HSBC Corporate Bond Fund NFO Review

With bank deposit interest rates on a declining trend, investor interest in debt mutual funds has been rising over the past few years. Debt funds not only provide diversification benefits and relative stability to your investment portfolio, they are more tax efficient compared to the traditional fixed income investment options like Bank FDs and Government Small Savings Schemes.

Suggested reading: What are debt Mutual Funds

However, a series of credit rating downgrades and default events have raised concerns about risks in debt funds. In light of the severe economic slowdown due to COVID-19, it is natural that many investors may have continuing or even heightened concerns about credit risk.

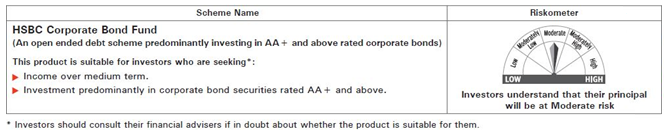

In this economic backdrop, HSBC Asset Management India Pvt. Ltd has launched HSBC Corporate Bond Fund New Fund Offer (NFO). In this post, let us l discuss about it.

Why corporate bond funds are suitable in this risk environment?

The COVID-19 crisis has resulted in a severe economic slowdown around the world. India’s Gross Domestic Product contracted by 23.9% in Q1 FY 20-21. Q1 results also indicate severe revenue contractions of many companies. Given the nature of the crisis, full economic recovery will happen over a protracted period of time. In the current economic circumstances credit risk will continue to remain a concern for many bond issuers.

As per SEBI’s mandate, corporate bond funds invest at least 80% of their assets in the highest rated debt papers. These issuers have strong balance sheets and superior capacity in meeting their debt obligations. As such, these funds with high credit quality may be suitable investment options for investors who are concerned about credit risks in the current economic climate.

Corporate bond yields are attractive now?

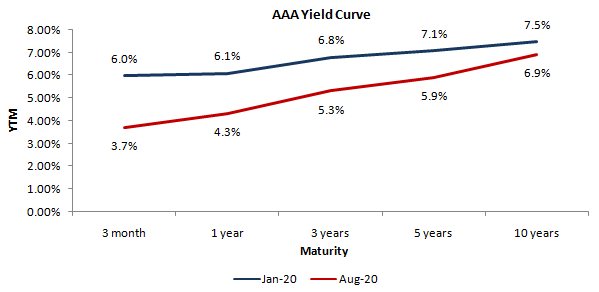

The AAA yield curve has steepened in the middle of the year. Yields in the 3 – 5 year maturity ranges are attractive. The steepness of the yield curve is providing additional 105 – 165 bps of yield by moving from 1 year to 3 – 5 year segment of the yield curve.

Source: HSBC MF, Disclaimer: Yields are subject to change without notice. Past performance may or may not be sustained in the future

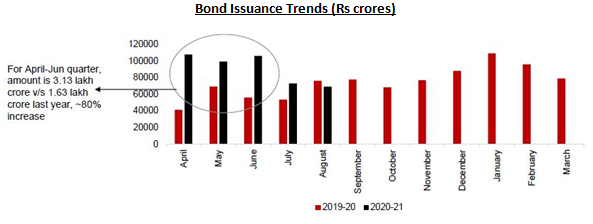

Supply of corporate bonds has also been high in the recent months. Corporate bond issuance from April to August 2020 showed a 50% increase on a year on year basis. However, high bond issuance in the near past was mainly used by corporates to refinance existing loans and create a buffer in their balance sheets taking advantage of low yields. Going forward borrowing by corporates is not going to be aggressive in the near term since capex levels are likely to remain low due to subdued economic outlook. Therefore, there will likely be limited supply side pressures on bond prices and yields.

