Nippon India Innovation Fund NFO

Nippon India Mutual Fund has launched a new fund offer, Nippon India Innovation Fund. Nippon India Innovation Fund is a thematic equity fund. The NFO has opened for subscription on 9th August and will close on 23th August 2023. The minimum application amount is Rs 500.

What is innovation-based thematic investing?

Investing in Innovation theme, which refers to a focus on companies that use innovative solutions to create new markets, increase market share or enlarge an existing market, is gaining increasing popularity with global retail and institutional investors over the past few years.

How can innovation create Shareholder Value?

Innovation in global megatrends

Innovation is playing a major role in all the global megatrends (source: MSCI)

- Transformative technologies – trends capturing disruptive technology innovations include Internet of Things, Artificial Intelligence and Machine Learning, Big Data, Robotics and Automation, Blockchain, etc.

- Environment and resources – innovations in resource use, infrastructure, climate change including Electric Vehicles, Battery Technologies, Solar Photovoltaic cells, Nanotechnology etc

- Health and Healthcare – Innovations in therapies and diagnosis include gene editing, digital healthcare (Virtual / Digital GP), 3D printing etc.

- Society and Lifestyle – Impact of demographics and how we organize our lives e.g. social media, EdTech (Education Technology), smart cities etc.

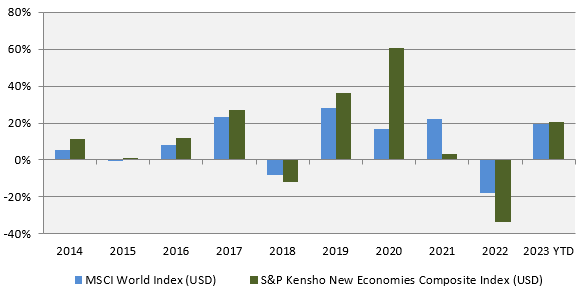

Innovation as a global investment theme has outperformed

The S&P Kensho New Economies Composite Index intends to represent companies that are focused on propelling the Fourth Industrial Revolution and fostering new industries (21st century sectors) that will be transformative. The index comprises of 543 companies across the world, the majority of the companies belonging to the United States. Over the last 10 years since the inception of the index, S&P Kensho New Economies Composite Index has beaten MSCI World Index in most years (see the chart below). The index underperformed in 2021-22 due to big correction in US tech stocks but has started outperforming again in 2023.

Source: MSCI, S&P Global. Period: 01.01.2014 to 31.07.2023. Disclaimer: Past performance may or may not be sustained in the future

Why should you invest in thematic fund for investments in innovation?

Globally innovation as an investment theme is under-represented in the major indices (see the chart below). Accordingly, a thematic fund may be better suited for investing in innovative companies compared to a diversified equity fund.

Representation of S&P Kensho New Economies Composite Index constituents in leading indices

Source: Factset, Nippon India Mutual Fund

Data as of 31/12/2022

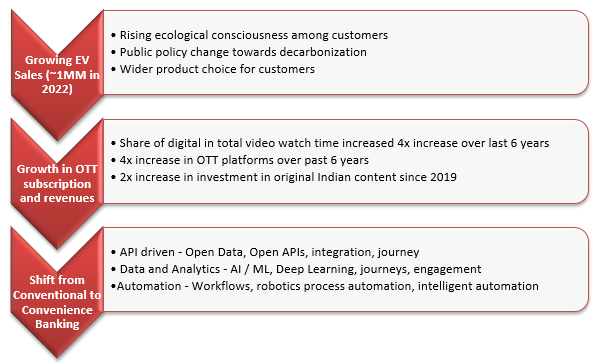

How is innovation shaping different sectors in India?

Here are some examples below from Automobile, Media and BFSI industry sectors:-

Source: Nippon India MF, BCG, Vahan

What are characteristics of innovative companies?

Innovative companies may exhibit one or more of the characteristics mentioned below:-

- Revenue growth higher than the industry combined with small market share in a large industry

- Large market share in a new industry with significant growth potential

- Superior gross margins giving capability of high R&D investments

- Access to global technology or partners

- Access to global capital

Government policy support for Innovation

Source: Nippon India MF

Salient features of Nippon India Innovation Fund

- The scheme will have the flexibility to invest across market cap segments

- The scheme will invest in companies across industry sectors

- The scheme will focus on high-quality businesses (low debt, higher profitability)

- The investment style of the fund manager will be biased towards growth stocks

- The fund manager will try to focus on companies taking advantage of early trends

How will the fund manager identify innovative companies?

The fund manager will apply the following criteria to identify innovative companies:-

- Companies with a proven history of investing in next generation technology/platforms to disrupt businesses

- Companies with a proven history of product / process /service / technological or business model innovation

- Companies in an industry going through a technological change forcing most participants to change

- Business disruptors like E-commerce, Fintech platforms, renewable energy, electric vehicles, etc

- Companies forming a part of digital economy or gaining market share through digital economy

- Companies using data to gain significant network effect and scale

- Companies creating a virtuous cycle of scale, profitability and market value to invest more in new technologies / new products cross-sell

Why invest in Nippon India Innovation Fund?

- While diversified funds should form part of your core portfolio, thematic funds in your satellite portfolio can provide a kicker to your portfolio returns over long investment horizons

- Innovation as a global theme has the potential to outperform the broad market

- The fund will focus on high-quality businesses

- The fund will have a concentrated portfolio. Concentration risks notwithstanding, concentrated portfolios have the potential to create higher alphas for you.

- Significant focus on innovation across themes like Fintech, speciality chemicals & pharma, auto & auto ancillaries, internet-based businesses, MNCs etc.

- Nippon India mutual fund has strong research capabilities. The fund house has a strong long term record of wealth creation across several equity scheme categories.

Who should invest in Nippon India Innovation Fund?

- Investors looking for capital appreciation over the long investment horizon

- Investors with very high-risk appetites

- Investors with minimum 5-year investment tenures

Investors should consult with their financial advisors or mutual fund distributors if Nippon India Innovation Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team