ICICI Prudential Long Term Equity Fund: One of the biggest wealth creators among tax saver funds

Equity Linked Savings Schemes not only helps investors save taxes under Section 80C of Income Tax Act 1961, they can also help investors to create substantial wealth in the long term. Rs 1 lakh invested in ICICI Prudential Long Term Equity Fund (ELSS) at the time of its inception in August 1999 would have grown nearly 39 times to Rs 38.7 lakhs by August 31, 2018.

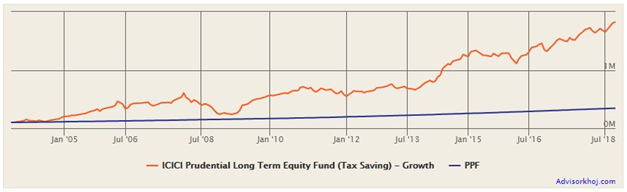

ICICI Prudential Long Term Equity Fund is also the best performing ELSS SIP Fund in the last 15 to 20 years (see our tool, Top Performing ELSS SIP). Rs 5,000 monthly SIP in ICICI Prudential Long Term Equity Fund over the last 15 years would have grown to Rs 37 lakhs, with a cumulative investment of just Rs 9 lakhs. The chart below shows the SIP returns of ICICI Prudential Long Term Equity Fund over the last 15 to 20 years. The terrific wealth creation track record of this fund over long tenors is clearly evident from this chart.

Source: Advisorkhoj Top Performing ELSS SIP

ICICI Prudential Long Term Equity Fund (ELSS) versus PPF – Lump Sum mode

Public Provident Fund is often described as the best non-market linked investment under Section 80C. PPF offers one of the highest rates of interest among non-market linked 80C investment. It is also one of the most tax efficient investment options under Section 80C – PPF maturity amount is totally tax free.

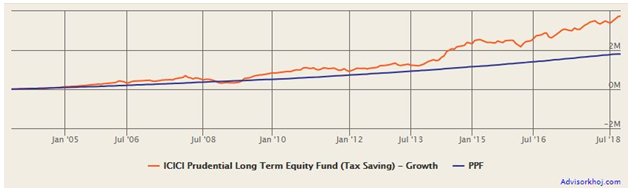

However, over long investment tenors, PPF is no match to top performing ELSS Mutual Funds in terms of wealth creation. The chart below shows the growth of Rs 1 lakh investment in ICICI Prudential Long Term Equity Fund versus PPF over the last 15 years (15 years is the maturity term of PPF). While ELSS investment would have grown to over Rs 18 lakhs (@ CAGR of 21%) PPF would have grown to only Rs 3.4 lakhs (@ compound interest rate of 8.5%).

Source: Advisorkhoj PPF versus ELSS

The chart below shows the growth of Rs 1 lakh investment in ICICI Prudential Long Term Equity Fund versus PPF over various time periods. Clearly across all investment tenors the ELSS has outperformed PPF, though market conditions differed over different tenors. The performance of ELSS, however, is best over very long tenors.

Source: Advisorkhoj PPF versus ELSS

ICICI Prudential Long Term Equity Fund (ELSS) versus PPF – SIP mode

Since tax savings investments need to make every financial year to avail tax deduction from gross taxable income under Section 80C, in our view, Systematic Investment Plan (SIP) is the better mode of tax saving investment. Read what is SIP and what are the benefits of SIPs

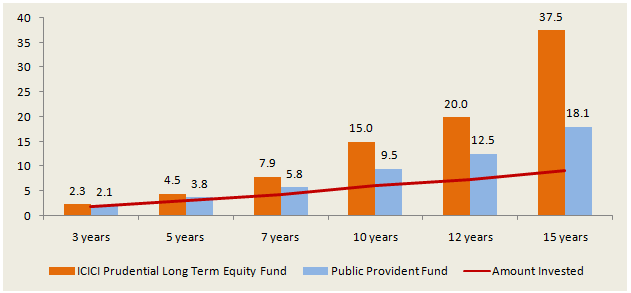

Through SIP, you can do your tax planning in a more disciplined way. By investing every month, you can get higher returns as opposed to waiting till the end of the financial year to make your 80C investments. The chart below shows the growth of Rs 5,000 monthly SIP in ICICI Prudential Long Term Equity Fund versus PPF over the last 15 years. Again the ELSS outperformed PPF. While ELSS investment would have grown to over Rs 37 lakhs (@ XIRR of 17%) PPF would have grown to Rs 18 lakhs (@ compound interest rate of 8.7%).

