ICICI Prudential Balanced Advantage Fund: Best performing dynamic asset allocation funds in last 5 years

After a prolonged period of volatility, the Nifty has stabilized and is consolidating near the all time highs. Even the broader market has shown solid signs of recovery, with Nifty Midcap 100 trading nearly 15% higher than its all time low. While historical data shows that equity is the best performing asset class in the long term, but in the short term volatile is an intrinsic attribute of equity as an asset class. While market has recovered somewhat, slowdown in Indian economy and global risk factors like US / China trade war, fears of US recession etc, can bring in a fresh bout of volatility if some of these factors worsen in the near or medium term.

Volatility affects different investors in different ways. Investors with high risk appetites are less affected by volatility but volatility can be stressful for investors with more moderate risk appetites. Hybrid funds are good investment option for investors with moderate risk capacities, since the debt component of these funds reduces downside risks and provides stability (reduces volatility) to the portfolio.

You may like to read: Importance of asset allocation in volatile Markets

Within the broader hybrid funds category, dynamic asset allocation funds or balanced advantage funds can provide better stability and superior risk adjusted long term returns because they dynamically manage their asset allocation according to market conditions. As such, these funds are excellent investment options for first time investors or investors with moderate to moderately aggressive risk appetites.

ICICI Prudential Balanced Advantage Fund is the best performing dynamic asset allocation fund in the last 5 years (please see our top performing mutual funds). The scheme is also one of the best performing funds in its category in the last 1 year (please see our top performing mutual funds). The scheme has a more moderate risk profile compared to aggressive equity oriented hybrid funds because its active equity allocation can range between 30 – 80% based on dynamic asset allocation strategy determined by equity valuations.

The other major advantage of ICICI Prudential Balanced Advantage Fund is that despite a more moderate risk profile compared to aggressive balanced funds, the scheme enjoys equity taxation. Short term capital gains (investments held for less than 1 year) from the scheme are taxed at 15% while long terms capital gains (investments held for more than 1 year) of up to Rs 1 lakh is tax exempt. Long term capital gains in excess of Rs 1 lakh are taxed at 10%. Dividends paid by the scheme are tax free in the hands of the investors, but the Asset Management company has to pay 10% Dividend Distribution Tax (DDT) before paying dividends to investors.

ICICI Prudential Balanced Advantage Fund was launched in December 2006 and has more than Rs 28,287 crores of Assets under Management (AUM). The expense ratio of the fund is just 1.73%. The dynamic asset allocation strategy of ICICI Prudential Balanced Advantage Fund has enabled it to outperform dynamic asset allocation funds category and several in different market conditions especially over longer investment horizons. Please see the trailing annualized returns of the scheme versus the dynamic asset allocation funds category and other asset classes over different time-scales.

Source: Advisorkhoj Research

The investment objective of ICICI Prudential Balanced Advantage Fund is to generate steady (not spectacular returns) and to limit downside risks. The fund has given around 11% annualized returns since inception.

The chart below shows the NAV growth of ICICI Prudential Balanced Advantage Fund over the last 5 years versus Nifty 50 TRI. You can see that in the last 5 years, despite more moderate risk profile, the scheme was able to outperform the Nifty.

Source: Advisorkhoj Research

Manish Banthia, RajatChandak, SankaranNaren, DharmeshKakkad and IhabDalwaiare the fund managers of the scheme.

Investment Strategy

The fund employs the buy low sell high strategy through dynamic asset rebalancing between equity and debt. The active (net) equity allocation of ICICI Prudential Balanced Advantage Fund ranges between 30 – 80% based on dynamic asset allocation strategy determined by Price / Book ratio of the equity market.Buying low and selling high is the mantra of equity investing success. However, it is very difficult to execute because basic greed and fear psychology prevents investors from buying low (due to fear) and selling high (due to greed). ICICI Prudential Balanced Advantage Fund removes the psychological barrier for investors and makes investing a disciplined process through the dynamic Price to Book based asset rebalancing strategy. The fund shifts its asset allocation from equity to debt when equity valuations (Price / Book) rise and from debt to equity when valuations (Price / Book) fall.

How does the fund achieve twin objectives of downside risk limitation and tax efficiency?

Equity is a riskier asset class than fixed income or debt. According to the conventional theory of asset allocation, in order to portfolio risk, you need to reduce your equity exposure and increase debt exposure. However in India, equity enjoys a significant tax advantage over debt. If equity exposure of a scheme is less than 65%, then the returns of the scheme will be taxed like a debt fund. How can you reduce risk, while continuing to enjoy equity taxation? ICICI Prudential Balanced Advantage achieves this by employing derivatives (futures) to hedge its portfolio.

