Mirae Asset India Equity Fund: One of the most consistent multi cap mutual funds

We have stressed the importance of performance consistency for mutual funds a number of times in our blog. For the benefit of all our readers, let us briefly explain why performance consistency should be the most important factor in fund selection. It is impossible to predict how much return a mutual fund scheme will give in the future. Some funds outperform when market conditions are favorable vis-a-vis their investment strategies and underperform when they are not favorable. Some funds outperform in bull markets, simply by taking more risks (higher beta), but these funds underperform in bear markets. Consistent performers do well across different market conditions. Therefore, over sufficiently long investment tenors, there is a higher probability of consistent performers delivering superior returns (higher alpha).

How to identify consistent performers? In Advisorkhoj, we have built a tool which looks at annual quartile rankings (relative rankings) of funds in different categories over the last 5 years. 5 years is a sufficiently long period of time and is likely to cover different market conditions like bull market, volatile market, sideways market, bear market etc. Our proprietary algorithm ranks funds based on their annual quartile ranks in each of the last 5 years. The highest ranked funds are the most consistent performers. Mirae Asset India Equity Fund (formerly Mirae Asset India Opportunity Fund) is one of the most consistent multi-cap funds (please see our tool, Top Consistent Mutual Fund Performers). The fund has consistently ranked in the top 2 quartiles every year, over the last 5 years (including 2018 YTD).

Fund Overview

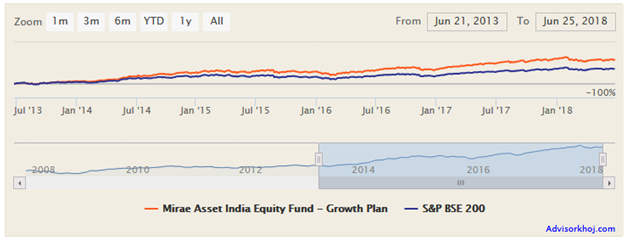

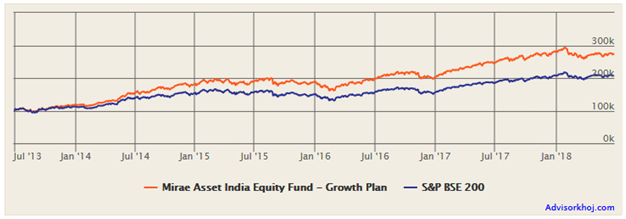

Mirae Asset India Equity Fund was launched in April 2008. The fund has Rs 7,733 Crores of assets under management (AUM). The expense ratio of the fund is 2.28%. Neelesh Surana and Harshad Borawake are the fund managers of this scheme. The fund has given 16.18% CAGR returns since inception. The chart below shows the NAV growth of the fund over the last 5 years versus the scheme benchmark BSE-200.

Source: Advisorkhoj Research

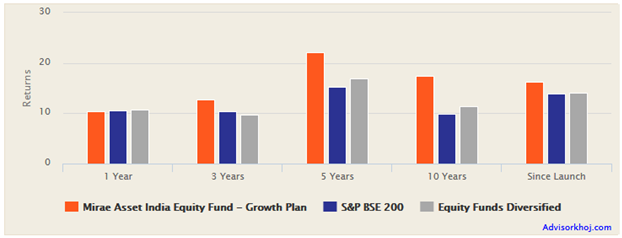

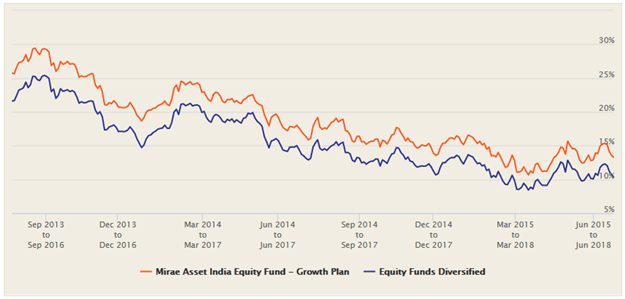

A common characteristic of the best, most consistent funds is that, they are not only able to outperform their benchmark consistently, but they are also able to outperform peer funds on a consistent basis. The chart below shows the trailing annualized returns of Mirae Asset India Equity Fund versus the market benchmark and diversified equity funds category over different time-scales (periods ending June 26, 2018).

Source: Advisorkhoj Research

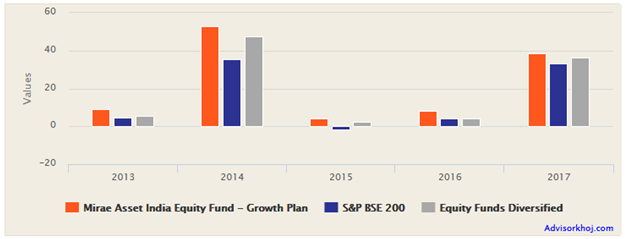

You can see that the fund outperformed both the benchmark and the category average across most trailing periods. The fund also outperformed both the benchmark and the category average in different market conditions over the last 5 years (see the chart below). 2013 was a sideways and volatile market, 2014 was a bull market year, 2015 saw a deep correction, 2016 saw recovery from a 20% correction and 2017 was again a bull market year – Mirae Asset India Equity Fund outperformed the benchmark and peers in all the different market conditions, strengthening our conviction in the performance consistency of the fund.

