Mirae Asset Large and Midcap Fund reopened for lump sum and SIPs above Rs 25,000

Mirae Asset Large and Midcap Fund is one of the most popular diversified equity funds among retail investors. The fund has the highest asset under management (AUM) in the large and midcap funds category. According to SEBI’s mandate, large and midcap funds must invest minimum 35% of their assets in large cap stocks (Top 100 stocks by market capitalization) and minimum 35% of their assets in midcap stocks (101st to 250th stocks by market capitalization).

Vide a notice cum addendum dated July 26, 2024, Mirae Asset Large & Midcap Fund has withdrawn existing temporary suspension on subscription through Systematic Investment Plan (SIP), Systematic Transfer Plan (STP), Switch-ins & Lumpsum in the scheme with effect from 1st August 2024.

Background

Mirae Asset Large & Midcap Fund has a long track record of strong performance. The fund was in top 2 quartiles for seven consecutive years from 2014 to 2021 (see the infographic below). Strong performance attracted investment flows into the fund.

In the October 2016, the fund stopped taking lump sum investments. We have seen that funds which have substantial investments in midcap and small cap stocks, from time to time, may stop taking new lump sum investments.

An AMC may stop taking lump sum investments or even restrict SIPs if it is concerned about valuations of stocks. For examples, if valuations of midcap or small cap stocks are high and the fund continues to get large inflows, the fund may be forced to deploy the inflows in stocks with very high valuations, which may be detrimental to the interests of existing investors.

In November 2020, Mirae Asset MF had restricted subscription in the scheme to Rs 2,500/- through monthly SIP which was increased to Rs 25,000/- in October 2023. The AMC had also suspended Systematic Transfer Plan (STP) facility for the large and midcap fund.

Why has Mirae Asset MF lifted the restrictions?

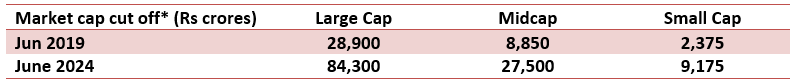

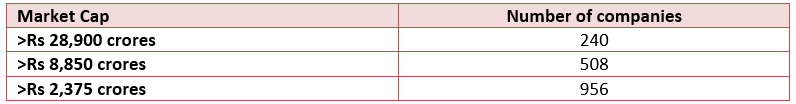

Over the past 4 – 5 years, there has been a significant increase in scale and opportunities, especially as far as midcap stocks are concerned. Aggregate market cap of Nifty Midcap 150 index has increased by more than 2 times to Rs. 82.5 lakh crores from Nov 2020 to Jun 2024. Market cap cut off for midcaps has increased by 3X.

*As per AMFI classification

There are currently more than 500 companies which are bigger than Jun 2019’s market cap cut off for Midcap stocks. The aggregate profit after tax of midcap companies has grown by 142% from November 2020 (when the SIP restrictions were announced) to Rs 2.1 lakh crores in June 2024 (source: Mirae Asset MF).

The midcap segment is now more diverse with more than 50 new companies that were listed in the mid cap space across financials, fintech, e-commerce, discretionary, chemicals, logistics, healthcare, real estate, retail, capital goods, etc. over the past few years.

Source: AMFI India, June 2024

Flows into large and midcap category

In FY 2019-20 the gross flows were Rs 17,834 crores which have risen to Rs 47,440 crores in FY23-24, growing nearly 2.7 times in this period. The large and midcap category’s market cap construct of minimum 35% in both large and midcap has allowed absorption of such increased flows without impacting the overall portfolio liquidity significantly.

Taking into consideration the above factors and with a view to provide meaningful participation to investors in the scheme without adversely impacting the interest of existing unitholders, Mirae Asset MF has decided to withdraw the existing suspension on subscription through Systematic Investment Plan (SIP), Systematic Transfer Plan (STP), Switch-ins & lumpsum and allowing other facilities in Mirae Asset Large and Midcap Fund with effect from 1st August 2024

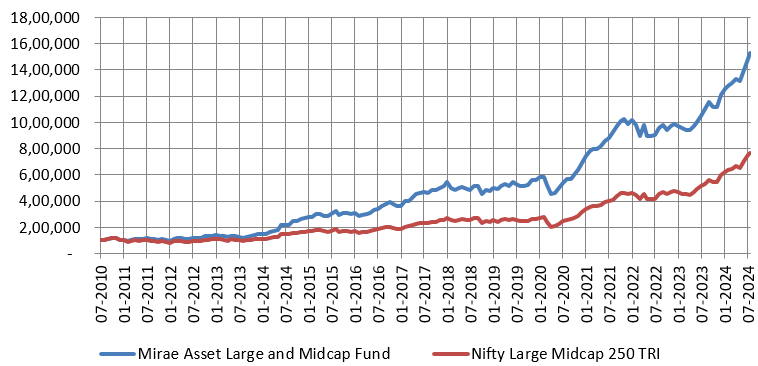

Mirae Asset Large and Midcap Fund long term performance track record versus benchmark

The chart below shows the growth of Rs 1 lakh lump sum investment in Mirae Asset Large and Midcap Fund versus its benchmark index Nifty Large Midcap 250 TRI since the inception of the fund (as on 31st July 2024). Your investment would have grown to Rs 15.3 lakhs at a CAGR of 21.4%, as on 31st July 2024.

Source: Advisorkhoj Research, as on 31st July 2024

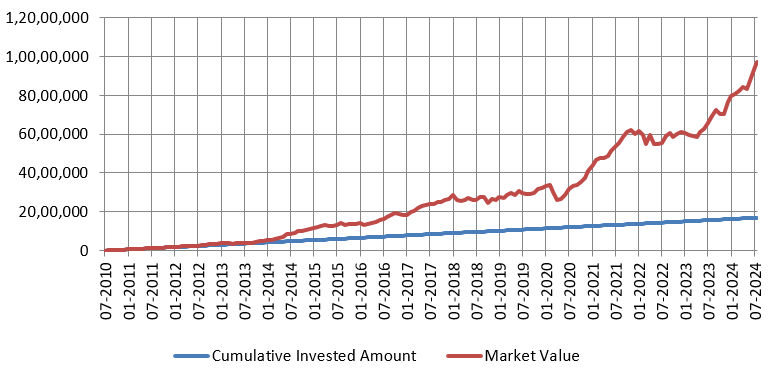

Wealth creation through SIP

The chart below shows the growth of Rs 10,000 monthly SIP (assuming no restrictions) in Mirae Asset Large and Midcap Fund since the inception of the scheme. With a cumulative investment of Rs 16.9 lakhs, you could have accumulated a corpus of Rs 97 lakhs (XIRR of 22.4%).

Source: Advisorkhoj Research, as on 31st July 2024

Conclusion

The reopening of Mirae Asset Large and Midcap fund for lump sum, SIP, STP and other investment facilities is a very welcome move. Existing and fresh registration through SIP (Systematic Investment Plan), STP (Systematic Transfer Plan) & such other facilities under the scheme shall be available under all available frequencies from the effective date. Also, fresh & additional subscription through Lumpsum or Switch-in from any other scheme to all the plans & options of Mirae Asset Large and Midcap Fund shall be allowed from 1st August 2024.

Who should invest in Mirae Asset Large and Midcap Fund?

- Investors looking for capital appreciation and wealth creation.

- Investors having a minimum 5 year plus investment horizon.

- This fund can be suitable for new or first time investors.

- Investors with very high risk appetite.

- Investors can invest in this scheme either through lump sum or SIP depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributors if Mirae Asset Large and Midcap Fund will be suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team