For the benefit of new investors let us understand how hedging works. Suppose you own 100 shares of a company. Let us assume the current market is Rs 100. The total value of your holding is therefore Rs 10,000. Let us now assume that the share price falls to Rs 80; you will make a loss of Rs 2,000 (Rs 20 X 100 shares). If you want to limit your losses, you can hedge your holdings through derivatives. For example, you can sell a futures contract which has lot size of 80 shares; you do not need to own the shares to sell its futures, you simply need to keep a margin with your broker in the form of cash or stock. If the share price falls to Rs 80 you will make a loss of Rs 2,000 on the shares you own, but you will make a profit of Rs 1,600 on the futures contract (Rs 20 X 80). Therefore, your net loss is only Rs 400.

In this example, the net equity exposure at current market price is Rs 2,000 (Rs 100 X 20 net shares) while your gross exposure is Rs 10,000. From a taxation standpoint, the gross equity exposure is considered when determining whether a scheme is eligible for equity taxation – derivatives are equity related securities and treated as part of gross equity exposure from tax standpoint. Hedging therefore helps in ensuring equity taxation at all times.

The table below shows a hypothetical example of how hedging ensures equity taxation for ICICI Prudential Balanced Advantage Fund.

You can see that the active (net) equity position is always the desired equity allocation based on the P/B dynamic asset allocation model. But the minimum gross equity allocation is always above 65% to ensure equity taxation.

Rolling Returns

The rolling returns of ICICI Prudential Balanced Advantage Fund will reveal useful characteristics of the fund performance. The chart below shows the 3 year rolling returns of the fund over the last 5 years versus the dynamic asset allocation funds category. We chose a 3 year rolling return period because, investors should have a sufficiently long time horizon (3 years at least) for hybrid funds.

Source: Advisorkhoj Rolling Returns Calculator

Our regular blog readers know that, rolling returns is the best measure of the performance of fund, because it is not biased by specific market conditions. You can see that, the 3 year rolling returns of ICICI Prudential Balanced Advantage Fund has consistently outperformed the category average. Performance consistency is one of the hallmarks of good fund management.

Let us now discuss some other interesting rolling return characteristics of the fund. The average 3 year rolling returns of ICICI Prudential Balanced Advantage Fund over the last 5 years was close double digits (9.6%). The maximum 3 year rolling return was 13%, while the minimum was 6.4% which on post tax basis was higher than average post tax fixed income returns. The scheme gave 8%+ nearly 90% of the time, irrespective of market conditions.

Suggested reading: Which are the best mutual funds for medium term investments

SIP Returns

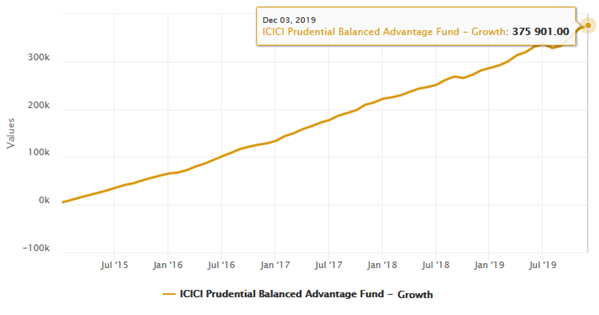

The chart below shows returns of Rs 5,000 monthly SIP started in ICICI Prudential Balanced Advantage Fund, Growth Option, over the past 5 years. By investing Rs 5,000 monthly, the investor would have accumulated Rs 3.75 lakhs with a cumulative investment of Rs 3 lakhs – profit of Rs 75,000.

Source: Advisorkhoj Research

Conclusion

ICICI Prudential Balanced Advantage Fund has completed 12 years since inception. The popularity of the fund among retail investors has sky-rocketed in the last few years. While long term returns of ICICI Prudential Balanced Advantage Fund cannot be compared with its peers in the aggressive hybrid funds category or pure equity funds, limited down side risks, stability of returns and tax efficiency makes this fund an ideal investment choice for investors with moderate to moderately aggressive risk appetite across all market conditions.

In our view, you should have at least 3 year investment horizon for this fund, but you can get better results over a longer time-frame. Historical data shows that, you do not need to take excessive risk or extraordinarily high returns to achieve your financial goals. Astute asset allocation and disciplined investing over long periods of time are the key success factors in wealth creation. In the case of ICICI Prudential Balanced Advantage Fund the age old adage, slow and steady wins the race, holds true. You should consult with your financial advisors if this fund is suitable for your investment needs.

Meanwhile we also suggest you to read the following – Why you need to have hybrid mutual funds in your portfolio: Misconceptions

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team