ICICI Prudential Medium Term Bond Fund: A good debt fund for short to medium term

As per SEBI’s directive, medium duration debt funds invest in debt and money market instruments such that the Macaulay Duration of the scheme portfolio is between 3 years to 4 years. Regular Advisorkhoj readers know that prices of debt securities have an inverse relationship with interest rate movement. When interest rate goes up prices of debt securities fall and vice versa. Macaulay Duration, in simple terms, refers to the interest rate sensitivity of the fund. Medium duration funds have moderate sensitivity to interest rates – less than long duration funds but more than short and low duration funds.

In the last one year, long duration funds have the best performers among debt funds. We think that there is further scope of interest rate reduction in the current economic environment and longer duration funds may continue to outperform. However, longer duration funds tend to be much more volatile compared to shorter duration funds.

If you want to benefit from interest rate movement, higher yields compared to short duration funds and have moderate appetite for volatility then medium duration funds can be good investment options for 2 – 3 year tenures. You can also invest in these funds with tenure of 3 years or more to take advantage of long term capital gains taxation with indexation benefits.

In this blog post, we will review one of the best performing medium duration funds, ICICI Prudential Medium Term Bond Fund.

Fund Overview

The scheme was launched in 2004 and has an AUM of Rs 5,518 Crores. The minimum investment in this scheme is Rs 5,000. For units in excess of 10% of the investment, the scheme charges exit load of 1% for redemptions within 365 days. Manish Banthia and Shadab Rizvi are the fund managers of this scheme.

Trailing Returns

The chart below shows the trailing annualized returns of ICICI Prudential Medium Term Bond Fund and average category returns of Medium Duration Funds over different time-scales (ending 28th February 2020). You can see that the scheme outperformed the category average across all time-scales. The outperformance in the last 1 year has been spectacular.

Source: Advisorkhoj Research

If you compare the returns of this scheme with the post-tax interest on your fixed deposits,ICICI Prudential Medium Term Bond Fund would have given you much higher returns than your Fixed Deposit interest. You should also note that, over investment tenures of three years or more debt mutual funds are much more tax efficient than fixed deposits.

Suggested reading: Why are debt mutual funds better investments than Bank FDs

Rolling Returns

The chart below shows the 3 year rolling returns of the scheme over the last 5 years versus the fund category (medium duration funds). You can see that ICICI Prudential Medium Term Bond Fund consistently outperformed medium duration funds category across different debt market conditions over the last 5 years. You can also see that the 3 year annualized rolling returns of the scheme across different interest rate environments over the last 5 years was quite stable (in the 7 - 8% CAGR range), making this scheme ideal for investors with moderate risk appetites.

Source: Advisorkhoj Research

Portfolio Construction

In the current economic environment with high profile downgrades making headlines, credit risk should be a key consideration for debt fund investors. ICICI Prudential Medium Term Bond Fund scores high on the credit quality front. 100% of the portfolio is rated AA or above, with about 36% of the portfolio rate AAA. The yield to maturity (YTM) of ICICI Prudential Medium Term Bond Fund scheme portfolio is 8.59%. These are very good yields in light of the scheme’s high credit quality. As such, ICICI Prudential Medium Term Bond Fund is an excellent investment option for investors looking for higher yields and minimizing credit risks.

The average maturity of the scheme portfolio is 3.39 years, while the modified duration is 2.82 years. Modified duration is the scheme’s price sensitivity to interest rates. For example, if interest rate falls by 50 bps during a year, the scheme’s NAV will increase by 1.41% (2.82 X 0.5%). This NAV increase will be over and above the accrued yield (8.59%). On the other hand, if interest rate rises by 50 bps during a year, the effect on scheme’s return will be -1.41% and this will lower the scheme returns. This is the risk / return trade-off. Given the relatively high YTM and the current economic conditions where interest rate cut is more likely than rate hike, the risk / return trade-off is favourable for the scheme.

Did you know – What are the myths versus reality of debt mutual fund investments

Growth of lump sum investment

The chart below shows the growth of Rs 1 lakh lump sum investment in ICICI Prudential Medium Term Bond Fund over the last 5 years. You can see that investment grew by more Rs 46,000 (on an investment of Rs 1 lakh) over the last 5 years.

Source: Advisorkhoj Research

Historical Dividends

The table below shows the historical dividends paid by the ICICI Prudential Medium Term Bond Fund (Half yearly - dividend option) over the last 7 years. The scheme has been paying regular half yearly dividends.

Investors should note that, from next financial year onwards dividends will be added to your income and taxed as per your income tax rate. For investors in the highest tax brackets your tax on dividends will increase compared to the current dividend taxation regime (dividends are tax free in the hands of investors after scheme pays dividend distribution tax). If you are in the higher tax brackets SWP from growth option will be more tax efficient over long investment tenures compared to dividend option.

Conclusion

We will summarize why ICICI Prudential Medium Term Bond Fund is a good investment option for 2 – 3 year or even longer tenures.

- In the context of economic slowdown in India, reviving GDP growth is the key concern for both the Government and Reserve Bank of India. As such, we can expect interest rates to remain low or even decline in the near term

- Even though creeping inflation was a concern over the last 2 months or so, economists believe that inflation will come down since the effects of Coronavirus will have an effect on global commodity prices

- In such economic environment, medium duration funds are good investment options for investors with moderate risk appetites over the next 2 – 3 years

- If you can remain invested for 3+ years, you can take advantage of long term capital gains taxation for debt funds. Long term capital gains in debt funds are taxed at 20% after allowing for indexation benefits, which reduce your tax obligations considerably.

- ICICI Prudential Medium Term Bond Fund is a strong performer in its category. The scheme has not only delivered high short term returns, but has maintained strong performance consistency across different interest rate conditions

- The credit quality of the scheme is excellent which makes it a great choice in the current economic conditions

Investors should consult with their financial advisors if ICICI Prudential Medium Term Bond Fund is suitable for their short to medium term investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

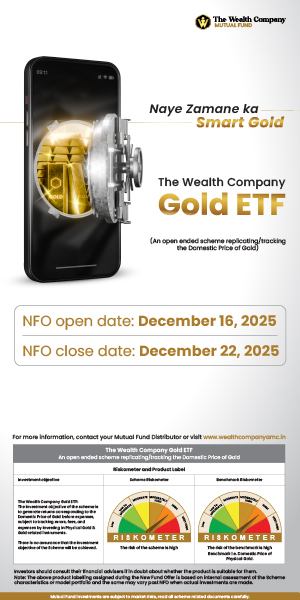

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team