Nippon India Corporate Bond Fund: Best performing corporate bond fund in last 3 years

Nippon India Corporate Bond Fund has been the top performing corporate bond fund in the last 3 years. The fund continues to be one of the top performers even in CY 2024. With interest rates peaking, we are now in a favourable macro environment for debt funds. Nippon India Corporate Bond Fund can be a good alternative investment option to traditional fixed income investments (e.g. Bank Fixed Deposits) for investors with 2 – 3 years or longer investment horizon.

What are corporate bond funds?

Corporate bond funds are debt mutual funds which invest primarily in corporate bonds. As per SEBI’s mandate, corporate bond funds must invest at least 80% of their assets in AAA rated corporate bonds. Since AAA credit rating denotes highest safety, the credit risk in corporate bond funds is low. Credit risk is an important consideration in fixed income investments since a credit default i.e. the issuer failing to make interest or principal payments, can cause a permanent loss. SEBI does not have any duration mandate for corporate funds. Corporate bond fund managers have the flexibility to invest across durations, based on their interest rate outlook.

Current Interest rate outlook

The US Federal Reserve has held interest rates (Fed Funds Rate) steady at 5.25 – 5.5% since July 2023. The RBI has also kept the repo rates at 6.5% for the last one year. The US Fed indicated in its January FOMC meeting that it may cut interest rates in 2024. Other central banks, including the RBI, are expected to follow suit in cutting interest rates. Long duration bond yields have declined in anticipation of rate cuts. Yields are expected to decline further as rate cuts draw nearer and continue to fall when central banks start cutting interest rates later this year.

Yields are currently attractive in the 3 – 5 year maturity range

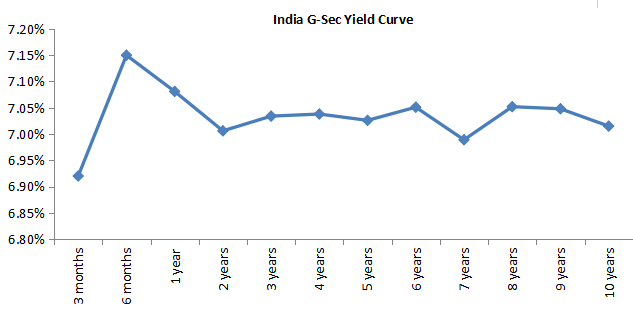

Government bond yields in the 3 – 4 maturity ranges are in 7.05 – 7.1% range (see the G-Sec yield curve) below.

Source: worldgovernmentbonds.com, as on 15th March 2024

The AAA rated corporate bond yield spread with G-Sec is 60 – 70 bps (source: CRISIL) over 3 to 5 year maturities. Therefore, if G-Sec yield is 7.05%, then AAA bond yield will be in the range of 7.65 – 7.75% range. These yields are significantly higher if you compare with current interest rates of traditional fixed income (e.g. Bank FDs) of similar tenures, when interest rates are in 7 – 7.2% range (source: Bank Bazaar). Please note that the AAA denotes highest safety. Yield to maturity of Nippon India corporate bond fund, which endeavours to invest in 100% Sovereign / AAA rated instruments is currently 7.74% (as on 29th February 2024), which is among the highest YTMs in the corporate bond fund category.

Potential for price appreciation – higher returns

Bond prices have an inverse relationship to interest rate changes. Bond prices go up when interest rates fall and vice versa. The percentage price change for percentage change in interest rates or yields depends on the duration of the bond. If the duration of a debt fund is 1 and interest rates change by 50 bps, then NAV of the scheme will appreciate by 0.5%. The returns of a debt fund include both price appreciation and income accrual from the interest (coupons) paid by the underlying bonds.

Nippon India Corporate Bond Fund has a modified duration of 3.14 years (as on 29th February 2024). If interest rates fall by 0.5% in next 1 year, the return of the scheme can be = 7.74% (YTM) + 1.56% (Modified Duration X Interest rate change) – 0.71% (TER) = 8.59%. Please note that this return is purely illustrative assuming a certain interest rate change and no changes in underlying portfolio. There is no guarantee that the scheme will deliver this return.