Source: Advisorkhoj PPF versus ELSS

The chart below shows the returns of Rs 5,000 monthly SIP in ICICI Prudential Long Term Equity Fund versus PPF over various tenors. Clearly across all investment tenors the ELSS has outperformed PPF, though market conditions differed over different tenors. The performance of ELSS, however, is best over very long tenors.

Performance of Scheme versus Benchmark

The chart below shows the 5 year rolling returns of ICICI Prudential Long Term Equity Fund versus its benchmark index Nifty 500 TRI since inception of the scheme. You can see that the scheme was able to consistently beat its benchmark most of the times and create alphas for investors. Performance consistency over a long period of time, across different market conditions, is a hallmark of well managed mutual fund scheme.

Source: Advisorkhoj Rolling Returns Calculator

Let us now compare the performance of ICICI Prudential Long Term Equity Fund versus the ELSS category. The chart below shows the rolling returns of ICICI Prudential Long Term Equity Fund versus the ELSS category since the inception of the scheme. You can see that the fund was consistently able to beat the category average.

Source: Advisorkhoj Rolling Returns Calculator

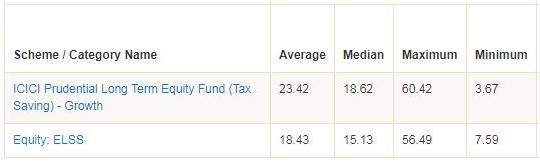

The table below the key 5 year rolling returns statistics of ICICI Prudential Long Term Equity Fund versus the ELSS Funds category since the scheme inception.

Source: Advisorkhoj Rolling Returns Calculator

The chart below shows the rolling return consistency of the fund versus the category.

Source: Advisorkhoj Rolling Returns Calculator

Investment Strategy

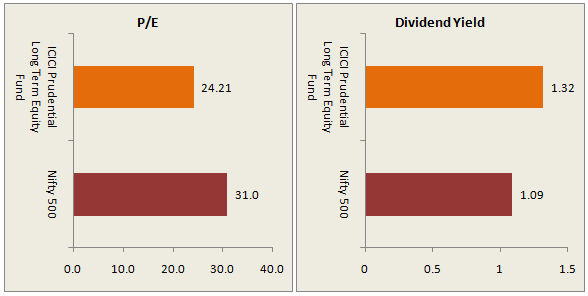

The scheme has a three year lock-in period like other mutual fund tax saver schemes (ELSS). The lock in period allows flexibility to select stocks with long term perspective. George Heber Joseph is the fund manager of ICICI Prudential Long Term Equity Fund. The fund manager follows Value Investing approach to Stock Selection. The value investing style of the scheme is evident when we compare the average PE ratio and dividend yields of the scheme portfolio with that of the benchmark index, Nifty 500 TRI (see the charts below).

Source: ICICI Prudential AMC and National Stock Exchange

The scheme portfolio is currently underweight on Banks & Finance, Oil, Gas & Petroleum Products, and Auto Ancillaries. The portfolio is overweight on Pharmaceutical & Healthcare Services, Telecom, Hotels and Leisure sectors. The Pharmaceutical and Healthcare Services sector could gain from increasing life expectancy, under penetrated healthcare services space, higher non-discretionary spend and India fast becoming a global drug manufacturing and research hub. The Telecom sector could gain from higher rural penetration and government push towards automation of services. Introduction of GST (goods and services tax) could benefit organized players in the Hotels and Leisure sector. Further, increasing discretionary spending and favorable demographic dividend could also benefit the sector.

