Invest in ELSS Funds to save taxes and grow your money

We are almost in the final month of the current tax assessment year. You can claim deductions of up to Rs 1.50 Lakhs from your taxable income by investing in schemes eligible under Section 80C of Income Tax Act 1961. In order to claim maximum tax benefits in this financial year, you need to make your 80C investments by March 31st 2019. If you have not been able to claim maximum tax deductions this year, you should invest sooner than later. Among the different investment options available under Section 80C, Equity Linked Savings Schemes (ELSS Funds) or tax saver funds are the best option for wealth creation and tax savings for investors with high risk appetite.

Superior Long Term Returns

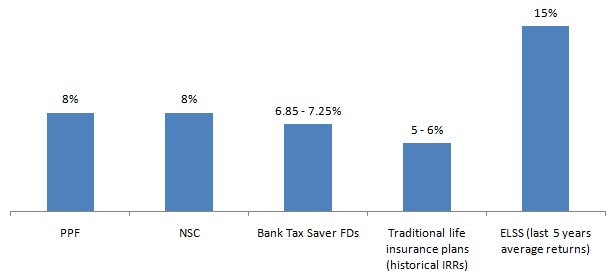

ELSS funds are market linked instruments which invest in diversified portfolio of stocks across different industry sectors and market capitalization segments. Though ELSS Fund investments are subject to market risks, they are among the best tax saving investments under Section 80C because historical data shows that equity has been the best performing (in terms of returns) asset class in the long term. The chart below shows interest rates / historical returns of select 80C schemes.

Source: Paisabazaar, Advisorkhoj

Superior Liquidity

Equity Linked Savings Schemes or ELSS Funds offer more liquidity compared to most tax saving (Section 80C) investment options. Equity Linked Savings Schemes have a lock-in period of 3 years. If you are investing in ELSS Funds through systematic investment plan (SIP), each SIP installment will be locked in for three years. Other 80C investment options (excluding ELSS) have a minimum lock-in period of 5 years. The shorter lock in period of ELSS Funds not only gives you more liquidity should you need the same, it also gives you the flexibility of redeploying your ELSS investment for future tax savings (after the lock-in period) by redeeming and re-investing the proceeds. The flexibility in terms of liquidity provided by ELSS Funds also enables you to put your money to its most productive use.

Tax Advantage

ELSS Funds enjoy significant tax advantage to many 80C investment schemes. 80C schemes like bank tax saver FDs, senior citizens savings scheme (SCSS) and national savings certificate (NSC) interests are taxed as per the income tax rate of the taxpayers (albeit NSC investors can claim accrued interest during the investment term as deduction from their taxable income). ELSS capital gains up to Rs 1 Lakh are tax exempt; capital gains in excess of Rs 1 Lakh are taxed at 10%. If you opt for the dividend option for ELSS Funds, the dividend is tax free in the hands of the investors, but the fund house (AMC) will have to pay 10% dividend distribution tax (DDT) before paying dividends to investors.

Indiabulls Tax Savings Fund

Indiabulls Tax Savings Fund is a promising tax saving product offering by Indiabulls AMC. This scheme is fairly new, just over a year old (launched in December 2017) and therefore, does not have a long enough track record. Further, the last 1 year has been a volatile period of stocks, especially in the midcap and small cap segments. What works however, in favor of the scheme, is the good track record of the fund managers, Veekesh Gandhi and Malay Shah versus benchmarks over sufficiently long investment periods, across different investment categories.

Indiabulls AMC constructs the tax savings mutual fund portfolio using bottom up approach and have the flexibility to invest across the market capitalization spectrum. The investment environment, valuation parameters and other investment criteria will determine the allocation and the investment style. The AMC will conduct in-house research in order to identify investable ideas. AMC will evaluate appreciation potential of individual stocks from a fundamental perspective, assess industry and company fundamentals, robustness of business model, sustainability of moat, valuations, quality of management, corporate governance standards etc. This tax savings fund Scheme will have reasonably well diversified Portfolio without being overly diversified.

Other details

The scheme has Rs 73 Crores of AUM with an expense ratio of 2.74%. The turnover ratio of the scheme is 86%. There is no entry or exit load. Minimum application amount is Rs 500 and in multiples of Rs 500 thereafter. Minimum additional purchase amount is Rs 500. Minimum SIP amount is Rs 500. The scheme is available in both Growth and Dividend Options. The scheme benchmark is Nifty 500 TRI.

Conclusion

- Investors should maximize their tax savings by investing in eligible schemes under Section 80C before the end of the financial year (March 31st). You can save up to Rs 46,800 in taxes in a financial year by investing up to Rs 1.5 Lakhs in 80C schemes. If you have not made sufficient tax savings investments, you should prioritize it in your financial planning over the next few weeks.

- Equity Linked Savings Schemes or ELSS Funds is one of the best investment options available under Section 80C for investors with high risk appetite. ELSS has the potential to give much superior returns in the long run compared to other investment options under Section 80C.

- ELSS investors also get superior liquidity from their investments compared to other 80C investment options with the shortest lock-in period.

- ELSS Funds enjoy tax advantage compared to many other 80C investment options. Capital gain of up to Rs 1 Lakh is tax exempt and gain in excess of Rs 1 Lakh is taxed at only 10%.

- Indiabulls Tax Savings Fund is a promising ELSS fund offered by Indiabulls AMC. The fund managers have good performance track record and the investment strategy has potential of delivering strong returns in the long term.

- Investors should consult with their financial advisors if Indiabulls Tax Savings Fund is suitable for their tax saving investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team