How SIPs in Top 6 Best ELSS Mutual Funds have created wealth over last 12 years

In our last two posts we had discussed How SIPs in Diversified Equity Mutual Funds have created wealth over the last 15 years and How SIPs in Mid and Small Cap Mutual Funds have created wealth over last 10 years. We found amazing example of funds which have created wealth over 10 – 15 years if the investor has invested through the SIP route. This has prompted us to do this post where we will discuss the same topic but relevant to the Equity Linked Savings Schemes or ELSS Category as it is popularly known.

But before we get deep into today’s topic, let us first recap the key benefits of Investing in Equity Linked Savings Scheme (ELSS).

Tax Saving along with regular investment

- The main reason, apart from a habit of investing small amount every month, the retail Indian investors have realised that timing the equity market is not only difficult but impossible and thus investing a small amount systematically makes sense in ELSS as it also helps save taxes Under Section 80C of Income Tax Act 1961. For the current FY, you can claim a total deduction of upto Rs. 150,000 on your ELSS investment along with your Life Insurance premium, NSC investment & other tax saving schemes.

We suggest you to read this How ELSS Mutual Funds can be your best Tax saving option

Superior returns

- ELSS provides you an opportunity to grow your money by investing in equities through professional fund managers and thus get superior returns from other tax saving avenues like – Public Provident Fund, NSC or Fixed Deposits. You should read this post Should you Invest in ELSS or PPF and convince yourself before you start investing in ELSS.

Tax Efficiency

- Long term capital gains and dividends are tax free for equity oriented mutual funds and so for ELSS. You may like to read – Mutual Fund ELSS Schemes are ideal for Tax Savings and Wealth Creation

Wealth Creation

– By investing in ELSS you get market linked returns which are far superior to conventional tax saving schemes or ULIPs. You may like to read How Top Performing Mutual Funds outperformed ULIPs. We did a study in September 2014 and found that an annual Rs. 50,000 deposit in PPF account started in 2002 will have a corpus of Rs. 11.40 Lacs as on September 1, 2014 against a cumulative investment of Rs. 6.50 Lacs. Whereas the same amount if invested in a popular ELSS fund, it would have fetched you a corpus of Rs. 37.5 Lacs! The difference between the two is Rs. 26.10 Lacs. You may like to read this post – How ELSS Mutual Funds have created wealth over last 12 years

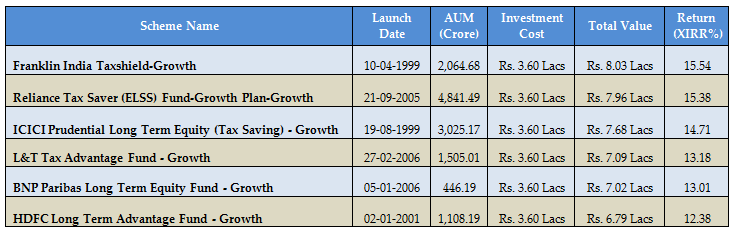

For our topic of today, we have selected Top 6 ELSS Schemes based on their 10 year SIP returns. However, by no means, it is a comprehensive list of all the ELSS funds that gave good returns in the last 10 years. This is just an illustration to show how long term ELSS SIPs have created wealth for the investors compared to popular tax saving options like Public Provident Fund, NSC and Tax saving bank fixed deposits etc.

However, to see the comprehensive list, you may click here Top Performing Systematic Investment Plans – ELSS Mutual Funds

Each of the ELSS funds in our selection has given SIP returns ranging from 12.38 – 15-54% annualized. The monthly instalment amount has been taken as र 3,000. Assuming that the SIP start date was 10 years back in June 2006, therefore, the investor would have invested Rs 3.60 Lakhs through 120 SIP instalments of र 3,000 each.

Readers should note that, since SIP investments are made over a period of time, the method of calculating SIP returns is different than that of Lump Sum investments. SIP returns are calculated by a methodology called XIRR, which is a variant of Internal Rate of Return (IRR). XIRR is similar to IRR, except XIRR can calculate returns on investments that are not necessarily strictly periodic.

