Mirae Asset Balanced Advantage Fund: A good fund to beat volatility

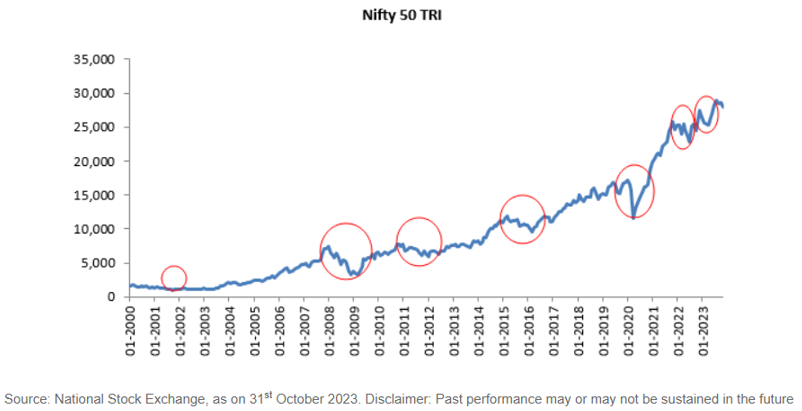

The equity market is prone to fluctuate between highs and lows. In the long run above 3 years, the troughs in equity performance have historically always been followed by a correction and then rising markets. These points in the downward markets are where valuations are attractive due to sell offs and a consequent high in the markets leads to a point where valuations become very expensive. (see the growth of Nifty 50 TRI growth in the period from January 2000 to January 2023 in the chart below). The circles in red represent when the markets corrected and started rising again. These cycles in the market are inevitable.

It is evident that buying when valuations are low and selling when the valuations are high will be beneficial for investors. However, the scenario becomes quite different. Greed buying and emotional selling is one of the human biases that often rules the investment decisions of investors. This is in opposition to the first rule of investment ‘buy low sell high’. In bullish markets, investors are overcome by greed, thinking that the market will rise further and keep buying. In bearish markets fear takes over and the investors start selling, thinking that the market will fall further and they will lose money.

The Balanced Advantage Funds do away with the pitfalls of biases of the investors with its dynamic asset allocation approach to maintaining the debt equity ratio.

How does a Balanced Advantage Fund work?

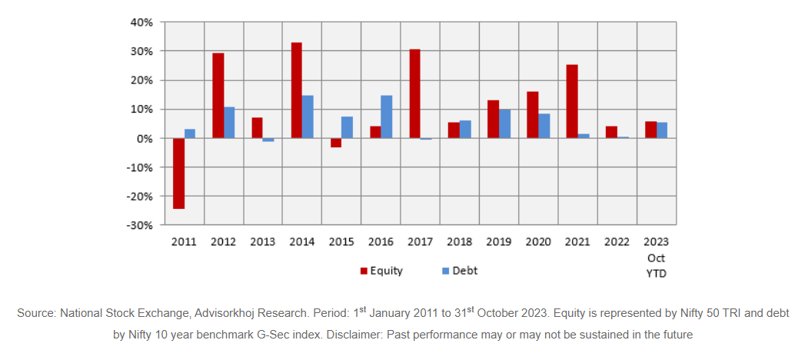

The Balanced Advantage Funds invest in a mix of equity, arbitrage and debt instruments. The equity and debt markets have low correlation between their returns (See chart below). These funds manage their asset allocation dynamically to earn higher returns from equity and balance out the risks associated with equity holdings by investing in debt when the equity performance is low.

The Balanced Advantage Funds perform by containing the downside in the markets and also by participating in the bull runs.

In this article we will discuss a fund from this category: The Mirae Asset Balanced Advantage Fund.

About Mirae Asset Balanced Advantage Fund (MABAF)

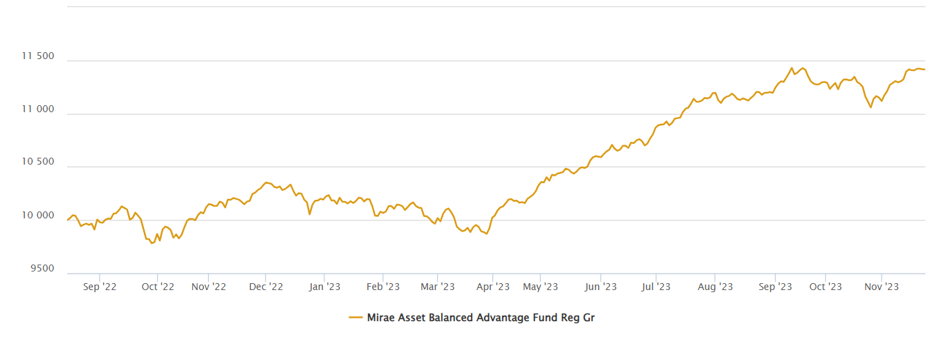

The Mirae Asset Balanced Advantage Fund is an open-ended Dynamic Asset Allocation Fund. It was launched on 5th August 2022 and has an asset under management (AUM) of 1253.2 crores as on 31st October 2023. The fund tracks the benchmark Nifty 50 Hybrid Composite Debt 50:50 Index. Since its inception in August 2022, the fund has given a return of 12.56% compared to the category average return of 10.02% (Returns as on 2nd December 2023).

The expense ratio of the fund is 2.16% for the Regular plan. The minimum investment amount is Rs 5,000/- and at multiples of Rs 1/- thereafter. Additional purchases or SIPs can be made at a minimum investment of Rs 1,000/- and multiples of Re 1/- thereafter. The fund is managed by Mr. Harshad Borawake for the equity portion and Mr. Mahendra Jajoo for the debt portion. The fund uses an internal proprietary model based on P/E and P/B valuations to monitor the markets and determine the asset allocation from time to time.

