Indiabulls Equity Hybrid Fund NFO: Using Current Account Deficit Movement for superior returns

Aggressive Hybrid Funds are excellent investment options for investors who want capital appreciation in the long term, but do not have appetite for high volatility. These funds invest 65 to 80% of their asset corpus in equity and equity related securities and 20 to 35% of their assets in debt and debt securities.

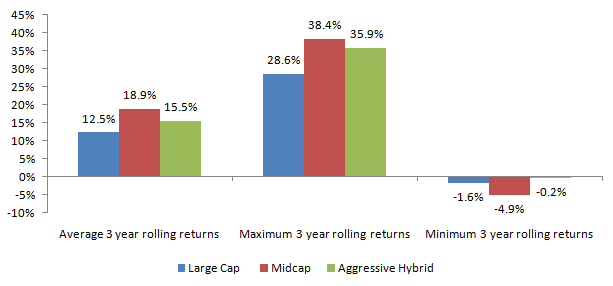

The asset allocation characteristics of these funds enable them to give good risk adjusted returns in the long term. We compared the 3 year rolling returns of large cap equity, midcap equity and aggressive hybrid funds as categories over the last 10 years. The results may surprise you – please see the chart below.

You can see in the chart above that, Aggressive Hybrid Funds protected downsides much more than both large cap and midcap equity funds. At the same time, it was able to beat large cap 3 years average rolling returns and also maximum 3 year rolling returns. That is why we have suggested that aggressive hybrid funds (commonly known as balanced funds previously) are able to generate superior risk adjusted returns compared to equity fund categories.

Indiabulls Equity Hybrid Fund

Indiabulls Asset Management Company is launching the Indiabulls Equity Hybrid Fund. The NFO will be open for subscription from November 22nd to December 6th 2018.

Indiabulls Equity Hybrid Fund is an Aggressive equity oriented hybrid fund, where equity allocation will range from 65 to 80%, while fixed income (debt allocation) will range from 20 to 35%. Since at least 65% of the portfolio will always be invested in equity, the scheme will enjoy equity taxation as per our tax laws.

Equity, as an asset class, enjoys considerable tax advantage compared to other asset classes. While income from traditional fixed income schemes like bank FDs and post office small savings schemes are usually added to the taxable income of the income and taxed as such, short term capital gains (investment held for less than 12 months) in equity oriented mutual funds, including aggressive hybrid funds are taxed at 15%. Long term capital gains (investment held for more than 12 months) in equity oriented funds are tax exempt up to gains of Rs 1 Lakh. Long term capital gains in excess of Rs 1 Lakh are taxed at 10%. Dividends paid by equity oriented funds are tax free in the hands of the investors but the fund house has to pay 10% dividend distribution tax (DDT) before paying dividends to investors.

The equity portion of Indiabulls Equity Hybrid Fund will help investors in wealth creation through capital appreciation, while the debt portion of the scheme will provide stability by reducing volatility. The scheme may be volatile in the short term and is thus, suitable for investors with moderately high risk appetites. However, as discussed earlier, the volatility of the scheme is likely to be less than pure equity funds and therefore, Indiabulls Equity Hybrid Fund will be a good investment option for new investors and investors who do not have high appetite for stock market volatility.

Investment thesis - Current Account Deficit

The investment thesis of this fund is modeled on the current account deficit (CAD) of our economy. Current account deficit is one of the most important macro-economic indicators and has a strong correlation with capital market returns. For the benefit of retail investors among Advisorkhoj readers, let us discuss what Current Account Deficit is.

Current Account = Exports – Imports + Net Income from Abroad + Net current transfers from abroad

The first two terms on the right side of the equation are self-explanatory. Net income from abroad is the income earned by Indian citizens and companies in foreign countries. Net current transfers from abroad is the unrequited monies received from Non-resident Indians (NRIs) to residents Indians adjusted for outflows from resident Indians to Non-resident Indians (NRIs).