As you can see from the chart below even the lowest return generating scheme has given far superior return than PPF! Please note that had you invested a fixed amount of र 36,000 per year since 2006 in PPF at an interest rate of 8.70%, your PPF corpus value would have been र 5.86 Lacs against your total investment of र 3.60 Lacs. Compared to ELSS, taking the same period and same amount (invested through Monthly SIP), your PPF corpus would be lower by र 2.17 Lacs and र 0.93 Lacs respectively against ELSS returns of Franklin India Taxshied and HDFC Long Term Advantage Fund! You may like to check this PPF Calculator

Source: Advisorkhoj Top Performing Sip – ELSS Funds (Based on NAV data of 23/5/16)

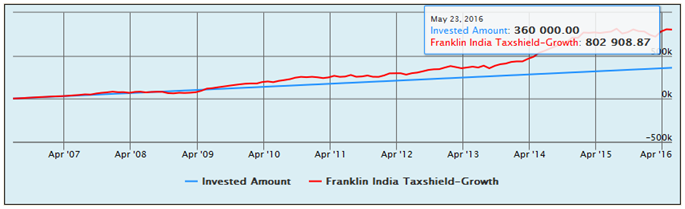

Franklin India Taxshield

The Franklin India Taxshield was launched in April 1999 and is one of the oldest ELSS Schemes in India. This fund from Franklin Templeton Investments has an AUM base of nearly र 2,064 Crores (As on April 30, 2016). The fund has been ranked No. 2 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016. It is a 4 Star rated fund by Valueresearch.

If you had started a monthly SIP of र 3000 in Franklin India Taxshield in June 2006, you would have accumulated a corpus of nearly र 1.94 Lakhs by March 2010 and र 3.56 Lakhs by March 2013. The final corpus (at the end of 10 years) would have been र 8.03 Lakhs with an investment of only र 3.60 Lakhs.

Over the 10 year period the compounded annual returns on your SIP investment in this fund would be around 15.54%. The chart below shows the SIP returns of the Franklin India Taxshield, Growth option, over the last 10 years.

Source: Advisorkhoj Research

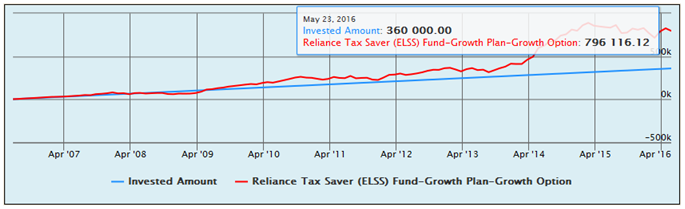

Reliance Tax Saver (ELSS) Fund

The Reliance Tax Saver (ELSS) Fund was launched in September 2005 and is one of biggest schemes in terms of AUM. This fund from Reliance Mutual Fund has an AUM base of nearly र 4,841 Crores (As on April 30, 2016). The fund has been ranked No. 3 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016. It is a 4 Star rated fund by Valueresearch.

If you had started a monthly SIP of र 3000 in Reliance Tax Saver (ELSS) Fund in June 2006, you would have accumulated a corpus of nearly र 1.89 Lakhs by March 2010 and र 3.28 Lakhs by March 2013. The final corpus (at the end of 10 years) would have been र 7.96 Lakhs with an investment of only र 3.60 Lakhs.

Over the 10 year period the compounded annual returns on your SIP investment in this fund would be around 15.38%. The chart below shows the SIP returns of the Reliance Tax Saver (ELSS) Fund - Growth option, over the last 10 years.

