ICICI Prudential Value Discovery Fund: One of the best performing equity funds in last 10 years

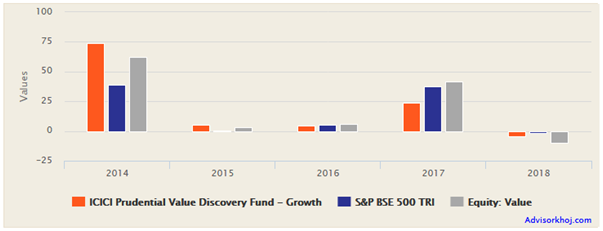

ICICI Prudential Value Discovery Fund was one of best performing and popular equity mutual fund schemes for many years till around 2016. The scheme consistently beat its benchmark (BSE 500 TRI) and category peers for a number of years. The scheme’s performance versus benchmark and category slipped in 2016 and 2017; the scheme gave negative returns in 2018 (the chart below shows the annual returns of the scheme over the last 5 years).

There were queries from investors whether they should exit this fund and the experts had their take on the performance of this fund on the digital media. We have stated a number of times in our post that investors should always evaluate the performance of a scheme over sufficiently long investment periods (at least 3 years for equity mutual funds) and try to understand the reason for outperformance or underperformance.

Investment style of ICICI Prudential Value Discovery Fund

We will try to explain the relative underperformance of ICICI Prudential Value Discovery Fund in the 2016 to 2018 period so that investors can make informed decisions with regards to this scheme. As the scheme name suggests, ICICI Prudential Value Discovery Fund is a value oriented fund. In this investing style, the fund managers try to identify stocks which are trading at significant discounts to their intrinsic value or fair price. Value stocks typically trade at low P/Es and have high dividend yields. Once the market discovers the intrinsic value or fair price of the stock, valuation re-rating takes place and investors can get good returns. Another benefit of investing in value stocks is the margin of safety. Since these stocks trade at low valuations, price corrections or downside in volatile markets is limited. You can observe that even though the ICICI Prudential Value Discovery gave negative returns in 2018, the fall was not as much as the category average.

You may like to read investing in mutual fund Value Funds

Change in investment mix with market movement

Valuation of midcap and small cap stocks was significantly lower than large cap stocks from 2011 to 2013. During this period, the scheme found value opportunities in midcap and small cap stocks. With rally in the stock market, especially in the small / midcap segment in anticipation of NDA victory and post Lok Sabha election in 2014, value re-rating took place and scheme delivered outstanding returns in 2014.

You can see in the chart above that the scheme gave more than 70% return in 2014.

The big price appreciation of small and midcap stocks meant that the valuation discount relative to large cap stocks narrowed in 2015. Till 2015 ICICI Prudential Value Discovery Fund had a strong bias towards small and midcap stocks, but when the valuation discount of midcaps turned to premium versus large cap, the scheme started increasing its allocation to large cap stocks, staying true to its value investment style.

Despite trading at substantial valuation premiums to large caps, midcaps rallied in 2017. Midcap funds gave extraordinary returns in 2017, but with widening valuation premium, value investment approach dictated that ICICI Prudential Value Discovery Fund reduce its midcap allocations further and assume a large cap orientation.

Suggested reading: 5 myths you need to know about mid cap and small cap funds

You can see in the annual returns chart above that ICICI Prudential Value Discovery gave nearly 25% return in 2017, but it was low relative to its peers which had midcap bias. However, the changed market cap mix of the scheme enabled it to outperform the category in 2018. On a year to date basis in 2019, the scheme has outperformed both benchmark (BSE – 500 TRI) and the category average.