Current account is usually expressed as a percentage of the Gross Domestic Product (GDP) and may be either positive (resulting in current account surplus) or negative (resulting in current account deficit). Current account surplus / deficit is a very macro-economic parameter, which has implications on other macro parameters like exchange rate, inflation and interest rate – all of which affect the capital markets.

There can be a number of factors which cause current account deficit (CAD):-

- Higher Inflation making export less competitive

- Rising Import Bill

- Decline in Export Sector

- Overvalued Exchange rates

- High Consumer Spending

- Global Recession

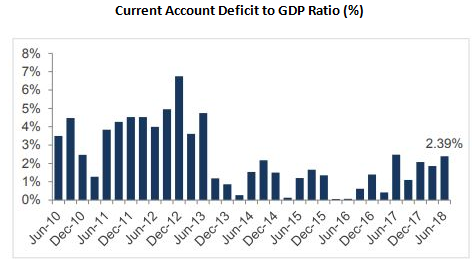

Our current account deficit, though much lower than 2013 levels, is negative and is widening primarily on account of the rising crude prices.

Source: Indiabulls

Sector Allocation on the basis of Current Account Deficit

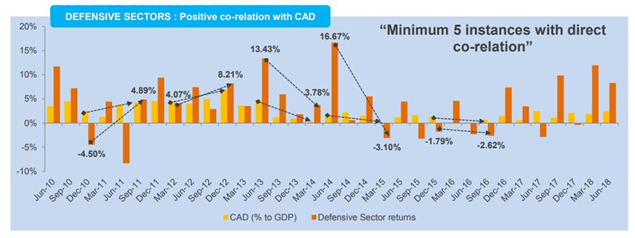

The last 10 years, covering several economic and investment cycles, average Current Account Deficit to GDP ratio is 10%. As per Indiabulls AMC equity hybrid fund investment thesis, 2.30% is the reference point to determine allocation bias to Cyclical or Defensive sectors. As per Indiabulls investment hypothesis, Current Account Deficit movement has positive correlation with defensive sectors and negative correlation with cyclical sectors. In other words, when current account deficit widens, defensive sectors give higher returns and vice versa. The opposite behavior is observed with cyclical sectors, i.e. when current account deficit narrows, cyclical sectors give higher returns and vice versa.

Source: Indiabulls

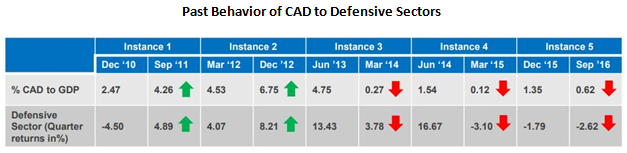

The table below shows the 5 instances of positive correlation between current account deficits versus defensive sector returns. Examples of defensive sectors are IT, Pharmaceuticals and FMCG

Source: Indiabulls

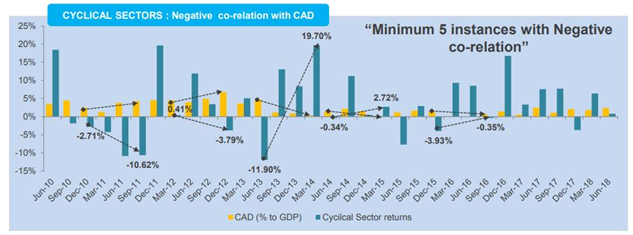

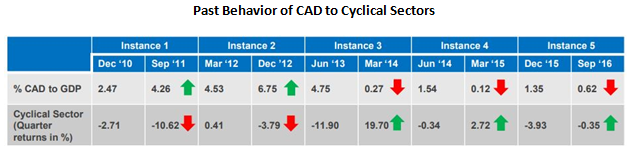

Let us now observe the relationship between current account movement and cyclical sectors. Examples of cyclical sectors are Automobile, Banking and Financial Services, Metals and Energy.