Suggested reading why investing in debt funds is a good idea now?

Nippon India Corporate Bond Fund

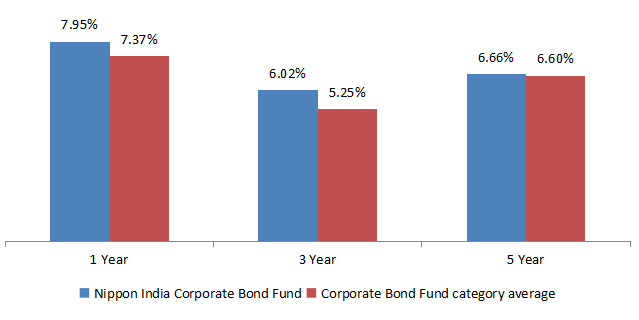

Nippon India Corporate Bond Fund was launched in September 2000. The expense ratio of the scheme is just 0.71% (as on 29th February 2024). It invests based on short to medium term interest rate view and shape of the yield curve. The scheme has given 7.4% CAGR returns since inception. The chart below shows the performance of Nippon India Corporate Bond Fund versus its category average across different investment horizons.

Source: Advisorkhoj Research, as on 20th March 2024

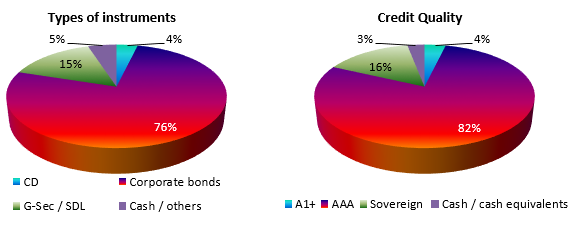

Portfolio positioning and strategy

- The Fund endeavours to invest in 100% Sovereign / AAA rated instruments.

- Investments are steered by credit quality, liquidity, interest rate scenario and fund manager’s views.

- Selective exposure to high yielding / structured instruments with an endeavour to enhance overall gross yield.

- These assets also provide capital gains as they roll down to lower maturity.

- The fund endeavours to maintain moderate portfolio duration between 1.25 - 4 years.

- The current portfolio is almost 100% in AAA / A1+, Sovereign and cash / cash equivalents – very high credit quality.

Source: Nippon India February 2024 monthly portfolio, Advisorkhoj Research (as 29th February 2024).

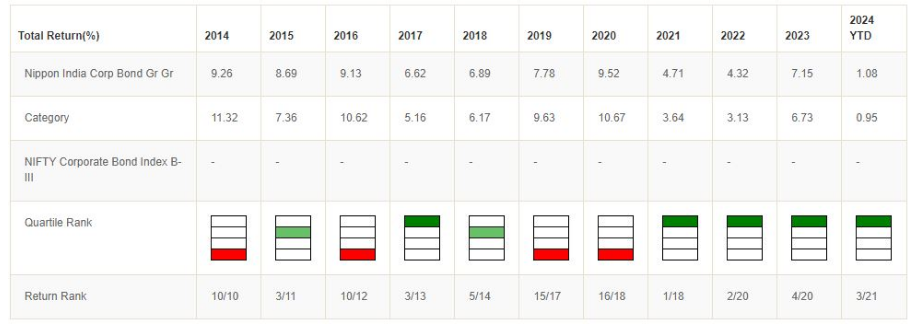

Outstanding track record

The chart below shows the annual (calendar year) performance of Nippon India Corporate Bond Fund relative to peer funds category over the last 10 years. You can see that the fund has been a top quartile performer for last 4 consecutive years. In the last 10 year, Nippon India Corporate Bond Fund has been in the top 2 quartiles 70% of the time (7 years out of years). This shows strong out performance with consistency in performance.

Who should invest in Nippon India Corporate Bond Fund?

- Investors looking for income or stable returns higher than traditional fixed income investments.

- Investors with moderate risk appetite.

- Investors with minimum 2 – 3 years investment horizon.

- Investors may consult their financial advisors or mutual fund distributors if Nippon India Corporate Bond Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team