Source: HSBC MF, Disclaimer: Bond issuances are subject to change without notice. Past performance may or may not be sustained in the future

Performance of corporate bonds

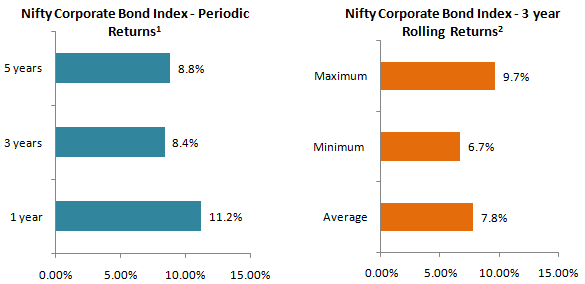

The charts below shows the performance of Nifty Corporate Bond Index both in terms of trailing returns across different time-scales and 3 year rolling returns over past 6 years. You can see that across different interest rate environments, average 3 year rolling returns of Nifty Corporate Bond Index was 7.8%

Source: HSBC MF, Notes: (1) Periods ending 31st August 2020. (2) 3 year rolling returns, rolled daily from the period 31st Aug 2014 to 31st Aug 2020. Disclaimer: Past performance may or may not be sustained in the future

HSBC Corporate Bond Fund NFO – Salient investment features

- The scheme aims to deliver superior risk adjusted returns with a high credit quality portfolio

- The scheme will invest 80 – 100% of its assets in corporate bonds rated AA+ and above. 0 to 20% of scheme assets will be invested in G-Secs

- The scheme will invest in medium maturity bonds such that the scheme duration will be in the range of 3 – 5 years

- The scheme will aim to generate income mainly through accruals. It will also actively seek to create alphas by identifying switch opportunities within liquid AAA / AA+ papers

- The security selection would be driven by investment team’s view on credit spreads, liquidity and the risk reward assessment of each security

- In depth credit evaluation –industry dynamics, external credit ratings opinions, operational, business and financial metrics, past track record as well as the future prospects of the issuer.

- Ritesh Jain is the fund manager of this scheme

- The scheme benchmark is Nifty Corporate Bond Index

Read the full interview of Mr. Ritesh Jain, Head of Fixed Income at HSBC Global Asset Management India, whose key responsibility include managing various fixed income funds.

Why invest in HSBC Corporate Bond Fund NFO?

- As discussed earlier, the 3 – 5 year segment of AAA yield curve provides attractive investment opportunities. RBI accommodation and surplus liquidity has reduced the returns in the shorter end of the yield curve. HSBC Corporate Bond Fund is positioned to take advantage of the opportunity in the 3 – 5 year segment.

- Though yields are also attractive in the longer end of the yield curve, longer duration also implies higher volatility. The duration profile of HSBC Corporate Bond Fund will make it less volatile than longer duration funds.

- Recent credit events and fiscal concerns due to the on-going pandemic will keep the credit environment uncertain. High credit quality of HSBC Corporate Bond Fund will imply significantly lower credit risks.

- There is no exit load in the scheme. Investors will enjoy high liquidity. However, we always recommend investors to remain invested for a sufficiently long investment horizon to get the best returns from the scheme.

- Investors who have investment tenures of 3 years or longer can enjoy the benefits of long term capital gains taxation. Long term capital gains in this scheme (investment holding period of 36 months or longer) will be taxed at 20% after allowing for indexation benefits. Long term capital gains taxation provides a significant benefit to debt fund investors compared to traditional fixed income investment options, especially for investors in the higher tax brackets.

Conclusion

Given the environment of declining interest rates, HSBC Corporate Bond Fund seems to be a good investment option for fixed income investors in the current economic conditions. The NFO was launched on 14th September and will remain open for subscription till 28th September 2020. The minimum application amount is Rs 5,000. You can also invest through SIP / STP modes. You should read the Scheme Information Document (SDI) very carefully before investing. You should always consult with your financial advisor, if you have any doubt about the scheme risk / return characteristics and its suitability for your needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Sundaram Mutual Fund launches Sundaram Income Plus Arbitrage Active FoF

Jan 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Dividend Yield Fund

Jan 5, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team