Performance of Mirae Asset Balanced Advantage Fund (MABAF)

An amount of Rs 10,000 invested at the inception of fund would have grown to Rs 11,669 giving an absolute return of 16.69% (Return as on 2nd December 2023).

Source: Advisorkhoj research

The MABAF has also outperformed the returns of fixed income instruments like PPF and fixed deposits. The fund gave a CAGR return of 12.56% as compared to a CAGR of 6.3% on fixed deposits and 7.1% on PPF savings (Return as on 2nd December 2023).

SIP returns - If you had invested Rs 10,000/- in monthly SIPs since the inception of the fund, your investment amount of Rs 1,60,000/- for 16 months would have become Rs 1,78,198/- giving an XIRR of 16.93% (Return as on 2nd December 2023).

Dynamic Asset Allocation of Mirae Asset Balanced Advantage Fund

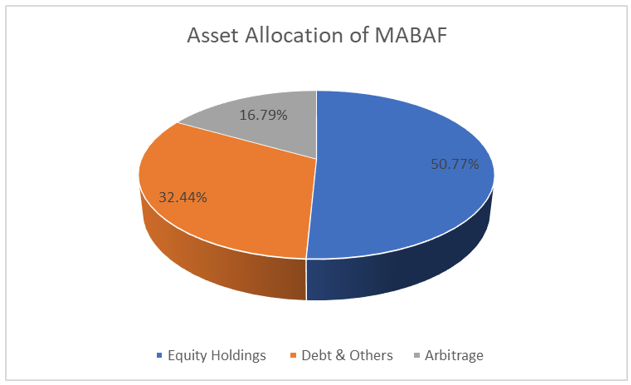

The Mirae Asset Balanced Advantage fund model is guided by a combination of P/E and P/B valuations of Nifty 50 TRI Index to decide the net equity allocation. The fund uses the arbitrage position to reach its total equity position to achieve equity taxation status for the investors. The debt position is achieved by taking a duration call and then employ a buy and hold strategy.

The fund attempts to achieve the equity taxation status for its investors and hence keeps equity investment (Equity + Arbitrage) at 65%. The net equity range as per the fund’s model may be between 30% to 80%, arbitrage between 0% to 35% and debt is maintained between 20% to 35%.

The overall asset allocation of the fund as on 31st October 2023 was 50.77% in equity holdings, 16.79% in Arbitrage and 32.44% in Debt and other securities.

Equity holdings of MABAF

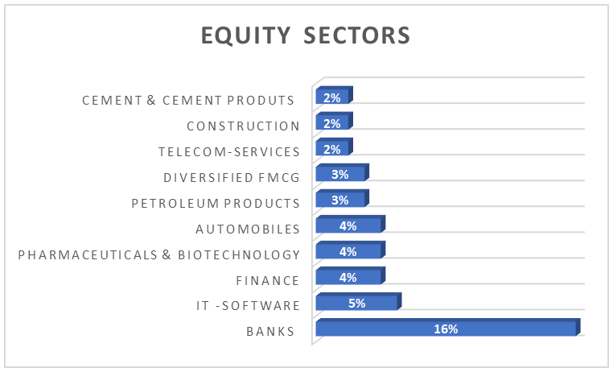

The internal model of the fund allocates net equity based on a Valuation Framework Model with additional insights by the fund managers. The key sectors in which the fund invests are Financials, IT, Healthcare and Auto. The chart below shows the top 10 Sectors of the fund with their percentages as on 31st October 2023

Debt holdings of the MABAF

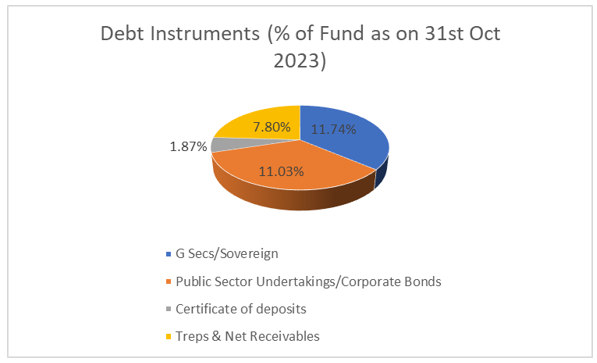

The current debt holdings of the fund are a mix of government securities, high quality corporate bonds and certificates of deposits. The strategy for Debt holdings in the fund is mostly buy and hold. However, any expectations of interest rate fluctuations may change the strategy from time to time.

Why invest in Mirae Asset Balanced Advantage Fund?

- Discipline with discretion: Discipline of a time-tested and transparent asset allocation framework combined with the discretion of the fund managers to tap market volatility / opportunities makes the fund attractive.

- Long Term capital growth: Due to asset allocation strategy and contrarian stock calls, the fund is best suited for long term investment.

- Reduce downside risks: Asset allocation is very important in sideways and volatile markets. Mirae Asset Balanced Advantage Fund can reduce downside risks in volatile markets and provide relative stability to your portfolio.

Who should invest in Mirae Asset Balanced Advantage Fund?

- Investors who want capital appreciation and income over long investment tenures.

- Investors who do not want high volatility in their portfolios.

- Investors with minimum 3 to 5 years investment horizon.

- New investors or investors who do not have experience of investing in volatile markets can also invest in this scheme.

You should consult with your financial advisor or mutual fund distributor if Mirae Asset Balanced Advantage Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mirae Asset Investment Managers (India) Pvt. Ltd. IFSC branch launches Mirae Asset Global Allocation Fund IFSC at Gift City

Apr 21, 2025 by Mirae Asset Mutual Fund

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund