Nippon India Large Cap Fund: One of the best performing large cap funds in last 10 years

Rs 1 lakh invested in Nippon India Large Cap Fund 10 years back would have multiplied more than 3 times (as on 22nd November 2019) and grown to a value of Rs 3.13 lakhs. The systematic investment plan (SIP) performance of the scheme over the last 10 years is equally impressive. A monthly SIP of Rs 10,000 in Nippon India Large Cap Fund would have grown to over Rs 23 lakhs in market value (as on 22nd November 2019) with a cumulative investment of just Rs 12 lakhs. The scheme is one of the best performing large cap funds in the last 10 years (please see our research, Top Performing Mutual Funds (Trailing returns) - Equity: Large Cap)

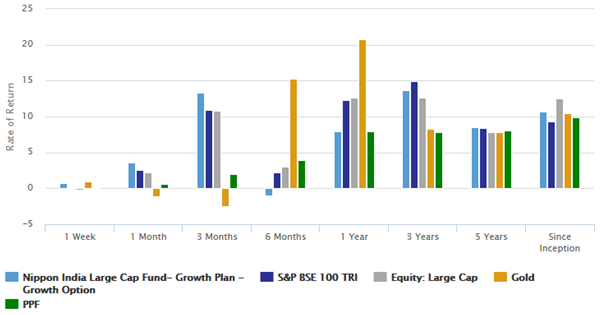

Relative performance of Nippon India Large Cap Fund over different periods

The chart below shows the trailing returns (annualized for more than 1 year periods) of Nippon India Large Cap Fund versus its benchmark index S&P BSE 100 TRI, large cap funds category and different asset classes (e.g. gold and fixed income) over different time scales (periods ending November 2019). You can see that, Nippon India Large Cap Fund outperformed its benchmark, category peers and other asset classes, like gold and fixed income across most periods.

Source: Advisorkhoj Research

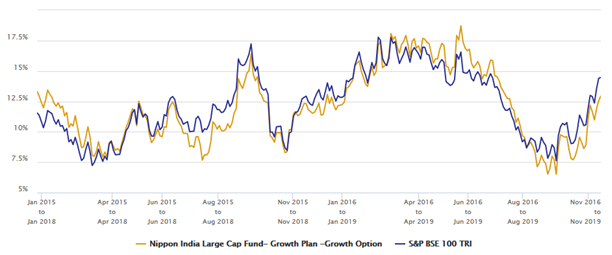

Rolling Returns

As mentioned earlier in our blog, rolling returns is the most unbiased measure of mutual fund performance. The chart below shows the 3 year rolling returns of Nippon India Large Cap Fund versus the scheme category over the last 5 years. We have chosen to show 3 year rolling returns of the scheme because we think investors should have at least 3 year investment horizons when investing in equity funds. You can see that the scheme outperformed its benchmark many times across different market conditions in the last 5 years. This is indeed outstanding performance due to several reasons viz. the scheme is large cap where alpha creation is difficult compared to other categories (due to earlier price discovery in large caps), the benchmark is a total returns index, high performing stocks get high weights in the index whereas the scheme has to diversify company concentration risks etc.

Source: Advisorkhoj Research

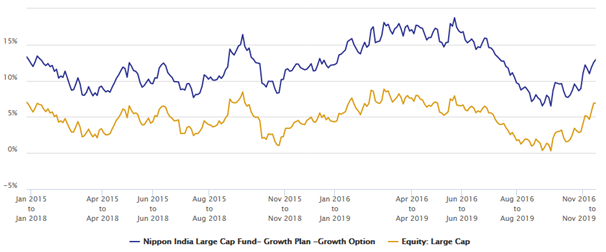

Let us now compare the 3 year rolling returns of the scheme with the large cap funds category, in other words, average returns of the scheme’s peers, across different market conditions over the last 5 years. This comparison in our view is more relevant for scheme selection from among its peers. You can see that Nippon India Large Cap Fund consistently outperformed the large cap category average during this period. Performance consistency is one of the most important attributes of good fund managers which enable them to create wealth for investors in the long term relative to their peers.

Source: Advisorkhoj Research

The average and median 3 year rolling returns Nippon India Large Cap Fund over the last 5 years were 12.1% and 11.8% respectively. The maximum 3 year rolling return of the scheme was 18.7% and the minimum 3 year return was 6.5%, which is higher than post tax fixed income returns. The scheme gave 8%+ annualized 3 year rolling returns 95% of the times over the last 5 years and 12%+ annualized 3 year rolling returns 46% of the times over the same period.

About Large Cap Funds

SEBI classifies the top 100 stocks by market capitalization as large cap. Large cap stocks are much less risky (prices are less volatile) than midcap or small cap stocks. According to SEBI’s directive large cap schemes must mandatorily invest at least 80% of its assets in large cap; the remaining portion of the assets can be invested in midcap and small cap stocks. SEBI’s mandate for large cap schemes restricts flexibility of fund managers in terms of stock selection across market cap segments to a certain extent, but at the same time ensures downside risk limitation for investors. As such these funds are suitable for first time investors or investors who do have high risk appetites.

About Nippon India Large Cap Fund

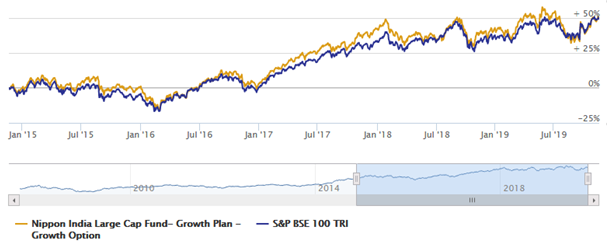

Nippon India Large Cap Fund (erstwhile Reliance Large Cap Fund) was launched more than 12 years back in August 2007. The scheme name was changed after the stake sale of Reliance Capital to its long term joint venture partner Nippon Life Insurance earlier this year. Nippon Life Insurance is one of the largest asset managers in the world and Nippon India Mutual Fund is largest foreign owed asset management company (AMC) in India. Nippon India Large Cap Fund has more than Rs 13,000 Crores of assets under management (AUM) as on 31st October 2019. The expense ratio of the scheme is 1.89%. The scheme is helmed by veteran fund manager Shailesh Raj Bhan. The chart below shows the NAV movement of the scheme over the last 5 years versus its benchmark index.

Source: Advisorkhoj Research

Lump Sum and SIP Returns

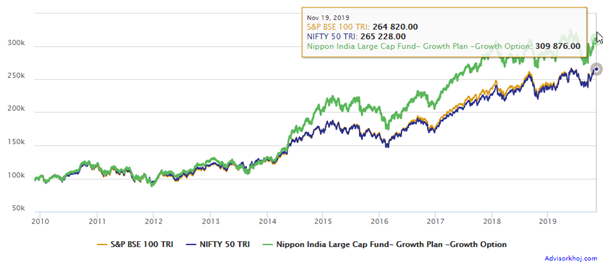

The chart below shows the growth of Rs 1 lakh lump sum investment in the scheme over the last 10 years. You can see that the investment would have grown over 3 times in value over the last 10 years.

Source: Advisorkhoj Research

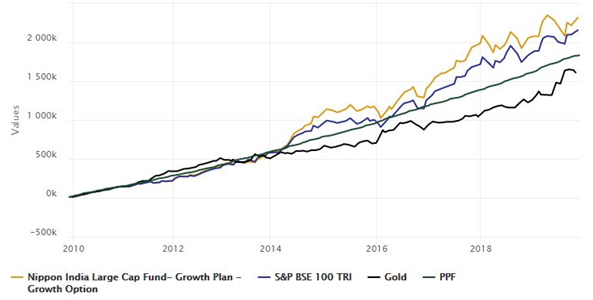

The chart below shows the SIP returns of Nippon India Large Cap Fund versus its benchmark and other asset classes over the last 10 years. You can see that the scheme created much more wealth than other assets. The 10 year SIP returns comparison is a testimony to the superior wealth creation potential of Nippon India Large Cap Fund.

A monthly SIP of Rs 10,000 in Nippon India Large Cap Fund would have grown to over Rs 23 lakhs in market value (as on 22nd November 2019) with a cumulative investment of just Rs 12 lakhs.

Portfolio Construction

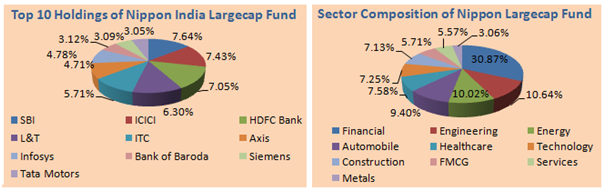

The portfolio of Nippon India Large Cap Fund, as the scheme name suggests, comprises primarily of large cap stocks. After large caps, midcaps constitute the second largest portion of the portfolio, in terms of market capitalization segments. From a sector composition perspective, the scheme is biased towards cyclical sectors with some allocation defensive sectors as well. Banking and financial services, engineering, energy, automobile, healthcare, technology, construction and FMCG are the major sectors in the scheme portfolio. The scheme portfolio is well diversified from a company concentration risk standpoint.

Source: Advisorkhoj Research

Summary

Large cap funds have been the preferred investment choices for equity mutual fund investors for the past 12 to 18 months due to high volatility in the midcap and small cap segments of the market. Irrespective of market conditions, financial planners recommend that large caps should comprise the core allocation of your equity portfolio. Large cap funds provide stability and liquidity to your portfolio in different market conditions. Nippon India Large Cap Fund is one of the best performing large cap schemes over the last 10 years. This scheme is suitable for your long term financial goals like retirement planning, children’s higher education, children’s marriage, wealth creation etc. You need to have moderately high risk appetite for this scheme. Investors should consult with their financial advisors if Nippon India Large Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team