Source: Advisorkhoj Research

Rolling Returns

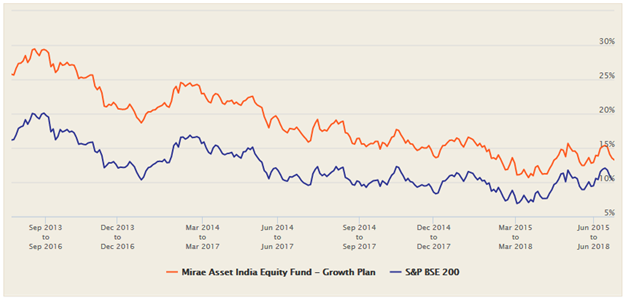

Regular Advisorkhoj readers know that rolling returns is one of the most powerful tools in evaluating mutual fund performance over an investor’s holding period in different market conditions. Accordingly, in Advisorkhoj, we give more importance to rolling returns than other returns measures. The chart below shows the three year rolling returns of Mirae Asset India Equity Fund versus the market benchmark, BSE-200. We are showing 3 year rolling returns because we think that investors should remain invested in an equity fund for a period of at least 3 years, if not longer.

Source: Advisorkhoj Research

You can see that Mirae Asset India Equity Fund consistently outperformed the market benchmark over a 3 year investment tenor. This rolling returns performance is a testimony to the fund managers’ capabilities and prudence of their investment strategy. Let us now see how the fund performed against the category average 3 year rolling returns over the last 5 years – please see the chart below.

Source: Advisorkhoj Research

You can see that the 3 year rolling returns of the fund over the last 5 years also outperformed the category rolling returns.

Portfolio Construction

The fund managers employ a combination of both “top-down” and “bottom-up” approach. In his interview with Advisorkhoj, CIO Equity of Mirae Asset India and the fund manager of Mirae Asset India Equity Fund, Neelesh Surana said that “focus however, is more on the stock selection which is driven by a bottom-up approach. The industry selection is done through top down approach which is mainly based on growth prospects. Thereafter, the decision to include a stock is essentially driven by the individual traits of the company which include analysis of its business model, understanding management bandwidth and review of valuation”.

Stock selection process has three aspects related to Business selection, Management analysis, and valuation. Surana told us that, “while selecting businesses, we look at growth prospects and quality of growth as defined by the ROCE (i.e. Return on capital employed). Management analysis evaluates factors related to the past track record, capital allocation, corporate governance, etc. The last factor is related to valuation. It is important to have a decent “Margin of Safety”, i.e. the gap between value and price should be decent”. We like the fund managers’ focus on value and not simply chasing momentum; we believe this has enabled the fund to deliver superior outperformance even in tough market conditions.

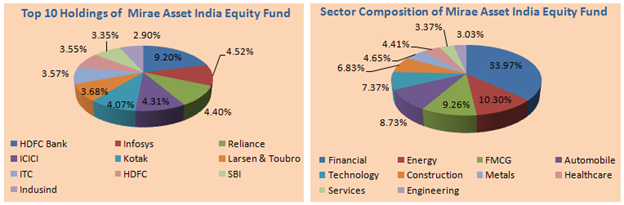

The portfolio of Mirae Asset India Equity Fund is well diversified in terms of sector and company concentrations. Please see the chart below.

Source: Advisorkhoj Research

Lump Sum and SIP Returns

The chart below shows the return on Rs 1 lakh lump sum investment in Mirae Asset India Equity Fund over the last 5 years (period ending June 26, 2018). You can see that the investment would have grown to 2.6 times in value over the last 5 years, a CAGR of around 21%.

Source: Advisorkhoj Research

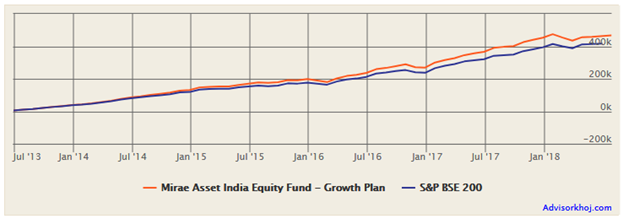

The chart below shows the return of Rs 5,000 monthly SIP in Mirae Asset India Equity Fund over the last 5 years (period ending June 26, 2018). You can see that with a cumulative investment of Rs 3 lakhs, the investor could have accumulated a corpus of over Rs 4.5 lakhs in the last 5 years, XIRR of over 17%.

Source: Advisorkhoj Research

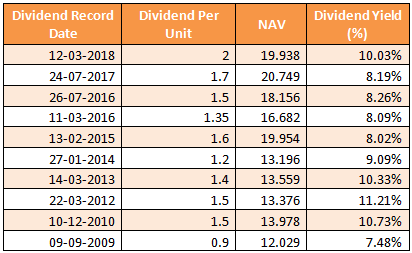

Dividend History

Mirae Asset India Equity Fund has been paying regular annual dividends since 2009, except in the year 2011. The dividend yield is quite good.

Conclusion

Mirae Asset India Equity Fund celebrated its 10th anniversary a few months back. During this time, the fund has been able to establish itself as one of the best multi-cap funds with a strong record of wealth creation. It is highly rated by the different mutual fund research firms. You should have a long investment horizon, ideally 5 years or longer, for this scheme. Investors should consult with their financial advisors if Mirae Asset India Equity Fund is suitable for your long term investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team