Source: Indiabulls

Source: Indiabulls

Any robust investment hypothesis has to be backed up by solid evidence from past returns under specific conditions – this is known in finance as back-testing. The charts and tables shown above are evidences of the efficacy of Indiabulls Equity Hybrid Fund’s investment hypothesis and should provide reasonable confidence to the investor that the investment thesis of this scheme will play out as expected in different macro-economic circumstances in the future.

The investment thesis of the scheme in summary is that, the scheme will shift its allocation to defensive sectors above a certain current account deficit threshold (2.3%, as discussed earlier) and keep investing in defensive sectors as the deficit widens. Vice versa, the scheme will shift its allocation to cyclical sectors below a certain current account deficit threshold (2.3%) and keep investing in these sectors as the deficit narrows.

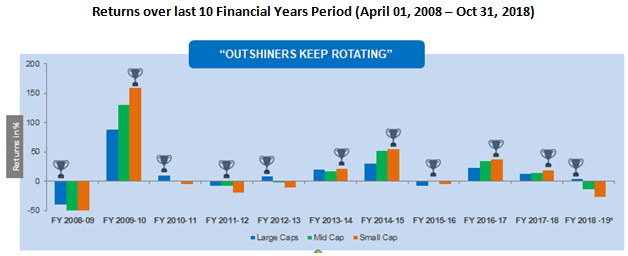

Market cap strategy – Multi-cap with large cap bias

Different market cap segments outperform / underperform in different market situations, across different periods and investment tenors. Regular Advisorkhoj readers know that we advocate active multi-cap strategy versus strictly large cap or mid / small cap strategies, because an active multi-cap strategy can deliver superior returns across various time-cycles vis-a-vis a market cap restricted investment strategy. The chart below shows that market cap out-performers keep rotating.

Source: Indiabulls

Multi Cap Growth Strategy takes a concentrated, high-conviction approach to growth investing, emphasizing stocks across market capitalizations. It benefits from relatively low volatility of large cap stocks and higher growth potential of mid and small-cap stocks in moderate portfolio allocations. Multi-cap strategy is typically followed to find higher growth opportunities in the rising markets with flexible bias to large, mid and small cap stocks.

Debt strategy on the basis of Current Account Deficit

So far, we have discussed the equity strategy of the scheme in relation to current account deficit. Since equity will comprise 65 to 80% of the scheme portfolio, it is undoubtedly the most important attribution factor in scheme returns. However, debt strategy also plays an important role in ensuring good returns from a hybrid scheme. Let us now discuss how current account deficit plays out in relation to the bond yields and debt fund returns thereof.

Source: Indiabulls

You can see that when current account deficit narrowed, Government Bond yields fell and when it widened yields rose. This shows that there is a direct co-relation of current account deficit with G – Sec yields. The fixed income strategy of the fund is also therefore, linked with current account deficit movement. The scheme will take duration calls based on current account deficit levels. Regular Advisorkhoj readers know that duration calls imply investing in bonds of specific maturity profiles in line with interest rate outlook.

Indiabulls Equity Hybrid Fund will aim to maintain portfolio duration up to 18 months, when current account deficit is higher than a certain threshold (2.3%), but when current account deficit (CAD) moves below the threshold the scheme will aim to a have portfolio duration of up to 60 months. The objective of the fixed income strategy of the scheme seems to be able to generate capital appreciation in favorable interest rate environments, while generating stable returns across all interest rate scenarios.

Other than current account deficit, which forms the foundational basis of the debt strategy, the scheme will also look at macro factors like inflation, fiscal deficit, currency, duration view and liquidity to determine duration strategy. Credit Risk is managed through Investment in debt papers having credit quality AA+ & above,minimizing credit risk in the debt portion of the portfolio. The fixed income strategy aims to maintain reasonable liquidity through active management. The scheme will make reasonable allocations to money market instruments based on equity & debt market outlook.