You may like to read this fund review – Highest 10 year SIP returns from this fund

Source: Advisorkhoj Research

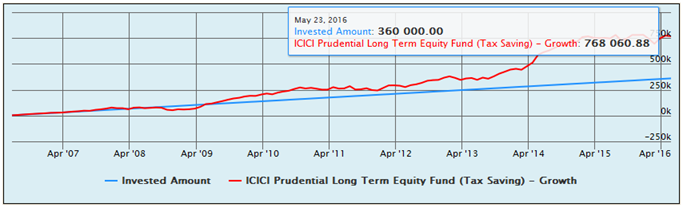

ICICI Prudential Long Term Equity Fund (Tax Saving)

The ICICI Prudential Long Term Equity Fund (Tax Saving) was launched in August 1999 and is one of oldest ELSS schemes in India. This fund from India’s No. 1 AMC, ICICI Prudential Mutual Fund has an AUM base of nearly र 3,025 Crores (As on April 30, 2016). The fund has been ranked No. 3 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016. It also has a 3 Star rating by Valueresearch.

If you had started a monthly SIP of र 3000 in ICICI Prudential Long Term Equity Fund (Tax Saving) in June 2006, you would have accumulated a corpus of nearly र 2.03 Lakhs by March 2010 and र 3.46 Lakhs by March 2013. The final corpus (at the end of 10 years) would have been र 7.68 Lakhs with an investment of only र 3.60 Lakhs.

Over the 10 year period the compounded annual returns on your SIP investment in this fund would be around 14.71%. The chart below shows the SIP returns of the ICICI Prudential Long Term Equity Fund (Tax Saving) - Growth option, over the last 10 years.

Source: Advisorkhoj Research

You may like to read – Terrific track record of wealth creation by over last 15 years

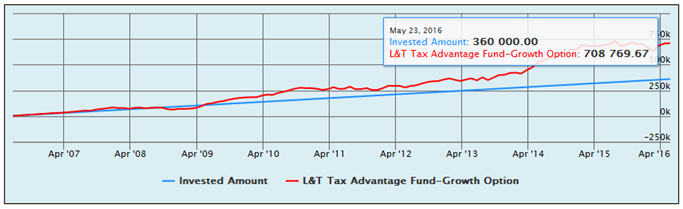

L&T Tax Advantage Fund

The L&T Tax Advantage Fund was launched in February 2006. This fund from L&T Mutual Fund has an AUM base of nearly र 1,505 Crores (As on April 30, 2016). The fund has been ranked No. 3 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016. It also has a 3 Star rating by Valueresearch.

If you had started a monthly SIP of र 3000 in L&T Tax Advantage Fund in June 2006, you would have accumulated a corpus of nearly र 1.97 Lakhs by March 2010 and र 3.42 Lakhs by March 2013. The final corpus (at the end of 10 years) would have been र 7.09 Lakhs with an investment of only र 3.60 Lakhs.

Over the 10 year period the compounded annual returns on your SIP investment in this fund would be around 13.18%. The chart below shows the SIP returns of the L&T Tax Advantage Fund - Growth option, over the last 10 years.

Source: Advisorkhoj Research

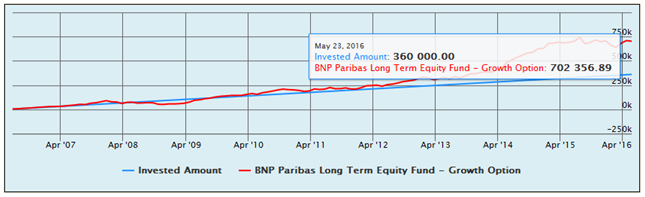

BNP Paribas Long Term Equity Fund

Launched in January 2006, the BNP Paribas Long Term Equity Fund has a relatively lower AUM of र 446 Crores. But the Fund is rated high – Valueresearch has given it a 5 Star Rating whereas CRISIL has given it Rank 3 in its recent mutual fund ranking for the quarter ending Mar 31, 2016.

