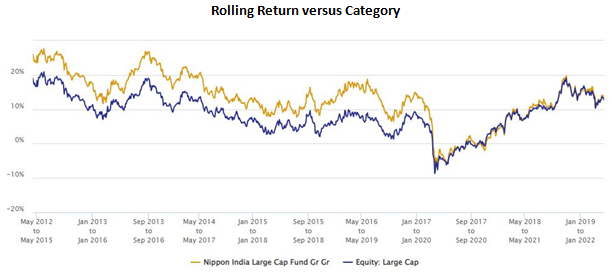

Let us now compare the 3 year rolling returns of the scheme with the large cap funds category, in other words, average returns of the scheme’s peers, across different market conditions over the last 5 years. You can see that Nippon India Large Cap Fund consistently outperformed the large cap category average during this period.

Source: Advisorkhoj Research (as on 13th September 2021)

Why invest in Nippon India Large Cap Fund

- Large cap funds provide stability and liquidity to your portfolio in different market conditions.

- Since large cap funds are less volatile than small / midcap funds, they are suitable both for lump sum investments and SIPs.

- Nippon India Large Cap Fund is the top 3 best performing large cap schemes over the last 1 year (see our tool ->Mutual Fund Trailing Returns - Equity: Large Cap)

- Even over long investment horizons Nippon India Large Cap Fund stands out among its peers. It is one of the top 5 best performing large cap schemes over the last 10 years (se our tool ->Mutual Fund Trailing Returns - Equity: Large Cap)

- The scheme has consistently created alphas over long investment tenures.

Who should invest in Nippon India Large Cap Fund

- Investors who are looking for long term capital appreciation.

- This scheme is suitable for your long term financial goals like retirement planning, children’s higher education, children’s marriage, wealth creation etc.

- This scheme is also suitable for young or new investors since large funds are less volatile than flexicap, midcap or small cap funds.

- You need to have moderately high to high risk appetite for this scheme.

- You need to have minimum 5 years or longer investment horizon for this scheme

- Investors should consult with their financial advisors if Nippon India Large Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team