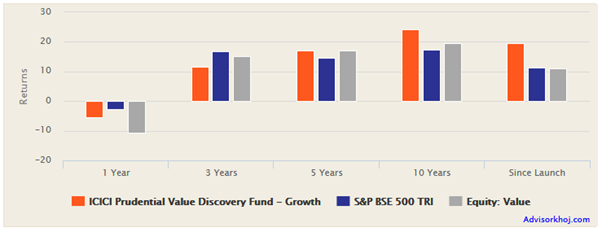

We have discussed a number of times in our blog post on value investing and value fund topics that value funds can underperform for a protracted period of time and that, investors need to be patient with these funds and get the best results over fairly long investment tenors. The chart below shows the trailing annualized returns of ICICI Prudential Value Discovery Fund over several time-scales.

You can see that despite underperforming in the last 1 to 3 years, the scheme outperformed the benchmark and category over the last 5 and 10 years. The CAGR return over the last 10 years is more than 24% and the return since inception (around 15 years) is also nearly 20%, outperforming both the benchmark and category by a significant margin.

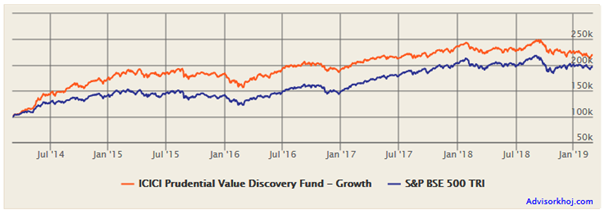

Lump Sum Returns

The chart below shows the growth of Rs 1 Lakh investment in the ICICI Prudential Value Discovery fund (Growth Option) over the last 5 years. Your money would have more than doubled in the last 5 years despite the correction in 2018 and first two months of 2019.

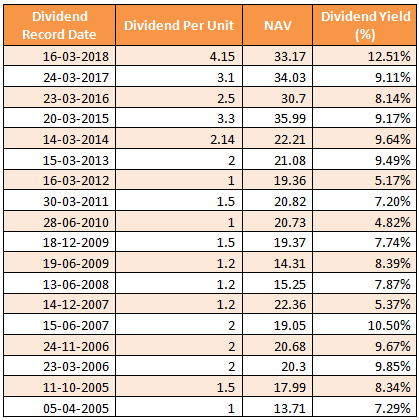

Dividend Payout Track Record

ICICI Prudential Value Discovery fund, dividend option, has a strong dividend payment track record. The fund has paid dividends every year since inception. The table below shows the dividend history of the fund’s dividend option. You can see that the dividend yield over the past 5 years is quite good.

Source: Advisorkhoj Research

About ICICI Prudential Value Discovery Fund

The ICICI Prudential Value Discovery fund was launched in July 2004. The fund has around Rs 15,800 Crores of average assets under management (AUM). The expense ratio of the fund is 2.12%. The fund has been helmed by Mrinal Singh since 2011. Singh has a strong track record as fund manager. In the last 10 years, the scheme was not only the best performing value fund (with over 24% returns), but also one of best performing equity funds across all categories. A considerable portion of the last 10 year track record (8 out 10 years) of ICICI Prudential Value Discovery can be attributed to the fund manager.

ICICI Prudential AMC is one of the largest fund houses in India and one of the strongest research capabilities in the mutual fund industry. In our view, fund manager’s and AMC’s long term track record are more important than short term performance (which can be biased by market conditions) to evaluate future potential of a mutual scheme.

Conclusion

The ICICI Prudential Value Discovery fund has been a favourite with mutual fund investors for many years. It has a terrific long term track record and despite the relative underperformance for the last couple of years, we feel that the scheme can effect a turnaround in performance in the near to medium term. This fund is suitable for investors with a long time investment horizon. Investors, who are looking for long term capital appreciation, can consider investing in the scheme through the systematic investment plan (SIP) or lump sum route. Investors who prefer dividend payout can also invest in this fund. Investors should consult with their financial advisors if ICICI Prudential Value Discovery fund is suitable for their investment objectives.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Sundaram Mutual Fund launches Sundaram Income Plus Arbitrage Active FoF

Jan 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Dividend Yield Fund

Jan 5, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team