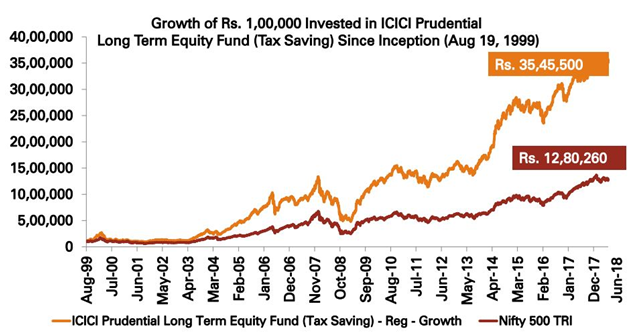

Wealth creation by ICICI Prudential Long Term Equity Fund

The chart below shows the wealth creation by ICICI Prudential Long Term Equity Fund versus Nifty 500 TRI since the inception of the scheme. Rs 1 lakh invested in ICICI Prudential Long Term Equity Fund at the time of its NFO would have grown Rs 35.5 lakhs till June 30, 2018. The same investment in its benchmark index Nifty 500 TRI would have grown to Rs 12.8 lakhs over the same period. The chart below shows that ICICI Prudential Long Term Equity Fund created a huge quantum of alpha for investors.

Source: ICICI Prudential AMC

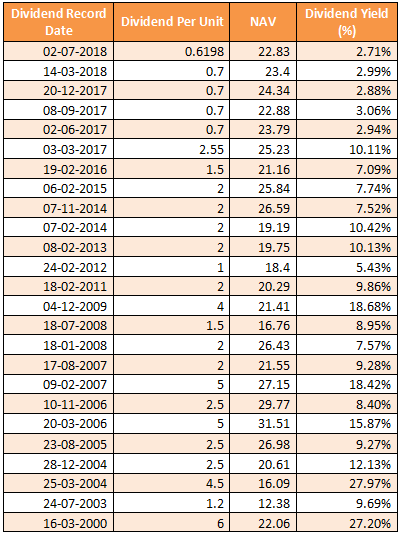

Dividend Pay-out Track Record

ICICI Prudential Long Term Equity Fund has a strong dividend pay-out track record. The scheme has been paying dividends almost every year (except 1 year) since 2003.

Tax Benefits

Investors can claim deduction up to Rs 1.5 lakhs from their taxable income by investing in Equity Linked Savings Schemes. For investors in the highest tax bracket, the maximum tax savings can be Rs 46,800 per year. The capital gains made in the scheme is tax exempt up to Rs 1 lakh under Section 80C of The Income Tax Act 1961. Capital gain above Rs 1 lakh is taxable at 10%. Dividends paid by the scheme are tax free in the hands of the investors, but the AMC has to pay a dividend distribution tax of 10%, before paying dividends to investors. Income from many 80C investment options like tax saver FDs, Senior Citizens Savings Schemes and NSC are taxable as per the income tax rate of the investor. ELSS is one of the most tax-friendly investment options under 80C.

Liquidity

Equity Linked Savings Schemes enjoy the best liquidity among all Section 80C investment. There is limited liquidity in PPF prior to its maturity (15 years). The minimum lock-in period of 80C investments, other than ELSS, is 5 years. Equity Linked Savings Schemes have a lock in period of 3 years. Unlike life insurance plans, there are no charges for redemptions after 3 years in ELSS.

Conclusion

In this post, we reviewed ICICI Prudential Long Term Equity Fund. The fund, now in its twentieth year, has a terrific record of wealth creation. Investors with high risk appetites can invest in this fund either in lump sum or SIP mode, but investors need to have a long investment horizon for this fund. Investors should consult with their financial advisors if ICICI Prudential Long Term Equity Fund is suitable for their tax planning needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Jio BlackRock Mutual Fund launches Jio BlackRock Short Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Low Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Small Cap Fund

Jan 8, 2026 by Advisorkhoj Team

-

Bank of India Mutual Fund launches Bank of India Banking and Financial Services Fund

Jan 8, 2026 by Advisorkhoj Team

-

Sundaram Mutual Fund launches Sundaram Income Plus Arbitrage Active FoF

Jan 5, 2026 by Advisorkhoj Team