If you had started a monthly SIP of र 3000 in BNP Paribas Long Term Equity Fund in June 2006, you would have accumulated a corpus of nearly र 1.54 Lakhs by March 2010 and र 3.06 Lakhs by March 2013. The final corpus (at the end of 10 years) would have been र 7.09 Lakhs with an investment of only र 3.60 Lakhs.

Over the 10 year period the compounded annual returns on your SIP investment in this fund would be around 13.01%. The chart below shows the SIP returns of the BNP Paribas Long Term Equity Fund - Growth option, over the last 10 years

Source: Advisorkhoj Research

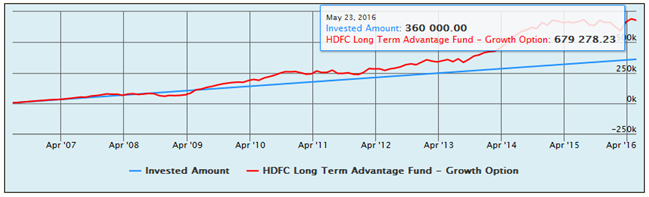

HDFC Long Term Advantage Fund

Launched in January 2001, the HDFC Long Term Advantage Fund has an AUM of र 1,108 Crores and has a track record of 15 years. This popular fund from India’s No. 2 AMC, HDFC Mutual Fund has got a Valueresearch 3 Star Rating whereas CRISIL has given it Rank 4 in its recent mutual fund ranking for the quarter ending Mar 31, 2016.

If you had started a monthly SIP of र 3000 in HDFC Long Term Advantage Fund in June 2006, you would have accumulated a corpus of nearly र 1.86 Lakhs by March 2010 and र 3.40 Lakhs by March 2013. The final corpus (at the end of 10 years) would have been र 6.79 Lakhs with an investment of only र 3.60 Lakhs.

Over the 10 year period, the compounded annual returns on your SIP investment in this fund would be around 12.38%. The chart below shows the SIP returns of the HDFC Long Term Advantage Fund - Growth option, over the last 10 years

Source: Advisorkhoj Research

Conclusion

In this article, we have seen how SIPs in Equity Linked Saving Schemes have created wealth for the investors over the long term. We have found that ELSS SIPs are most suitable to those investors who invest in tax saving schemes Under Section 80C. ELSS should be the preferred choice for them for the reason we discussed at the beginning of the post. ELSS has the least number of lock-in years compared to PPF, NSC etc. but if you invest in these through SIP mode and hold for long term, you benefit from the power of compounding and rupee cost averaging while enjoying the tax free superior returns that the equity investing provides.

Another point, the best time to start is when you join your first job and your employer asks you to save for your taxes. Start the SIP earlier in your career; continue as long as you can while reviewing the performance atleast once every year and you are good to go for your long term wealth creation goals. You may like to read ELSS is one of the best Retirement Planning Investments for young investors

However, it is important to select a good ELSS Fund for your SIPs with the help of a financial advisor as each ELSS fund has a different portfolio based on the Fund Manager’s stock selection criteria. While, some funds are diversified in nature, some may be tilted towards Small and Mid Cap stocks. You should select the one which is suitable according to your risk profile. We are sure; your financial advisers can help you select a good ELSS Fund for your SIPs.

Would you like to check your risk profile, try this – Asset Allocation Calculator based on risk profile and investment horizon.

In our next post, we will discuss How SIPs in Top and Best Large Cap Funds have created wealth for the investors. Stay in touch!

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Kotak Mahindra Mutual Fund launches Kotak Nifty200 Value 30 Index Fund

Jan 15, 2026 by Advisorkhoj Team

-

Bandhan Mutual Fund launches Bandhan Silver ETF FOF

Jan 12, 2026 by Advisorkhoj Team

-

Bandhan Mutual Fund launches Bandhan Gold ETF FOF

Jan 12, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF FOF

Jan 9, 2026 by Advisorkhoj Team

-

Mahindra Manulife Mutual Fund launches Mahindra Manulife Innovation Opportunities Fund

Jan 9, 2026 by Advisorkhoj Team