SWP from Indiabulls Equity Hybrid Fund

We have often been asked by investors, what are best funds for SWP. One can try to answer this question based on historical SWP returns of various schemes. But SWP returns vary from scheme to scheme, the investment period (especially when the SWP was initiated) and the SWP tenor. Equity funds can give great SWP returns if the SWP is initiated during the early phase of a bull market. On the contrary, if SWP is initiated in the early phase of a bear market, it can result in substantial reduction in unit balance by the time the market bottoms out; this can impair long term SWP returns. As such, we in Advisorkhoj, think that hybrid funds are one of the best SWP investment options.

For moderate rates of withdrawal aggressive hybrid funds, like the Indiabulls Equity Hybrid Funds are excellent choices for SWP because they not only limit downside risk, reducing draw downs in your investment value in bear markets, but also provide sufficient capital appreciation in bull markets, which in the long term can beat inflation and create wealth for you.

Indiabulls Equity Hybrid Fund is an actively managed fund based on the current account deficit driven investment model, which aims to reduce risk is different market conditions. We think that schemes like these are ideal for SWP, across different market conditions. With moderate rates of withdrawal from Indiabulls Equity Hybrid fund using SWP, you can create fixed cash-flows, while generating capital appreciation on your investment in long term at the same time. SWP from Indiabulls Equity Hybrid will also be a highly tax efficient way of income generation (due to equity taxation) compared to traditional fixed income products.

Why invest in Indiabulls Equity Hybrid Fund?

Strong Investment Hypothesis

– Economic Indicator, Current Account Deficit (CAD) to determine sector selection in equity and duration calls in debtStability with long term capital appreciation potential

- Large Cap bias with a multi cap strategy thus ensuring quality portfolioMinimized credit risk and adequate liquidity

- Portfolio above AA+ thus ensuring quality debt portfolio & adequate liquidity with an active duration managementActive asset allocation to capture return potential while optimizing volatility

- Asset allocation based on macro-economic factors and fund manager outlook thus capturing opportunity activelyRobust stock selection process to generate alphas

– Idea generation process which identifies companies with strong business models, competitive advantage, brand equity, strong management teams, earnings visibility, reasonable pricing, low financial leverage and high economic returns (ROCE, ROE etc.). Leverages strong in-house research capabilities. Follows a combination of top down and bottom up portfolio construction strategy.

Who should invest in Indiabulls Equity Hybrid Fund?

- First time investors who look for marginal exposure to debt instead of a pure equity fund due to lesser volatility

- Investors looking for equity long term tax advantage(as discussed earlier) with a combination of growth due to equity and lower volatility due to debt

- Well suited to investors looking to invest on a regular basis through Systematic Investment Plan (SIP) route

- Investors looking for regular cash flows through Systematic Withdrawal Plan (SWP) route

Key Features of this scheme

- Fund managers: Mr. Sumit Bhatnagar (Equity Segment), Mr. Veekesh Gandhi – Co Fund Manager (Equity Segment) and Mr. Malay Shah (Debt Segment)

- Exit Load: For exit < 12 months from the date of allotment:- (a) For 10% of investment – Nil (b) For remaining investments - 1.00%. For exit > 12 months from the date of allotment – Nil

- Minimum Investment: Rs. 500 and in multiples of Re. 1/- thereafter

- SIP Mode: Available

- Benchmark: CRISIL Hybrid 35+65 - Aggressive Index

Conclusion

In this post, we have reviewed the upcoming NFO, Indiabulls Equity Hybrid Fund. The scheme follows a robust macro-economic parameter (current account deficit) based investment hypothesis. As discussed in this post, historical data shows that the relationship between current account deficit (CAD) movement and capital market returns (both equity and debt market) are quite strong, both direct and inverse (depending on the direction of movement).

Investors with moderately high risk appetites can invest in this scheme with a sufficiently long investment tenor. Investors should consult with their financial advisors if Indiabulls Equity Hybrid Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team